IBM CEO Arvind Krishna Appoints New Ecosystems Chief To Accelerate Hybrid Cloud-AI Sales Offensive

“For those partners that actually help to drive the software consumption they are going to get the energy, the recruitment, the resources and the trainings that they need in market,” said new IBM Senior Vice President of Worldwide Ecosystems and Blockchain Bob Lord. “So it is going to be less of a peanut butter spread and much more of a targeted spread in the market.”

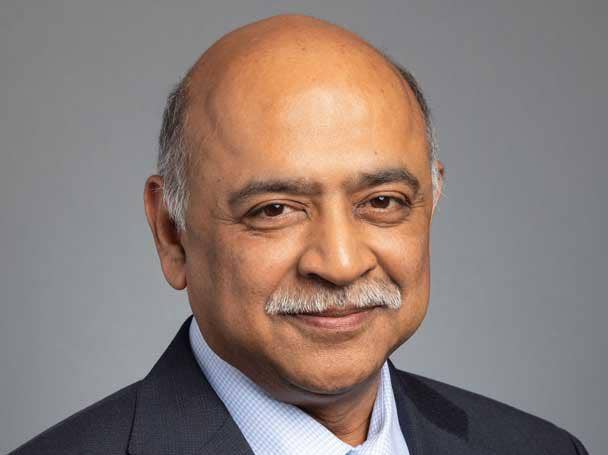

IBM CEO Arvind Krishna (pictured) is making IBM’s cloud partner ecosystem a top priority with the appointment of IBM Senior Vice President Bob Lord as the new head of worldwide ecosystems and blockchain.

Krishna is putting all the pieces in place—including Lord’s appointment—to ensure the hybrid cloud partner ecosystem model is a top priority in 2021.

The appointment of Lord, who has been overseeing cognitive applications, blockchain and developer ecosystems for the past two years, comes after Krishna told investors last week that he is “elevating the role of partners,” with IBM set to invest $1 billion to “rapidly” expand its cloud ecosystem.

[RELATED: CEO Arvind Krishna: IBM To Invest $1B In Cloud Ecosystem, ‘Elevating The Role Of Partners’]

At the start of the year, Krishna dramatically simplified the IBM go-to-market model by reducing the number of customer groups from 50 to just two, clearing the way for less competition between the IBM direct sales force and partners.

Lord, the onetime former global CEO of dot-com solution provider darling Razorfish, said Krishna’s call to action is for him to “step up” and “really go hard” on building out the IBM RedHat OpenShift hybrid cloud and AI partner ecosystem. That means building a robust ecosystem across the board from IBM’s traditional VARs and VADs to ISVs to IBM global systems integrators and even IBM’s Global Business Services group all focused squarely on driving the Red Hat OpenShift cloud model.

The driving force behind the new ecosystem buildout, said Lord, is Krishna’s crystal-clear software vision. “His software vision is so dead-on,” he said of Krishna. “I have a platform to go talk to each of those four sectors [global systems integrators, IBM VARs and VADs, ISVs and IBM Global Business Services] in a way that I could not have done before. This is our hybrid cloud architecture and platform and AI solutions, and this is how you can bring it to market: No. 1 to bring value to your clients but also how you make money and how you get value out of this whole equation. I think sometimes we may have missed that piece.”

Mark Wyllie, CEO of Flagship Solutions Group, a Boca Raton, Fla., IBM cloud partner that has provided transformative cloud services for NASCAR and The Atlanta Falcons, said he was heartened by Lord’s appointment to the new post.

“I’m excited about Bob’s appointment,” said Wyliie. “Bob gets the [channel]. He gets partners and he gets IBM and he has the ability to get things done in IBM. I don’t think you could find a better executive to lead the new partner ecosystem go-to-market model.”

Lord–who joined IBM four years ago as chief digital officer—has done a good job of being able to break through the IBM culture to get things done, said Wyllie.

Wyllie said he is also encouraged that John Teltsch Jr.—who led IBM’s partner ecosystem for two years from July 2017 to June 2019—is now the general manager of the IBM Americas Technology Group.

“John came from running the partner channel so he gets partners and now is running the Americas,” said Wyllie. “The fact that he is in that role is a big deal for partners. That is going to be key to making sure the sales restructuring takes hold in the field.”

The challenge facing Teltsch and Lord is making sure the massive IBM sales restructuring is executed in the sales trenches, said Wyllie. “There is a big opportunity for partners to make more money, but it has to be executed properly,” he said.

Lord, who will report to IBM President Jim Whitehurst, said he is moving fast to build out the Red Hat OpenShift ecosystem, drawing up billion-dollar business plans with top global systems integrators and accelerating midmarket relationships with VARs and VADs. But the “real opportunity,” he said, is driving ISVs to embed OpenShift into their software offerings.

