Salesforce Partner Silverline Growing More Than 20 Percent, CEO Says

‘At 500-plus people, we’re probably the largest pure play Salesforce practice that exists, or very close, which we’re proud of,’ Silverline CEO Gireesh Sonnad tells CRN in an interview.

A recently introduced practice around the media and entertainment industry and growth in Canada have contributed to 20-plus percent growth in sales year over year expected by Salesforce partner Silverline, co-founder and CEO Gireesh Sonnad told CRN in an interview.

The growth comes as a result of New York-based Silverline’s acquisition of Canada-based Shift CRM, Sonnad said. And while he doesn’t predict more acquisitions in the near future, growth in Silverline’s future will come from diving deeper into Salesforce’s product portfolio, including recent acquisition Slack.

“At 500-plus people, we’re probably the largest pure play Salesforce practice that exists, or very close, which we’re proud of,” Sonnad said. “And certainly the biggest one that focuses entirely on an industry model. And so we’re going to continue to push on that as hard as we can. And Salesforce is lining straight up with that. Everything that they’re doing now is in the industry vein as well. And so I think that’s the best growth area for us.”

[RELATED: SALESFORCE’S MARC BENIOFF: ‘NO COMPANY IS BETTER POSITIONED’]

Sonnad hopes to hear more from Salesforce on integration with Slack – a collaboration application that rivals Microsoft’s Teams app – as well as its Customer 360 customer relationship management (CRM) platform during the San Francisco-based vendor’s Dreamforce conference, happening in person and streaming online Sept. 20 to Sept. 22.

Looking forward, Sonnad said that if Salesforce decides to work with distributors and indirect partners – such as TD Synnex, Pax8 and Ingram Micro – that could help the vendor grow its partner ecosystem.

Ongoing Salesforce investments in training engineers and workers in Salesforce’s product portfolio – which includes Slack, data analytics software provider Tableau and integration platform provider MuleSoft – is another help to partners such as Silverline, Sonnad said. He’s had success filling open positions by hiring people from health care and other industries Silverline serves as opposed to hiring people from other partner businesses and IT companies.

“The single hardest thing we do is to bring great people on board to serve as our clients,” he said. “And so the more that Salesforce can use some of the weight and the resources that they have to make training easier and better and faster. Or to push even farther into things like university programs – so on and so forth — so that most people come out of the gate understanding who we are that the Salesforce ecosystem is a great place to be, (that) would be super welcome.”

He continued: “In fairness, they’re doing a very good job of it and probably a better job than they ever have been. It’s just an enormous mountain to climb. It’s hundreds and hundreds of thousands of certified consultants that is the gap over the next five years.”

Here’s what else Sonnad had to say to CRN.

How are things going at Silverline?

It’s been going well. We’re having a really, really nice growth year, which we’re excited about.

We’re surpassing the growth of last year, which is exciting. And really feeling like we’re coming out of some of the stickiness that we saw in the last couple of years, if you will, which has been great.

One of the things that has changed for us in the last 12 months is the addition of a new industry. And so around this time last year we acquired an organization (Shift CRM) and started our media and entertainment practice. And that’s been going really well, too.

That’s helped us to actually get some additional offerings out into additional markets and look at ways that we can help companies in different areas.

It’s also helped us to expand geographically. The organization was located in Toronto, and so we’ve been able to push deeper into the Canadian market. And it’s been a great growth vector for us both from the headcount perspective, as well as from a client perspective.

So it’s been really nice to see some of those additional angles play out as we push the growth.

In terms of offerings in the market, certainly everything that we do is still industry focused. And, and for us, it’s even deeper than industry. It’s at the sub-vertical level. Things like our banking and lending practices are doing spectacularly well right now, just because a lot of those organizations are spending money on technology and they’re revamping the way they do things.

They’re looking at ISVs (independent software vendors) like nCino, helping with loan origination. And looking at Salesforce for help with their whole digital transformation initiatives.

So that’s been really positive, and we really like seeing that. In some of the other industries, some of the offerings have been resonating are our ability to continue to integrate and make Salesforce the one-stop shop for all the different information that they might have in their legacy environments, or maybe third-party environments.

