AWS, Google, Microsoft Drive Data Center Colocation Growth Despite COVID-19

The data center colocation market reached $9.5 billion in the first quarter of 2020 as hyperscale operators like AWS, Google and Microsoft continue to spend billions each quarter to expand their global networks.

Hyperscalers like Amazon Web Services, Google and Microsoft are spending a combined $30 billion per quarter on Capex data center infrastructure, which is driving the data center colocation market, according to new data from Synergy Research Group. The coronavirus pandemic is having little impact on this spending, the study found.

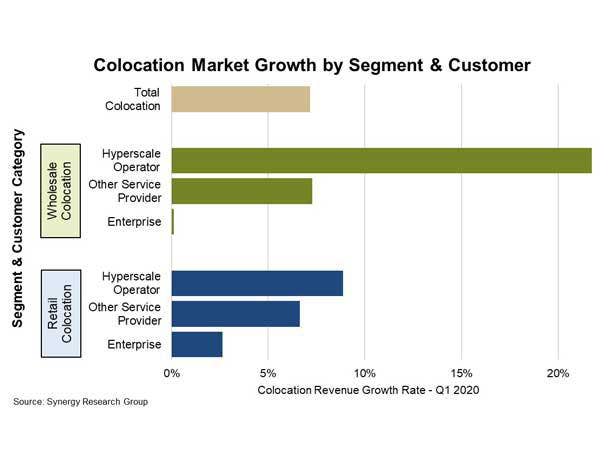

The total data center colocation market grew to $9.5 billion in the first quarter of 2020, according to Synergy. The colocation market grew 7 percent year over year, with revenue from hyperscale operators jumping 22 percent in the wholesale segment and 9 percent in retail colocation.

Enterprise spending on wholesale data centers was flat in the first quarter year over year, while growing around 3 percent in the retail colocation market, according to Synergy. Service provider spending in both the retail and wholesale colocation markets grew approximately 7 percent year over year.

[Related: The 50 Hottest Software-Defined Data Center Vendors Of 2020]

John Dinsdale, a chief analyst at Synergy, said as cloud services continue to grow over the next few years and hyperscale operators continue to expand their global networks, they will become even more critical to the colocation market vendors.

“Hyperscale operators continue to grow their revenues at double-digit rates and to maintain Capex spend at $30 billion per quarter, the majority of which is targeted at their data center infrastructure,” said Dinsdale. “As part of that, they rely on colocation providers to lease out both large wholesale facilities and capacity at smaller edge locations.”

The top five hyperscale spenders in 2019 were AWS, Google, Microsoft, Facebook and Apple, all of whose Capex data center budgets far exceeded all other data center spenders. Total hyperscale Capex spending on data centers reached a record high of over $120 billion in 2019, peaking with a record-breaking fourth quarter of over $32 billion.

These hyperscalers continue to become an “ever-more important source of business” for the two biggest colocation companies in the world—Equinix and Digital Realty—as well as other large players such as NTT, CyrusOne, QTS and GDS Holdings, according to Dinsdale.

Hyperscale operators continue the drive to rapidly expand their data center footprint and to put edge facilities ever closer to major business centers, with COVID-19 having very little impact on this trend. “This market has remained mostly unaffected by COVID-19,” said Dinsdale.

While a traditional data center typically supports hundreds of physical servers and other IT hardware along with thousands of virtual machines, these massive hyperscale data centers house tens of thousands of servers and hardware alongside millions of virtual machines.

At the end of 2019, there were a total of 512 hyperscale data centers in production with that number expected to grow significantly in 2020.