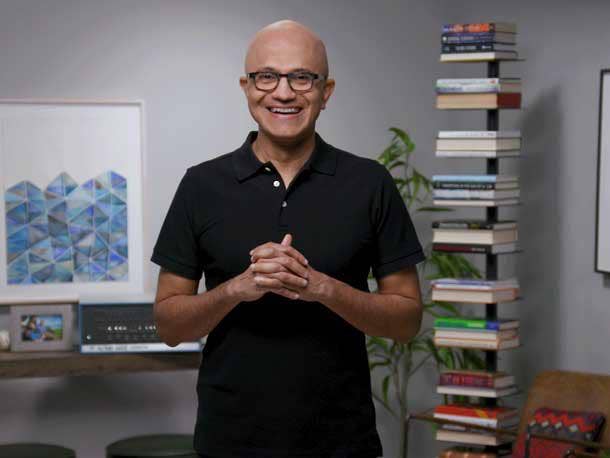

Microsoft CEO Satya Nadella: We ‘Outgrew The Market In Every Category’

‘We will invest to take share and build new businesses in categories where we have long-term structural advantage,’ Microsoft CEO Satya Nadella said on the company’s latest earnings call.

Microsoft CEO Satya Nadella said that his company is prepared to seize market share and grow despite economic uncertainty over inflation in the U.S. and a potential recession in the near future, promising that the tech giant will grow its slice of the pie in PCs, security, with its collaboration application Teams and in other areas.

“We will invest to take share and build new businesses in categories where we have long-term structural advantage,” Nadella said Tuesday during the Redmond, Wash.-based tech giant’s quarterly earnings call for the fourth fiscal quarter, which ended June 30.

“We are helping organizations digitize their customer experience, service, finance and supply chain functions as we continue to outgrow the market in every category,” he said.

[RELATED: MICROSOFT ‘PARTNER TRANSITION’ EATS INTO SMB, OFFICE 365, WINDOWS BUSINESSES]

Nadella On ‘Best-Of-Suite’ Value

Microsoft’s $51.9 billion in revenue for the quarter came in lower than what analysts expected, but optimistic comments about the company’s future sent the stock price up about 7 percent, from $251.90 at Tuesday’s market close to $268.74 at Wednesday’s market close.

“We do have every layer of the tech stack, right?” Nadella said during the question-and-answer section. “Whether it’s infra[structure], data, hybrid work, security, even Power Platform—in each one of these we do have this best-of-suite value, which includes best-of-category products. And that is leading to share gains.”

Phil Walker, CEO of Manhattan Beach, Calif.-based Microsoft partner Network Solutions Provider, told CRN that he is investing in growing his businesses across the Microsoft portfolio.

“We are doubling down on Azure,” Walker said. “We are investing in people, tools and growth in Azure, Windows, security and ERP.”

His company is also investing in Microsoft offerings around the Internet of Things, Walker said.

Reports issued by multiple investment banks following Microsoft’s earnings call were also optimistic on the tech giant’s quarter and future.

A Credit Suisse report Wednesday said that Microsoft’s results show that “businesses are moving forward on multiyear, strategic cloud-first transformation roadmaps and” that “Azure is disproportionately benefiting, as the ‘enterprise cloud,’ from this accelerated shift.”

“Azure to continue to narrow the revenue gap to No. 1 AWS and widen the gap to No. 3 Google Cloud,” according to Credit Suisse. The firm went so far to forecast mid- to high-teens of revenue growth from Microsoft for at least the next five years, with about 25 percent growth in its Intelligent Cloud segment, about 15 percent growth in its productivity and business processes segment and between 2 percent and 5 percent growth in Windows.

“Despite a worsening macroeconomic environment, management remains confident in achieving double-digit revenue and operating income growth in FY2023—with operating margin to be roughly flat,” according to the note.

Morgan Stanley issued a note Tuesday, saying Microsoft’s 35 percent year-over-year growth in commercial bookings “highlights Microsofts strong value proposition and solid secular positioning, while sustained guidance for double-digit operating income growth illustrates a steady hand at the helm.”

Although Microsoft gave “a credible outlook for double-digit revenue growth into FY23.” and Morgan Stanley called the company “a safe haven within software (and realistically the broade market),” its outlook for its current fiscal year could be rosier than expected seeing as “many investors feel the macro backdrop is likely to worsen further,” according to the firm.

The Morgan Stanley note also applauded more than 60 percent growth in E5, a license type usually held by larger customers. E5 should account for 12 percent of the Office 365 commercial installed base, according to the note.

