Microsoft Q4 Earnings Preview: 5 Things To Know

The news from Microsoft’s partner-focused Inspire event this month and the buzz around generative AI and Copilots has multiple investment firms expecting positive results when the company reports earnings Tuesday.

Big news out of Microsoft’s partner-focused Inspire event this month and the interest in generative artificial intelligence and Microsoft Copilots has multiple investment firms expecting positive results from the tech giant when it reports earnings Tuesday.

A recent Bank of America report predicts 1 percent of upside to its $55.45 billion revenue estimate for Redmond, Wash.-based Microsoft’s fiscal quarter ended June 30. Should Bank of America prove correct, that’s a 9 percent increase year over year.

A price on Microsoft 365 Copilot and more AI offerings were some of the biggest announcements out of Inspire. For solution providers, Microsoft Chairman and CEO Satya Nadella’s predicted partner ecosystem opportunity that could span $4 trillion to $6.5 trillion is a strong sign that AI is the future for enterprises.

[RELATED: Microsoft CEO Nadella: AI Partner Opportunity Could Reach $7T]

Microsoft 4Q Earnings Preview

Bank of America’s report included a predicted $400 million-plus upside to predicted productivity and business processes revenue of $18.1 billion, which would represent an increase of 11 percent year over year. This segment includes Office Commercial products, LinkedIn and Dynamics.

The firm expects continued weakness in PCs, with predicted downside of between $300 million and $350 million to $13.6 billion in revenue in Microsoft’s “more personal computing” segment. This segment includes devices, Xbox content, news advertising and Windows OEM revenue.

If BoA is correct, that would mean a 6 percent decline in this segment’s revenue year over year.

Here’s what else analysts are saying ahead of Microsoft’s earnings report Tuesday.

Copilots Take Flight

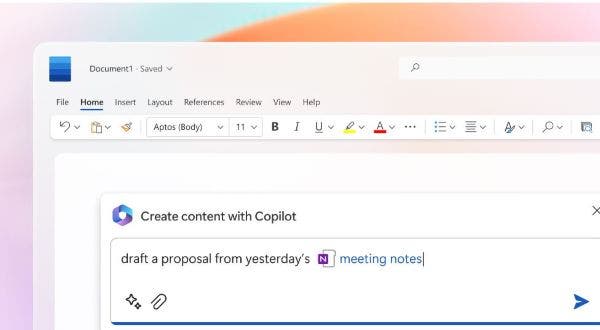

Analysts will likely have questions for Microsoft following a big reveal at Inspire that Microsoft 365 Copilot will cost $30 per user, per month, on top of certain M365 plans once the generative AI offering becomes generally available.

A general availability date for M365 Copilot is not yet known.

Generative AI won’t come cheap. A July Bernstein note said that the price uplift ranges from 53 percent to 240 percent. M365 E3 is $36 per user, per month. M365 E5 is $57. M365 Business Standard is $12.50. And Business Premium is $22.

A Sunday note from Wedbush said that the $30 price tag “would significantly increase list prices for MSFT (Microsoft) on the commercial front and in our opinion penetration would be significant over the coming years around AI within its installed base.”

The firm believes that more than 50 percent of the Microsoft installed base will adopt this AI functionality for enterprise and commercial use over the next three years.

“We view the initial pricing details as very bullish for the total addressable cloud AI market opportunity for Microsoft that could increase cloud revenue annually by 20 percent by 2025 based on our estimate,” according to the Wedbush report.

A Monday note from KeyBanc said that a survey of resellers resulted in mixed reactions to Copilot pricing, “with some seeing it as providing value but others judging the pricing as steep.”

“We are positive on Microsoft’s ability to upsell customers on the company’s growing AI initiatives including M365 copilot, and have estimated a potential $1.4 [billion] revenue benefit to Microsoft from M365 copilot for each 1 percent customer attach,” according to the report.

Morgan Stanley on July 20 estimated that about 192.5 million Microsoft seats are eligible for Copilots through E3, E5, Business Standard and Premium plans.

Generative AI Hype

A Monday Wedbush report said that the generative AI hype has changed the sentiment “for many CIOs.”

“While multiple expansion was the name of the game for the tech sector so far in 2023, we believe further evidence of this generational AI spending trend will be sprinkled in the forecasts/commentary from Microsoft, Google, Amazon, Nvidia, AMD, IBM, and other tech software/chip stalwarts during this key 2Q earnings season and be a catalyst for a broader tech rally ahead,” according to Wedbush.

