IBM CEO Arvind Krishna Says Partners Should Raise Prices, Weighs In On Broadcom-VMware Deal

‘From our conversations with clients, I would tell you that nobody loves it [a price increase], but they all understand. Because most of our clients are doing the same out to their clients,’ says IBM CEO Arvind Krishna.

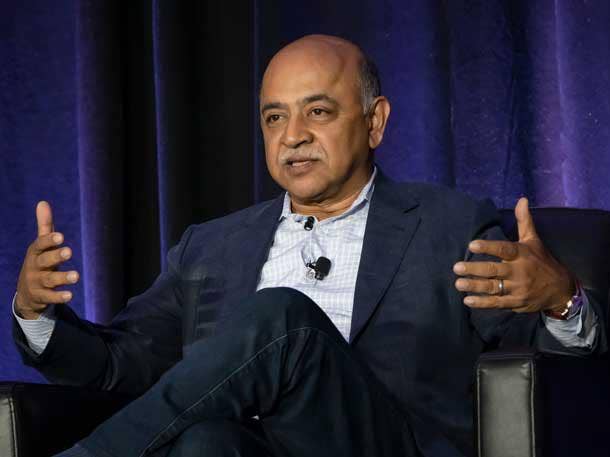

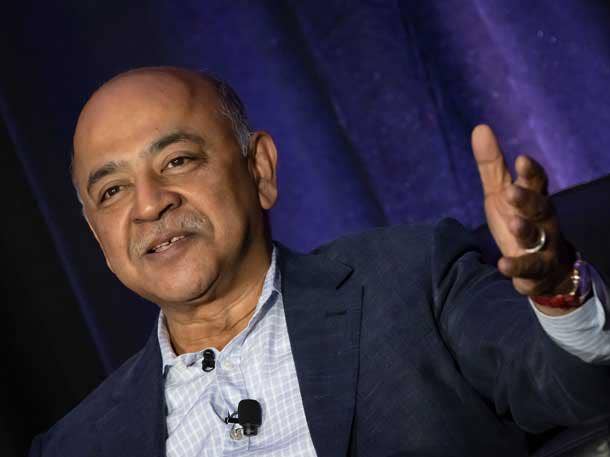

(L-R) The Channel Company Founding Partner Robert Faletra, IBM Chairman and CEO Arvind Krishna and CRN Executive Editor of News Steven Burke.

IBM Chairman and CEO Arvind Krishna encouraged partners to raise prices, weighed in on the pending Broadcom acquisition of VMware and touted his company’s cybersecurity prowess during an event at CRN parent The Channel Company’s 2022 XChange Best of Breed Conference.

“From our conversations with clients, I would tell you that nobody loves it [a price increase], but they all understand,” Krishna told attendees Monday. “Because most of our clients are doing the same out to their clients. … Pricing power comes down to something simple. Is the product highly valuable and is it sticky? … In a world of fewer skills, if you have the skills, you can price those skills.”

Krishna was on stage responding to questions from The Channel Company Founding Partner Robert Faletra and CRN Executive Editor of News Steven Burke. XChange Best of Breed runs Monday to Tuesday in person in Atlanta.

[RELATED: IBM Assimilates Red Hat Storage Technology Into Own Storage Business]

What Did IBM CEO Arvind Krishna Say About Red Hat?

Mark Wyllie, CEO of Boca Raton, Fla.-based IBM partner Flagship Solutions Group, told CRN in an interview that he’s glad to hear IBM plans to continue integrating different parts of the Red Hat business.

Earlier this month, IBM said that it had absorbed storage technology and teams from its Red Hat business to combine them with IBM’s own storage business unit as a way to help customers take advantage of the two without requiring extra integration or having to deal with multiple sales teams.

Wyllie wants to see IBM further integrate Red Hat services into its portfolio to help partners push the services out to existing IBM customers.

“I think that’d be a benefit to us and IBM,” Wyllie said.

