10 Hot Semiconductor Companies To Watch In 2023

CRN breaks down 10 semiconductor companies that are driving the market with new innovations — or are on the verge of doing so — while navigating the tough economic environment.

The Chips Are Down But Not Out

When the pandemic started in 2020 and chip shortages became acute, the world woke up to the importance of semiconductors. Then, the economy shriveled and bounced back and once again started to diminish in the ensuing years, leading to where we are today.

The change in fortunes was summed up last November by research firm Gartner, which projected that global semiconductor revenue will decline 3.6 percent in 2023.

“The short-term outlook for semiconductor revenue has worsened,” said Richard Gordon, practice vice president at Gartner, in a statement. “Rapid deterioration in the global economy and weakening consumer demand will negatively impact the semiconductor market in 2023.”

[Related: As Intel’s Revenue Plunge Continues, CEO Says Comeback Plan On Track]

This puts the semiconductor industry in a precarious position, where investments in next-generation chip design and manufacturing remains critical while demand for many chips have plummeted far below the highs that were seen a couple years ago.

As a result, semiconductor companies must find a delicate balance between building for the future and reacting to the swaying markets. There are still plenty of willing buyers out there. There’s just fewer of them. But that isn’t stopping applications across PCs, servers, smartphones and other devices from demanding greater performance and efficiency from silicon.

Then there’s the new geopolitical reality of countries like the United States, China, India, Germany, and others putting a premium on building up domestic chip design and manufacturing capabilities. The U.S., for instance, plans to spend $52 billion on subsidies for new chip-making plants while China is expected to spend triple as much for its own industry as trade tensions mount between the two world powers.

“Semiconductors may contribute to only a small percentage of global GDP, but they power trillions of dollars of goods and processes,” consulting firm Deloitte wrote last year.

CRN breaks down 10 semiconductor companies that are driving the market with new innovations — or are on the verge of doing so — while navigating a tough economic environment.

AMD

It’s been nearly six years since AMD reinvigorated its client CPU portfolio and re-entered the server chip market with the company’s game-changing Zen architecture. In that time, the Santa Clara, California-based chip designer has proven that it can firmly challenge Intel’s CPU dominance in PCs and servers while making inroads with GPUs and expanding to other product areas like adaptive system-on-chips (SoC) and data processing units (DPU) with its Xilinx and Pensando acquisitions.

This has built AMD into what CEO Lisa Su has called the “high-performance computing leader,” but now the company must keep executing as Intel plans a rebound and Nvidia fights to protect its AI crown. One major focus this year are AMD’s Ryzen 7000 processors for client PCs and fourth-generation EPYC server chips. At the same time, the company is seeking to make a bigger challenge against Nvidia with its upcoming Instinct MI300, which AMD claims will be the first data center processor to integrate a CPU and GPU in the same package. 2023 is also an opportunity for AMD to show how its newer product lines like adaptive SoCs and DPUs will help make it a much larger and diversified company in the future.

Ampere Computing

While Amazon Web Services was the first vendor to prove that Arm-based processors can take on x86 chips from Intel and AMD in the cloud, Ampere Computing has enabled major AWS rivals like Microsoft Azure and Google Cloud to offer their own flavor of competitive Arm-powered instances. The Santa Clara, California-based chip design startup, founded and led by former Intel executive Renee James, is also entering the on-premises world thanks to deals with server vendors like Hewlett Packard Enterprise.

This year could be an important one for Ampere for a couple reasons. First, the company started sampling its next-generation Ampere One CPU with select customers last year, so there’s a good chance some next-generation cloud instances and servers could become available in 2023, giving the startup another chance to further show how its silicon designs stand out from rivals. Then there’s the fact that the startup confidentially filed for an initial public offering early last year. Ampere has yet to go public, likely due to the shaky economy. If things stay that way or get worse, Ampere may have to postpone its IPO further and raise more private financing, most of which has come from Oracle so far.

Arm

Ever since Nvidia’s deal to acquire Arm fell through nearly a year ago, the British chip designer has been forced to figure out an alternative path, one that will likely return it to the public market after being owned by Japanese investment giant SoftBank for several years. The company has been planning for an initial public offering for almost a year but has held off so far due to global economic uncertainty. This raises the possibility that Arm could IPO in 2023, though the company’s plan could be stymied further if the economy falls into a recession later this year.

