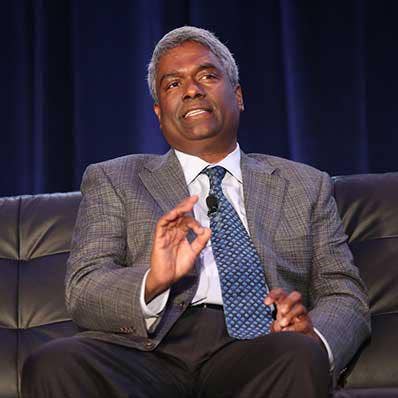

NetApp CEO Kurian: ‘Sizable Opportunity’ Exists In Cloud Operations Portfolio

‘We believe strongly in the sizable opportunity created by our cloud operations portfolio, where we bring differentiated enterprise capabilities to cloud infrastructure management, built on our long experience supporting a broad range of applications,’ says NetApp CEO George Kurian.

NetApp’s forays into the public cloud storage, compute and development business has grown quickly over the past couple of years. The Santa Clara, Calif.-based company Wednesday reported that its fiscal fourth quarter 2022 public cloud annualized revenue run rate, or ARR, increased by 68 percent over that of fourth quarter 2021.

That was not good enough, said NetApp CEO George Kurian.

[Related: NetApp CEO George Kurian: Dell, HPE Are ‘Doing What We Did In 2014’]

Kurian, in his prepared remarks Wednesday during NetApp’s fiscal 2022 financial analyst conference call, told analysts he wanted to address the fact that NetApp’s public cloud ARR of 68 percent came short of expectations.

“Demand for our cloud storage solutions was strong in Q4,” Kurian said. “We also saw a healthy number of new customer additions across both cloud storage and cloud operations services in the quarter. Unfortunately, these tailwinds were not enough to offset the lower-than-expected growth created by higher churn, lower expansion rates and sales force turnover in our cloud operations portfolio.”

During its third fiscal quarter of 2022, NetApp’s public cloud ARR rose 98 percent year over year.

Kurian said that fiscal 2023 NetApp will be focused on returning these services to the growth trajectory it saw in the first three fiscal quarters of 2022.

“We have made organizational changes to increase focus on renewal and expansion motions and will continue to refine our go-to-market activities to better address the cloud operations market,” he said. “Additionally, we have refreshed the sales organization and strengthened the leadership team. We believe strongly in the sizable opportunity created by our cloud operations portfolio, where we bring differentiated enterprise capabilities to cloud infrastructure management, built on our long experience supporting a broad range of applications.”

Despite Kurian’s disappointment in the public cloud ARR growth figures, the company pulled off a strong fourth fiscal quarter and fiscal 2022, he said.

“We made sustained progress against our strategic goals, successfully achieving our commitment to grow the business while delivering operating leverage in fiscal 2022,” he said. “We gained share in enterprise storage with strong growth in all-flash array and object storage products. We expanded our public cloud business with robust expansion of customers, ARR, innovation and routes to market. And, most notably, we delivered record levels of gross margin dollars, operating income and earnings per share.”

NetApp found the demand environment to remain strong despite complex macroeconomic issues testing the company’s teams, including supply constraints, rising interest rates, inflation and geopolitical conflict, Kurian said.

“Backlog is elevated due to supply constraints, despite our excellent supply chain management helping us meet as much of the demand as possible. ... That we achieved all-time highs for gross margin dollars, operating income and earnings per share in the face of these headwinds demonstrates our disciplined operating management,” he said.

The turbulent environment also creates challenges for NetApp’s customers, raising the urgency for data-driven digital and cloud transformations, which means increased opportunities for the company, Kurian said.

“We sit at the intersection of these megatrends, as the complexities created by rapid data growth, multi-cloud management and the adoption of next-gen technologies such as AI, cloud-native, and modern application and data infrastructures create a sizable opportunity for us. ... Our critical role in helping customers achieve their transformation goals underpins our strategy and drives confidence for future growth,” he said.

When asked by an analyst about how customers are viewing the business environment, Kurian said customers are moving forward with strategic projects around customer experience transformation, business process automation and analytics.

“AI and ML [machine learning] projects, for example, continue to see a strong year and continue to see a strong outlook for that part of our business,” he said. “So far, as we’ve said, the demand picture has been steady. And we recognize that there is increased uncertainty. But I think so far the demand picture for IT spending within our customer bases remain steady.”

For its fourth fiscal quarter 2022, which ended April 29, NetApp reported revenue of $1.68 billion, up 7.7 percent over the $1.56 billion the company reported for its fourth fiscal quarter 2021. That included product revenue of $894 million, up from $840 million, and services revenue of $786 million, up from $715 million.

NetApp also broke its fourth fiscal quarter 2022 revenue into hybrid cloud revenue of $1.56 billion, up from $1.49 billion, and public cloud revenue of $120 million, up from $66 million. The hybrid cloud revenue figure includes sales of the company’s storage arrays and other products.

Public cloud ARR of $505 million grew 68 percent year over year.

About 54 percent of NetApp’s fourth fiscal quarter 2022 revenue came from the Americas, including 45 percent of revenue from Americas commercial business and 9 percent from the U.S. public sector. On a worldwide basis, 76 percent of the quarter’s revenue came from indirect sales channels, down as a percentage slightly from last year’s 77 percent.

NetApp also reported GAAP net income of $259 million, or $1.14 per share, down from last year’s $335 million, or $1.46 per share. On a non-GAAP basis, NetApp reported net income of $324 million, or $1.42 per share, up from last year’s $268 million, or $1.17 per share.

For the quarter, revenue was in line with analysts’ expectations, while non-GAAP earnings per share beat analysts’ expectations by 14 cents, according to Seeking Alpha.

For all of fiscal 2022, NetApp reported total revenue of $6.32 billion, up 10.1 percent over the $5.74 billion the company reported for fiscal 2021. That included product revenue of $3.28 billion, up from $2.99 billion, and services revenue of $3.03 billion, up from $2.75 billion.

By segment, NetApp reported full year hybrid cloud revenue of $5.92 billion, up from $5.45 billion, and public cloud revenue of $396 million, up from $199 million.

NetApp also reported GAAP net income for the year of $937 million, or $4.09 per share, up from last year’s $720 million, or $3.23 per share. On a non-GAAP basis, the company reported net income of $1.21 billion, or $5.28 per share, up from last year’s $917 million, or $4.06 per share.

Looking ahead, NetApp expects first fiscal quarter 2023 revenue to range between $1.48 billion and $1.63 billion which, at the midpoint, implies a 6 percent increase year-over-year. The company also expects non-GAAP earnings per share for the first fiscal quarter to range between $1.05 and $1.15 per share.