As for Broadcom and VMware, Krishna said that VMware remains an important partner for his company. And as long as VMware keeps investing in its products, it should remain “a strong franchise.”

“I think it’ll come down to what is going to happen in 2023 and 2024,” Krishna said. “As long as they keep innovating on the products, they keep giving more function back to their clients—it’s a strong franchise. That falls away, then that’s a different question. But I think the virtualization world likes those products. Now it’s up to them to keep innovating.”

Here’s more of what Krishna had to say during XChange Best of Breed 2022.

Is IBM changing how it works with partners?

The number of clients that we go to directly is now like 400. … If you go back two years ago, that was more like 5,000. … [And we would be] very open about it, we would say, ‘Those are meant for the channel, those are meant for the resellers, for the distributors.’

But the reality was that you [partners] would often complain, ‘Hey, wait a moment. There’s a big business there. But then you guys put them into the top 5,000 because somebody there wasn’t doing well.’ … Part two, how about market share?

So last four quarters, we said we’re going to grow in constant currency at mid-single digits, 4 [percent] to 6 percent. We actually exceeded that for the fourth quarter of last year, for the first quarter, for the second quarter. Third-quarter results are not yet out.

But we expect that we are going to maintain that. That means we are taking share … and the bulk of that is not in the top 400 [enterprises]. The bulk of that is in the long tail.

So I can look at that and say, clearly, that we are either increasing wallet share of clients or increasing the number of clients that are there.

By the way … I want to increase the number of clients also, not just wallet share. … That means that we need your help. We are not going to go there directly at all.

The third part, in terms of being partner-friendly, I’ll take a different kind of partner. So in January of 2020, our book of business—you can take Amazon, you can take Microsoft, it‘s very similar with them, combined, because often what many of you will do is put a solution together for a client—was not measurable, maybe a few tens of millions [of dollars].

Our annual run rate combined with them is now over $1 billion. And the pipeline is more than $3 billion to $5 billion. So that tells you that we are much more open. We’re much more friendly.

Who would have thought three years ago that IBM and Microsoft or IBM and Amazon would work together? But that is where it comes together through all of you. It doesn’t really come together because we say so.

Where are partners successful with IBM?

So one, I’d like to thank everybody here who is a storage partner. … Our storage is absolutely succeeding.

Second, Red Hat is absolutely succeeding. … Red Hat is almost 70 percent channel, which is actually our single biggest success. Everything else at IBM is more like 30 percent. So that’s a strong success. … We’re not going to touch that. If anything, we want them to only go up from there, not down.

Three, on AI, we’re seeing a lot of success around conversational agents. Basically, how do you begin to deflect calls, emails, queries coming into an enterprise. … An area where I think there’s a lot of opportunity, but we are not seeing it yet with the channel, is around AIOps [artificial intelligence operations].

So when I say AIOps, I mean observability, application resource monitoring, application performance monitoring. … The products in there will be Turbonomic, Watson AIOps, Instana as examples.

I think the ability to go into an enterprise and tell them, ‘Look, we can do things a lot more automated. We can take some cost out. We can do monitoring, and eventually go closed loop on AI’—which I don’t think is happening yet, I think is a massive opportunity given the current labor market.

As a VMware partner and competitor, what do you think of the Broadcom deal ?

We are a partner. I just want to be clear. Look, the whole world competes.

We can partner with Microsoft and we can partner with AWS. And we run Linux on those clouds. We run Red Hat Linux on the spot. We run OpenShift on those clouds. … We run a lot of our software portfolio on top of VMware. VMware in turn becomes the layer that helps to abstract out hardware, whether from Lenovo, HP, Dell and many other partners.

So I would to call it more of a partner, not a competitor. So what are we hearing? Look, I think that vSphere, vSAN, NSX have a really strong position in the ecosystem. I think that the 20,000-plus—I think it is that many, but there could be more—clients who use it are probably very reluctant to move. …

Now, commercial is always going to cause some to churn, some not to churn. So my gut says they will gain some, they’ll lose some.

