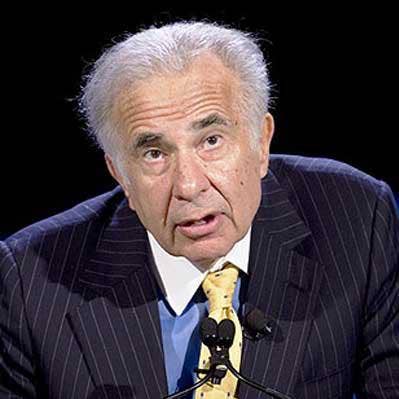

Carl Icahn Calls For 'Immediate Action' By HP Shareholders

'I implore all HP shareholders who agree with me to reach out to HP’s directors to let them know that immediate action is necessary to explore this opportunity NOW while there is still a willing counterparty on the other side,' Icahn wrote in an open letter posted Wednesday.

Carl Icahn called on HP Inc. shareholders to demand “immediate action” on Xerox’s buyout offer, saying HP’s restructuring plan is akin to “rearranging the deck chairs on the Titanic.”

“It is absurd for the HP board and management team, with such a history of underperformance and missteps, to claim to have had a sudden epiphany and now expect shareholders to trust them to execute a standalone restructuring plan rather than to even explore an opportunity to enter into a combination that could bring about a much needed $2+ billion of cost synergies and possibly save the company,” Icahn wrote in a letter that he posted online Wednesday. “Over the past few decades, we have created literally hundreds of billions of dollars of value for shareholders by guiding boards and CEOs to take the mostly obvious steps necessary to greatly increase the value of their companies.”

Icahn—who said he owns a 10.85 percent stake in Xerox and 4.24 percent stake in HP—pushed the board to carry out the due diligence that both sides have claimed the other is holding up. In his letter, Icahn posits that newly appointed CEO Enrique Lores and HP’s board are stalling to protect their jobs.

[RELATED: Carl Icahn's HP-Xerox Moves: 5 Big Things To Know]

“Because I see no other plausible explanation for HP to refuse to engage in customary mutual due diligence, I am left to wonder whether this is simply a delay tactic aimed at attempting to preserve the lucrative positions of the CEO and members of the board, which they fear might be affected if a combination does take place,” he said.

This is Icahn’s first public statement about the deal, which came to light a month ago after Xerox offered to buy HP for $22 a share in a combination of cash and Xerox stock. Both HP and Xerox acknowledged that they have carried out talks for months about the best ways to combine their business operations, but thus far they have failed to reach an accord.

In a letter last week from the HP board of directors to Xerox that was signed by Lores, the company said it had “significant concerns about both the near-term health and long-term viability of your business.”

“When we were in private discussions with you in August and September, we repeatedly raised our questions; you failed to address them and instead walked away, choosing to pursue a hostile approach rather than continue down a more productive path,” the letter stated. “But these fundamental issues have not gone away, and your now-public urgency to accelerate toward a deal, still without addressing these questions, only heightens our concern about your business and prospects. Accordingly, we must have due diligence to determine whether a Xerox combination has any merit.”

HP has also said it believes the restructuring plan will create the value it projects, and it can achieve that without combining with Xerox.

“We have great confidence in our strategy and the numerous opportunities available to HP to drive sustainable long-term value, including the deployment of our strong balance sheet for increased share repurchases of our significantly undervalued stock and for value-creating M&A,” HP’s letter to Xerox stated.

However, Icahn called the deal is the “most obvious no-brainer” he has seen in his career. He said HP shareholders who agree with him should reach out to HP’s board of directors and demand “immediate action.”

“I can say without exaggeration that the combination of HP and Xerox is one of the most obvious no-brainers I have ever encountered in my career—one where activism should not even be necessary at all because the merits of the combination are so obvious to everybody involved,” he said. “I implore all HP shareholders who agree with me to reach out to HP’s directors to let them know that immediate action is necessary to explore this opportunity NOW while there is still a willing counterparty on the other side.”