12 Printer Companies Leaving Their Mark On 2022

For Printer Week 2022, we take a look at a dozen top printer vendors who are inking deals with channel partners with new products and services.

Like the rest of the world, the print industry has been on a rollercoaster ride since the start of the pandemic. Remote work initially sent workers scrambling for home printers and supplies and sent demand soaring. As companies began bringing people back to the office, that demand for home supplies started fading. Consumer sales started showing softening in the printer market in the early part of 2022 and worsened as spring COVID-19 lockdowns in China exacerbated an already snarled supply chain.

Still, business print sales remain strong, and companies are shifting to focus on hybrid work solutions and subscription models that will capitalize on the future of work. The top printer companies have been nimble enough to navigate those treacherous supply woes while pivoting their business models quickly.

As part of CRN’s Printer Week, CRN takes a closer look at 12 of the printer companies making their mark on 2022:

Brother

Japanese printer giant Brother posted strong results in the first quarter of its current fiscal year ending March 31, 2023 despite supply chain issues plaguing the print industry and a slowdown in the consumer tech market. The company pulled in $1.38 billion (converted from 199.7 billion yen), a 14.8 percent increase from the same period in the previous fiscal year.

David Fisher, senior sales manager for the VAR channel for Brother USA, told CRN that hybrid work is fueling new opportunities for the company, including a shift to subscriptions for hardware, supplies, services and support. “This hybrid working environment has really given us an opportunity to address some changing needs with print and documents as well,” he said.

Notable Products:

MFCJ5855DW Color Inkjet All-In-One

HLL3290CDW Compact Digital Color Printer

MFCL9570CDW Business Color Laser All-in-One

Refresh EZ Print Ink & Toner Subscription

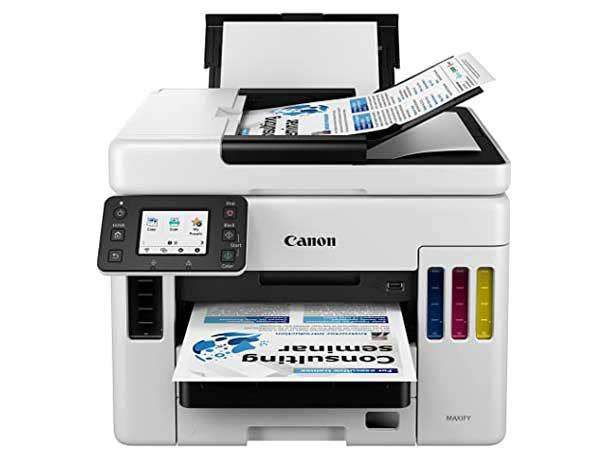

Canon

Japanese imaging behemoth Canon reported a 13.3 percent year-over-year increase in revenue for its second quarter ending June 30. The company posted strong sales in its printer segment despite a shortage in semiconductor chips slowing shipments. Canon gained serious ground in unit sales of both cartridge printers and refillable in tank printers and supplies. Overall, the print unit’s net sales increased 15.9 percent year over year.

The company offered a mixed outlook in its earnings report: “…demand for office MFDs and laser printers are expected to remain solid. However, there is a concern that the demand for services and consumables will be affected by the slow recovery in office work. Demand for inkjet printers is expected to remain solid due to increasingly widespread remote work and education in response to the impact of the COVID-19 pandemic.”

Notable Products:

imageCLASS D1620 - Multifunction, Wireless, Mobile Ready, Duplex Laser Printer

imageCLASS MF452dw - All-in-One, Wireless, Mobile Ready Laser Printer

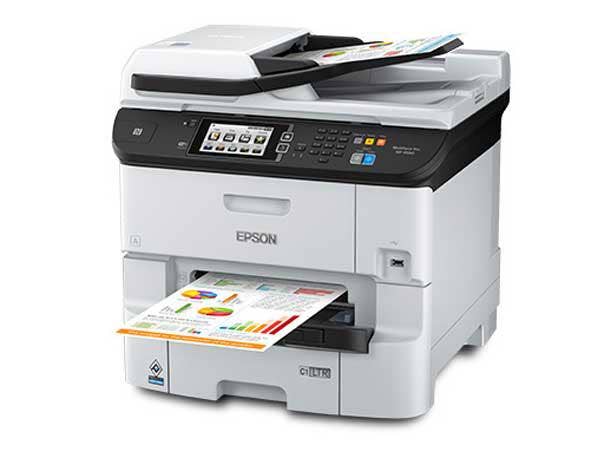

Epson

Japanese printer giant Epson had a rough year with supply chain constraints, but still managed to post gains in revenue year-over-year. The company showed a 5.6 percent increase year over year (from 282 billion yen to 297.8 billion yen) for the first quarter of fiscal year 2022. Profit, however, was down 1.5 billion yen.

“Results were negatively affected by supply constraints, which caused unit sales to decrease, and by skyrocketing materials and logistics costs, but they were positively affected by dynamic product pricing based on supply and demand,” the company said in its earnings report.

