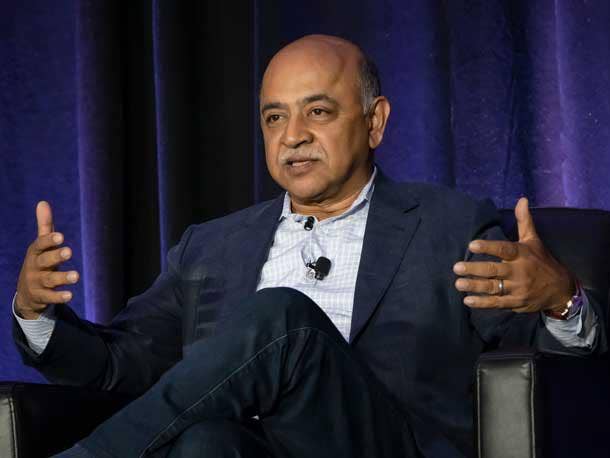

IBM CEO: AI, Hybrid Cloud The ‘Most Transformational Enterprise Technologies’

‘Hybrid cloud is about offering clients a platform that can drive value across these different environments. Our platform, based on Red Hat, allows our clients to consume software driven by open-source innovation,’ says IBM CEO Arvind Krishna.

IBM Chairman and CEO Arvind Krishna called his company’s partner ecosystem a “crucial element” of the tech giant’s go-to-market while highlighting strong returns from IBM’s Red Hat business, consulting segment and offerings around hybrid cloud, automation and mainframes.

These are some of the highlights of Krishna’s remarks to investors Wednesday during the company’s earnings call for the third quarter of IBM’s fiscal year, a quarter that ended Sept. 30.

“Our partner ecosystem is a crucial element of our strategy,” Krishna said. “Each quarter, we continue to expand the work we do with partners to serve our joint clients.”

[RELATED: IBM Resists Recession Fears, Calls Partners ‘Crucial’ To Strategy]

Here’s more of what Krishna had to say about IBM’s performance and the road ahead.

IBM Raised Revenue Guidance

Technology remains a fundamental source of competitive advantage. And we continue to see solid demand for our hybrid cloud and AI solutions.

Continued double-digit revenue growth in IBM Consulting captured client demand for digital transformation. Software revenue performance was also strong, with growth across all categories. And our infrastructure business had another high-growth quarter in both Z systems and distributed infrastructure. Our revenue strength was broad-based geographically as well.

When I talk with clients, it’s clear there’s a real opportunity to help businesses leverage technology in today‘s environment. Clients are dealing with everything from inflation to demographic shifts, from supply chain bottlenecks to sustainability efforts.

By deploying powerful hybrid cloud and AI technologies, IBM is helping businesses seize new opportunities, overcome today’s challenges and emerge stronger. We, too, are building a stronger company that is closely aligned to the needs of our clients.

In line with our hybrid cloud and AI strategy, we have continued to focus our portfolio; invest in our offerings, technical talent and ecosystem; and streamline our go-to-market model with strong performance through the first three quarters.

We are taking up our revenue expectations for the year and now expect 2022 revenue above our mid-single-digit model.

IBM’s Hybrid Cloud, AI Transformational Technologies

Hybrid cloud and AI are the two most transformational enterprise technologies of our time.

Hybrid cloud is already becoming the dominant architecture for enterprises. …

Hybrid cloud is about offering clients a platform that can drive value across these different environments. Our platform, based on Red Hat, allows our clients to consume software driven by open-source innovation.

IBM software has been optimized to run on that platform and includes advanced data and AI, automation and security capabilities.

Our consultants offer deep business expertise and co-create with clients to accelerate their digital transformation journeys. And our infrastructure allows clients to take full advantage of a hybrid cloud environment.

Our platform-centric strategy continues to have good momentum, adding a couple of hundred hybrid cloud platform clients in the third quarter. We see more and more clients consuming across our portfolio of software, consulting and infrastructure capabilities.

This quarter, clients such as Bank of America … and Samsung Electronics have chosen IBM to realize the full potential of a hybrid cloud computing model.

IBM Partners ‘Crucial’

As demographic shifts continue to add pressure to modern economies, coupled with wage inflation, companies are eager to deploy AI and automation capabilities at scale to boost their levels of productivity.