And so this concept of bringing in data and information from other information stores that they have in their business has been really helpful to drive the transformation initiative.

One of the reasons for that is actually so that they can do a better job interacting with their clients. And so when they have more of the information from their enterprise structures, they can then use – for example, Salesforce’s Marketing Cloud – to engage with and build better journeys for their clients and connect with them better.

One of the style offerings that we’ve seen an uptick in across the board is all things marketing cloud and all things interacting with our clients’ clients, and how can they do a better job of segmenting the types of communications that they are attending to those folks? That needs a high degree of very sophisticated data in order to do that well.

What’s fueling customer demand for your offerings?

It’s starting at the front and pushing back. So it’s starting at, ‘Hey, we want to do a better job of staying close to our customers. … We want to do a better job of engaging them. And we can’t do that if we’re not digitally enabled. And part of that digital enablement is not just having the tools to do that interaction, but having the data in the right place to help us do that.

And so, if it’s a health care organization that’s trying to do a better job with recall management or doing sort of care coordination – you need data from the electronic medical record (EMR) in order to help you with that. You need some aspect of the clinical data.

Or, if you’re in the financial services world, and you want to talk to a wealth management client about, ‘Hey, you should add a 401(k).’ I need to know what you do and don’t have in order to identify who’s a good fit for this next best purchase type of a thing.

These aren’t revolutionary use cases, but they’re becoming more enabled because of the technology’s ability to talk and Salesforce’s Customer 360 perspective to do that the right way.

Marketing automation has been an initiator of some of these digital transformation projects, whereas in the past, it was maybe an add-on afterwards. So that’s been interesting. But it required some good investment from us or built the teams to do that the right way.

Are you hiring?

Hiring. And for everything. It’s probably a common theme you’ll hear in the Salesforce world.

We’re excited to have just crossed the threshold of 500 people globally. … So we’re a little bigger.

We’ve done a tremendous amount of hiring this year. And we are hiring across the board. For us, being so industry focused, industry specialists and industry knowledgeable folks or people who are experienced in Salesforce’s industry clouds are really hot areas for us in terms of recruiting.

I’ll take that tangent as a chance to talk about one of the ways that we’re investing. We’re investing heavily in our people. We’re investing heavily in the experience that we’re building for those folks. We’re investing heavily in finding ways to get back out there and get people connected in person. That hasn’t happened in a long time.

And our 500-plus people are very disparately situated. But how can we keep them connected? And how can we continue that camaraderie that is so important to Silverline and its culture?

So we’re investing a lot in that. In a similar vibe, we’re investing in our clients in the sense of, hey, it’s about time that we go meet them where they are again and build those tighter connections in person.

There’s a great connectivity or camaraderie that gets built when the team project team goes on site with a client team, works through a problem together. It’s hard to reproduce that otherwise.

And so we definitely see that as a place to invest and a great place to do that. Things like Salesforce’s Dreamforce conference will be another example of us doing that as well.

You’ll be at Dreamforce?

We’re sending a couple of dozen people and we’ve got some clients there. … A lot of people are excited about the prospect of it returning and getting a chance to get back together and making it as important and as impactful a thing as you can.

What could Salesforce do looking ahead that would help your business?

We’re always interested in them helping us from a partner perspective with the labor issue.

I mean, good for them, they’re growing at enormous rates. They’re generating tremendous demand for our services, which we’re very obviously very excited about.

But the single hardest thing we do is to bring great people on board to serve as our clients. And so the more that Salesforce can use some of the weight and the resources that they have to make training easier and better and faster. Or to push even farther into things like university programs – so on and so forth — so that most people come out of the gate understanding who we are that the Salesforce ecosystem is a great place to be, (that) would be super welcome.

In fairness, they’re doing a very good job of it and probably a better job than they ever have been. It’s just an enormous mountain to climb. It’s hundreds and hundreds of thousands of certified consultants that is the gap over the next five years. And so where those people are coming from is something I’d like to know.

How are you navigating the talent gap?

Those investments in the people and the experience that I mentioned is obviously a big part of it.

We’re doing a lot of hiring now outside of the Salesforce ecosystem. Especially as an industry-focused player, we’re finding a great amount of success with folks outside of the ecosystem and hiring from an industry.