But it comes down to not what is happening today. I think it’ll come down to what is going to happen in 2023 and 2024. As long as they keep innovating on the products, they keep giving more function back to their clients—it’s a strong franchise.

That falls away, then that’s a different question. But I think the virtualization world likes those products. Now it’s up to them to keep innovating.

Is VMware your biggest hybrid cloud competitor?

I don’t look at it that way. So I believe the world is going to become multi-cloud. Multi-cloud means it’s not just VMware, but it’s not just virtualization. … I think, ‘What’s the opportunity?’

I think our clients are going to need multiple public clouds. And for the larger ones, they’re going to have a lot of on-premises infrastructure.

That is the world, I think, for the next 10 years. Five years ago, people debated, ‘No, it all goes to a singular public cloud.’ And we looked at it and said, ‘That doesn’t ever happen.’

People want diversity. People want optionality. People want flexibility. Nobody’s going to get themselves locked into only one [public cloud]. There are a few, but that’s probably 10 percent of the world.

So that environment, we said, you need an architecture, and they need a set of products that fulfill that architecture. So we said, ‘Containers [are] the answer to that world.’

If I look at containers, now you can go around and say, ‘Where is the volume of containers?’ So I raise my hand and say, ‘Outside of public clouds, I think OpenShift by far is the largest container infrastructure—billions of containers, maybe even more, are running out there. ‘

Then if you’re looking beyond that, I think the next one is people doing do-it-yourself Kubernetes.

I think No. 3 is probably what’s happening on Amazon with EKS [Elastic Kubernetes Service]. No. 4 is probably AKS [Azure Kubernetes Service]. After that, I stop worrying about who else is there.

So that’s really the world of containers. But in this day and age, everyone that I’ve mentioned, it behooves us to help all of them go along because that lets clients embrace what we really think is the correct architecture.

And then who gets more share depends on how good are we? How open are we? How good is our channel? How good is our sales team and client engineering and helping clients derive value from it? So that’s the path that I go down.

How should partners move customers to hybrid with OpenShift instead of another service?

I think there’s a lot more growth to get. … I think we have pockets of success. But this comes down to a different set of skills that are going to be needed by, especially, the services partners.

The skills they need are … in the old days you would talk about Java skills. People need Java skills, and if so they can take people and modernize their applications. … Today, that world comes down to do you have skills, and how do you deploy on containers?

How do you do things with one person instead of 10 people? Can you take care of all the monitoring and patching and security and all those aspects?

If you have those skills, you have a lot of confidence in walking to a client and saying, ‘Let me help modernize you’ so that you don’t leave it to just the big consulting companies and big SIs [systems integrators] to do that because I think there is a ton of opportunity in all the clients that you go to. ...

A lot of times, it’s on a public cloud. … A great example I will use is one that is right here in Atlanta, Delta Airlines.

They went to AWS. But they wanted flexibility. What do I do on-premises? What do I do on AWS? What do I do maybe on some other cloud, if I choose to go down that path a few years from now?

So they picked Red Hat as that abstraction layer so that they get an advantage. Yes, they do some things natively on AWS. And do some things natively in the data center. But for hundreds of applications, they’re doing it on that.

That is the skill set that if we all get together, then I think that there are tens if not hundreds of billions of dollars of opportunity, actually, for all of you. The multiplier on services is 10 times, probably.

What’s the opportunity with IBM on security?

I think most of your clients … the last budget that they will touch is the cyber budget. … You have criminals who are going to come.

I kind of react to it very simply. I’ve always said this, ‘Why do criminals come after the cyber infrastructure? … Where’s the value for most companies?’ It lies in that infrastructure.

If you begin to either encrypt it or create ransomware or come after it, it has value. If people manage to steal credit card numbers, you can sell them on the black market. They have a certain value. So they are going to, whether it’s criminals or whether it’s nation-states.