Notable Products:

WorkForce Pro WF-C4810 Color MFP

WorkForce EC-C7000 Color Multifunction Printer

WorkForce Pro WF-M5299 Workgroup Monochrome Printer

Formlabs

Somerville, Mass.-based Formlabs got its start as a Kickstarter concept spun out from a team at MIT in 2011. With the goal of making an accessible 3D printer, the company says it has sold 90,000 printers to date. The company announced a pair of new printers at CES earlier this year – the Form 3+ and Form 3B+. “Formlabs created the professional desktop printer market, and our Form 3 has become a best-seller,” CEO Max Lobovsky said in a statement. “The Form 3+ is the next iteration designed to help users go from idea to part in hand as quickly and easily as possible.”

And the company plans to bolster its healthcare 3D printing after recently naming Guillaume Baillaird president of Formlabs Healthcare. “3D printing in healthcare is an exciting opportunity that can streamline workflows, enable precision healthcare, and improve patient outcomes,” Baillaird said in a release. “Formlabs has been at the forefront of this innovation…”

Formlabs said it has sold more than 25,000 healthcare 3D printers. “Formlabs is a driving force in advancing 3D printing adoption in the healthcare sector, pioneering materials and solutions that enable the industry to innovate and improve patient healthcare,” Lobovsky said in a statement.

Notable Products:

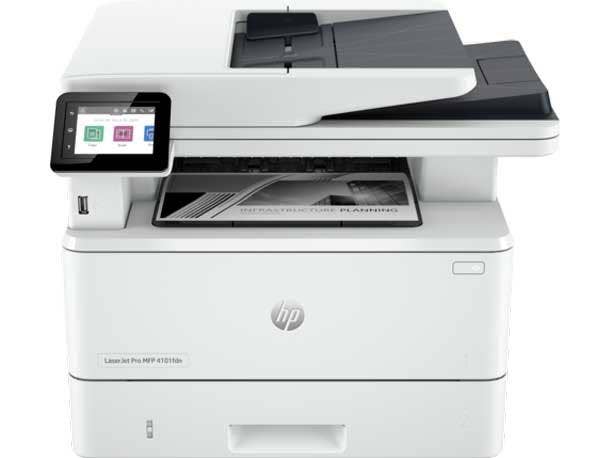

HP Inc.

Palo Alto, Calif.-based HP Inc. is banking on changing customer demands as it updates its enterprise print business offerings. The company has added its HP+ subscription management services to its new LaserJet business class lineups. While consumer print business suffered in 2022 as inflation soared, enterprise print revenue has remained steady.

So it’s no coincidence that the company’s latest business printer offerings – the LaserJet Pro 3000 and 4000 series – are aimed squarely at the small- and medium sized business (SMB) market. Those new machines, coupled with the company’s HP+ service will give channel partners more options to sell, the company said.

“One thing we hear from channel partners and from small businesses is as much as they don’t have time to manage the printer, they often don’t have time to research the printer as well – and they often look to the channel partner as their trusted IT adviser,” said Vivian Chow, global head of product and portfolio management for HP’s print hardware systems. “From a channel partner perspective, they can offer an all-inclusive way for an SMB to be productive and to not worry about management. It helps them regain that position of trust…”

Notable products:

HP LaserJet Pro 3001dwe Wireless Printer with HP+

HP LaserJet Pro MFP 3101fdwe Wireless Printer with HP+ and Fax

HP LaserJet Pro 4001ne Printer with HP+

Konica Minolta

Fiscal year 2022 was a banner year for business printing revenue at Tokyo-based Konica Minolta, which showed a 15 percent year-over-year revenue increase. While COVID-19 lockdowns had an impact on other portions of the company, business printing hardware and services remained in high demand.

Toshimitisu Taiko, Konica Minolta’s president and CEO, told investors during a call that “sales of printing applications for the U.S., Europe and India, and industrial applications for South Korea were higher than the original plan.” While beating expectations, the company noted an order backlog of about 10 billion yen for print hardware. “The impact from lockdowns will recover… but we assume (supply chain impact) will continue for some time.”

Notable Products:

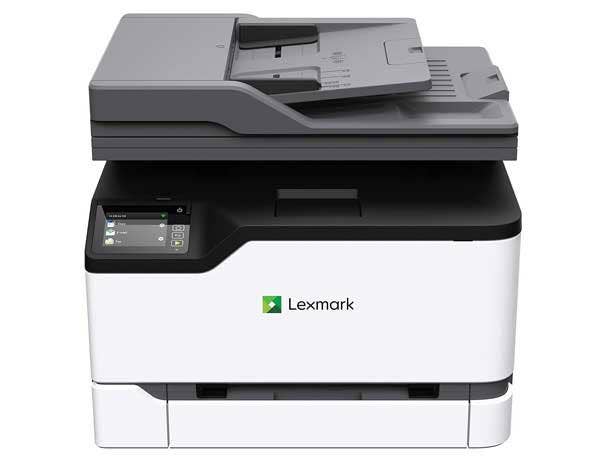

Lexmark

Lexmark showed nimble reaction to the supply chain issues facing the industry by shifting focus to its suite of cloud print management and fleet management services. Lexmark, which become a privately held concern in 2016, does not share financial information. Research firm Quocirca named Lexmark as a 2022 cloud print leader for its digitization efforts.

