Icahn Increases VMware Tracking Stock Stake As Another Investor Lines Up Against Dell Stock Swap

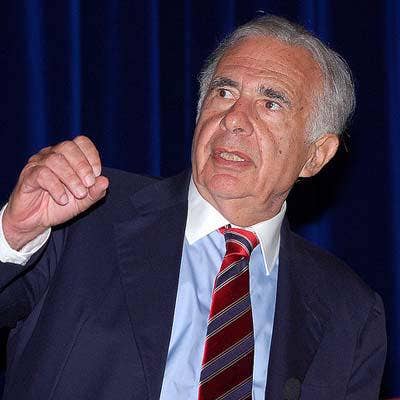

The critical stockholder vote to determine whether Dell Technologies can go public through a VMware stock swap seems tougher for Dell to win as another investor publicly announced its intention to vote against the plan andtop opponent Carl Icahn has increased his stake in the DVMT stock.

Icahn reported an increased stake in the DVMT tracking stock from 8.3 percent reported earlier this month, to now 9.3 percent, according to a filing with the U.S. Securities and Exchange Commission Tuesday. The billionaire investor, who is the second-largest shareholder, now owns approximately 18.53 million shares, which were purchased for a total of $1.71 billion, according to the filing.

Icahn has been publicly fierce regarding his stance against Dell's bid to become public once again through a proposed $21.7 billion share swap with its DVMT VMware software business tracking stock which would see Dell buy out DVMT stockholders before listing its own shares on the New York Stock Exchange.

[Related: Dell Fires Back At Icahn: VMware Stock Swap 'In The Best Interests' Of Shareholders]

"I firmly believe Dell and Silver Lake are trying to capture $11 billion of value that rightly belongs to us, the DVMT stockholders. As such, I intend to do everything in my power to stop this proposed DVMT merger," said Icahn in a letter to shareholders this month. "It is better to have peace than war, but be assured, I still enjoy a good fight for the right reasons, and in the current situation, I do not see peace arriving quickly!"

Other investors seem to agree that the proposal is not a fair deal for current DVMT stockholders.

Investment firm P. Schoenfeld Asset Management (PSAM), which advises clients that own more than $150 million shares of DVMT, said Monday it will vote against the proposed transaction because it is "grossly inadequate."

"Dell must increase the offered consideration by at least 20 percent to narrow the discount and value the DVMT stock more fairly," said PSAM in a letter sent to the Dell board of directors and filed with the SEC.

PSAM questioned how Dell determined the valuation of Dell's new Class C shares at $79.77 per share, a figure that has increased during the company's internal calculations in the months before the deal, according to the filing. "The company's valuation of the Class C Shares as part of the consideration to DVMT holders is unsupportable and contrary even to Dell's recent valuations of such shares," wrote PSAM.

In order for Dell to become a public company again, DVMT shareholders -- other than those held by affiliates of Dell Technologies such as Michael Dell and private equity firm Silver Lake -- must approve the agreement. Under the terms, shareholders of the DVMT tracking stock would exchange each share of DVMT tracking stock for 1.3665 shares of Dell Technologies Class C common stock, or $109 per share with the aggregate, not exceeding $9 billion.

In a statement to CRN regarding PSAM's filing, Dell said it continues to believe that the proposed offer "is fair and in the best interest of DVMT shareholders." The transaction also offers DVMT shareholders seeking liquidity $9 billion in aggregate cash consideration, Dell said.

CRN reached out to Icahn and PSAM for comment but did not receive a response as of price time.

It was also reported that DVMT investor Elliott Management is not in favor of the deal, although the investment management firm has yet to take a public stance.

Icahn and Dell Technologies CEO Michael Dell have butted heads on more than a few occasions. During a keynote presentation at The Channel Company's 2014 Best of Breed conference, Michael Dell was blunt about his feelings toward Icahn, calling the investor "a bad guy."

"He lies. He has no ethical boundaries. He'll say anything, do anything, I have no time for him," said Dell.

Dan McCormick, executive vice president of Davenport Group, a St. Paul, Minn.-based Dell EMC partner and 2018 CRN Triple Crown winner, said he's in favor of any transaction that provides better alignment between VMware and Dell because it will benefit channel partners.

"For the channel and our mutual customers, I'm excited for any transaction that provides additional leverage for alignment, while maintaining the unique value and vision that each individual company brings to the industry," said McCormick.

The critical shareholder vote will take place at 8 A.M. CT on Dec. 11 during a special meeting of stockholders at Dell's headquarters in Round rock, Texas. Dell confirmed it is meeting with investment banks to explore the option of a traditional IPO if shareholders reject its bid to go public through a stock swap with VMware.