How do you protect yourself? So I think it’s a massive opportunity first. Then you say, ‘OK, in that, where is IBM going to be great?’

So whether it’s threat management—and we keep innovating, we keep building our own, we keep buying properties. And so what is called threat surface management is a big topic. What is my threat surface? Doing the old days of pen[etration] testing once in two years—really, for two years, you’re going to leave yourself open in case something came the day after the pen test?

So how do you do it much more automatically? So our threat management portfolio there with both Randori and QRadar, I think it’s a great place where we can work together.

Then if I look at identity management, it’s a problem. Yes, on a singular public cloud, maybe you can get an answer. But if you’re not on a singular public cloud, you go to the to-do identity management and access controls across all of the spaces.

I talked about data. How do you protect your data—especially databases, because that’s typically where credit card numbers and people’s names and addresses and their personal information are stored.

So those are all areas that I think we are great at. Yes, you have other choices. But the fact that we have a multibillion-dollar business there tells you there is a lot of opportunity that is there together for all of us, going down that path together with our clients.

Is IBM going to become the best multi-cloud security platform for partners?

I would say we are [the best], not going to become. But there are plenty of pieces we will not do.

We will not do firewall. We are not going to do anti-virus. We‘re not going to sit on your iPhone or your Windows machine or a desktop Linux for the few of you who have those. … So these are all areas we partner with.

But when you step back and say, ‘But I need to have a common view of what is happening. How many attacks am I getting? I’ll give you a great stat from the Masters. So that’s a golf tournament. … 40 million attacks in the four days of that tournament.

So if we had to stand up a team of analysts, that would be thousands of analysts. … So you did begin to go through all the AI triage. How do you take those and say, ‘OK, which ones are duplicate? Which ones are serious? Which ones are not serious … to triage it down to where you get to a couple of thousand per day, which means you need tens of analysts, not thousands of analysts.

I think that is the power of platforms. That is what we do there. We do this for three or four different sporting events. … So that’s why I say we are [the best]—not going to be. … It’s more than the multi-cloud. It’s more, where are my risks? When am I going to get attacked? How am I going to get attacked?

So we can bring the learnings we get from across all our clients, which are across different clouds and different on-premises infrastructures and different countries in the world. Because you do get people trying things out in different places. So you can bring all that learning into our technology and then give it back to our partners.

Adding Red Hat storage to IBM storage, what’s the effect on the addressable market?

If I remember right, storage is—depending on who you talk to—is either $50 billion or $100 billion. … Software-defined storage runs on what are called storage RAID [redundant array of inexpensive disks] servers, as opposed to unique boxes.

I think that’s half the opportunity over time, that time being in the next one to five years. Not way out there.

So if you say it’s that big, then the ability to put it all together with object storage and Ceph and all of the ways to do backup and encryption and all those capabilities together is a massive opportunity.

And so the moment you go to storage with servers, you would say the hardware and Capex probably decreases by 50 percent compared to having a box.

By the way, we will cannibalize ourselves because we do like to sell storage boxes, too. The V7000 and the DS8K, so it will cannibalize that.

But once people have learned that you can keep going down this path of being able to add capacity and it’s pretty nondisruptive. And you can keep adding capabilities, not having to upgrade the box itself. That’s pretty attractive as a market.

So I think it’s a massive market. And by the way, I think this appeals all the way down to probably client 30,000, 40,000. This is not confined to the top few.

Because everybody has storage storage is only going to increase with ransomware. Everyone’s going to worry about having three, four or five copies of data. Where are you going to keep that? How are you going to run that? How are you going to manage it?

I think it’s a big big opportunit. ... That’s not going to happen without the skills of all of you helping these clients get there.

Where is next for Red Hat integration into IBM’s portfolio?

I would go to, say, Linux first. … Is the world worried about energy prices? Especially here?.... OK, so if you look at electricity prices in the U.K.—and that isn‘t even as impacted as some other countries in Western Europe—are anywhere from two to five times higher. Those gaps of one to two times are confined for residents, not for commercial businesses.

