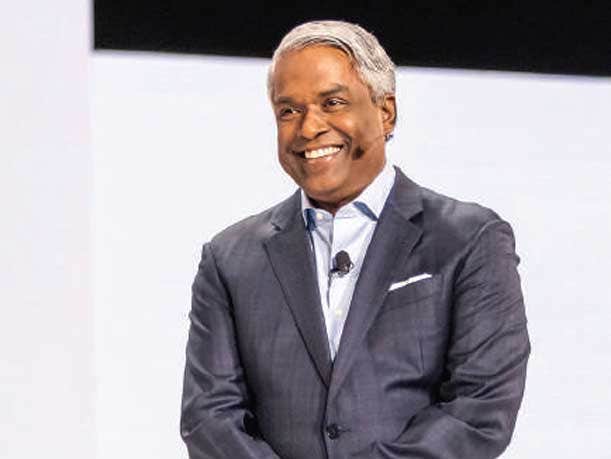

Google Cloud CEO: AI MSPs Are The Future

Thomas Kurian is leading the charge to build an ecosystem of AI life-cycle partners, providing them with financial incentives, lead generation and training and ensuring Google Cloud’s products have AI built in.

Google Cloud CEO: AI MSPs Are The Future

Thomas Kurian sees the need for a next-generation solution provider that is the tip of the spear for Google Cloud’s aggressive generative AI charge, where partners will become AI life-cycle MSPs tasked with transforming the business of every customer.

“Our vision for AI is very simple,” Google Cloud’s CEO told CRN. “Our view of what AI models do is take every role in a company—marketers, customer services, salespeople, etc.—they now have a digital expert that can collaborate with them. … A partner can build an entire business, a brand-new business, using AI models to do that.”

[RELATED: Thomas Kurian On Google Cloud’s AI Differentiators Vs. Rivals AWS, Microsoft]

Mountain View, Calif.-based Google Cloud is “meeting the AI moment,” with partners being the critical ingredient to the $33.6 billion company’s success in the GenAI era, Kurian said.

“Every role will transform over the coming years in every organization. It’s an opportunity for partners to think about, ‘How can I use this technology to reimagine that role? And what are the software packages and services I create for it?’” said Kurian. “As AI model capabilities evolve, customers constantly want to iterate what are the new things that the model can help them do, either in the existing department and solution they have, or elsewhere in the company. Leading partners are saying, ‘We’re going to build you a structure where we can just engage with you as a client. We can stay with you for multiple months or longer, delivering more and more capability. And we’ll take care of all the pieces that may be complicated for your company.’ … That’s what we mean by a full AI life-cycle partner. Many of them are now starting to say to clients, ‘You can give us a problem and we’ll solve it.’ We call that a new type of managed services partner.”

Google AI partners said they are no longer talking to customers about cloud spending commitments and consumption. Instead, they are explaining how AI can potentially solve business challenges—changing their relationships and total addressable market.

“The conversation is going beyond the Google technology and has moved from, ‘How much do you want to consume?’ to ‘Forget about consumption. Let’s look at the problem you’re going to get solved. Consumption will happen automatically,’” said Irfan Khan, president and CEO of Google Premier partner Cloudsufi, which specializes in AI and data analytics.

“That is a very powerful change of dialogue that is happening right now,” Khan said. “[Kurian’s] vision wants to move away from that [consumption] discussion, and he wants to say, ‘Look, how much value do you want?’ It’s a very big transition to create [Google Cloud’s] partner model on.”

San Jose, Calif.-based Cloudsufi’s revenue is up 50 percent in2023, while its AI customer pipeline has jumped 1,200 percent.

“Out of our massive pipeline growth, I would say at least 6X has come from areas which we never thought customers would explore,” he said. “AI is the new electricity. If we think about when electricity was formulated, it’s a general-purpose technology, which means it can be used for not one thing but a lot of different applications. That’s exactly what GenAI is.”

