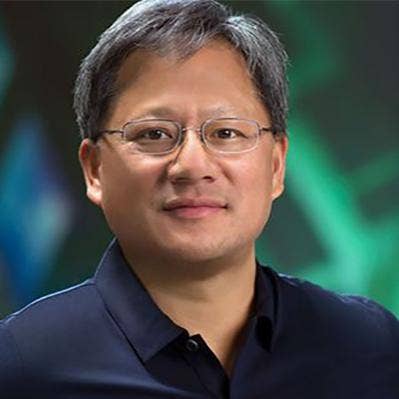

Nvidia CEO: 'Turbulent And Disappointing' Q4 Due To Weaker Data Center, Gaming Sales

Nvidia's stock price plummeted 14 percent Monday morning after the company lowered its sales forecast for its most recent quarter, which CEO Jensen Huang called "extraordinary, unusually turbulent and disappointing."

Lower gaming and data center sales forced the Santa Clara, Calif.-based company to cut its revenue forecast for the fourth quarter 2019 from roughly $2.7 billion to roughly $2.2 billion, causing it to fall below Wall Street's expectations. The chipmaker's forecasted gross margin also fell, from 62.3 percent to 55 percent.

[Related: Intel, AMD Lock Horns Over High-Performance Computing Prowess]

Nvidia shares were down 22.44 in mid-morning trading to $137.31.

The weaker sales forecast was in part the result of lower-than-expected sales of its GPUs for gaming PCs, Nvidia said. The company attributed the sales slump to lower demand in China, among other "deteriorating macroeconomic conditions" and lower demand for graphics cards based on the company's new Turing GPU architecture, which enables realistic lighting and shadow rendering through a technology called ray tracing.

The company said customers may have held back from purchasing Nvidia's Turing-based line of GeForce RTX graphics cards while they wait for lower prices and more games supporting ray tracing. A few weeks ago at CES 2019, the company introduced a more affordable version, the GeForce RTX 2060, which launched this month for $349, roughly half the price of the flagship card, the GeForce RTX 2080.

Nvidia said sales of its data center products also fell short of expectations, citing a number of deals that did not close in Q4 due to customers exercising cautious. Despite this, the company said it "believes its competitive position is intact" within a growing market for artificial intelligence and high-performance computing.

The data center has previously been a bright spot for Nvidia as more enterprises choose GPUs to perform performance-intensive applications on servers, such as computation

"Purchases can be large and are not always periodic or predictable," Huang said in a letter to shareholders. "As the quarter progressed, customers around the world became increasingly cautious due to economic uncertainties."

The company's struggles in the data center echo those of Intel, whose stock price sank after the semiconductor giant reported diminishing growth for its Xeon server CPUs.

“The foundation of our business is strong and more evident than ever – the accelerated computing model NVIDIA pioneered is the best path forward to serve the world’s insatiable computing needs," Huang said in a statement. "The markets we are creating – gaming, design, HPC, AI and autonomous vehicles – are important, growing and will be very large. We have excellent strategic positions in all of them."

Nvidia's Q4 earnings is scheduled for Feb. 14.