IBM Q1 2023 Earnings Preview: 5 Things To Know

IBM’s most recent fiscal quarter ended March 31.

On Wednesday, IBM reports first fiscal quarter earnings, with its Partner Plus program, acquisition strategy and movement in quantum computing likely discussion topics from executives.

Along with these topics, CEO Arvind Krishna and Chief Financial Officer Jim Kavanaugh are likely to discuss:

*IBM Security ahead of RSA Conference 2023

*Any effects from the uncertain economy and financial sector on Armonk, N.Y.-based IBM

*Any effects from IBM’s layoffs announced in January

IBM’s most recent fiscal quarter ended March 31.

[RELATED: IBM’s Most Highly Compensated Executives In 2022]

IBM 1Q Earnings

The pressure’s on for Krishna and Kavanaugh. Credit Suisse predicts revenue for IBM’s first fiscal quarter of $14.46 billion in revenue. That’s still a 2 percent increase year over year, but lower than the firm’s initial expected revenue of $14.58 billion “due to increased macro uncertainty during the last weeks of” the first quarter of 2023, according to a Thursday report.

Morgan Stanley issued a report April 11 saying that topline results should line up with expectations, but “any small blemishes in the quarter are likely to result in post-earnings stock weakness” and decrease confidence in IBM reaching full-year expectations.

Bo Gebbie, president of Minneapolis-based IBM partner Evolving Solutions – No. 165 on CRN’s 2022 Solution Provider 500 – recently told CRN in an interview that hardware, artificial intelligence (AI) and security have been top of mind for his IBM clients.

“I couldn’t tell you a mainframe conversation that doesn’t involve security – whether that’s on the compute side, the storage side, and most often it’s both of them,” he said. “So that’s been important.”

Here’s what else you need to know before IBM’s first-fiscal-quarter report Wednesday.

IBM channel chief Kate Woolley

Partner Plus Praise

With IBM’s new Partner Plus program now three months old, perhaps Krishna or Kavanaugh will find an opportunity to highlight the work of IBM channel chief Kate Woolley.

In a blog post Thursday, Woolley revealed that IBM has “seen the addition of over 1,400 registered partners since the new program was announced.”

Woolley also revealed that in one year since introducing deal sharing, IBM has “integrated partners into more than 23,000 deals valued at over USD 2.8 billion.” About 45,000 people have started new learning journeys since IBM launched a new skilling feature.

New features coming this month include a simple incentives stack across software and infrastructure to show how a partner’s business decisions impact the incentives they receive, including how to maximize incentives and eligibility. And a new Value Seller Tool provides partners with upfront discounts on infrastructure and services.

Woolley also said that IBM increased the amount of partner resources by 50 percent, on top of increases last year of 35 percent more technical resources and 100 percent more brand-specialized resources. IBM also increased direct investments in its demand generation program campaigns, according to the vendor.

Partners have already received demand engine and marketing kits access and a revamped Partner Portal that shows program tier scaling and a live dashboard for earnings, according to the vendor.

Economy’s Effect On IBM

IBM has made multiple product announcements leading up to earnings – including Power updates ripe for smaller customers and the partners they use plus new form factors for IBM z16 and LinuxOne.

A Morgan Stanley report April 6 surveying chief information officers (CIOs) on quarterly spending found that IBM has seen improvement in customer intentions consistent with past mainframe cycles – spending intentions for IBM rose 12 points to -44 percent year over year.

And yet, a Thursday Credit Suisse report questioned whether IBM feels the effects of an uncertain economy and a financial sector rocked by the Silicon Valley Bank collapse and increasing interest rates from the Federal Reserve to combat inflation.

The report notes that as of December, 45 of the world’s top 50 banks used IBM zSystems. Deals could be pushed into the second quarter due to events in March.

Credit Suisse predicts revenue for IBM’s first fiscal quarter of $14.46 billion in revenue. That’s still a 2 percent increase year over year, but lower than the firm’s initial expected revenue of $14.58 billion “due to increased macro uncertainty during the last weeks of” the first quarter of 2023, according to the report.

Savings From Layoffs, Spending On Acquisitions?

Credit Suisse expects good margins from IBM following layoffs. The vendor announced in January that about 3,900 workers – 1.5 percent of its workforce – were targeted for layoffs due in part to the 2021 Kyndryl spinoff and the 2022 sale of IBM’s health care data and analytics business to Francisco Partners. The layoffs were not due to 2022 performance or 2023 expectations.

IBM might also see more money for dealmaking should an April 12 report from The Wall Street Journal come to fruition and IBM sells its weather business for more than $1 billion. The business includes Weather.com but not The Weather Channel, which licenses weather data and analytics from IBM.

And overall, Credit Suisse still expects IBM to outperform the market “as we think the company is more insulated than others to a potential recession given recurring software revenue and AI assets.”