Kurian: GenAI Is ‘All About Changing The Customer Experience’

Partners cite a wide variety of successful customer GenAI use cases in production today, including helping pharmaceutical companies redo the way they conduct drug discovery, implementing net-new code generation and code refactoring, helping banks become closer to millennial customers by leveraging AI for digital transactions and creating AI models to do image detection on factory assembly lines. Other key use cases include improving patient care for hospitals by making a person’s entire medical history easily available for doctors and cleaning up companies’ data lakes and databases to automate new areas of business.

Kurian said one of the largest sales-driving opportunities for the partner ecosystem is not only selling to the IT department, but to the back offices of customers as well, opening up brand-new line-of-business dollars to chase after, thanks to GenAI.

“Some CEOs say, ‘Hey, I’m using AI to improve efficiency. Efficiency means my finance and back-office function, my human resources, my help desk, my call center and customer service system.’ Others say, ‘Hey, I want to change the way I engage customers, change the way that people book travel with me, change the experience they have when they visit my hotel, change how they order food.’ These are all about changing the customer experience,” said Kurian. “We provide amazing technology through Vertex AI [MLOps tools] and [AI-powered collaborator] Duet AI, but somebody needs to sit down with the customer and redesign that business process.”

In Kurian’s mind, that somebody is a partner with AI expertise.

Kurian is putting AI specialist partners front and center to drive this services-led customer redesign, armed with some of the most innovative GenAI solutions.

Google Cloud’s AI innovation engine has been revving in 2023, with nearly every new product launch this year revolving around AI. This includes the launch of Vertex AI, Duet AI, as well as new GenAI features injected into BigQuery, Workspace and the GoogleCloud Platform.

‘Every Company Who Needs Customer Services’ Is Seeking AI

Building and managing a customer’s AI life cycle is the biggest money-making services opportunity partners have ever witnessed, Google Cloud executives told CRN, as solution providers are poised to discover new use cases outside IT departments, build and maintain a customer’s AI models and constantly fine-tune and upgrade customer data.

Onix is a 13-time Google Cloud Partner of the Year winner that has been focused on data and AI for years. The company has 75 AI customer projects in production—from transforming patient care to deploying AI in call centers to boost agent productivity, as well as AI customers in retail, telecom and financial services industries.

“We’re helping customers with business transformation across the value chain, creating nonlinear growth models for customers,” said Sanjay Singh, CEO of New York-based Onix. “We’re enabling new product introductions, new solutions, new manufacturing capabilities as well as breaking the linearity between cost and revenue.”

Because “every company who needs customer services” is seeking Onix to transform their business via AI, the company’s sales are up 500 percent in 2023 compared with last year, including several recent big wins from Fortune 100 companies, Singh said.

“Google is innovating at a very rapid pace. Let’s suppose there are multiple models deployed within the customer environment in which that model also undergoes refresh all the time from Google. That is where a partner like us comes in, and we make sure that the model is giving the right results, you’re fine-tuning it, you’re making sure that the model is trained on the right data—that is where the MSP MLOps, DataOps and the AI Ops come into the picture,” Singh said. “That is supercritical, and it’s a very high-growth area for us. … The deployment of this AI tech is giving dramatic outcomes. Not small results, but dramatic improvements across cost, innovation and customer experience.”

Transforming a customer’s data into usable AI solutions is key for partners and leads to rich services opportunities, he said. Because customer demand for GenAI is far outweighing supply, Onix acquired business intelligence data analytics and AI company Datametica in October.

“Data exists in multiple systems, but customers need to form a 360-degree view of everything. That’s what this platform does from a contextual perspective—managing the models to make sure it is giving the right output and inputs, and managing that for the customer life cycle,” said Singh. “All my new hires are in the data and AI [areas]. My demand is outstripping supply in terms of data and AI capabilities.”

Google Cloud Faces AWS, Microsoft Competition

This year, the three largest cloud computing companies placed their investment dollars in GenAI. Like Google Cloud, Microsoft and Amazon Web Services are pouring billions into launching new GenAI products, services, tools and partnerships with AI startups like OpenAI and Anthropic, respectively, as the cloud giants want to inject AI into everything—from collaboration tools to new AI foundation models.

Kurian said Google Cloud will win this AI arms race by providing the best AI infrastructure for training and serving models in terms of cost, performance, scale and throughput. He cited as proof that 70 percent of AI unicorn companies and 50 percent of all AI startups are using Google Cloud Platform.