After more than a decade of dominance in mobile devices, Arm has been making a big push in recent years for its instruction set architecture and processor designs to get adopted in the data center and PC markets. The company has enjoyed significant uptake in the cloud computing world thanks to the likes of Amazon Web Services and Ampere Computing developing competitive Arm-compatible processors. It’s also proven itself in personal computers, thanks to Apple’s new M-series chips that go inside nearly all the company’s Mac devices now. A big question moving forward is how Arm will improve its footprint in Windows PCs, given that the company is currently suing one of its biggest PC chip design partners, Qualcomm, over a licensing dispute. It’s a critical issue to sort out as Arm seeks to put greater pressure on the x86 duopoly that is Intel and AMD.

Astera Labs

2023 is the year that CXL, short for Compute Express Link, will become a common term in the data center world thanks to new server chips from Intel and AMD that enable the new game-changing technology. One semiconductor company that hopes to gain big from CXL adoption is Astera Labs. The Santa Clara, California-based startup has built an array of connectivity solutions for CXL, PCIe 5.0 and 100G Ethernet that aim to break down bottlenecks in data center performance, capacity and bandwidth.

While some semiconductor startups have struggled with the economy’s ongoing slowdown, Astera managed to raise a new $150 million funding round last year that tripled its valuation to $3.2 billion after delaying plans for an initial public offering. One of Astera’s marquee products is the Leo CXL Memory Connectivity Platform, which supports the memory expansion, memory pooling, and memory sharing features made possible by CXL 1.1 and 2.0. These features will allow servers to support larger, more flexible and less expensive DRAM configurations, among other kinds of capabilities.

Cerebras Systems

Cerebras Systems believes it can beat Nvidia at AI computing with a computer chip the size of a dinner plate. Called the Wafer-Scale Engine, Cerebras’ processor packs 850,000 cores on 2.6 trillion transistors in the second generation, and a growing stable of companies and research labs have started buying into this massive piece of silicon. These backers include pharmaceutical giants GlaxoSmithKline and AstraZeneca as well as oil behemoth TotalEnergies and generative AI startup Jasper.

In recent months the Sunnyvale, California-based startup has expanded its offerings with Cerebras AI Studio, a cloud-based service that allows users to train large generative AI models such as GPT-3 on its Wader-Scale Clusters, including its new Andromeda AI supercomputer. While the startup claims its chips and systems are faster and more capable than Nvidia’s, it will have to contend with a shrinking economy and hope that investors and customers keep coming back for more.

Intel

It’s been nearly two years since Pat Gelsinger became Intel’s CEO and laid out an ambitious comeback plan for the Santa Clara, California-based chipmaker to regain its chip design and manufacturing mojo. Now the semiconductor giant is at a critical turning point this year as it begins to make billions of dollars in cuts to counter a significant slowdown in demand for the company’s products. With the chipmaker reducing its headcount, making cuts to product lines and slashing other programs, the stakes are higher than ever for Intel to execute Gelsinger’s turnaround scheme, which seeks to put Intel ahead of chip manufacturing rivals in advanced chip-making capabilities by 2025.

This year, Intel is hoping to defend its data center market share against rivals with the recently launched fourth-generation Xeon Scalable processors, and it’s taking a new swing at Nvidia and AMD with its new Intel Data Center GPU Max Series for high-performance computing and AI workloads. Another area to watch is Intel’s PC efforts, where the company will continue to push its new 13th-generation Core chips and Arc discrete graphics products. What’s most important, however, is whether the company can prevent further product delays and stay on track with its aggressive manufacturing plan.

