Microsoft Q3 2023 Earnings Report: 5 Things To Know

Microsoft executives might talk about generative AI, security and overall tech spending on the earnings call Tuesday.

Along with updates on Microsoft’s expansion plans for generative artificial intelligence, security and other technology areas, the vendor’s next quarterly earnings report should add more insight into whether business spending has continued to take a hit from moderated demand since the height of the COVID-19 pandemic.

On Tuesday, Redmond, Wash.-based Microsoft will report earnings for the third quarter of its fiscal year, a quarter that ended March 31. The company has operated in a cloud “optimization cycle” in recent months, and analysts will look for any signs of customers increasing their spend on new projects.

[RELATED: IBM Q1 Results: Consulting Weakness, Software Strength And Investing In Enterprise AI]

Microsoft Q3 Earnings

A Bank of America report published Wednesday said to expect:

*About 30 percent growth in Azure

*Productivity and business processes segment to report $17.1 billion, up 12 percent year over year ignoring foreign exchange

*Office 365 subscription growth of 11 percent, down a point from the prior quarter

*Average selling price growth of 6 percent ignoring foreign exchange

*Revenue from Microsoft’s intelligent cloud segment of $21.9 billion, a 17 percent increase year over year ignoring foreign exchange

Here’s more of what to look for when Microsoft next reports earnings.

Business Tech Spending Bellwether

Microsoft reports earnings after a week of slowdown-related comments from various technology companies.

IT solution provider CDW last week warned investors that the company’s first fiscal quarter 2023 would fall below expectations.

The company, No. 4 on CRN’s 2022 Solution Provider 500 list, also said it expects “intensifying economic uncertainty” to negatively affect the U.S. IT market.

On Thursday, AT&T CEO John Stankey told analysts on the vendor’s first-quarter 2023 earnings call that some products and services business customers bought at the height of COVID-19 to move to remote work “have reached their point of use that they no longer need them” as people return to the office from remote work and the economy normalizes.

“People are making their businesses more efficient—trimming,” Stankey said on the call. “And the wireless business is, of course, correlated to head count. And as some businesses have done some things to trim their employee ranks, you see that flowing through on handsets and data cards and things like that.”

Stankey continued: “It’s again nothing that’s out of the pattern of what we expected in terms of overall growth in the industry. We still have very healthy business services growth. We feel very comfortable about our share. … We’re penetrating in segments like in the public safety area better than the market in total. All considered, that’s pretty consistent with what we expected this year.”

Meanwhile, IBM executives said it saw “deceleration” and “weakness” in its consulting business during the first quarter of its 2023 fiscal year, but software demand remained “very steady” and the vendor detailed some of its investments in bringing more AI to enterprises, which could prove an opportunity for partners.

With that backdrop, analysts will likely want Microsoft executives to talk about not only the vendor’s performance, but to read the tea leaves for tech spending overall.

An End To Microsoft’s Cloud ‘Optimization Cycle?’

With that, analysts will likely look for signs that Microsoft and its partners have passed the business slowdown.

Microsoft Chairman and CEO Satya Nadella (pictured) explained the slowdown as the result of customers spending a lot of money on digital tools during the height of the pandemic and now wanting to get the most out of what they bought before spending more money.

Customers have been “looking to bank some savings on some workloads and then start [a new project],” Nadella said on the January earnings call. “So that’s where I think a little bit of what has to happen is a cycle time, where the optimization cycle finishes, the projects start and then the projects wrap.”

For the company’s per-user license business, customers who bought more licenses for knowledge and frontline workers previously are “now making sure that they’re all getting used,” he had said.

In Wedbush’s April 12 report, the firm predicted that Azure will hit at least 30 percent growth for the quarter.

“While the environment remains somewhat cautious given the uncertain macro, we are seeing slippage/downsizing on less than 10 percent of the larger Azure deals we are tracking in the field, which is an improvement from deal closure rates we picked up in the very shaky months of December/January when IT budgets were a moving target,” according to the Wedbush report.

For long-term prospects, Wedbush still estimates that less than 50 percent of workloads are in the cloud. Microsoft “remains in an enviable position to gain share in its enterprise backyard against AWS in this cloud arms race over the next 12 to 18 months.”

A Wedbush partner survey resulted in estimates that more than 90 percent of large deals involving Azure and Office 365 are still on track, with some “modest push-outs” and major cloud project downsizing “containable.”