So maybe you’re not a Salesforce consultant, but you’re a CIO (chief information officer) or manager at a hospital system that’s using Salesforce. ’Hey, maybe you’d like to try this thing out for a little bit.’

So we’re doing things like that. And it’s been really successful. The majority of the hiring that we’ve done in the last 12 months has been outside of the Salesforce ecosystem.

And it’s twofold. It’s that industry-type hiring I talked about, but it’s also this thing that we call the Silverline Academy, which is just what it sounds like. It’s a junior program to bring people in and to teach them.

But it takes investment. It’s a three-month training program with a three-month shadow program. And then after six months, you’re out there as a consultant.

But that takes a tremendous amount of investment – which hurts our profit margins and means we don’t have as much money to spend on other things.

So we love it. We’re big fans of it, and we’re not going to stop doing it. And it helps us to grow the talent. But that’d be one of the things I’d love to get some help on.

Would you like Salesforce to work with distributors?

They’re just now starting to talk about allowing other folks to do that type of distributor resale style model. So it’s just not mature enough yet. … I actually don’t see it as another middleman. I see it as another channel. And I think it’s important.

If Salesforce wants to get to 100 billion (dollars), they’re going to have to start doing that. And part of the reason that Microsoft has it is because they’re got a couple of decades on Salesforce in terms of figuring out this partner ecosystem.

So Salesforce will get there. They definitely will get there. They’re just not there yet. … I think they’re gonna go after the BPO (business process outsourcing) firms. I think they’re going to go for the folks who are already selling Amazon (Web Services) or already selling Microsoft and say, ’Hey, why don’t you sell Salesforce, too?’ And then figure it out that way.

I think it’ll happen in the next couple of years, not the next couple of decades. But it’ll happen.

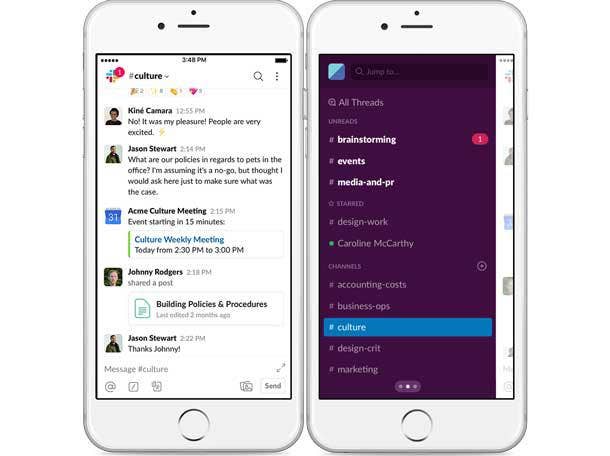

How’s the investment in Slack?

We’re huge fans of Slack. We were one of the preferred partners in the beginning as soon as Slack launched, which was great.

We’re investing in Slack, and we’re making sure that that is an area that we can continue to play and help our clients.

We’re taking a little bit of a ’crawl, walk, run’ style, approach. Our clients are starting to get the hang of what it means to be Slack. … This Digital HQ offering is one of the things that we’re really excited about. We’re putting it out there for our clients. We’re excited to hear more about it from Salesforce at Dreamforce. And I do think that’s going to be another big part of it.

But the crawl, walk is really about the use cases starting to appear. … We’ve got even got a couple of success stories out there. … With some clients who have used it for better collaboration, better ability to connect their teams.

And we’re really talking to clients now about how it’s an important part of any digital transformation initiative. Not a cool add-on, but a really important part of making it really sing.

But then also looking for specific use cases where, in health care, some sort of coordination activities. Or in financial services, account teaming – or something like that – where that can kind of actually work. That’s something we’re very excited about.

And as we start to walk – where the clients have Slack built in – then we can start to run. What I’m really excited about is Salesforce and Slack’s ability to tightly, tightly integrate. And so Slack becomes even yet another sort of interface in front of the Salesforce data. And they can start to let Salesforce speak to Slack and push things out proactively.

One of the promises or chatter that never really happened was its ability to speak proactively. And I think Slack is going to be a great way to do that when you start to get that moving.