That is what IBM is helping companies bring to bear. In the context of enterprise, you’re seeing four main use cases emerge. AI to interact and converse. AI to automate IT processes. AI to extract knowledge and insights. And finally, AI to automate business workflows, such as HR, supply chain and financial reporting.

We are working to bring these capabilities to clients across all industries. For instance, this quarter, IBM Consulting partnered with the U.S. Department of Veterans Affairs to automate business workflows related to the delivery of pension benefits. This helps free up valuable time of their staff and speeds up the processing of claims made by the veterans most in need.

Our partner ecosystem is a crucial element of our strategy. Each quarter, we continue to expand the work we do with partners to serve our joint clients. For instance, we recently announced an expansion of a partnership with VMware to help clients in regulated industries more easily move workloads to the cloud, with IBM Consulting now serving as a GSI partner for VMware.

We announced that Red Hat and Dell are launching a set of containerized solutions aimed at simplifying the management of multi-cloud environments on premises. … These actions represent another step in our efforts to seize this opportunity to ecosystem relationships and our technology offerings.

Technology Innovations At IBM

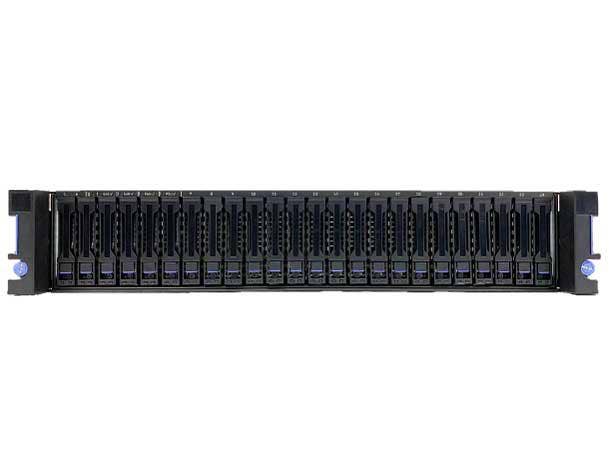

We are actively working to introduce new innovations and shape the technologies of the future. Most recently, we unveiled the next generation of a LinuxOne server, a Linux- and Kubernetes-based platform designed to support thousands of workloads within the footprint of a single system.

As an example, Citibank is hosting MongoDB on IBM LinuxOne, leveraging the platform’s security, resiliency and elastic capacity, and helping Citi lower its overall carbon footprint.

We also continue to make progress in quantum computing. We remain on track towards a goal of building a 1,000-qubit system by 2023. To advance the security of our communication networks, IBM, alongside Vodafone, recently joined the GSMA [a mobile network operators industry group]’s post-quantum telco network task force.

This task force aims to introduce a framework for the telco industry to adopt new quantum-safe approaches.

Complementing our organic innovation, we recently acquired Dialexa. This brings our total number of acquisitions this year to seven, adding new capabilities in areas like hybrid cloud services, security, data observability and sustainability.

As the world takes on the challenge of sustainability and building a more circular economy, IBM has been building a portfolio of solutions to help companies make progress on this journey.

IBM’s Positive Revenue And Demand Outlook

If you just look at the data going backwards, we see pretty strong demand. And we saw double-digit growth in Europe, double-digit growth in Asia and double-digit growth in the Americas.

And let me add some color to that as we look forward. … One, we are B2B. We have almost no B2C. ...

I could say none, but there is the weather business, which has got a little bit of elements of B2C in it, but it’s tiny. … Second, we’ve done a lot of work over the last few years, and our portfolio is largely in mission-critical areas, areas around automation, areas that are about leveraging AI for enterprise productivity. And I think that that productivity team is going to play out over actually not just this remaining part of this year, but for the next half-decade, maybe the full decade.

In the Americas, I find a very robust business environment. I find that most enterprises want to invest. They are leveraging technology to scale their business.

If I go to Asia, very similar. Very little change from the past, I think, going into the next few months, at least.

In Europe, I think we shouldn’t put our head in the sand. I think that with the mixture of energy and inflation, you can sense that there is some caution creeping into the conversations [with European customers], albeit not in the data and not yet in what we are doing as business there.

But we’d be foolish not to prepare. There could be a bit of a downturn in Europe only.

But let me now put all of that back into context. So you’re saying, Americas, Asia fine. If I get to Europe, Western Europe, ballpark, 20 percent of global GDP [gross domestic product].

