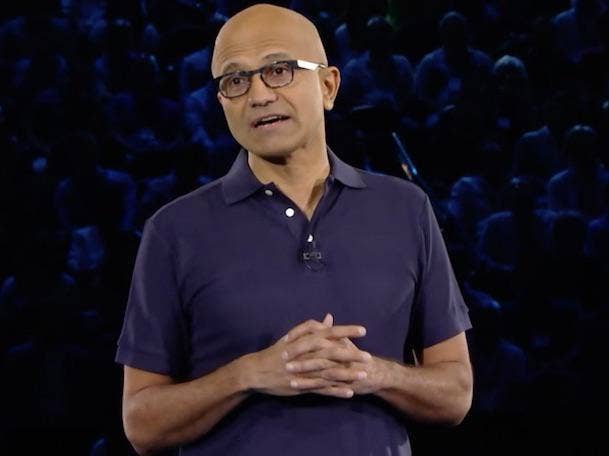

Microsoft CEO Nadella: 'Unique' Cloud Approach Powers Surging Growth In Azure

While hybrid cloud has become 'more mainstream' in the industry of late, 'we were talking about this five years ago,' Nadella says.

Microsoft is increasingly reaping the benefits of its smart bets in cloud made years ago, particularly when it comes to hybrid cloud, CEO Satya Nadella said Wednesday.

"We always believed that in distributed computing you need a cloud and an edge. You need hybrid. And guess what, today in 2019, hybrid's become much more mainstream. But we were talking about this even five years ago," Nadella said during Microsoft's quarterly earnings call with analysts, pointing to major momentum for Microsoft's Azure Stack hybrid offering.

The comments came after the Redmond, Wash.-based company reported strong growth in its Azure cloud business for its third quarter of fiscal 2019, ended March 31.

[Related: Microsoft Channel Chief On The Top Reason Partners Should Pick Azure Over AWS]

Revenue in Microsoft's intelligent cloud segment rose to $9.65 billion during the fiscal third quarter, up 22.2 percent from $7.9 billion during the same period a year earlier. The results were driven in large part by 73-percent growth in Azure revenue.

Years ago, Microsoft determined that "things that will matter in this transition to the cloud will be consistency and productivity," Nadella said during the quarterly call. "So for example, whether it's developer productivity or IT productivity--it's not any one dimension. You need to bring IT and developers together to drive agility in an organization in digital capability building. This is again a place where we've had a traditional strength, and that's showing up in the marketplace."

Additionally, "if you look at our cloud stack, we have application and infrastructure, data and AI, productivity and collaboration, as well as business applications. That's pretty unique," Nadella said. "So that's I think what is showing up at scale as competitive differentiation. And that's what you see in our numbers."

Overall for Microsoft's fiscal Q3, revenue reached $30.57 billion, up 14 percent from $26.82 billion during the same quarter the year before.

GAAP net income during the quarter rose to $8.81 billion, or $1.14 per diluted share, up from $7.42 billion, or 95 cents per diluted share, during the same period a year earlier.

Azure

Microsoft's "architectural advantage" in cloud is "a clear reason for our success," Nadella said during the call with analysts.

"Azure is the only true hybrid, hyperscale cloud that extends to the edge," he said. "Operational sovereignty is increasingly critical to customers, and Azure uniquely provides consistency across development environments, operating models and technology stacks, whether connected or disconnected to the public cloud."

Despite the fact that Amazon Web Services has the larger market share in public cloud, solution provider Anexinet has been seeing comparable demand among customers for Azure as for AWS, said Ned Bellavance, director of cloud solutions at Blue Bell, Pa.-based Anexinet, No. 209 on the CRN Solution Provider 500.

"AWS seems to be the cloud of choice for developer-driven companies that are building net-new solutions," Bellavance said in an email to CRN. "Azure, on the other hand, seems to be the choice for infrastructure-led and enterprise organizations that are looking to migrate their existing resource to the cloud."

Many of these organizations "are very comfortable using VMware as their virtualization platform and Windows as their primary OS today," Bellavance said. "For them, the look and feel of Azure is immediately more comfortable and they already have an Enterprise Agreement with Microsoft that makes the procurement process for Azure simpler."

Solution providers have a massive opportunity for migrating Windows Server and SQL Server instances to the Azure cloud, helping to make Azure a savvier choice for partners than AWS, Microsoft Channel Chief Gavriella Schuster told CRN in an interview earlier this month.

As support ends for SQL Server 2008 in July—followed by Windows Server 2008 in January 2020—there are tens of millions of SQL and Windows Server instances available to be migrated to Azure, Schuster said.

"That is, bar none I think, the biggest opportunity for our partners," Schuster said. "We talk to [partners] about that, and we talk to them about how it is five times more expensive for a customer to choose to migrate those servers to AWS versus Azure. And how Azure really is the most cost-effective opportunity for a customer to maximize their move to the cloud."

Office 365 & Dynamics 365

Microsoft's productivity and business processes segment enjoyed solid performance in the fiscal third quarter, as well, with revenue reaching $10.24 billion. That was up 13.8 percent from $9.01 billion the year before.

Key growth areas within the segment included Office 365 commercial revenue, which grew 30 percent year-over-year, and Dynamics 365, the company's combination cloud CRP and ERM system, which jumped 43 percent. LinkedIn revenue rose 27 percent from the same period in 2018.

At Anexinet, "we have definitely seen an acceleration in Office 365 migrations," Bellavance said. The firm has launched several "kickstart" programs over the past year, which aim to quickly help customers with key portions of migrating to Office 365.

"Our marketing and kickstarts have been a big part" of the growth in Office 365 migrations, Bellavance said. "There's a lot more to moving to Office 365 than just shifting mailboxes to the cloud. Proper planning and design are key, and that is the central point of the kickstart. We help clients truly understand the driving forces behind a migration, the order in which to adopt services, how to do so in a secure way, and some of the pitfalls to avoid."

While many organizations are already on Office 365, "there are plenty of companies that were a little hesitant to jump onboard," he said. "They are now seeking guidance and best practices on migration to ensure that it is smooth and successful."

Windows & Surface

Microsoft also saw a turnaround in its Windows business following sagging results in the previous quarter that stemmed from Intel's processor shortage. Windows OEM revenue climbed 9 percent during the third fiscal quarter, helping to drive Microsoft's personal computing segment to $10.68 billion--up 7.6 percent from $9.92 billion the year before.

Windows 10 is now active on more than 800 million devices, and "continues to gain traction in the enterprise as the most secure and productive operating system," Nadella said during the quarterly call.

Revenue from Surface devices, which grew by 21 percent, and Windows commercial products and cloud services, which rose 18 percent, also contributed to the personal computing segment results.