Large-Scale Data Center Spending Pauses In Q1 2019

“The hyperscalers' underlying businesses are strong and growing. Their need for data center infrastructure continues to grow, new data centers continue to be built, and they have to maintain and refresh an ever-larger installed base of servers, storage and networking gear,” says John Dinsdale, managing director and chief analyst at Synergy Research Group.

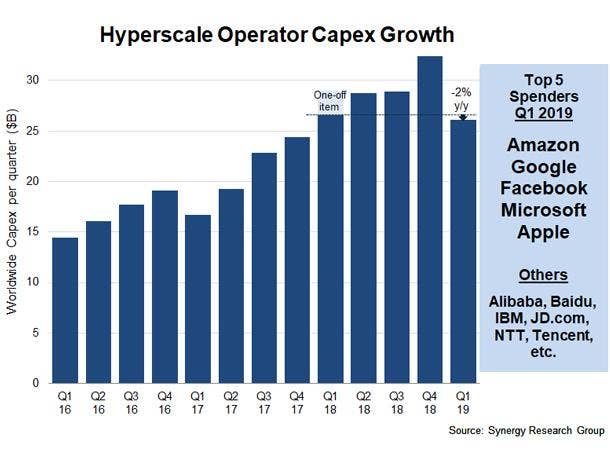

Even though capex spending from hyperscale data center operators like Amazon, Google and Microsoft decreased year over year to $26 billion in the first quarter of 2019, heavy investment dollars in new data centers will continue throughout the year, according to new data from Synergy Research Group.

The record-setting 2018 saw large-scale data center operators led by Amazon, Apple, Google, Facebook and Microsoft spend a whopping $120 billion in a single year on data centers.

After seven quarters of strong sequential capex growth, hyperscale data center leaders took a breather in the first quarter of 2019, with capex spending down two percent year over year, which excludes Google’s one-off $2.4 billion purchase of Manhattan real estate in the first quarter of 2018, according to Synergy.

[Related: Lenovo’s Everything-As-A-Service Strategy: From The Data Center To The Edge To IoT]

However, John Dinsdale, managing director and chief analyst at Synergy, told CRN that capex spending on data center technologies and new facilities will bounce back and continue to grow in 2019.

“Nothing important has changed. The hyperscalers' underlying businesses are strong and growing. Their need for data center infrastructure continues to grow, new data centers continue to be built, and they have to maintain and refresh an ever-larger installed base of servers, storage and networking gear,” said Dinsdale.

Dinsdale said all of the “basic drivers” of capex spending are still in place. “The capex growth rates seen in 2018 were so high that they are not sustainable, but capex will continue to grow,” he said.

As of the first quarter 2019, there are now approximately 458 large-scale data centers worldwide.

Synergy’s data center numbers are based on analysis of the capex and data center footprint of the world’s 20 major cloud and internet services firms including Amazon, Alibaba, Apple, Facebook, Google, IBM, Microsoft, NTT and Tencent. Synergy said ten companies are seeing year-on-year growth while ten are showing a decline year-on-year.

Dinsdale said hyperscale operators did take a “littler breather” in the first quarter 2019.

“However, though Q1 capex was down a little from 2018, to put it into context it was still up 56 percent from Q1 of 2017 and up 81 percent from 2016; and nine of the 20 hyperscale operators did grow their Q1 capex by double-digit growth rates year on year,” he said. “We do expect to see overall capex levels bounce back over the remainder of 2019. This remains a game of massive scale with enormous barriers for those companies wishing to meaningfully compete with the hyperscale firms.”

Looking at the entire data center market, IT market research firm Gartner is predicting worldwide spending on data center systems will decline 2.8 percent in 2019 to $204 billion year over year.

There are many factors in the broad data center market that is causing the spending to drop; however, Gartner told CRN that the 2019 decline comes after data center spending jumped a whooping 15.5 percent in 2018 compared to 2017. Other main factors included a lower average selling price for servers in 2019.

The decline in worldwide spending on data centers in 2019 is not expected to continue into 2020, according to Gartner, with spending projected to increase to $207 billion next year.