Financial-focused businesses might be downsizing cloud deals and data center projects, but “federal deals are seeing the opposite impact as MSFT as well as cloud brethren Amazon, Google, Oracle, and IBM are seeing a surge of Beltway cloud deal activity in 2023 with a major shift to cloud underway from the Pentagon to civil agencies in the 202 area code,” according to Wedbush.

Morgan Stanley, meanwhile, said that cloud optimization has “a slightly longer digestion period than we expected, but a significantly higher degree of cloud adoption longer-term, leading to a larger” total addressable market.

“An elongated period of cloud optimization” could mean Azure growth below guidance with about 30 percent year-over-year growth—about $14 million in sequential decline. The prior quarter saw 38 percent year-over-year growth. And total Azure revenue has posted $434 million in average sequential adds during the third fiscal quarter since the start of the pandemic, according to Morgan Stanley.

It should be noted that the firm is acting as a financial adviser to Microsoft acquisition target Activision Blizzard.

Microsoft’s guidance for next quarter could show further Azure deceleration, with about 25 percent growth expected, according to Morgan Stanley. Microsoft could even forecast growth in the low 20s for fiscal year 2024.

Microsoft’s long-term health appears positive based on Morgan Stanley’s recent quarterly CIO survey.

“Microsoft widened its substantial lead in expected IT wallet share gains with shift to cloud over the next [three] years to 49 percent of CIOs surveyed, compared to Amazon at 14 percent,” according to Morgan Stanley.

The report continued: “Medium and long-term durability of growth is driven by continued cloud migrations, long-term Azure deals going into production, Microsoft’s intensifying focus on cloud verticalization, strong positioning for the rise in AI/ML use cases and a Microsoft 365 sales motion to support the seat-based/SaaS Azure workloads.”

Microsoft Azure was also most cited by CIOs for cloud-based data consolidation over the next three years, followed by AWS, Snowflake and Google.

Among Morgan Stanley’s cloud predictions for Microsoft for the quarter:

*Office 365 commercial growth of 13 percent year over year, a decrease from 18 percent growth the prior quarter and 20 percent for the third fiscal quarter of 2022

*Microsoft Cloud gross margins of about 72 percent, helped by $3.7 billion in depreciation savings from useful life accounting changes

*Microsoft Cloud—which includes Azure, Office 365 Commercial, Dynamics 365 and LinkedIn Commercial—grows about 23 percent year over year to about $28.2 billion, down from 29 percent the prior quarter.

Generative And Other AI Advancements

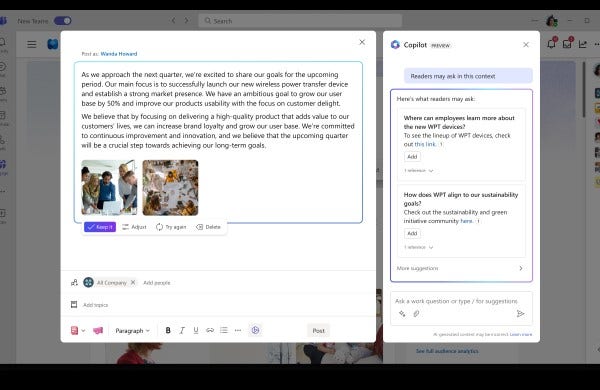

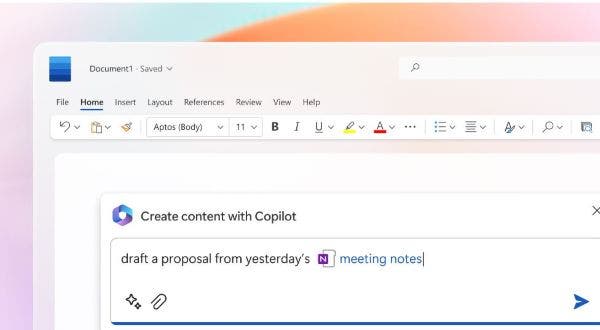

With “A” and “I” perhaps the most hyped letters of 2023, there is no doubt Microsoft executives will use the earnings call to tout generative artificial intelligence offerings and the expanding access to the vendor’s Copilot tools in various products.

Nicole Dezen, Microsoft’s chief partner officer and corporate vice president of the Global Partner Solutions organization, even called AI “the No. 1 topic with partners right now” in an interview with CRN last month.

In March, Microsoft revealed that Copilot AI tools similar to what users of GitHub and content-generating programs such as ChatGPT have experienced are available to select users of applications including Teams, Outlook, Word, Excel and Power Platform.

The same month, the vendor also made waves with its announced Security Copilot and billing information for GPT-4 use on Azure OpenAI Service. Microsoft added its Viva suite of employee engagement tools to the future Copilot camp on Thursday.