In a Morgan Stanley survey asking CIOs which vendor is expected to gain the largest incremental share of artificial intelligence and machine learning spending in 2023 and over the next three years, IBM and Red Hat came in fourth for 2023 spending, behind Microsoft, Amazon and Google but ahead of SAP, Accenture, Dell and EMC and Salesforce.

For the next three years, the ranking was Microsoft, Google, Amazon, Snowflake and then a tie between IBM and Red Hat and Dell and EMC.

As for Morgan Stanley’s predictions for Wednesday, the firm issued a report April 11 saying that topline results should line up with expectations, but “any small blemishes in the quarter are likely to result in post-earnings stock weakness” and decrease confidence in IBM reaching full-year expectations.

Morgan Stanley analysts will watch revenue growth, deal commentary, Red Hat growth, consulting revenue, book-to-bill ratio, free cash flow and other measures, according to the report.

For the earnings call Wednesday, Credit Suisse also hopes for information on IBM’s acquisition strategy looking ahead given lowered multiples for target companies. Recent acquisitions include Dialexa, Octo and Databand.ai.

## Morgan Stanley Survey Mixed On IBM

More insights from the April 6 Morgan Stanley CIO survey include IBM – along with Dell, Hewlett Packard Enterprise, Oracle and NetApp – named as most at risk of losing incremental budget share over the next three years due to the shift to cloud.

Among IT hardware vendors, “a net 5 percent of CIOs still expect IBM to be the largest net budget share loser due to the shift to the cloud over the next year, up 2 points from 3Q22 and is 5 points ahead of peers,” according to the report.

IBM’s “expected budget share gains/losses due to the shift of workloads to the cloud over the next year improved 2 points from 3Q22, to -5%, but on a 3 year basis it downticked 2 points to -9 percent,” according to the report. “In addition, while net spending intentions on IBM Cloud Paks and RHT (IBM enterprise open software subsidiary Red Hat) improved vs. our 3Q22 survey, spending intentions for IBM Consulting fell 18 points, to -45 percent, fell 18 points for IBM Cloud, to 26%,and fell 27 points to -10 percent for Security.”

IBM Cloud Paks improved 13 points to -23 percent and Red Hat improved 3 points to 0 percent.

Morgan Stanley also notes that “while this deterioration is notable, we also caveat this could be a function of surveying Hardware domain experts, not software/services experts.”

Spending intentions for IBM rose 12 points to -44 percent – a bump seen during past mainframe cycles. By comparison, Logitech declined 20 points to -16 percent and Dell fell 9 points to -17 percent.

HPE stayed flat at -31 percent. Nutanix dropped 31 points to -25 percent. NetApp gained 10 points to -16 percent. Pure Storage fell 14 points to -10 percent. Cisco fell seven points to -5 percent.

In the end, “while IBM spending intentions still remain negative, we are encouraged by the improvement over the past ~1 year and will be watching these data points over the coming quarters,” according to Morgan Stanley.

Movement In IBM Security And Quantum

With the annual RSA Conference set to start Monday, IBM will likely want to talk about its security offerings and tease upcoming announcements.

The new form factors recently introduced by IBM for z16 and LinuxOne promised to help more customers adopt edge computing and better security. The new form factors should introduce more customers to IBM’s Z Security and Compliance Center and time and manpower savings for audits and have security capabilities like confidential computing, centralized key management and quantum-safe cryptography.

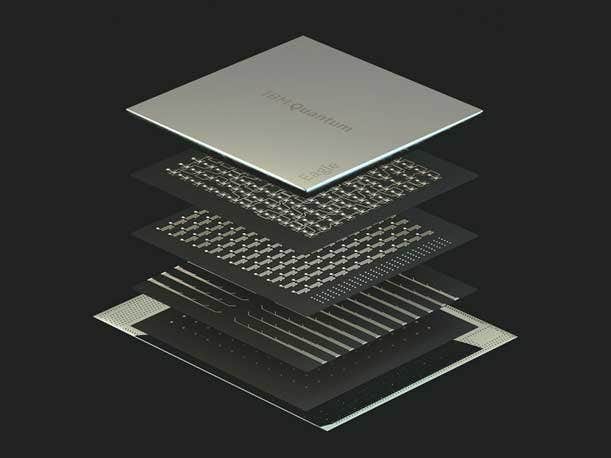

Meanwhile, IBM’s Krishna may want to celebrate some recent wins in quantum computing for the vendor. Consulting giant EY joined the IBM Quantum Network, adding more manpower to the advancement of quantum and giving EY access to IBM’s fleet of quantum computers over the cloud.

In March, Cleveland Clinic and IBM also unveiled the first deployment of an on-site, private sector IBM-managed quantum computer in the United States. The computer is focused on health care research.