“We have to make it easier for ISVs to on-board with us,” he said. “We’ve got to give them some economic models that make sense to them. The great news with OpenShift is it gives a software vendor flexibility to run on multiple environments. So there is a real business need of why they would want to get on Red Hat OpenShift for their business model.”

Lord said he is also planning to bring on board more talent as IBM steps up its partner ecosystem charge. “We have got to scale this,” he said. “I will be recruiting also and bringing on board folks.”

The epochal moment for the new partner ecosystem model came with Krishna’s game-changing $34 billion acquisition of Red Hat 19 months ago, said Lord.

“The watershed moment for me was the acquisition of Red Hat because it fundamentally pivoted the company,” said Lord. “The second watershed moment, though, is having Arvind be very clear about what the software strategy is, having us develop this platform, the mandate around OpenShift so that we can activate the ecosystem at scale.”

Another critical blockbuster move, said Lord, is the plan to accelerate the hybrid cloud transformation by splitting IBM in two and creating a publicly held spin-off of its behemoth Global Technology Services’ (GTS) managed infrastructure services unit. That managed services infrastructure spin-off—which is expected to be completed by the end of this year—creates a $19 billion business with 4,600 clients. It also sets the stage for deeper hybrid cloud partnerships with the channel and a robust IBM OpenShift ecosystem.

That spin-off is one more sign that IBM is no longer competing with its partner ecosystem in the Red Hat OpenShift architectural cloud battle. “We’re supporting the ecosystem with OpenShift,” said Lord. “We’re not competing against the ecosystem. That is the subtlety in 2021. ... It’s a big change.”

IBM has started the ISV build-out with targeted cloud ecosystems such as the IBM Financial Services cloud, where it now has 75 ISVs that have committed to build on top of it.

At Razorfish, Lord was driving big sales growth by leveraging IBM’s WebSphere e-commerce server. At that time WebSphere was driving 30 percent to 40 percent annual sales growth, said Lord. Now, he said, he is working with partners to drive similar services growth at IBM for partners. “I’m now on the other side of it here, which is kind of exciting,” he said.

IBM is taking the same recipe for success that propelled dramatic growth for IBM WebSphere and using it to drive Red Hat OpenShift into the marketplace, said Lord. “We’re taking that same [WebSphere] formula now, certifying people on OpenShift and [educating them on] what does Red Hat do and we are going out to the ecosystem,” he said.

Lord said he is focusing 50 percent of his time in the first six months of the year building out billion-dollar business plans with the top 10 global systems integtrators. The remaining 50 percent of his time, he said, will be working on scaling the other channel ecosystem initiatives.

The global systems integrator effort represents a major commitment of investment and resources from both IBM and the partners, said Lord. Among the major GSI relationships are with HCL, Infosys and Wipro, said Lord. The emphasis is on creating a unique value for each of the systems integrators, said Lord. “My job is to make sure they get the resources to actually help to build those business plans, quite honestly, for them to make money,” he said. “Because I know if they make money, then I will make money. I have to think first about their value proposition and how they are going to make money and then ultimately I make money right after it.”

In addition to the global systems integrators charge, Lord is promising an all-out partnering effort in the midmarket with ecosystem leaders in all of IBM’s geographies leading the charge. “There is a lot of energy around that midmarket,” he said.

Those midmarket partnerships will be driven in the individual markets—where new ecosystem leaders have been named with responsibility for building and driving those relationships in concert with an IBM technology leader, which owns the hardware-software business, said Lord. “They are working together to drive the adoption of the software and hardware,” he said. “The segmentation that has been rolled out eliminates a lot of the conflict in the market.”

The ecosystem leaders are charged with recruiting new partners and even established IBM midmarket partners to drive the new hybrid cloud and AI architectural model. The bottom line is partners that adopt the new cloud consumption model with Red Hat OpenShift, IBM Cloud Paks and IBM public cloud will see more “energy” from IBM going forward, said Lord.

Those partners sticking with pure reselling and not moving to a consumption model will find themselves getting “less energy” from the IBM ecosystem effort, said Lord.

“For those partners that actually help to drive the software consumption they are going to get the energy, the recruitment, the resources and the trainings that they need in market,” he said. “So it is going to be less of a peanut butter spread and much more of a targeted spread in the market. So if you’re a midtier partner and you have an expertise in insurance infrastructure and modernization, we are going to want to work with you because we are going to want you to take our hybrid cloud platform in with OpenShift into that market for us and go and provide the service. Also if you are a partner that has a very big sales force we are going to want to make sure we get in bed with you because we want more sellers out on the street, selling and talking about this new infrastructure and where this is going.”