Morgan Stanley did say that deal moderation in the SMB customer base is an area “to monitor,” with the trend expected to continue in the current fiscal year.

On Tuesday, Microsoft CFO Amy Hood said the company continues to deal with some weakness among SMB customers, a possible result of partner program changes in 2022.

Microsoft expects between about $49 billion and $50 billion in revenue in the first quarter of the new fiscal year, according to the tech giant.

Here’s what else Nadella had to say on the earnings call this week.

Nadella On Microsoft Taking Share

The Microsoft Cloud surpassed $25 billion in quarterly revenue for the first time, up 28 percent and 33 percent in constant currency.

When I talk with customers, it’s clear there’s a real opportunity to help organizations in every industry use digital technology to overcome today’s challenges and emerge stronger.

In this environment, we are focused on three things. First, no company is better positioned than Microsoft to help organizations deliver on their digital imperative so that they can do more with less.

From infrastructure and data to business applications and hybrid work, we provide unique differentiated value to our customers.

Second, we will invest to take share and build new businesses in categories where we have long-term structural advantage.

Lastly, we will manage through this period with an intense focus on prioritization and executional excellence in our own operations to drive operational leverage.

Nadella On Azure Progress

Organizations in every industry continue to choose our cloud to align their IT investments with demand. We are seeing larger and longer-term commitments and won a record number of $100 million-plus and $1 billion-plus deals this quarter.

We have more data center regions than any other provider, and we will launch 10 regions over the next year.

Our new Microsoft Cloud for Sovereignty helps public sector customers meet urgent compliance, security and privacy requirements. With Azure Arc, we are meeting customers where they are, enabling companies like GM [General Motors] ... UBS and Juniper to run applications across on-prem, edge and multi-cloud environments.

We’re seeing more customers move their mission-critical workloads to Azure. American Airlines, for example, chose our cloud to run its key operational workloads, including its data warehouse. And Telstra [an Australian telecommunications company] will move its internal IT workloads to Azure.

And we are the platform of choice for SAP apps on the cloud. Leaders in every industry including Kraft Heinz, Fujitsu and Unilever have migrated ERP workloads to Azure. Just last week, we announced a new service to accelerate adoption of Oracle workloads on Azure. We’re the only public cloud with simplified direct access to Oracle databases running in the Oracle Cloud.

Nadella On Data And AI

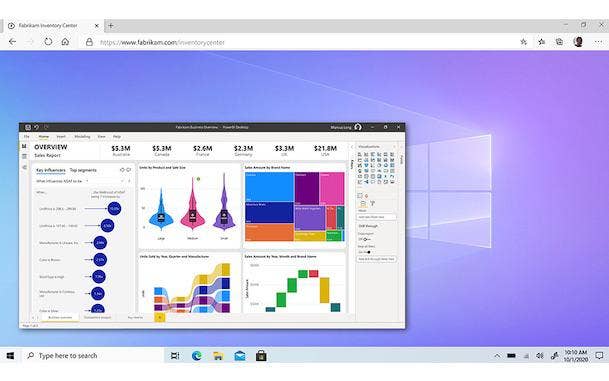

With our Microsoft Intelligent Data Platform, we provide a complete data fabric spanning operational databases, analytics and governance, helping customers focus on creating value instead of integrating fragmented data estates. More than 65 percent of the Fortune 1000 use three or more of our data solutions, and we are growing faster than the market.

We are seeing leaders in every industry—from LaLiga [a Spanish soccer association] and Lenovo to Swiss Re [a reinsurance company] and Walgreens—unify their data using our tools.

Cosmos DB is the go-to database powering the world’s most demanding mission-critical workloads at any scale. Transactions and data volume increased over 100 percent year over year for the fourth quarter in a row.

When it comes to AI, we are seeing a paradigm shift as the world’s large AI models become powerful platforms themselves. With our Azure OpenAI Service, a diverse set of customers from HSBC, PwC and RTL Group [a Luxembourg-based media conglomerate] to Shell and Wipro are applying language models to advanced scenarios like content and code generation.

Nadella On Developer Tools

We have the most popular developer tools across any cloud and any platform. Leaders in every industry, from Ahold Delhaize to KPMG to Philips are all choosing GitHub to build software.

GitHub Copilot is the first of its kind AI pair programmer which helps developers write better code faster. More than 400,000 people have subscribed since we made it generally available a month ago.

And with our expanding portfolio of container services, organizations like [retailer] H&M can build modern, more resilient cloud-native applications. All up, revenue from Azure container services increased by triple digits.

Nadella On Power Platform

With Power Platform, we’re helping domain experts rapidly drive productivity gains at a time when it’s never been more important.