“Being recognized as a leader in cloud print serves demonstrates our commitment to the continued development of our extensive cloud offering,” Brian Saladin, Lexmark’s senior vice president and chief commercial officer, said in a statement. “Our investment in innovation and new technologies continues to provide Lexmark customers with the industry-leading products and solutions they expect from us.”

The company still produces plenty of hardware for physical offices, but it has definitely shifted its focus to digitization.

Notable Products:

Lexmark Color All-in-One 4-series (MC3426i)

Markforged

Watertown, Mass.-based Markforged Holding Corp. has used its 3D printing prowess for solid earnings in its most recent quarter. The integrated metal and carbon fiber additive manufacturing platform creator posted year-over-year revenue gains of 19 percent for the second quarter, with $20.4 million in revenue.

“Demand for The Digital Forge continued to grow,” Shai Terem, president and CEO of Markforged, said in a statement. “Our customers realize the value of our additive solutions as they solve for a growing number of applications with high-quality parts right at the point of need, especially in the current global environment racked with supply chain challenges.”

Markforged said cash and cash equivalents totaled $243.2 million as of June 30. “We continue to make great strides in executing our strategy thanks to great efforts from our talented team. We feel very confident in our long-term opportunity to extend our leadership position in distributed manufacting as our product portfolio grows and evolves.”

Notable Products:

Ricoh

Despite supply chain weaknesses, Japan’s Ricoh managed to turn a 34.5 percent year-over-year revenue increase in the first quarter. For its office printing services, the company said it remained on track with sales, despite impacts from Shanghai’s COVID-19 lockdown and other macroeconomic factors. While sales in Japan were slightly lower, the company was on target with sales in Europe and the U.S., according to its quarterly report presentation.

Takashi Kawaguchi, corporate officer and CFO, said the company was taking steps to mitigate impacts from supply chain snarls. “We are procuring alternatives for parts and materials that are in short supply,” Kawaguchi told analysts during a call. “We boosted production after authorities lifted the lockdown (in Shanghai, China). We aim to overcome any lingering effects. ... There is more to the office printing business than just hardware sales.”

Notable Products:

M C251FW Color Laser Multifunction Printer

IM 9000 Black and White Laser Multifunction Printer

Sharp

Sharp Imaging and Information Company of America, a division of Japan-based Sharp Electronics Corp., in August announced new high volume monochrome series of document systems. The company said the BP-70M75 and BP-60M90 documents systems are designed to enable workers to collaborate and share information seamlessly and securely throughout their office environment, even while working remotely.

The machines deliver speeds of up to 70-90 pages per minute.

“In an age of diverse workstyles, the need for seamless collaboration between colleagues has never been more critical,” Shane Coffey, vice president for production management said in a statement. “We’re excited to offer these new high volume monochrome document systems to help organizations streamline communication and work simply smarter.”

Other notable products:

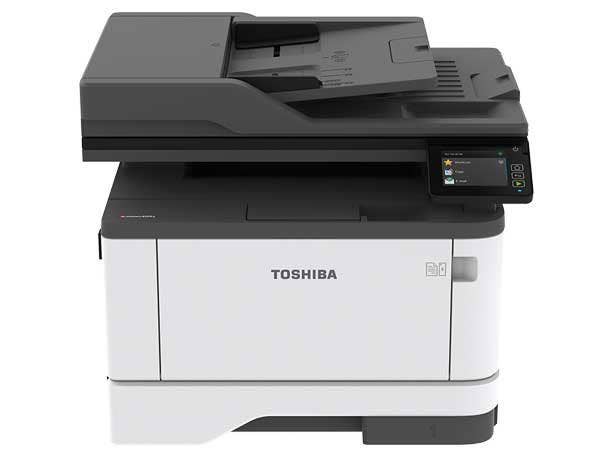

Toshiba

Japan’s Toshiba posted a 12.8 percent year-over-year revenue gain in the first quarter of 2022, and its printer business was on the winning side of the ledger. Retail and Printing Solutions posted net sales of 110.6 billion yen.

Toshiba America Business Solutions’ printer business offers a wide variety of business solutions, including label printers, laser printers, multi-function printerss, cloud solutions and more.

Notable Products:

Xerox

It’s been a year of upheaval at Xerox. The Norwalk, Conn.-based company’s former CEO John Visentin died in June after an ongoing illness with Steve Brandrowczak taking over the chief executive reins as the company continues to deal with a massive backlog.

Still, the company remains a powerhouse in the business printer world and one of the most recognizable names in the market. The company in April posted first quarter 2022 revenue of $1.6 billion, down 2.5 percent from the same quarter in 2021.

Brandrowczak believes the company still has a bright future: “I see great potential for our company and I’m honored to work alongside all of my Xerox colleagues as we build momentum toward the future,” he said in an August release coinciding with his being named permanent CEO.

Notable Products: