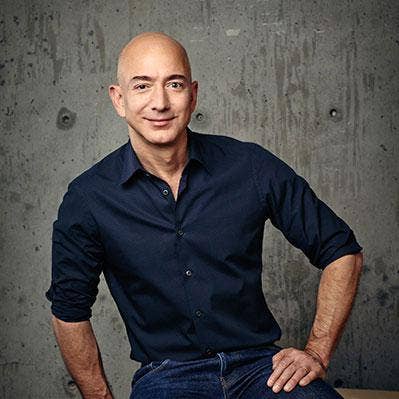

Jeff Bezos Unloads 3 Percent Of Amazon Stake

The Amazon founder cashed out almost $3.5 billion in the last week in pre-arranged sales executed after fourth-quarter earnings sent the stock soaring.

Amazon CEO Jeff Bezos has been divesting from the company he founded, selling off in the last week roughly 3 percent of his Amazon stake.

A series of pre-arranged stock sales timed to follow fourth-quarter earnings raked in for the world’s richest man almost $3.5 billion in cash. A couple years ago Bezos said he would sell at least $1 billion in Amazon stock a year to fund Blue Origin, his private space company, but this week’s transactions were the largest he’s made yet.

Bezos’ first sell-off started last Friday, the day after Q4 earnings sent Amazon’s valuation back into trillion-dollar territory. By Monday, he had sold 905,456 shares at roughly $1.84 billion, he disclosed to the SEC.

[Related: Warren Buffett Reveals $904M Berkshire Hathaway Stake In Amazon]

Through another pre-arranged sale executed Tuesday and Wednesday, Bezos divested from more than 810,000 shares, taking in roughly $1.65 billion, another SEC filing revealed.

Bezos net worth stands at roughly $126 billion, with almost $117 billion of that still represented by Amazon stock. His share of the e-commerce and public cloud giant has fallen from 11.6 percent to 11.2 percent with the recent deals.

The mega-billionaire has been pumping money obtained through Amazon stock sales into Blue Origin as the company competes with SpaceX for contracts to launch commercial satellites and ultimately drive a space tourism market.