CEO Antonio Neri On HPE’s Supercomputing ChatGPT Advantage, Axis Security And GreenLake Momentum

HPE CEO Antonio Neri tells CRN that ChatGPT has created a ‘very, very strong’ sales pipeline for an HPE Supercomputing-as-a Service offering.

HPE Is Set To Capitalize On ChatGPT Frenzy

Hewlett Packard Enterprise’s AI supercomputing prowess is proving to be a game-changer for companies looking to implement natural language AI models like ChatGPT, HPE President and CEO Antonio Neri told CRN.

“This is one of those things that happens every so often in the history of the company where a unique inflection point intersects unique innovation you have in the company,” Neri said.

In fact, HPE is already seeing a large pipeline of customers looking for help in leveraging large natural language AI models in a Supercomputing-Platform-as-a-Service model.

What’s more, HPE is already working with Aleph Alpha, which owns and operates Europe’s largest high-performance AI cluster, on AI-based natural language models.

“That pipeline of customers and verticals that are looking for supercompute capacity as a cloud consumption model is very, very strong, and we are uniquely positioned for that,” said Neri.

HPE’s $1.3 billion acquisition of Cray Supercomputer four years ago—which was driven by Neri—has set HPE up to capitalize on the ChatGPT frenzy. Furthermore, one of the public cloud providers looking for a natural language AI edge is already using HPE Cray systems. “We understood AI was going to change the world,” said Neri.

HPE is looking at providing a “cloud supercomputing IaaS [Infrastructure-as-a-Service] layer with a Platform as a Service” that opens the door for developers to deploy large natural language models at scale, said Neri.

HPE plans to provide more details around its cloud Supercomputing-as-a-Service offering in subsequent quarters, said Neri.

“We are very well positioned, and we have a very large pipeline of customers,” said Neri. “Last week I was in Europe and I was amazed to see the large pipeline of customers demanding this.”

HPE’s ambitious AI Supercomputing-as-a-Service charge comes after the company delivered better-than-expected record-setting results for its first fiscal quarter ended Jan. 31.

HPE posted non-GAAP diluted net earnings per share of 63 cents in the first quarter, a new quarterly record for the company. That was up 19 percent from the year-ago period and exceeded guidance of 50 cents to 58 cents per share.

HPE also reported revenue of $7.8 billion for the quarter, up 12 percent from the prior-year period, the highest first-quarter performance in six years.

The strong performance resulted in HPE raising estimates for Fiscal 2023, with revenue growth of 5 percent to 7 percent adjusted for currency. That is twice the prior revenue guidance from HPE.

HPE also raised its non-GAAP diluted net earnings per share to 2.02 to $2.10 cents per share, up from $1.96 to $2.04.

“Our customers have responded to the hybrid cloud value proposition we uniquely provide as they seek better ways to drive value from data from edge to cloud,” said Neri. “We are attracting more customers and executing with discipline. As we look forward, we remain laser-focused on executing our winning strategy, which is delivering unmatched innovation and significant results for our customers and shareholders. We are confident in our strategy and execution for the long term.”

Here are Neri’s comments on ChatGPT, the Axis Security acquisition and GreenLake on- premises edge-to-cloud platform pay-per-use momentum.

There has been a frenzy around ChatGPT. What does that mean to HPE, which has tremendous high-performance AI compute capabilities?

This is one of those things that happens every so often in the history of the company where a unique inflection point intersects unique innovation you have in the company. So if you recall, when we bought Cray Supercomputer in 2019, we understood AI was going to change the world and it will disrupt every industry.

Now we are seeing the fact that the cloud as designed today will not solve some of these challenges. When you look at the current size of the high-performance computing that ChatGPT uses, it is actually very small.

In order to train the model, you need way more supercomputing power because you have to constantly train it and retrain it to improve the accuracy. And for that you need things like our high-performance supercomputing systems a la Frontier [which HPE calls the “world’s first and fastest exascale supercomputer”].

So we have a unique opportunity to offer supercomputing as a cloud. This is the model we’re working with now with the team. Obviously, we want to understand the customer interest.

Today I will be speaking about one customer [Aleph Alpha, which owns and operates Europe’s largest high-performance AI cluster, on AI-based natural language models] that is already coming to us to offer that as a service to them.

I can tell you that the pipeline of customers and verticals that are looking for supercompute capacity as a cloud consumption model is very, very strong, and we are uniquely positioned for that.

So is ChatGPT going to be a boon for HPE?

ChatGPT is an AI model, but there are so many other AI models in terms of simulation modeling and the ability to do mundane tasks and automate the web. It‘s not just ChatGPT. AI has broad applications and models that eventually impact certain workflows in the enterprise in applications.

How does the Axis Security acquisition position HPE versus SASE competitors like Cisco and Palo Alto Networks?

We announced another great acquisition with Axis Security. This is the fourth acquisition in two months. Last week, we announced the [acquisition of] Athonet, which is in the private 5G space.

When you add Athonet with Axis Security plus, obviously, our intelligent edge portfolio with Aruba, we now have the most comprehensive edge portfolio in the industry.

We now are bringing together the entire connectivity layer with Wi-Fi, LAN, SD-WAN and private 5G. And on top of that, we have a consistent security framework with secure access service edge [SASE], which brings elements of the connectivity and the firewall with ZTNA [zero trust network access], CASB [cloud access security broker] and SWG [secure web gateway]. Now we will be the most comprehensive because some of the vendors you named only address one aspect of that security whether it’s the firewall, CASB or ZTNA.

