PC Shipments Plummet 15 Percent In Q3 As Demand Cools: IDC

‘In 2020 and 2021, people were stuck at home and were more likely to spend their money on PCs and entertainment. Now after the pandemic, they have more options for travel and other spending. So the biggest issue is the huge growth in the PC business in the previous two years. This year is a tough compare. The market is saturated,’ says Jitesh Ubrani, mobility and consumer device research manager at IDC.

Falling demand combined with supply chain issues have led to a 15-percent fall in total traditional worldwide PC shipments, according to the latest PC market report released Monday from analyst firm IDC.

According to IDC, shipments of traditional PCs, which it defined as including desktop PCs, notebooks, and workstations but not including tablet PCs, detachable tablet PCs, or servers, fell 15 percent compared to the third quarter of 2021 to a total of 74.3 million units.

[Related: PC Slowdown Will Drain Shipments Through 2023: IDC]

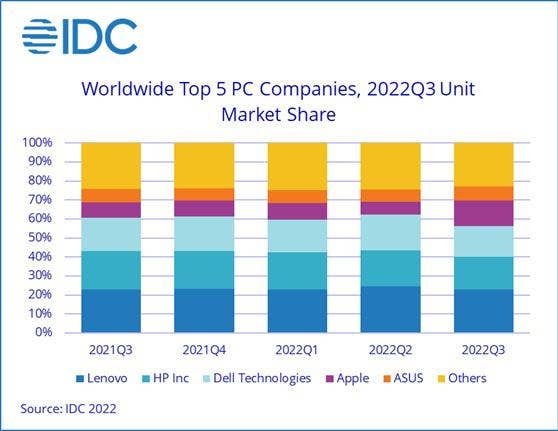

Of the top five vendors, Apple, which kept its No. 4 spot in terms of market share was the only one to see a rise in shipments, while Lenovo, HP Inc., Dell Technologies, and Asus all saw significant drops in shipments, Needham, Mass.-based IDC said.

Similar results were reported by market research firm Canalys, which estimated that worldwide combined shipments of desktop and notebook PCs fell 17.7 percent to 69.4 million units. That included a 19-percent year-over-year drop in notebook PC shipments to 54.7 million units, while desktop PC shipments fell 11 percent to 14.7 million units.

Canalys also estimated that Apple was the only PC vendor in the top five to see sales rise in the third quarter over last year.

The impact from falling PC shipments is already being felt. AMD’s stock price plunged about 12 percent Friday the day after reporting preliminary third fiscal quarter 2022 financial results. The Santa Clara, Calif.-based semiconductor manufacturer said its third fiscal quarter 2022 revenue is likely to fall around $1.1 billion to about $5.6 billion.

That drop in AMD revenue was led by a 40-percent year-over-year plunge in client device revenue, the company said.

Intel, which is expected to report its third fiscal quarter 2022 financial on Oct. 27, in late July reported second fiscal quarter 2022 revenue of $15.3 billion, which was down 22 percent year-over-year. That drop was led by a 25-percent fall in client computing-focused revenue, the company said.

The fall in PC sales stemmed primarily from a drop in demand after the heady days of the COVID-19 pandemic, said Jitesh Ubrani, a research manager for mobility and consumer device research at IDC.

“Demand has cooled off for the last few quarters,” Ubrani told CRN. “We saw a substantial increase in consumer and business PC sales in 2020 and 2021. Everyone who wanted a PC got one.”

However, macroeconomic conditions led to falling demand in 2022, Ubrani said.

“We’ve seen a drop in demand for PCs and all consumer electronics,” he said. “In 2020 and 2021, people were stuck at home and were more likely to spend their money on PCs and entertainment. Now after the pandemic, they have more options for travel and other spending. So the biggest issue is the huge growth in the PC business in the previous two years. This year is a tough compare. The market is saturated.”

Shipments of lower-end to midrange PCs are doing relatively better than shipments of high-end PCs, although they are still falling, Ubrani said.

“Manufacturers saw supply challenges in 2020 and 2021, and so they shifted to manufacturing higher-end PCs,” he said. “Now they can shift to do more in the lower to mid market PCs. And gaming PC sales fell less than the industry as a whole. So there are pockets of relative strength.”

Ubrani said the plunge in PC sales compared to last year is not a big reason to worry.

“It’s worth reminding people that the PC market now is still larger than it was before the pandemic,” he said. “But it is lower now that the peak pandemic market.”

About 70.9 million PCs were shipped during the third quarter of 2019, before the pandemic began, he said.

Apple’s third-quarter rise in PC shipments stems from supply issues the company had in the second quarter, Ubrani said.

“Apple took a pretty big hit in the second quarter, but it caught up in the third quarter,” he said. “We also saw Apple promotions for its M1-based Macs, which used last year’s processor. That again is part of the trend to focus on lower-cost PCs.”

For the third quarter, Lenovo saw shipments of 16.9 million units, down 16.1 percent over the 20.1 million units it shipped a year ago. Despite the drop in shipments, Lenovo maintained its number-one share of the market.

HP kept its No. 2 market share with third-quarter PC shipments of 12.7 million units despite a huge 27.8 percent year-over-year drop, IDC said.

Remaining at No. 3 was Dell Technologies, which shipped 12.0 million PCs in the third quarter. That was down 21.2 percent over last year.

Apple stayed at No. 4 with shipments of 10.1 million units. A 40.2-pecent rise in shipments over last year made Apple the only one of the top five vendors to see shipments rise.

Number five vendor Asus shipped 5.5 million PCs, which was down 7.8 percent, which was the lowest drop of the four primary vendors who saw PC shipments fall.

The “other” category of vendors saw shipments fall 19.4 percent to 17.1 million units, IDC said.