We now have nearly 25 million monthly active users, and we are innovating to make it even easier for teams of pro and citizen developers to build end-to-end business solutions together.

AB InBev, Arm, Equinor [an energy company], Toyota, Vodafone and Zurich Insurance have all built centers of excellence to train employees at scale on how to use Power Platform.

PG&E, for example, expects to save at least 720,000 hours by eliminating redundant and manual processes across employee workflows.

Nadella On Dynamics 365

We are helping organizations digitize their customer experience, service, finance and supply chain functions as we continue to outgrow the market in every category.

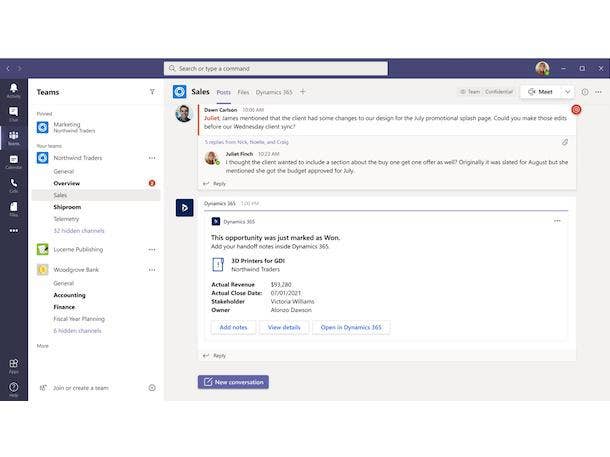

Our new Microsoft Digital Contact Center Platform brings together Dynamics 365, Microsoft Teams as well as enterprise AI capabilities from Nuance to help customers like HP deliver omnichannel customer engagement.

And new integrations between Dynamics 365 and Intelligent Order Management and Teams help people collaborate in the flow of work to overcome supply chain disruptions.

We are winning customers as we help organizations address their most pressing challenges. Peet’s Coffee is modernizing its supply chain with our business applications. Carlsberg is standardizing its field service and customer service operations. And Visa switched to Dynamics 365 for both its sales and call center organizations.

When it comes to our industry and cross-industry clouds, we are seeing strong adoption as we take a platform-driven approach to help organizations deliver on their digital imperative.

For example, Microsoft Cloud for Healthcare, inclusive of Nuance, is becoming the platform of choice for companies across the health-care value chain looking to drive meaningful clinical and financial outcomes.

Whether it’s a provider modernizing care delivery or health plan—transforming the member experience—or a retailer expanding into health services, having a technology partner that is truly dedicated to empowering their success is a significant differentiator for us.

Intermountain Healthcare, for example, chose the Cloud for Healthcare as well as Nuance’s DAX (Dragon Ambient eXperience) ambient intelligence solution as the pillar of its new digital strategy.

Nadella On Microsoft 365 And Teams

In this economic environment, every organization is looking to support employee flexibility and improve productivity.

Hybrid work is now just work, and it’s imperative that organizations reconnect and re-engage the workforce at home and the office and everywhere in between.

To do this, companies need a digital fabric that connects employees as well as customers and partners wherever and whenever they work while reducing cost and complexity.

We are all in on Teams. Over the past year, weve introduced more than 450 capabilities to empower frontline and knowledge workers to collaborate synchronously and asynchronously as well as remote and in person.

Teams is taking share across every category—from collaboration to chat to meetings to calling—and seeing higher usage intensity as companies turn to the platform to accelerate their digital transformation and orchestrate all their business processes in the flow of work.

ISVs from Adobe to Workday have built deep integrations with Teams.

And more than 100,000 companies—including Johnson & Johnson, Lumen Technologies and Progressive Insurance—have deployed custom line-of-business [LOB] applications in Teams.

All up, the number of third-party and LOB apps with active usage increased by 40 percent year over year. Teams Phone is the market leader in cloud calling across VoIP and PSTN. We now have over 12 million PSTN users, nearly double the number a year ago.

And Teams Rooms bridges the gap between people working remotely and those in the office with innovations like AI-powered cameras. More than 60 percent of the Fortune 500 have chosen Teams Rooms to connect employees across the hybrid workplace.

We’re also building a completely new suite with Microsoft Viva as we create a new employee experience category. This is both a priority for our customers and an expansive and high-growth TAM [total addressable market] for us.

Twenty-five percent of the Fortune 500 already use Viva as organizations increasingly recognize that employee experience and well-being are essential to their productivity.

Weve seen broad adoption across segments and industries – from Commonwealth Bank, Fidelity Investments and MasterCard to AstraZeneca and Schlumberger.

