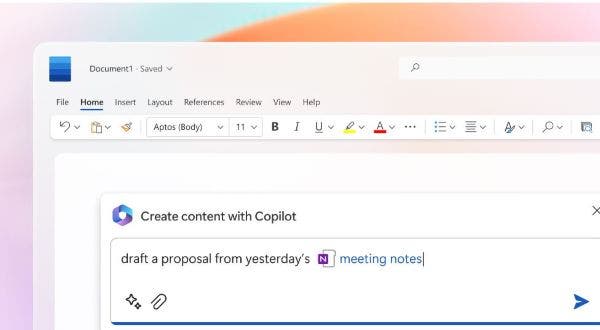

Microsoft Q4 Earnings: ‘Aggressive’ Spending, ‘Gradual’ AI Services Growth

‘Even with strong demand and a leadership position, growth from our AI services will be gradual as Azure AI scales and our Copilots reach general availability dates. … I do think this is really about pacing,’ Microsoft CFO Amy Hood said on the company’s fourth fiscal quarter earnings call.

Microsoft CFO Amy Hood

Microsoft may own the generative artificial intelligence market so far, but executives warned that the vendor won’t see much of that potential revenue until the winter—during the second half of its 2024 fiscal year.

Microsoft CFO Amy Hood told listeners on the vendor’s earnings call Tuesday for the fourth fiscal quarter that releasing more pricing information for Copilots, moving them through the preview and general availability process and then selling them all take time.

“Even with strong demand and a leadership position, growth from our AI services will be gradual as Azure AI scales and our Copilots reach general availability dates. … I do think this is really about pacing,” Hood said.

[RELATED: Microsoft CEO Nadella: AI Partner Opportunity Could Reach $7T]

Microsoft 4Q Results

Microsoft is “aggressive in meeting the demand curve and focusing on the transition and growth in gross margins and delivering the operating leverage,” Hood told analysts on the call. But the Redmond, Wash.-based vendor still expects year-over-year growth from the prior fiscal year, which ended June 30.

“To support our Microsoft Cloud growth and demand for AI platform, we will accelerate investment in our cloud infrastructure,” she said. “We expect capital expenditures to increase sequentially each quarter through the year as we scale to meet demand signals.”

However, gross margins should scale faster than in past technology adoption, she said.

“We start out in a different place with more of a shared platform, which allows us to scale those gross margins a bit faster than last time,” she said. “And we do expect … the pace of this adoption curve, we do expect to be faster. … We’re talking about all that and going through that transition while delivering in FY ’24 over FY ’23, effectively, a point higher operating margins.”

While the vendor expects to report in its next quarterly earnings that Microsoft Cloud gross margin percentage decreased by a point year over year, that decrease will be due to an accounting change instead of spending overtaking revenue, Hood said.

“We are committed to driving operating leverage, and therefore we will manage our total cost growth … in line with the demand signals we see as well as revenue growth,” she said.

She said that to expect higher cost of goods sold (COGS) year over year with operating expense growth low as Microsoft prioritizes spending. “We expect full-year operating margins to remain flat year over year.”

When asked about what the capital spending includes, Hood said that it includes physical data centers, GPUs, CPUs, networking equipment and other items and includes accelerations of normal Azure workloads and AI workloads.

When asked about gross margins in the future, Hood said that she expects them “to transition over time just like they did in the prior cloud transition” and “the gross margins of the workloads to be different just like they are in the cloud today.”

Microsoft’s stock fell by about 4 percent after hours to about $338 a share.

AI Should Benefit Azure

Microsoft’s spending is a signal of how important generative AI and Copilots are to the vendor’s future, executives said Tuesday. The interest around generative AI should have a ripple effect on other Microsoft offerings.

“The platform effect is really all about the extensibility of the copilots,” Microsoft Chairman and CEO Satya Nadella said on the call. “You see that today when people build applications in Teams that are built on Power Apps, and those Power Apps happen to use something like SQL DB on Azure. That’s a classic line-of-business extension.

“You’ll see the same thing when I have a Copilot plug-in. That plug-in uses Azure AI, Azure meters, Azure data sources, Azure semantic search. So you’ll see, obviously, a pull-through not only on the identity or security layer, but in the core … services of Azure plus the Copilot extensibility in” Microsoft 365.

Hood added that “lots of these AI products pull on Azure because it’s not just the AI solution services that you need to build an app.”

“And so it’s less about Microsoft 365 pulling it along, or any one Copilot,” she said. “It’s that when you’re building these, it requires data and it requires the AI services. So you’ll see them pull both core Azure and AI Azure along with them. And I think that’s an important nuance as well.”

AI Already Driving New Business

Still, Nadella said that generative AI has generated new business for Microsoft even if revenue from that new business comes later. The activity has helped the No. 2 cloud computing vendor —behind Amazon Web Services—become the No. 1 generative AI vendor.

“We have grown Azure over the years coming from behind,” Nadella said. “And here we are, as a strong No. 2, in the lead when it comes to these new workloads.”

