Enterprises Spend $178 Billion On Cloud Services, Doubling Data Center Market

‘Enterprises are now spending twice as much on cloud services as they spend on their own data centers,]’ says Synergy Research Group Chief Analyst John Dinsdale.

Enterprise spending on cloud infrastructure services reached $178 billion in 2021, an increase of 37 percent compared to 2020, with enterprises across the globe investing in the likes of Amazon Web Services, Microsoft and Google Cloud compared to products inside their own data centers.

“Enterprises are now spending twice as much on cloud services as they spend on their own data centers,” said John Dinsdale, a Chief Analyst at IT research firm Synergy Research Group in an email to CRN. “It’s a strong testimony to the value and attractiveness of cloud services that the 2021 market growth rate actually exceeded 2020 growth, despite the enormous scale that has already been achieved.”

According to new data from Synergy Research Group, total spending on cloud services climbed to $178 billion in 2021 compared to $130 billion in 2020, representing a spike of 37 percent.

[Related: AWS, GCP, Oracle, Azure, SAP Lead Cloud DBMS Market: Gartner Magic Quadrant]

The market shift of enterprises spending more on cloud infrastructure services compared to data center hardware and software happened in 2019, when enterprise spending on cloud services surpassed data center hardware and software for the first time ever.

When the global COVID-19 pandemic first occurred in 2020, it fueled a major shift in worldwide IT operational and spending towards the cloud. In 2020, enterprises spent a total of $130 billion on cloud infrastructure services globally, blowing by the $90 billion enterprises spent on data center products.

Cloud infrastructure services is the clear future in the enterprise market, as data center hardware and software spent continues to lower year after year on a worldwide basis.

‘Battle For Cloud Market Share Is Getting More Interesting’

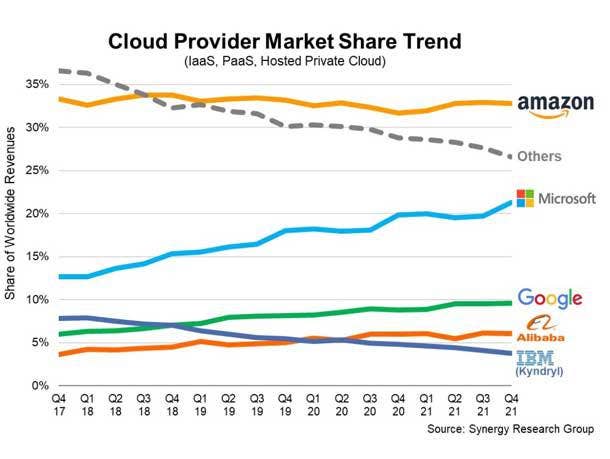

Amazon Web Services is still the dominant leader in cloud services, with approximately 33 percent of the worldwide market share as of the fourth quarter of 2021, according to Synergy Research Group.

However, Synergy’s Dinsdale said the “battle for cloud market share is getting more interesting” thanks to Microsoft’s “truly impressive” growth.

Microsoft now owns approximately 22 percent of the global cloud services market.

“It has taken Microsoft 18 quarters to double its market share, which has now passed the 21 percent mark,” said Dinsdale.

Google’s global market share stands at roughly 10 percent share of the cloud services market as of fourth quarter 2021, followed by Alibaba at 6 percent market share.

“Amazon continues to lead by a wide margin, but Microsoft, Google and Alibaba all continue to grow more rapidly. Microsoft’s market share is making impressive gains and is now just eleven percentage points behind Amazon,” said Dinsdale. “The rising tide continues to lift all boats, but some are being lifted more swiftly than others.”

Dinsdale said despite a relatively late start, Google too is now accelerating the pace of its cloud activities. Although its market share remains at less than half of Microsoft, Google continues to report strong cloud growth numbers.

The other major cloud computing companies with higher-than-average growth rates tend to be the Chinese-based cloud providers, according to Synergy, such as Huawei, Baidu, Tencent, China Telecom and JD Cloud.