And this innovation is driving revenue growth across Microsoft 365. Asahi, Expedia Group and Qualcomm all chose our premium offerings to transform how employees work. E5 seats increased more than 60 percent year over year.

Nadella On Windows

With Windows, we are putting people at the center to help them securely work, connect and play. Despite a changing market for PCs during the quarter, we continue to see more PCs shipped than pre-pandemic and are taking share.

And we are seeing higher monthly usage of Windows 11 applications with increased time spent across creative work, collaboration, gaming, media and writing code as people rely on the PC for its unique productivity capabilities, rich interactive experiences and to stay connected.

We’re transforming how Windows is experienced and managed with Azure Virtual Desktop and Windows 365. Azure Virtual Desktop monthly active usage increased nearly 60 percent year over year.

One year in, we are seeing strong adoption of Windows 365 from organizations in every industry—from … Commercial Bank and Kyndryl to Lego Group and [investment manager] Schroders—as they use cloud PCs to rapidly on-board new and temporary employees and speed M&A integration while reducing IT costs.

Nadella On Security

As the rate and pace of threats continue to accelerate, security is the top priority for every organization.

We provide comprehensive solutions that integrate more than 50 categories informed by more than 43 trillion signals each day, reducing cost and complexity.

We’re taking share across all major categories we serve. All up, our security revenue increased 40 percent.

We are the only cloud provider with protection for the top three cloud platforms, and we are seeing more and more customers turn to us to protect their multi-cloud, multi-platform infrastructure. [Exam provider] Pearson VUE and Vodafone both chose our security stack to protect the digital estate across clouds. And we’re going further to help protect organizations. Our new Entra product family includes tools for permissions management, identity governance and identity verification.

And we now offer managed threat detection and response with Microsoft Security Experts. The world’s largest hedge fund, Bridgewater Associates, for example, will use the service to supplement its own security operations. … We’re investing in sharpening our focus to help our customers during this critical moment and to capture the massive technological shifts underway.

Our portfolio of best-of-category products and best-of-suite solutions along with our durable business models and intense focus on prioritization and executional excellence make me confident about our opportunity ahead in the coming year.

Nadella On Landing Large Deals

It was a record—even for us—even with the context of Q4 [Microsoft’s fourth fiscal quarter, which ended June 30]. So there’s obviously something going on in the macro environment, which it does feel that it plays to our strengths.

There are two things, at least, that I’ve observed. One is the—whether the bookings number or the MACC [Microsoft Azure Consumption Commitment] deals and the size of the MACC deals and the number of them I think speak to very much what weve been talking about for a long time now, which is as a percentage of GDP, IT spend is going to increase because every business is trying to fortify itself with digital tech to, in some sense, navigate this macro environment.

So that, I think, is probably what is reflected in those numbers. And then the second aspect is … we do have every layer of the tech stack, right? Whether it’s infra[structure], data, hybrid work, security, even Power Platform—in each one of these we do have this best-of-suite value, which includes best-of-category products. And that is leading to share gains.

So if you want to bet on a vendor on a long-term basis, where you have that best-of-suite value, and then you’re able to consume it on your terms—I think that that’s effectively what some of those numbers are indicative of.

Nadella On Azure Resiliency

Overall, we’re not immune to what’s happening in the macro broadly, right? … I’d start there because whether it’s on the demand side with consumers or SMBs. … But what’s happening in Azure, though, is in some sense businesses trying to deal with the overall macroeconomic situation and trying to make sure that they can do more with less.

So for example, moving to the cloud is the best way to shape your spend with demand uncertainty, right? In fact, if anything, one of the things that we’re seeing is an increased shift toward the cloud, and then of course, optimizing your bill.

We are incenting, even, our own field to ensure that the bills for our customers come down. That, in fact, even shows up in some of the volatility in our Azure numbers because that’s one of the big benefits of the public cloud.

And that’s why I think, coming out of this macroeconomic crisis, the public cloud will be even a bigger winner because it does act as that deflationary force.

So that’s sort of what we are seeing in the Azure numbers. We will be exposed to consumer-driven businesses and SMBs. But at some level, our strength as a company is much stronger in the core commercial. So I think that we will do fine there.

The other one is also people building new applications at a completely new frontier. I mean, there are two numbers that I talked about. One is the triple-digit growth in Cosmos DB and triple-digit growth in container app services.

You take those two things and you say, ‘What are people doing?’ People are writing applications at a completely different frontier of efficiency, which is a cloud-native, serverless, container-based type of applications. And so to me, that’s another way for you to make sure that your IT spend goes a long way in a time like this.