Even if you have a massive impact—5 [percent] to 10 percent—that‘s a 1 [percent] to 2 percent impact on a global level, all in.

Technology is typically 3 [percent] to 4 percent ahead of GDP growth. That says there‘s still a robust technology environment in there.

IBM Mainframe Sales Help Growth

Last October, we talked about that we are going to be in a mid-single-digit revenue growth model and that we will be increasing cash flow each year. And we set out a target of $10 billion for this year and $35 [billion] over the period.

There is nothing that we see right now to alter us from that time. So I’m going to say that those projections stay in place.

As Jim [Kavanaugh, IBM CFO] pointed out, for 2022, we are saying that we will be above our revenue model. And that, we believe, will play out with the demand that you heard me talk about … Mainframe hardware has had a strong start.

We would expect that capacity increases. As the capacity increases, we expect that to follow with a tiny lag, sometimes a month, sometimes three months. into our transaction processing portfolio.

IBM’s Transactional Business And Pipeline

I can’t speak to the yield. I can speak to the yield about 10 weeks from now. The yield will come in over the next 10 weeks as opposed to right now.

If I look at our pipeline, pipeline indicates the strength that we are seeing. That is what gave us confidence to say that we see revenue coming in above our mid-single-digit growth model.

We see the pipelines are strong across software and hardware. So the very strong hardware growth in the third quarter, that is captured in the infrastructure business. I think that all reflects the demand that is there and across geographies—so not any particular, single market being strong.

If I look at software, I expect that the overall growth will remain strong. There’ll be some puts and takes in a couple of small countries. It’s possible. But that is the advantage of having a business that goes across 170 countries where that tends to get absorbed into the overall.

Right now, I’ll tell you, good pipelines based on the first nine months of the year. We expect yields to remain good or even better than before. … There is an impact on FX [foreign exchange rates]. That is probably the biggest impact to what we’re seeing right now.

I certainly, I’ll say, hope that we are seeing the end of the dollar strengthening as opposed to another significant change.

IBM’s Acquisition Strategy

Let me explain our rationale and our principles for acquisitions because it’s important to understand that it’s not so much size.

No. 1, they’ve got to fit our strategy, our strategy being hybrid cloud and AI. And in consulting, tools which add to our ecosystem, growth and our talent. That limits the universe of what we would look at.

Two, especially if it’s going to be larger, it’s got to be accretive. Whether we talk about at the end of the first year, or definitely in the second year, it’s got to be accretive to cash flow.

Three, there‘s got to be synergy with IBM. Like Jim [Kavanaugh] (pictured) mentioned, about $6 billion in inception-to-date signings, and the 1,400 projects that [IBM] Consulting did with Red Hat. That’s synergy—meaning that we would not have gotten that revenue and that book of business if we had not done that acquisition.

So then if I say that those are criteria, those would be criteria that would open up if there is something that is larger with the correct valuation and the correct economic returns for the company. … Thirdly, interest rates have an impact.

But, we’d also like to say there are multiple vehicles on how to raise cash … there are other vehicles for also raising cash when we are an attractive target for the acquisition to come into.

IBM Consulting Exceeding Expectations

[Last October, we] said that we expect software to grow in mid-single digits, so think 4 [percent] to 6 percent. And we had said consulting to grow in high single digits.

And we had said that infrastructure will be about flat. This year will be a good year because of the product cycle. And then probably somewhere in late ’23 or ’24, we‘ll get the flip side of that up from this year.

But then you get into consulting. Our long-term model was not in the teens, which it has done this year. It was in the high single digits.

So the book to build combined with the shorter-term signing gives us confidence that we will be able to maintain that model.

Look … the nature of our consulting business is very different from some others. The bulk of our consulting business is in digital transformation, helping our clients move to cloud. Not just our cloud, but AWS and Azure among it.

It’s on properties that I think are fairly essential to our clients—SAP, CRM, Adobe are great examples.

As you begin to wrap around, help them [customers] move to cloud—both public and hybrid—help them do digital transformation, help them take advantage of these massive productivity SaaS properties that I just named, even in a inflationary environment, even when the economy is not doing well, these tend to be the projects that stay the course.

But maybe the signings come in smaller chunks. And as long as we deliver well, then people tend to sign up more and more going forward. And that’s sort of a bit of color of what we’ve seen play out already this year, and we expect that to maybe increase next year.