Customers who didn’t use Azure for a cloud or who used multiple clouds are “for the first time, sort of starting to use Azure for some of their new AI workloads,” Nadella said.

“What I think you’ll see is more shared gains, more logo gains, reducing our CAC [customer acquisition cost] even,” he said. “And so, yes, we celebrate. That’s why we’re even giving you the visibility of one point of it showing up this quarter. A couple of points showing up next quarter. Those are material numbers.”

Nadella told analysts on Tuesday’s call that cloud migration is still only in its second or third inning.

“We do think that this is a business that can have sustained high growth, which is something that we’re excited about,” he said.

Hood added that Copilots and generative AI “reach new budget pools” based on her conversations with CIOs and CFOs.

“We’re focused on executing against that, and then revenue is an outcome,” she said. But ”the demand signal requires the capital expense and then creates the opportunity. And that’s why, I think, in some ways, we’re spending a little more time talking about some of that investment—because it is a demand signal.”

Customer Spending

When asked whether Microsoft is seeing customers ramp up spending on new projects—a slowdown identified by Nadella (pictured) in January in favor of customers working to “optimize” existing spending and workloads—the CEO indicated a return to normality.

That return to normal includes cloud migrations, data applications and AI applications, he said.

“What happened here was, during the pandemic, obviously, there were lots of new project starts and optimization, in some sense, was postponed,” Nadella said. “And that’s where you’re seeing, I’ll call it, ‘catch-up optimization.’ And that’s something that … we will lap going into the next couple of quarters. I think it will come down.

“We are seeing new project startups—both traditional type of project starts, even cloud migrations, data applications – and, of course, obviously, the AI applications. But we’ll get back to, I’ll call it, ‘the normal pace’ of new project starts and optimizations going forward. We will cycle through, I think, in the next couple of quarters what is the last catch-up optimization.”

Hood added that customer spending “felt very similar to last quarter, where we made the same comments, which is we’re seeing sort of the normal optimization, plus we’re seeing new workloads starts.

“The change is just that lapping of, I think, a bit of a catch-up from a year ago and … we’ll continue to do that through” the second half of fiscal year 2024.

Product Milestones

On the call, Nadella ran through new milestones for various products in the Microsoft portfolio.

In generative AI, those milestones include:

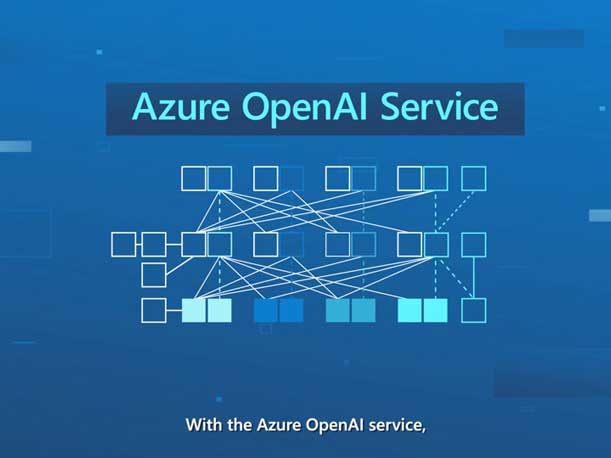

*Azure OpenAI Service has more than 11,000 organizational users, about 100 new customers added a day during the quarter.

*Mercedes-Benz will bring ChatGPT through Azure OpenAI to more than 900,000 vehicles in the U.S. through its in-car voice assistant.

*Microsoft Fabric, which is in public preview, has more than 8,000 customers signed up for trial, with more than 50 percent using four-plus workloads.

*More than 27,000 organizations, double quarter over quarter, use GitHub Copilot for Business. About 90 percent of GitHub Copilot sign-ups are self-service, showing strong organic interest.

*More than 63,000 organizations have used Power Platform AI-powered capabilities, up 75 percent quarter over quarter.

*Power Automate has more than 10 million monthly active users, up 55 percent year over year.

*More than 1 million organizations use Microsoft’s AI-powered products and services for cloud and endpoint platform estates, up 26 percent year over year.

*More than 60 percent of those organizations use four-plus security products, up 33 percent year over year.

*To date, Bing users have engaged in more than 1 billion chats and created more than 750 million images with Bing Image Creator.

*Microsoft 365 Copilot has 600 paid customers in the early access program, including General Motors, Goodyear and Lumen.

Milestones for the vendor’s popular collaboration and communication application Teams include:

*The Teams app store has more than 1,900 applications available.

*Customers have built more than 145,000 custom line-of-business apps with Teams.

*In five months, Teams Premium has passed 600,000 seats.

*Teams Phone has more than 17 million public switched telephone network (PSTN) users, an increase of 45 percent year over year. Nadella called it “the market leader in cloud calling.”

*More than 70 percent of the Fortune 500 use Teams Room, and its revenue more than doubled year over year.

Other product milestones include:

*Azure Arc now has 18,000 customers, up 150 percent year over year.

*Dynamics surpassed $5 billion for the fiscal year.

