Apple CEO Cook Touts 'Blockbuster' iPad Sales, But Mac Stalls On CPU Shortages

CEO Tim Cook points to Apple's 'highest iPad revenue growth rate in six years,' but said Intel's processor shortage hit Mac shipments hard.

As revenue from the iPhone continues to plunge, Apple's smaller product categories such as the iPad are helping to prop up the tech giant's results.

For Apple's fiscal second quarter, ended March 30, the company saw "blockbuster" iPad sales, Apple CEO Tim Cook said during a conference call with analysts on Tuesday.

[Related: Apple's 4 Newest Products: Here's What To Know]

"This is our highest iPad revenue growth rate in six years," Cook said.

According to Cook, the results were "driven primarily by strong customer response to iPad Pro"--Apple's 2-in-1 tablet aimed at creative professionals, which was refreshed in the fall.

Revenue for the iPad business reached $4.87 billion during Apple's fiscal second quarter, up 21.4 percent from $4.01 billion during the same period a year earlier.

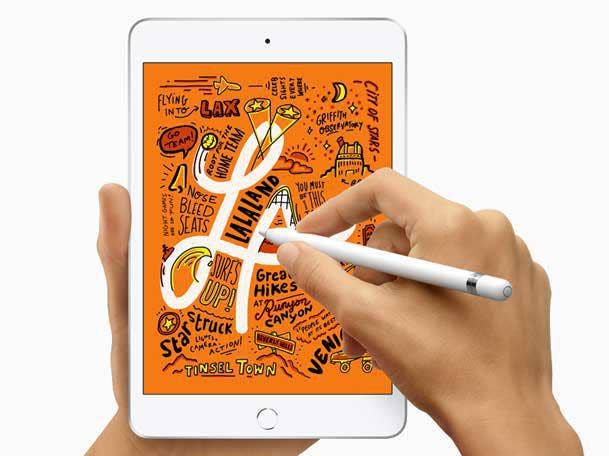

The results also included two weeks of sales for two iPad model refreshes announced in March. Those were the third-generation iPad Air and the fifth-generation iPad Mini, which both added Apple Pencil stylus support and performance improvements.

Cupertino, Calif.-based Apple also saw strong growth in its Services business (up 16.2 percent year-over-year to $11.45 billion) and in its Wearables, Home and Accessories business (up 30.2 percent to $5.13 billion).

The Mac business did not fare as well during Apple's fiscal Q2. Revenue fell 4 percent to $5.51 billion, from $5.78 billion the year before, reversing growth that the Mac had seen in the previous two quarters sequentially.

As with the other major PC manufacturers, Apple was hit hard by Intel processor shortages during the first three months of the year, research firm Gartner reported previously. Cook attributed the Mac decline in Apple's fiscal Q2 to the processor constraints.

"We believe that our Mac revenue would've been up compared to last year without those constraints," Cook said, adding that Apple doesn't believe the fiscal Q3 results will be impacted as significantly by CPU shortages.

Another potential lift to Apple's Mac business going forward is the broad update of the portfolio--with new iMacs unveiled in March, following long-awaited MacBook Air and Mac Mini refreshes last fall. Client demand is "pretty strong" for the new models, said Jim Harryman, founder and CEO of Kinetic Technology Group, a Mac-focused MSP and member of the Apple Consultants Network based in Dallas.

"I don't see that stopping at all," Harryman told CRN. "The newer [MacBook] Airs, iMacs and even the Mac Minis have all been released over the last six months—that has definitely helped from our perspective."

The iPhone business continued to sag during Apple's fiscal Q2, following weak demand from China and a slower pace of customer upgrades overall that had initially surfaced toward the end of 2018. Revenue for iPhone dropped to $31.05 billion during the fiscal second quarter for Apple, down 17.3 percent from $37.56 billion during the same period a year earlier.

Price reductions for the iPhone in China and other regions, along with a greater focus on trade-in programs, did aid the iPhone results during the quarter, Cook said.

Apple's financial results still surpassed Wall Street analyst projections, leading Apple's stock price to rise 5 percent to $210.78 in after-hours trading on Tuesday.

Overall, Apple's fiscal second-quarter revenue was $58.02 billion, a 5.1 percent slide from $61.14 billion the year before.

Fiscal Q2 net income came in at $11.56 billion for earnings of $2.46 per diluted share. That's compared to $13.82 billion in net income, and earnings of $2.73 per diluted share, during Apple's fiscal second quarter in 2018.