So if you can take maybe 50,000 Linux servers and consolidate them using OpenShift on LinuxOne, maybe that’s a play to be made.

I mean, why do I throw those numbers out? Because there’s a few clients who have woken up to that and are doing it right now. So I think that’s going to be a really big play you’re going to see.

By the way, we haven’t stopped [integrating Red Hat]. Since acquiring it [in 2019], we have acquired security capabilities into the Red Hat portfolio.

I think you’ll expect to see that those are going to come out stronger and stronger about security protection of containers, and more and more automation there.

You’ve seen us bring management capabilities into the Red Hat portfolio. On storage, you saw it go the other way from Red Hat into IBM. But let’s remember, the first three were the other way, from IBM to Red Hat.

So it’s going to go both ways [depending] on what makes sense. … Wherever it is strongly open source, the Red Hat brand carries a lot more capability than the IBM brand. You’re going to see us put things there.

Now on storage, I don’t know, maybe it makes sense. Maybe we already have a storage channel, which Red Hat kind of didn’t. I think if I remember right, there are 5,000 partners who sell IBM storage. So bringing those things in allows them a lot more access into the market.

So you’ve got to look at distribution, not just technology, which is why the storage one got done.

Where can the IBM public cloud be No. 1?

We’re chasing three markets for IBM public cloud. Now, once you get into a client, before I tell you what those three are, you’re always going to find this opportunistic workloads. And of course, we’ll take them.

The three we are after are the FSS [financial software services] cloud, which is building in the regulatory controls that our banking clients need all over the world. … As you build in those controls, it takes a lot of cost and angst out of those clients. … We have 150 banks now on our council for FSS cloud. That’s No. 1. But what’s under it is both Red Hat and VMware—that’s why I say it’s an ‘and’, it’s not a, ‘I don’t want to get into a conflict.’ Those are the two most common pieces inside of that.

The second workload we’re after is SAP workloads. And we are an SAP Rise premier partner. We do a lot of the cloud work, the automation scripts to be able to run SAP workloads on the IBM Cloud. I mean, talk about opportunities. I don’t think most partners that we have have woken up to that one…. And three, I think we have more VMware on our cloud, but I don’t know what they have on the other clouds. I think we have more VMware, I think, on the IBM cloud than most others.

So those are three pretty good areas. But that’s more workload-targeted and trying to go head-to-head with the other clouds. So it’s complementary, actually, I think, in a sense.

Should partners raise their prices?

Yes. Now, the question is how? So if you’re getting … an 8 [percent] to 9 percent increase in your labor rate, there isn’t that much margin. If you have 40 percent margin, OK, maybe you can live with it. … But if not, you’ve got to pass it on. Now the question is, how much do you pass on and in what time? … So maybe you pass 6 percent of it on and then see what’s going to happen.

If inflation comes down, then you can do six one more year, and then you’re caught up. … Maybe slightly lower margins for a while, but you are passing on a price increase.

Finally, from our conversations with clients, I would tell you that nobody loves it, but they all understand. Because most of our clients are doing the same out to their clients.

Then on the product side, wait, what’s the cost in building products? R&D? Those people are costing a lot more. Distribution? That’s costing a lot more. Our own supply is costing a lot more. … If it’s 9 [percent] or 10 percent you can’t put all of that out in one go because that’s tough.

By the way, we also have multiyear contracts, so we don’t get all of it in. … Pricing power comes down to something simple. Is the product highly valuable and is it sticky? … In a world of fewer skills, if you have the skills you can price those skills.

If you think those skills are fungible and easily taken up by somebody else … What, 5 million fewer people than there are jobs? OK, so then you’ve got to take and play that into the macro.

Our clients can’t hire people either in the world that we are in. So that means you can do it. And they would much prefer it to be variable than fixed. So I think that there is pricing power, but you have to do it in a way that they can live with. Go have a conversation … [Give them] a few months so they have time to prepare for it.