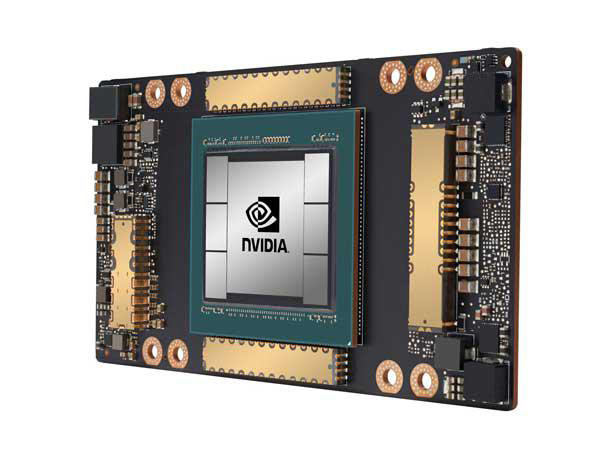

Nvidia

In 2023, it will become clearer than ever before that Nvidia is no longer just a GPU company. While the Santa Clara, California-based chip designer continues to make most of its money from GPUs, it’s hoping to change that soon with a growing portfolio of commercial software, its forthcoming Grace server CPU, a broader set of server appliances, and its expanding family of networking products that stemmed from the company’s 2020 acquisition of Mellanox Technologies.

Nvidia may have not been able to acquire Arm due to staunch regulatory opposition last year, but the chipmaker nevertheless plans to use Arm technology to power its new line of server CPUs. These efforts will begin in 2023 with the Arm-compatible Grace CPU, which will be available in the 144-core Grace Superchip and the CPU-GPU hybrid Grace Hopper Superchip. The company is also expected to make a big push for commercial software services like Nvidia Omniverse and Nvidia AI Enterprise. Will these efforts be enough to protect Nvidia’s dominance in high-value applications like AI as Intel, AMD and smaller rivals mount new challenges? Only time will tell.

Qualcomm

Qualcomm is staking a good chunk of its future on its 2021 acquisition of chip design startup Nuvia. The company has said that Nuvia’s tech will serve as the foundation for Arm-based custom application processing cores that will go into future chips for laptops, smartphones, and other device types. The problem is, Arm is suing the San Diego, California-based chip designer to destroy its custom cores because Qualcomm allegedly failed to negotiate a new license with Arm to keep using Nuvia’s tech.

This conflict is playing out as Qualcomm plans to ship its first Snapdragon chips using cores designed by the Nuvia team for Windows laptops by late 2023 or early 2024. That means this year will likely be full of intrigue as both parties begin submitting evidence for the lawsuit while Qualcomm moves forward with release plans for its contested technology. Qualcomm CEO Cristiano Amon has said that 2024 will be a big year for Snapdragon chips in Windows PCs, which means 2023 will be critical for the company to set expectations for the Nuvia cores and make assurances to OEMs worried about Arm’s lawsuit.

Tenstorrent

Among the various AI chip startups that seek to challenge Nvidia’s dominance, Tenstorrent has stood out for its team’s bona fides, its novel approach to AI acceleration, its roadmap progress and its expanding ambitions. The biggest reason Tenstorrent has likely entered the radar of many semiconductor enthusiasts is Jim Keller, the chip design legend who pioneered new architectures at AMD, Apple and Intel before joining the startup in 2021 and becoming its CEO this year.

After releasing its second-generation Grayskull machine learning processor in 2021, the Toronto-based startup is working on multiple iterations set to come over the next few years. These projects include Black Hole, which Tenstorrent calls a “standalone ML computer” because it incorporates 24 CPU cores based on the RISC-V instruction set architecture in addition to the startup’s AI-focused Tensix cores. The startup is also working on a chiplet design called Grendel that combines Black Hole with a CPU that has 128 RISC-V cores designed in house by Tenstorrent. The company believes its conditional execution architecture will set it apart from competitors because of how the processors can dynamically eliminate unnecessary computation, which can help with adapting to increasingly larger AI models.

Ventana Micro Systems

As Arm gains more support from major cloud service providers, Ventana Micro Systems is hoping to disrupt the Arm and x86 worlds with data center chips that are based on RISC-V, an open-standard, royalty-free instruction set architecture backed by the likes of Intel, Google and Qualcomm.

The Cupertino, California-based chip design startup plans to release its first RISC-V data center processor, Veyron V1, in the second half of 2023. It’s already making big claims about the processor, saying Veyron V1 can provide competitive single-threaded performance against established rivals in datacenter, client, automotive, 5G and AI applications while providing the most horsepower in a single-socket system. It’s expected to take some time for RISC-V to get to the same level of software compatibility of Arm and x86, and it may take even longer for it to gain acceptance from most data center users. For Ventana’s part, the company said it plans to offer some standard features that datacenter operators come to expect, like RAS and virtualization.