“We have a long history of integrating AI models into our products. Just saying, ‘I’ve got a model’ is not as capable as saying, ‘It’s integrated inside the product.’ Because the experience people have inside the product—How good are your prompts? How many times do I have to ask a question in the prompt to get an answer back?—that’s expertise we [have] built for a very long time,” said Kurian.

Google, for example, integrated AI inside its Gmail platform10 years ago, he said. “So [we brought] that expertise in terms of how we make models work efficiently inside products to Google Workspace and to Google Cloud Platform using Duet AI,” Kurian said. “And that enables partners to build solutions much more quickly around it because we’ve done it.”

This speed and established expertise are critical, partners said, as GenAI solutions have the ability to quickly create ROI for customers on a major scale. Historically, solution providers said, it was difficult for them to show value to customers in a matter of months when implementing a solution, typically taking several quarters or longer for them to realize ROI.

“In 10 weeks or 12 weeks, a customer was not able to visualize that something as drastic can happen where the entire piece of a problem can be fully, not just predicted, but become cognitive,” said Cloudsufi’s Khan. “With GenAI being added to the training engine, it’s possible. So what it does is customers’ commitment confidence goes up, and they are ready to commit.”

Khan said with GenAI, “It’s easy for customers to write the check because they can visually see an ROI, which is incredible. So with that, partners like us right are now going in saying, ‘In12 weeks, here’s what could be done.’”

New 10X GenAI Incentives For Partners In 2024

Google Cloud is putting its money where its mouth is in terms of enabling partners with financial incentives to become next-level AI MSPs. The company plans to double its incentive investments next year for partners driving GenAI deployments and life-cycle management.

“For partners who are deploying GenAI to customers, we plan to increase our investments by 10X,” said Google Cloud’s Kevin Ichhpurani, corporate vice president and head of global ecosystem and business development. “We’re really getting behind this. I’m super excited because 2024 is probably going to be one of the biggest opportunities for partners ever given the transformation that’s happening with our customers and given the new incentives and tools that we’re delivering for the ecosystem.”

Ichhpurani said Google Cloud is also “doubling” its investment in partner programs next year for GenAI customer adoption, including funding around sourcing of new logos, assessments and proofs of concept as part of the company’s Rapid Migration Program (RAMP).

“I’ve never seen an opportunity so large in my life for the ecosystem” said Ichhpurani, adding that he sees a 10X greater services opportunity for partners that provide high-value AI services. “Companies are trying to rethink their entire business using generative AI.”

Google Cloud is also investing heavily in training with Google partners already completing a total of over 100,000 AI courses. In addition, Kurian said Google is investing in demand generation and lead generation for partners byrunning events to teach customers and potential customers about AI.

“People come to our AIevents, then we give the leads to the partners. So it’s not just that they got trained and they have access to the latest models and have access to the solutions people are demanding but now, theyare being given a customer lead,” said Kurian.

The Google Cloud AI MSP

There are various opportunities for Google Cloud partners in the AI arena to make some serious money, from working with small businesses looking to begin their services-led AI transformation journey to enterprises already spending millions on AI to change their business model.

Google Cloud executives said customers are yearning for partners to help them identify AI use cases, the potential risks, and then prioritize use cases with the highest impact and lowest risk.

Then, customers are seeking partners to help them do proofs of concept and set up the correct data foundation needed to drive AI-fueled efficiency and ROI. This is then followed by customers’ need for data governance, data privacy and data refreshes as well as change management in areas like marketing departments and employee resources.

With GenAI impacting businesses’ top-line revenue while also bringing massive improvements to the bottom line, Ichhpurani said customers are begging for deeper expertise in AI, cybersecurity and data analytics.

“Customers are saying, ‘Hey, I don’t have the expertise inhouse to build these AI use cases. But I want you to not only build it, I want you to maintain it for me,’” said Ichhpurani. “They’re looking for this next-generation MSP, which is less about operating the infrastructure because the infrastructure is already highly automated in the cloud. They want somebody who is not just going to train an AI model, but they’re going to continue to refresh that model and update that model. So this next generation of MSPs that our customers are asking for is like an AI MSP that maintains that model, trains the model, refreshes the model and makes sure there’s not bias in the model. It’s not a one-time thing. It’s an ongoing thing.”