An April 12 report from Wedbush said that Microsoft, while gaining cloud market share, is “becoming the clear leader in the AI arms race with ChatGPT”—the text-generating AI tool created by Microsoft-backed OpenAI.

“While the macro is not roses and champagne, we believe Microsoft will emerge out of this period in a stronger position strategically,” according to Wedbush.

A Morgan Stanley report Monday named Microsoft followed by Google as the biggest beneficiaries of commercial investment in AI.

“AI as a [percentage] of cloud spend is set to increase meaningfully over the next three years from 3 [percent] to 9 [percent] and importantly Microsoft is most frequently cited as the largest share gainer of AI/ML spending this year and in the next [three] years,” according to Morgan Stanley.

When it comes to AI, “Microsoft is uniquely positioned, in our view, given its partnership with OpenAI, its vast installed bases and data sets, and existing solutions across most areas of software, to lead in the rollout of monetizable capabilities across its portfolio. … In turn, these dynamics translate to earlier training and improvement of AI models for Microsoft, expanding its mind share and market-share lead,” according to the report.

The data came from a Morgan Stanley first-quarter survey of CIOs, which found that AI and machine learning “rose to become the [fourth] largest area of spend increase in this survey,” although “CIOs are still in the process of evaluating this technology and most are not expecting AI innovation to have a material impact to investment priorities in” the 2023 calendar year.

“Only 2 [percent] of CIOs report that AI/ML will have a significant impact on CY23 investment priorities, compared to 43 [percent] expecting a minor impact and 55 [percent] expecting no impact,” according to Morgan Stanley.

Growing generative AI use will accelerate workload growth, “with CIOs expecting application workload growth to accelerate from 10 [percent] in 2023, to 12 [percent to] 14 [percent] annually in 2023/2024,” according to Morgan Stanley.

Update On Microsoft Security

Microsoft’s earnings come the week of the cybersecurity-focused RSA Conference, giving the vendor plenty of reason to talk about its $20 billion-plus revenue security business.

The vendor unveiled ts Security Copilot offering last month. But in a March report, Morgan Stanley called the tool “more evolutionary than revolutionary.”

“The primary features of Security Copilot so far aim to help security professionals summarize events and report incidents more quickly rather than automating threat detection/remediation and reducing false positives/alerts,” according to Morgan Stanley.

Security Copilot should compete with Splunk and other security information and event management (SIEM) vendors plus vulnerability management vendors such as Qualys, Tenable and Rapid7, according to Morgan Stanley.

The pace of generative AI “adoption in security is likely slower than other areas of IT,” according to the report.

Morgan Stanley predicts this in part due to “more limited availability of high-quality data to train AI models today due to the sensitive and siloed nature of security data” and because “gaining trust within security for widespread AI adoption will be far more difficult given the risk of data breach.”

Still, Morgan Stanley is “positive on the long-term benefits of generative AI in helping to automate and address the meaningful talent shortage in security,” with half of overall market spend on enterprise security due to the cost of people, consulting and other services.

Plus, the estimated global workforce gap for security is 3.4 million people. “While security will remain a collaboration between people, process and technology, much of the security services spend (projected to reach >$100B by 2025) includes manual tasks that can be automated by AI-powered security products,” according to Morgan Stanley.

Security software received the most responses in the Morgan Stanley first-quarter survey as the project area with the largest spend increase in 2023 at 11.3 percent, down from 12 percent the prior (it ranked No. 1 then as well.)

Following security software were cloud computing, data warehousing, business intelligence and analytics;,and AI and ML, according to Morgan Stanley.

PCs And Hardware Headache

Morgan Stanley predicts a worse decline for Windows OEM revenue in Microsoft’s third fiscal quarter than the consensus Wall Street expectation—a 38.2 percent decline compared with a 4.9 percent decline. Microsoft said to expect between the mid-30s and high-30s percent.

Morgan Stanley predicts a 27 percent decline year over year for Windows OEM revenue for calendar year 2023.

“Taken all together, while there could be upside to our conservative estimates, Microsoft tends to be more weighted to commercial units, which helps justify why Microsoft OEM is underperforming industry data.”

A Wednesday report from Bank of America called weakness in the PC market “a temporary macro headwind” for Microsoft that could still hurt revenue.

Microsoft’s personal computing segment could see a $400 million to $500 million hit from PC shipments. Bank of America predicted $12.1 billion in revenue from this segment for the quarter, up 19 percent ignoring foreign exchange.