IBM Earnings Preview: 5 Things To Know

Analysts will likely ask IBM Chairman and CEO Arvind Krishna for more details on how the tech giant seeks to differentiate itself in a competitive landscape.

Possible acquisitions, how IBM is investing in innovation, and customer spending habits in an economy potentially headed for a recession are some of the likely subjects to come up during IBM’s fourth fiscal quarter earnings report Tuesday.

The quarter covers the three months ended Dec. 31.

Armonk, N.Y.- based IBM is reporting its earnings during a period of mass layoffs across the tech sector.

[RELATED: IBM Introduces Partner Plus Program, Replacing PartnerWorld]

IBM Q4 Earnings Need To Know

Microsoft, Sophos, 8x8, Citrix and Salesforce are among the vendors to announce cuts in recent days, placing the blame on slowing spending by customers watching inflation and interest rates rise plus hiring too many people to keep up with customer demand for remote work and digital transformation amid the pandemic.

Likely on analysts’ minds during IBM’s earnings call is how a slowing economy will affect the tech giant.

In this earnings preview, CRN also looks at:

* Are Partner Investments Paying Off?

* IBM’s Innovation Investments

* Acquisition Updates

* Two Analysts Raised Expectations For IBM

* Lowered Expectations From Morgan Stanley

Here’s what you need to know.

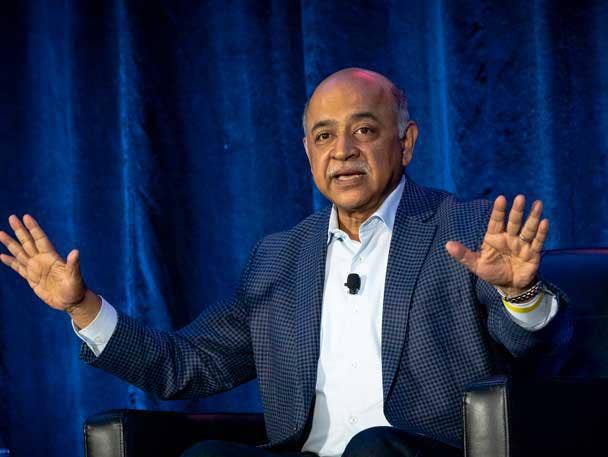

IBM Chairman and CEO Arvind Krishna

Are Partner Investments Paying Off?

IBM Chairman and CEO Arvind Krishna has publicly sung the praises of the tech giant’s partner ecosystem, and since Kate Woolley’s promotion to channel chief—or, more formally, general manager of the IBM ecosystem—the company has taken steps to make life easier for partners.

Some of those steps include more access to training resources and introducing the new Partner Plus program.

The performance of IBM services-led partners isn’t a common topic for the company’s quarterly earnings calls. But perhaps IBM has started to see some benefits in revenue from providing more resources to partners as customers become more reliant on MSPs, systems integrators and other such partners.

IBM’s Innovation Investments

Surveys of CIOs by KeyBanc Capital Markets and Morgan Stanley each showed that security, cloud and analytics, and business intelligence are the biggest priorities for 2023. Hardware sat among the least important.

IBM has captured some headlines with its innovations in quantum computing, AI and automation and cybersecurity, but mainframes and hardware remain a major part of the IBM brand.

Analysts will likely ask Krishna for more details on how the tech giant seeks to differentiate itself in a competitive landscape that includes security heavyweights Microsoft and CrowdStrike as well as automation heavyweights such as ServiceNow and Microsoft.

In Morgan Stanley’s fourth-quarter CIO survey, IBM actually increased its standing as an enterprise automation provider compared with a year prior.

## Acquisition Updates

Late last year, IBM acquired digital services provider Octo to add more government-focused muscle power to IBM Consulting.

And just before the end of the third fiscal quarter, IBM made its sixth purchase of 2022 with Dialexa, an engineering consulting specialist also meant to boost IBM Consulting.

Analysts may ask Krishna about future acquisition targets to help the vendor grow market share and revenue. A Morgan Stanley report issued Wednesday said that IBM should have a cumulative free cash flow of $35 billion for 2022 to 2024—although the firm said it has “no knowledge of any potential transactions.”

Two Firms Raise Expectations For IBM

At least two firms—Bank of America and MoffettNathanson—upgraded their expectations for IBM’s stock next week, according to multiple media reports.

Bank of America increased the price target for IBM from $145 a share to $152 a share, according to Investing.com. The firm expects IBM to outperform with revenue growth and improved free cash flow and a portfolio of products that should do well in a recession.

A MoffettNathanson report, meanwhile, upgraded IBM from underperforming to an expected performance in line with the market. The firm had rated IBM an underperforming stock since 2018, according to Seeking Alpha.

The firm expects IBM’s IT services to see strong demand in 2023 despite or even because of recession concerns, according to Seeking Alpha. MoffettNathanson’s report praised IBM for divesting Kyndryl and keeping its IBM Consulting wing vendor-agnostic.

Lowered Expectations From Morgan Stanley

Morgan Stanley issued a report Wednesday downgrading IBM from a rating of overweight to equal-weight— meaning the firm expects an average return of others in the coverage area.

Although the investment firm upgraded IBM to overweight in April, Morgan Stanley now thinks the vendor will have a tough time beating last year’s performance in mainframes and enterprise license agreements.

Morgan Stanley believes an “early cycle environment” will happen in early or mid-2023. These environments are usually when IBM underperforms, according to the report.

“Should our 2023 Industry Outlook prove correct, and early cycle dynamics emerge in mid 2023, we see risk to outperformance given the stock is trading near-record highs and IBM historically underperforms IT Hardware and its peers in an early cycle environment,” according to the report.

Still, the report complimented IBM on creating a “more defensive business model” of 60-plus percent recurring revenue mix and 75 percent software and services revenue mix.

Morgan Stanley forecasts that IBM reports $16.3 billion for the fourth fiscal quarter, a 5.2 percent increase year over year minus foreign exchange.