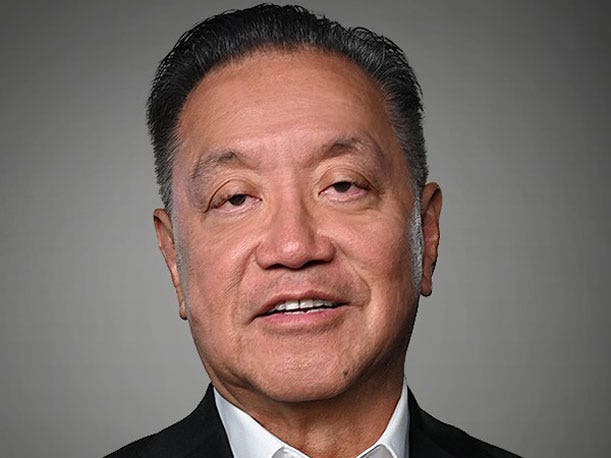

Broadcom CEO Hock Tan Says ‘Rich Catalog of Microservices’ On The Way To VMware Customers

Broadcom’s CEO vows to find ‘good homes’ for Carbon Black and VMware’s End-User Computing businesses as he lays out revenue projections for VMware that include double-digit growth and microservices.

Broadcom CEO Hock Tan is betting that VMware—minus Carbon Black and VMware’s End-User Computing Group—will deliver $12 billion in revenue in the next 11 months and then double-digit growth every year for the next three years.

Tan, who made the remarks during Broadcom’s first-quarter earnings call Dec.7, said his projection is built around the belief that enterprises need the flexibility VMware provides as technology trends drive customers’ apps and data into multiple hybrid environments and combinations of vendors and hyperscalers.

“Our strategy going forward is simply to enable global enterprises to run their applications across their data centers as well as on public clouds by consuming VMware’s higher-value software stack,” Tan said. “And to track and keep these workloads across the environment, we are investing in a rich catalog of microservices. So this will be our focus.”

[RELATED: Nutanix Partners Finding Wins Amid Broadcom-VMware Upheaval]

Tan said VMware by Broadcom will take the resilience of running software-defined workloads in the cloud and give it to customers in all variations of IT infrastructure environments.

“With VMware we are selling a product of the present and of the future. It is a growth product. [We will] be able to create a virtualized cloud environment in your own data center, on-prem for any global company,” he said. “We’re creating with VMware the same experience of virtualization of the data center, on-prem, for those companies—which have workloads by the way that are already running VMware products, and other applications that are already written on VMware Cloud Foundation. It’s then giving these enterprises the opportunity to have a hyperscaler on- prem. That’s the plan we’re doing. Plain and simple.”

In the last reported fiscal year, VMware’s revenue—including Carbon Black and the VMware User Group—was $13.4 billion, up 4 percent over the previous year.

Broadcom expects total software revenue—including VMware, Symantec for Enterprise, Brocade and CA—to reach $20 billion by the end of this year. Broadcom is guiding investors to $50 billion in total revenue. Last year without VMware software brought Broadcom $7.6 billion.

“We see a trajectory of accelerated growth through 2024, and it doesn’t stop there,” Tan said of VMware’s upside. “We are accelerating from $12 billion and we’ll probably see double-digit growth for the next three years, just by sheer math of selling that higher-value virtualization stack versus the very loose component sales in the past. “

Broadcom’s first-quarter revenue was up 4 percent to $9.3 billion, with semiconductor revenue up 3 percent, contributing $7.3 billion and software—not including VMware, which closed after the quarter ended—chipping in $2 billion. Tan said while there has been a slowdown in traditional semiconductor spending, Broadcom’s array of generative AI products made up for the shortfall and contributed $1.5 billion in revenue.

The estimated 2024 revenue figures do not include the projected $2 billion in sales from Carbon Black and VMware’s End-User Computing Group, which Tan said Broadcom would soon divest.

“We’ll find good homes for them. There are a lot of very interested parties who are more than happy to take those assets,” Tan said. “We will be very, very thoughtful about where we put those assets eventually, simply because many of their customers are also customers with VMware Cloud Foundation.”

CRN has reported that Broadcom has told VMware partners to stop commingling sales of VMware’s other products with those of Carbon Black or VMware’s End-User Computing Group.

Since Broadcom completed the $61 billion acquisition of VMware, it has laid off thousands of workers across the U.S., as the company quickly takes action on its plan to achieve profitability and pay back $30 billion in loans used to fund the deal.

Near the top of Tan’s agenda for VMware is converting the 60 percent of its licenses that are perpetual into subscription revenue, which he hopes to have done by the end of the year. It is a feat that Tan talked about when he first mentioned buying the company in May 2022.

Tan praised the VMware management team for their work during the transition. Tan said in the last 12 months he talked with at least 150 of the CIOs of VMware’s top customers. VMware Cloud Foundation is a mission-critical platform that provides the orchestration and management layer over their servers storage and networking.

“One thing is clear,” Tan said. “They want to make their data center, which is very heterogenous, between virtualization and compute to bare metal, a mix of environments with different vendors, where each is trying to optimize best of breed to one that is managing under a single abstraction layer across a diversity of hardware. That saves a lot of hardware purchases. That created a lot of cost reduction. That is the value of the technology that VMware brings to bear. The products are there. For us, it’s focusing and execution.”