Kurian’s Leadership Key To Partner Ecosystem Growth

Before Kurian joined Google Cloud in late 2018, the company was generating annual revenue of $5.8 billion. This year, Google Cloud’s annual revenue stands at $33.6 billion, representing a 479 percent revenue increase in just five years.

“Thomas Kurian taking on the role at Google Cloud as CEO was a pivotal moment, not just for Google Cloud but for the entire partner ecosystem,” said Asif Hasan, CEO of Quantiphi, an AI and data science software and services Google Cloud Premier Partner based in Marlborough, Mass. “Google Cloud’s trajectory has been completely transformed, and the numbers are there to prove it. It’s not just revenue, but it’s also the profitability—which is a much harder problem to solve.”

For the first time in its history, Google Cloud reported profitability during the first quarter of 2023 of $191 million, up from an operating loss of $706 million the year prior.

In the second quarter of 2023, Google Cloud generated a profit of$395 million compared with a loss of $590 million year over year, representing a nearly $1 billion operations improvement. During the third quarter of 2023, Google Cloud maintained profitability for the third straight time by reporting an operating profit of $266million compared with a loss of $440 million year over year.

Quantiphi’s CEO said that thanks to Google Cloud’s partner first mindset, his company’s head count exploded from 500 peopl ein 2018 to now 3,200 employees. Although Quantiphi also partners with AWS and Microsoft, Google Cloud is the company’s foundation in the new AI era.

“In all of 2022, we did 20 to 25 [GenAI] projects. In 2023 as of October, we’ve already surpassed 300 opportunities,” said Hasan. “The degree of investment that we have seen in Google positioning its generative AI solutions in front of customers this year has been unprecedented.”

Kurian On The ‘Heart’ Of Google Cloud’s Success And ‘New Frontier’ Of AI

When questioned about how he was able to drive such high-revenue growth, profitability and have customers pick Google Cloud for their AI journey, Kurian said one “simple” strategy made it possible.

“We started with a very simple premise: Our success has to drive our partner success, and our partner success has to drive our success. So we didn’t look at the business as a fixed pie where we give business to our own consultants versus the partners. We said, ‘This is going to be the bigger the pie, the better for everybody,’” he said.

Compared with some of its AI and cloud competitors, Google Cloud does not have a large internal services organization. Instead, it relies on systems integrators, consultants, ISVs and MSPs to drive services sales, Kurian said.“

Unlike the competitors who have large services organizations, we’re not going to customers saying, ‘You have to use our services.’ In fact, we’re telling customers, ‘Start with your systems integrator, the consultant, the technology partner, the AI MSP that you’re comfortable with.’ What we’re going to do is make our services people assist them on the project. That’s a very different approach than saying, ‘Well, I’m not sure if my partner has the expertise so I’m taking the business direct,’” said Kurian.

From dozens of Google Cloud partners in 2018 prior to Kurian joining, the company now has over 100,000 partners. Kurian said the company’s success has come by building the best technology, helping partners create solutions with it, then building a field and go-to-market organization based on bringing partners into customers.

“Everyone across my entire go-to-market organization understands the value of that. So [recognizing that] has been the heart of our success,” he said.

Overall, Google Cloud is in prime position to become the worldwide leader in GenAI and artificial intelligence broadly, Kurian said.

“AI is the new frontier, and we want partners to get value from this next technology revolution. Because we think the platforms that win in the end are the ones that are most open and the most partner-friendly. Because if partners can bring solutions to our customers, that in the end is what makes everybody successful,” he said.

“From small to large companies, we see tons of interest [in GenAI], and it’s the one time where we’ve seen the demand emerging globally,” said Kurian. “We want every partner to know we welcome them, and we’re investing heavily in these programs. We’re giving them the ability to build a business with us in an area that we are seeing extraordinary customer interest, not just from the IT departments, but also from the lines of business who want to use AI to change themselves.”