*Microsoft Viva has 35 million monthly active users.

*The number of devices running Windows 11 doubled over the year.

*Azure Virtual Desktop and Windows 365 together surpassed $1 billion in revenue for the first time over the past 12 months.

*Microsoft Entra ID has more than 610 million monthly active users.

Microsoft Q4 Results

Microsoft reported $56.2 billion for the quarter, up 10 percent year over year ignoring currency exchange. Hood said “results exceeded expectations with focused execution by our sales and partner teams.”

Microsoft Cloud brought in $30.3 billion of revenue, up 23 percent ignoring foreign exchange. Azure, Dynamics, security and Edge gained share during the quarter, she said. The vendor saw “healthy renewal strength, which includes our upsell and attach motions, particularly with Microsoft 365 E5” high-end plans—activities that can include solution providers.

However, “growth of new business continued to be moderated for products sold outside the Microsoft 365 suite, including stand-alone Office 365, Enterprise Mobility and Security (EMS), and Windows commercial products, Hood said.

Although during the quarter Azure customers continued to optimize existing spend “as expected,” Microsoft saw a record number of $10 million-plus contracts for Azure and M365, Hood said.

The vendor reported $24.3 billion in operating income, up 21 percent year over year. Net income increased 23 percent year over year to $20.1 billion.

Segment Results

Microsoft’s “productivity and business processes” segment—which includes Office Commercial, Office Consumer, LinkedIn and Dynamics— saw $18.3 billion in revenue for the quarter, up 12 percent year over year ignoring currency exchange.

Office Commercial products and cloud services grew 14 percent. Office 365 Commercial revenue grew 17 percent year over year. Seat growth for O365 Commercial was 11 percent, with SMB and frontline worker offerings driving that growth. Higher revenue per user also helped.

Office Commercial products revenue fell 20 percent due to more customers moving to the cloud.

Office Consumer products and cloud services revenue grew 6 percent year over year. Microsoft now has 67 million Microsoft 365 Consumer subscribers, an increase of 12 percent year over year.

Dynamics products and cloud services revenue grew 21 percent year over year. Dynamics 365 revenue grew 28 percent.

Microsoft’s “intelligent cloud” segment, which includes Azure and server products, reported $24 billion in revenue for the quarter, up 17 percent year over year ignoring currency exchange.

Server products and cloud services revenue grew 18 percent year over year. Azure and other cloud services revenue grew 27 percent. Server product revenue declined by 1 percent.

Microsoft’s per-user EMS install base grew 11 percent to more than 256 million seats, Hood said.

Enterprise services revenue grew by about 4 percent thanks to growth in support services. Microsoft’s “industry solutions” division, formerly Microsoft Consulting Services, saw an unspecified decline.

Microsoft’s “more personal computing” segment—which includes Windows OEM devices, Windows Commercial, Xbox and news advertising, declined by 3 percent year over year ignoring foreign exchange, bringing in $13.9 billion in revenue.

Windows revenue decreased 5 percent year over year. Windows OEM revenue fell 12 percent year over year due to continued PC market weakness but with help from back-to-school inventory builds. Device revenue fell 18 percent.

And Windows Commercial products and cloud services revenue grew 3 percent with help from Microsoft 365 demand.

FY23 Results

For the 2023 fiscal year, Microsoft reported revenue of $211.9 billion, up 11 percent year over year ignoring currency exchange.

Using GAAP, Microsoft saw operating income for the fiscal year of $88.5 billion, up 6 fpercent year over year. Net income was $72.4 billion, a slight decrease.

Microsoft’s remaining performance obligations (RPO) was $229 billion as of June 30. The vendor expects to recognize about 45 percent of that revenue over the next 12 months.

Despite the mass layoffs Microsoft announced in January amid decreased demand for digital tools following the height of the global pandemic, Microsoft’s head count was about flat year over year on June 30, Hood said.

Microsoft Q1 Guidance

Microsoft forecasts the productivity and business processes segment to grow between 9 percent and 11 percent year over year to $18 billion to $18.3 billion, Hood said.

Office 365 revenue growth should grow 16 percent ignoring foreign exchange. On-premises business should decline around 20 percent.

Office Consumer revenue should grow low- to-mid single digits thanks to Microsoft 365 subscriptions. Dynamics should grow in mid-to-high teens for Dynamics.

The intelligent cloud segment revenue should grow about 15 percent to $23.3 billion to $23.6 billion, driven by Azure. All Azure AI services should contribute 2 points to Azure’s expected 25-plus percent revenue growth, she said. On-premises server business should decline in revenue in the low- to-mid single digits.

The personal computing segment should bring in $12.5 billion to $12.9 billion. Windows OEM revenue should decline in the low-to-mid teens, with that back-to-school benefit moved to the prior quarter.

“Our guidance assumes no significant changes to the PC demand environment,” Hood said. Device revenue should decrease in the mid 30s.

Windows Commercial products and cloud services should grow mid-to-high single digits due to M365 and security products and services.