VMware CEO: Renew Now To Fight Broadcom Price Hike Worries

‘For customers that are worried that Broadcom will come in and raise prices post close, there’s plenty of time. There are customers who have said, I want to come in and do an early engagement with VMware, do an early renewal, and we are doing that all day long,’ VMware CEO Raghu Raghuram says.

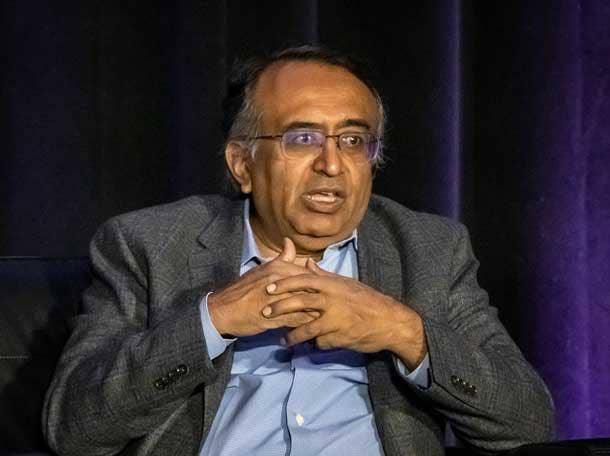

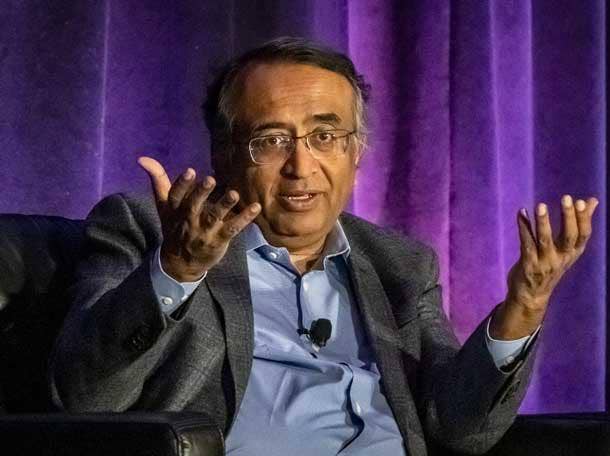

With a $61 billion deal in play, and several skeptical reseller partners in the audience, VMware CEO Raghu Raghuram sat down on stage at the Best of Breed conference this week in Atlanta, and for 37 minutes he tried to win them over.

“Thanks to all the partners here,” Raghurman started off. “I’m pretty sure most of you are also VMware partners. Thanks for all the collaboration over the years, and helping our joint customers.”

Unflappable throughout, Raghuram tackled the merger with Broadcom; what partners can expect after the deal closes; what “amazed” him about Broadcom CEO Hock Tan; where VMware competitors fall short; why VMware partners with them regardless; and the best way to approach the concern about Broadcom raising prices: renew early.

[RELATED: IBM CEO Arvind Krishna Says Partners Should Raise Prices, Weighs In On Broadcom-VMware Deal]

After the show, one partner said while his organization still has reservations about Broadcom, as a company, Raghuram’s commitment to the channel was evident.

“It was good,” said the partner who has been a VMware partner for “about a decade.”

“The concern is not necessarily around what we know about VMware. It’s more about what we don’t know about Broadcom,” said the partner who asked not to be identified. “It was good to hear from Raghu. It did make me feel better. I think the answers we really want are going to have to wait until we get a few quarters into Broadcom’s ownership. That will tell us a lot.”

Broadcom and VMware announced a merger agreement on May 26. The two companies negotiated about 20 days before agreeing to a purchase price of $142.50 per share of VMware stock. Broadcom said the FTC is taking a “second request” look at the merger, which blocks the deal from being finished until the government’s investigation is satisfied.

Since the announcement VMware resellers have voiced alarm over how Broadcom has treated channel partners in the past. Broadcom said it has learned from those transactions and intends to “embrace the channel.” The deal would enrich VMware leadership by $169 million, with Raghuram taking the lion’s share of that as his “golden parachute” was estimated by Broadcom to be $52.5 million.

Broadcom said the deal is expected to close by October 2023. Here is what VMware’s CEO told partners at The Channel Company’s Best of Breed (BoB) conference in Atlanta:

‘Make us feel good’ about the Broadcom deal.