The firm predicts an $800 billion AI spending wave over the next decade and that, in 2024, AI could comprise up to 10 percent of overall IT budgets compared with about 1 percent in 2023.

Based on Wedbush research, enterprise IT budgets showed signs of improvement during the June quarter with upticks in cloud spending for Microsoft, Amazon Web Services and Google Cloud, according to the report. Microsoft itself could expand its total addressable market around cloud by up to 40 percent over the next decade.

“We see a much broader tech rally kicking off with AI spending now a reality, not hype,” according to the Wedbush report.

A KeyBanc report Sunday said that a survey of resellers and channel partners showed “75 percent of VARs and some large channel partners seeing high interest in generative AI, although VARs indicated 0 percent had seen capabilities rolled out into production.”

Analysts will likely look for more information on the cost of generative AI to Microsoft. A KeyBanc report in July noted that, “We expect the costs associated with M365 Copilot offerings and GenAI could potentially be higher than stand-alone M365 E3/E5’s cost profile, leading to a potentially lower benefit to profitability than to top line.”

A Morgan Stanley report put Microsoft capital expenditures at 15 percent of revenue during fiscal years 2024 and 2025, up from 12 percent in fiscal years 2021 and 2022.

Total capital expenditures for fiscal year 2024 is estimated at $41 billion. Fiscal year 2025 should be $49 billion, according to the report. AI accelerator units could increase server costs from up to 45 percent of data center costs to up to 60 percent of data center costs.

Big Azure Expectations

Wedbush expects Microsoft to beat cloud expectations during the quarter, with “generally optimistic commentary” on cloud and AI spend plus caution on choppy unpredictable macroeconomics as the U.S. continues to deal with inflation and concerns for a potential recession.

The Wall Street consensus for Azure is 26 percent growth in revenue, according to Wedbush. Wedbush research has found that Microsoft gained “incremental share from Amazon and AWS in the field.”

For every $100 of cloud spend with Microsoft in the last decade, Wedbush estimates between $35 and $40 of incremental AI spend now on the horizon for the next three or four years, according to the report.

The Sunday KeyBanc report showed Azure growth stable or improved year over year.

“Both our survey and checks suggested less cost ‘optimization’ headwind,” according to the report. “Generative AI interest/’buzz’ for Microsoft was high, and some expressed optimism about a measurable boost to their FY24 Microsoft revenue.”

PCs Recovering?

Microsoft may gain some reprieve from recent PC declines.

Preliminary data from research firm IDC show about 13 percent contraction year over year in second-quarter 2023 units, an improvement over the first quarter’s 29 percent decline. Despite weak demand for consumer and commercial PCs and IT budgets shifting away from devices, IDC called the forecast better than expected.

Workforce reductions and generative AI have also created budget confusion for customers already trying to save.

Research firm Gartner, meanwhile, forecast 59.7 million global PC shipments in its second-quarter 2023 preliminary shipment forecast. That is a 16.6 percent decline year over year, but a noticeable improvement over the first quarter’s 30 percent decline. Gartner has seen signs of stabilization in the PC market, with inventories decreasing and demand growing.

Questions On Cloud Breach, Security

Microsoft might have to answer questions Tuesday about the recent compromise of Microsoft cloud email accounts by what Microsoft said was a hacking group working on behalf of the Chinese government.

The vendor has said a stolen Azure Active Directory key was misused to forge authentication tokens and gain access to emails from an estimated 25 organizations.

Speaking of security, the KeyBanc reseller survey found Microsoft’s positioning in security steady quarter over quarter. Three-quarters of those surveyed said the vendor’s competitive positioning in security increased in the past year, similar to the prior quarter’s survey.

Microsoft remained the top vendor in the survey for identity and access management (IAM), “but declined in best positioned consolidator, endpoint, cloud security and analytics.”

The survey found that CrowdStrike and SentinelOne overtook Microsoft as top-performing endpoint vendor, with the two security rivals tying for first place.

And just before Inspire, Microsoft expanded its Entra offering into security service edge (SSE) with the launch of Internet Access and Private Access features.

Internet Access protects against malicious traffic and threats from the open internet. Private Access applies to private applications and resources from any device or network.

Microsoft also rebranded its Azure Active Directory offering into Microsoft Entra ID as an effort “to unify our product family,” according to the vendor.