Even then you start thinking about bots and automation. And Slack has such a great tech stack for putting that together. We’re very, very close to that. I would be surprised if we don’t hear a lot more of that at Dreamforce.

You think Slack can overcome Microsoft Teams?

We’re biased because we’ve been a Slack user at Silverline for many, many years. And now we’re a Slack partner.

But it’s just got a better ability to connect to all the different data sources that are out there. And not just Salesforce.

And so that’s what’s great about it versus something like Teams, for example. It’s just an API (application programming interface) driven organization. And so they’re really able to make it do a lot of interesting things.

I sign my documents in DocuSign from Slack. That’s just how I do it now. I wasn’t doing that before. I had to go to DocuSign and log in and do that. So it’s amazing how something which seems as super streamlined and efficient as signing a DocuSign could be made even better.

So anyway, we’re really excited about that. We think a lot of the leading edge offerings will start coming out for us. And again, we’re all very much use-case based. And so it’s making sure that we’re hitting the clients where they have the most need.

Where do you see Silverline growing in the future?

There’s a tremendous opportunity out there across the board at Salesforce. And so it’s really about picking the right place and the most efficient place for us to grow.

The way that I’m thinking about it now – so we’ve just acquired and brought up our third industry practice.

And so I’m excited to let that grow, let that germinate. Let’s find the sub-verticals there while we’re letting the other practices grow. … I think about this in the short, medium and long term.

The short-term growth for us is going to be horizontally, thinking about more parts of the Salesforce platform to help our clients with.

We do some Tableau, but we should be doing more. We really could be doing more on the analytics front, on the data front, etcetera, etcetera. Those types of things.

We do the majority of the Marketing Cloud stack, but we’re not getting into the CDP (customer data platform) and Interaction Studio yet, so we should be doing more of that.

So pushing more horizontally to offer more abilities to offer our clients more consultative-style services with the existing industry is the near term.

With the growth into Canada, we’re going to be doing a better job of covering all of North America from a geography perspective. But I don’t see us growing geographically in the near term or even the midterm.

I do see in the mid to long term, though, using this industry model that we built at Silverline from an operational perspective as that growth engine.

And so it is likely that we’ll find in mid to long term – not in the near term – we’ll look for that growth to happen with additional industries that we snap on to our model and continue to go forward. … At 500-plus people, we’re probably the largest pure play Salesforce practice that exists, or very close, which we’re proud of.

And certainly the biggest one that focuses entirely on an industry model. And so we’re going to continue to push on that as hard as we can. And Salesforce is lining straight up with that. Everything that they’re doing now is in the industry vein as well. And so I think that’s the best growth area for us. And I think within our three industries that we already have, and the breadth of the Salesforce technology platform, we have a tremendous opportunity for growth just within that box.

Has a potential recession affected client spending?

It is being talked about. It’s on people’s minds.

I would be lying if I said a couple of our clients hadn’t decided to hold their breath a little bit and maybe be like, ‘Let me think a little bit more about this.’

We’re not seeing things disappear. We’re seeing things maybe take a little bit more investigation. But it’s still in pockets for us. And the digital transformation initiative or story or need from business isn’t going away.

And so I would echo what Salesforce and (CEO) Marc (Benioff) said at the last quarterly review. It’s not hitting our industry yet, and many companies still need to do this kind of work.

And so if there’s belt-tightening, it’s going to come from other places, potentially. … There’s a lot of people reacting to the fear of recession more so than the fact that it might actually happen.

Have you felt any effects of the supply chain crisis?

Almost all of our clients are services organizations. So financial services. Health care is providing services. And even media for the most part is technology services.

Almost none of our clients deal in hard goods. And so we’re probably not a good person to ask this question, because in a weird way, our industries are growing. Whereas if I’m a guy who does work for the manufacturing industry, and if I talked to some of my friends who run those companies, like they’re actually feeling a world of hurt because those companies have supply chain issues. … It’s interesting to think about how this macroeconomic environment is affecting services-based companies versus product-based companies. And it can be very, very different.

You talk to the product-based companies, and they’re thinking this recession is terrible and it’s crushing my business. And I’m growing more than 20 percent this year. So it’s like – that just doesn’t make any sense.