From Broadcom’s point of view, it is building a second leg of Broadcom’s business divisions. They’re primarly a semiconductor company. They want to buy VMware to get an infrastructure software business at scale, and this will become the platform for their future software efforts. The go-forward, post-close. Broadcom will have a strong semiconductor business worth about $20 billion in revenue and a strong software business with about $20 billion in revenue.

So you’ll have two equal-size businesses contributing to a $40 billion sized business. That gives Broadcom diversification to some degree as well. That’s really the strategy.

They like VMware for the breadth of the portfolio and to make VMware the foundation of their current and future software assets.

They’ve reiterated their commitment to accelerating VMware’s multi-cloud strategy. All of that will continue. From a VMware perspective the reason why that is good is they have five times our market cap. And they have a history of doing inorganic acquistions very well. So as VMware grows bigger and bigger, our ability to do these inorganic moves is much greater in this combination.

Can partners expect the lucrative relationship to remain?

I would not expect significant changes for the simple reason that VMware has a large customer base. There’s no way to effectively service a broad customer base without the expertise and the reach of the partners. So Broadcom and Hock Tan in his public statements have said as much.

Where does Red Hat fall short?

It’s not just enough to put in a Kubernetes layer. You have to be able to control it and manage it. Our product Tanzu Mission Control has no equal in the Red Hat portfolio. Our management products work with OpenShift. Our developer product work with OpenShift. So it’s all very modular. We have a broader portfolio that customers can pick and choose from that works with OpenShift, as well as can be an alternative to OpenShift in some areas.

It’s choice as well as the breadth of the portfolio that is the differentiator.

Where does Nutanix fall short?

With Nutanix there are similar arguments, right? Nutanix is a good supplier of HCI technology, for sure. But where customers are going and what we have been talking about is multi-cloud. That is, how do you connect these entire environments together. How do you help a customer go from on-prem to cloud or from cloud back?

We’ve shown time and time again, for customers moving to the cloud, we can do it in half the time, and half the time it takes with any other solution.

Nutanix does not have those kind of investments in their portfolio. It’s the breadth of the portfolio. It’s the depths of the capabilities in just the core hypervisor itself. Those are all reasons why customers prefer us.

What is your pledge to partners who might be concerned about prices being raised under Broadcom?

For customers that are worried that Broadcom will come in and raise prices post-close, there’s plenty of time. There are customers who have said, I want to come in and do an early engagement with VMware, do an early renewal, and we are doing that all day long.

For the partners, you have to be aware of that. If customers express a high degree of uncertainty and say, ‘What is VMware going to do?’ Introduce certainty (by offering early renewal).

There is an interoperability covenant that says for deals above a certain dollar figure, Broadcom has to approve. Since the first couple of weeks, since the deal was announced, it has run perfectly smooth. It costs us an extra day or so in those cases because there is a regular process between the Broadcom and us for to approve under the operating covenant.

We are completely approachable. We are here for you anytime you need help with a customer. If you are seeing friction with any sort of orders going through, quotes going through, etc. Its got nothing to do with Broadcom. It’s got more to do with VMware’s process. We introduced some new programs in the second half and we had some teething issues with getting codes through this new process, and approving everything rapidly.

What advice has (VMware board chair and majority stockholder) Michael Dell offered?

He’s done amazing things, but he also keeps his ears very close to the industry. He sees and understands a lot of things. He has been a great source of help, saying, ‘Hey look our for these potholes’ or ‘Do these things early.’

The thing he’s always preaching is getting out in front of customers and being very transparent and accountable to customers and partners. That’s the biggest thing that he’s doing.

What surprised you about Hock Tan?

I’m having a great time working with him through this acquisition. Number one, he’s very direct and decisive. He’s very transparent. You can go talk to him and say, ‘What do you think of X?’ the answer that he’s going to give you about X is what he is going to go do. So, this makes for very high bandwidth conversations and efficient set of activities.

Second, he’s very, very savy about the various routes to market. He “grew up” as a CFO. He still counts himself as more of a financial business person than a technology business person. But he understands the breadth of technology. Broadcom has 22 businesses. He understands all of them very well. He’s been digging deep into VMware’s businesses. I’m amazed at how much time he’s spent. What I’m surprised with is the level of detail he has gotten into in understanding all of our businesses, and having an open mind and probing: why this and why not that?

I would say those are the pros that he’s bringing. He’s not coming in with a preconceived idea of “I know the playbook and this is what we’re going to do.”

He’s taking his time and being really thoughtful about how he is doing this.”