Possible Nvidia, Intel GPU Alliance Could Frustrate Rivals AMD, TSMC

In a veritable arms race to meet a GPU supply shortage, the companies’ combined efforts could put pressure on chip powerhouses TSMC and AMD.

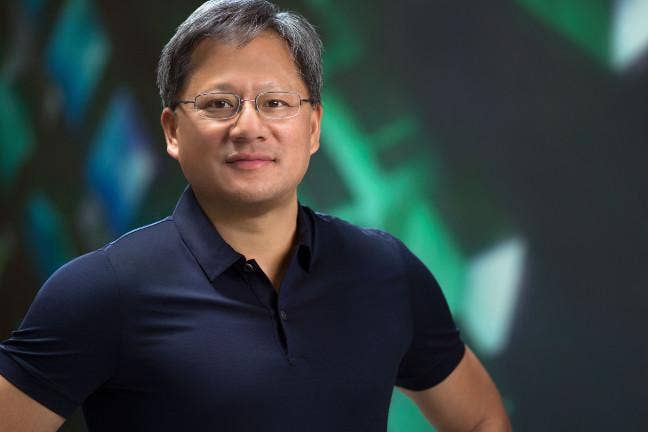

Nvidia CEO Jensen Huang on Wednesday said during a press briefing that he was in talks to use Intel foundries to produce GPUs, a development that could see the dogged rivals join forces.

With GPUs becoming the dominant data center technology and with Nvidia holding an 81 percent market share, an alliance between the two titans could spell trouble for AMD’s data center supercomputing ambitions - along with challenging top dog foundry Taiwan Semiconductor Manufacturing (TSMC).

“Our strategy is to expand our supply base with diversity and redundancy at every single layer,” Nvidia’s Huang told reporters, according to several published reports. “(Intel) is interested in us using their foundries, and we’re very interested in exploring it… I am encouraged by the work that is done at Intel. I think this is a direction they have to go, and we’re interested in looking at their process technology.”

For GPUs, AMD and Nvidia both use Taiwan Semiconductor Manufacturing’s (TSMC) foundry. AMD’s strategy so far has been to produce cheaper GPUs with similar performance to Nvidia. TSMC is currently the worlds top GPU foundry, with Intel seeking to take market share with its own proprietary chips. Intel CEO Pat Gelsinger at the “Intel Accelerated” event in July made it his mission to grab the number one spot from TSMC by 2025. If he manages to wrestle away one of TSMC’s biggest clients, Intel might be able to meet that lofty goal.

Gelsinger told Reuters that Intel is “thrilled for (Nividia’s) interest in using our foundry capabilities,” and confirmed that discussions between the companies were ongoing. A spokesperson for Intel declined to offer further comment. AMD did not return messages seeking comment.

Of course, Nvidia’s Huang played down the competitive angle of the possible collaboration, saying Nvidia has been sharing information and working with its competitors for years. “We have been working closely with Intel, sharing with them our roadmap long before we share it with the public…” he said. “Intel has known our secrets for years. AMD has known our secrets for years. We are sophisticated and mature enough to realize that we have to collaborate.”

However congenial the rivalry is, one thing is for certain: The prospect of billions of dollars in the booming-but-supply-chain-hobbled semiconductor business is at stake. And there will be winners and losers. Intel and Samsung’s recent showering of billions of dollars on new manufacturing facilities around the globe illustrate the desire to quickly mend supply issues dogging the tech sector.

One partner, who did not wish to be identified, said that vendors have been complaining about low yields from Samsung on the chip side. Samsung is Nvidia’s other top supplier. Intel could be making a play on that business as well, that partner speculated.

In any case, the ongoing drama that’s playing out in the semiconductor market is yielding interesting developments almost daily.

Kent Tibbils, vice president of marketing at Campbell, Calif.-based ASI Corp., says there could be several reasons for the collaboration discussions.

“Look, Intel is a world-class manufacturer,” Tibbils said. “The purchase of Tower Semiconductor last month is a big statement and brings a lot of manufacturing capability to that space. There are three choices at that level who can do advanced manufacturing. I don’t think the foundry choice would be something for AMD to worry about. I think they should be more worried about Intel coming out with a graphics card.”

Tibbils thinks AMD might prefer an Intel-Nvidia foundry collaboration because that would give them exclusivity at TSMC – which is already way ahead in the race to make chips smaller and more efficient.