Axis Security addresses all of that together with Aruba, where you have our firewall and obviously the most comprehensive connectivity layer. All of this will be fully integrated into our HPE GreenLake platform, which will be offered as a subscription service. Therefore, our partners will be able to sell all these solutions to drive a SASE model with recurring revenue, while also selling the underlying connectivity that comes with it.

This is another fantastic acquisition aligned to the mega trends we see where customers are now approaching this [edge market] from a security layer into the networking layer versus what traditionally has been more of a networking layer up into the security layer.

So the combination of access with [SD-WAN provider] Silver Peak, which we bought two years ago, plus the rest of Aruba, gives us the most comprehensive edge portfolio in the industry.

What do partners have to do to play in the SASE market with Axis Security?

Sell Aruba. If you sell Aruba, it comes with it. Fundamentally, I think the partners have a unique opportunity. Because you are already selling a subscription service with Aruba, this will be added to it.

This is especially attractive for what I call commercial, midmarket and SMB. In those three particular segments, they want to buy a complete solution. They don’t want to buy widgets or best of breed that they have to put together. Some very, very large enterprises may decide to go with aspects of best of breed. But when you talk about our joint route to market with the partners, and where we are very, very strong in the commercial, midmarket and SMB, we can sell the entire package as a subscription model.

Therefore, [Axis Security] SASE will come with it. You don’t have to do anything very specific. We want to make it so simple you don’t need a tremendous amount of skill sets and capabilities. You just click and deploy the subscription that comes with it.

Is the subscription GreenLake model going to be a big advantage for customers looking for SASE?

First of all, we have the most comprehensive portfolio at the edge. Second is an integrated experience, which means the same whether you’re deploying an access point, switching or an SD-WAN port. Now we have common Layer 7 [Network] Security on top, and we are integrating the private 5G versus selling many different aspects of this from other companies. In that case, there are many different solutions that the customer has to stitch together.

We offer all of this cloud-natively through HPE GreenLake. And then of course there is the simplicity and the experience, which will be so differentiated compared to everything else. That’s in addition to the fact that to begin with we have the best technology.

HPE is poised to get a cash windfall from the sale of its stake in H3C. What does that mean for HPE’s acquisition strategy?

I am focused on three big domains. One is the edge, where obviously security is a big component. Second is the cloud, where runtime and service automation is another big component. Third is AI, where obviously we are uniquely positioned at this point in time because of our supercomputing capability. So it could be any of those spaces. But remember, we always follow a very stringent return on invested capital.

Regarding H3C, we decided to exercise the put [option] because we believe this is the right answer for our shareholders considering everything that‘s happened in the market with China.

Right now we have ongoing discussions with our partner to come to the final agreement, and obviously there is a regulatory process that we follow in China. But as always, we’re going to look at what is the best return for our shareholders, and I believe M&A is a component of our strategy, knowing that we’re still very committed to returning capital to shareholders, particularly on the dividend side, and then also committed to a number of share buybacks on a yearly basis.

In the quarter for the first time you hit the $1 billion annualized revenue run rate [ARR] mark. What does that mean in terms of what you are seeing in terms of partner adoption of GreenLake?

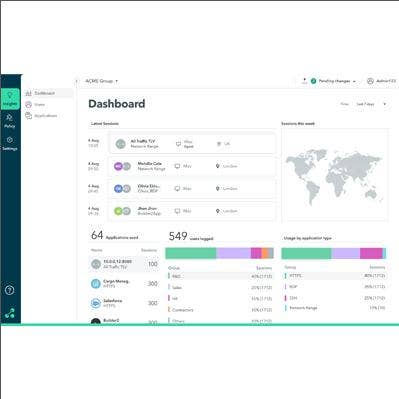

The more we grow our as-a-service business, the more resilient we become. That ARR grew 31 percent year over year and, today, the HPE GreenLake business that we sell is already 30 percent through the channel. That is up from 26 percent last year.

But here’s a more interesting factoid for you: The subscription services in the channel grew 163 percent year over year, and that’s a function of both storage and edge because edge and storage are now subscription services. And then last but not least, looking at our HPE total contract value for the as-a-service business, two years ago, meaning Q1 2021, it was close to $5 billion, which obviously takes a number of years to unwind. That’s what you see now with the $1 billion. At the end of Q1 2023, meaning two years later, we doubled it. Now the total contract value is almost $10 billion.

How does it feel to have recently celebrated your fifth-year anniversary as CEO?

Better than the first day on the job! It’s been a remarkable journey at all levels. I am the leader of an amazing company. I’ve worked on the culture with our employees and executives. They are the best ever. You can see the innovation. We are augmenting amazing organic innovation with amazing acquisitions that are tailored to the market trends we see.

And obviously we went through a lot these last five years. As a leader, I have learned a lot with COVID, supply chain disruptions, geopolitical tensions, inflation and currency effects. I think I’ve seen it all. But for me it has been a journey of a lifetime.

I am more excited than I was on day one. We always have work to do, but we are only as good as the people we have with us. And the partners play a big role because they are a part of the company. We always say partners are a natural extension of the company. So I want to thank them for being with me for the last five years and for sticking with me and my vision.