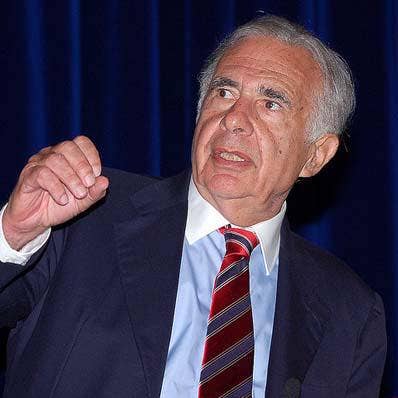

Carl Icahn Discloses Stake In HP Amid Xerox Takeover Bid: Report

The activist investor is pushing for a merger between the companies as opposition to the deal is building among HP channel partners.

Activist investor Carl Icahn has reportedly disclosed a stake in HP Inc. amid a takeover bid for the company by Xerox, where Icahn is a major shareholder.

The Wall Street Journal reports being told by Icahn that he owns 4.24 percent of HP shares, worth about $1.2 billion. Icahn owns 10.6 percent of Xerox shares.

[Related: 5 Reasons HP Might Oppose The Xerox Takeover Bid]

A week ago, Xerox made a takeover offer for HP that is reportedly 23 percent higher than where HP shares started the month. Combining Xerox and HP would bring together the leaders in A4 and A3 devices at a time when the print industry is waning. HP is by far the larger company with a market capitalization of $28.94 billion as of Wednesday, compared to Xerox's market cap of $8.23 billion.

According to reports, Xerox is proposing to buy HP at $22 a share in a cash and stock offer that would give HP shareholders a 48 percent stake in the combined enterprise. Xerox reportedly has lined up financing for the deal through Citigroup Inc.

However, HP management has not yet made a decision on the offer, and opposition to the deal has been building among top HP channel partners.

In a statement provided to CRN, HP said: “We are aware of Carl Icahn’s investment and are committed to doing what is in the best interests of all HP shareholders.”

Previously, Icahn was a central figure in dissolving Xerox's planned merger with Fujifilm in 2018. Instead, John Visentin, a long-time Icahn loyalist, took over as CEO of Xerox.

Earlier this month, Xerox sold off its Fuji Xerox stake to Fujifilm for $2.3 billion.

The Wall Street Journal quoted Icahn as saying that the combination of Xerox and HP is a "no-brainer," and that he believes "very strongly in the synergies." He reportedly bought the shares in HP between April and August of this year.

The leadership teams of both HP and Xerox do see a rationale for a merger, Bloomberg reported this week. However, there are major disagreements over the specifics—such as which company would be the acquirer in the deal and which of the two management teams would run the combined company, according to the report. Bloomberg characterized the issues as "potentially intractable disagreements."

HP said last week that it will "continue to act with deliberation, discipline and an eye towards what is in the best interest of all our shareholders” after receiving the takeover offer. The company has "great confidence in our multi-year strategy and our ability to position the company for continued success in an evolving industry, particularly given the multiple levers available to drive value creation," HP said in its statement.

The Xerox takeover bid came just days after Enrique Lores took the helm as CEO of HP and the company began rolling out a reorganization and restructuring plan meant to improve efficiency and support investment in key areas.

Overall at HP, "we are starting a new chapter," Lores said in a recent interview with CRN, prior to the Xerox takeover offer. "And the key elements of the chapter are our ambition to advance our leadership in personal systems and print, and the opportunity that we have to disrupt some key industries."

Key partners of HP have told CRN that they don't see the upside for HP if Xerox is successful in the takeover bid.

"This proposed move by Xerox has only negative outcomes for HP’s channel partners," said Harry Zarek, president and CEO of Compugen, No. 57 on CRN's 2019 Solution Provider 500.

"Xerox has historically been a direct sales organization and is still in the early stages of understanding how the channel model works," Zarek said. "Contrast that with HP as a mature, channel-focused business. There is a big cultural mismatch around Xerox being able to understand how today’s IT channel model works."

Notably, HP's personal systems business is nearly twice the size of its printing business, and the company is the second-largest PC maker worldwide and the largest in the U.S. HP generated $28.27 billion in personal systems revenue during its latest three quarters, up 2.4 percent year over year.

"Xerox has no skills in the PC market and would only be a negative influence on that business," Zarek said.