HPE-Juniper Networks Deal: 5 Crown Jewels HPE Will Gain From Juniper

From Mist AI capabilities to campus networking and service provider market share, here are a handful of the benefits that HPE will be coming into when it closes its $14 billion megadeal for Juniper Networks.

In a move that the market has been anticipating since reports first broke Monday, Hewlett Packard Enterprise said late Tuesday that it will be acquiring Juniper Networks in a $14 billion deal that sets the company up for a battle for network supremacy in the age of AI-powered networking.

HPE Tuesday evening said that once combined with Juniper, it will have the additional AI networking muscle it needs to compete with Cisco Systems while doubling its own networking business. And that’s not all. While Sunnyvale, Calif.-based Juniper is bringing the AI chops in the form of its Juniper Mist AI technology, it’s also bringing its own massive enterprise networking business, service provider business, and data center and cloud offerings.

The two companies say that the tie-up increases the scope of HPE’s networking business and will create meaningful opportunities for Juniper’s base of enterprise, service providers and tier-one cloud customers.

Now that the reported deal is confirmed, here are five crown jewels that HPE will be inheriting once it closes its Juniper Networks deal.

Mist AI Capabilities

Juniper has been busy transforming the company around software and injecting artificial intelligence into more places throughout the network. The company today is leading with its AI-powered Juniper Mist platform, which competes against Cisco Meraki and HPE Aruba’s Edge Services Platform (ESP).

The company’s focus on AI services is generating more interest from enterprises, especially as buying behaviors change and businesses look to infuse more automation where they can into their IT processes. Juniper CEO Rami Rahim recently hailed the company’s strong networking sales and said that he believes momentum will continue as enterprises look for full-stack networking platforms.

“For every dollar of wireless, there are actually $2 to $3 of wired switching opportunity for us to pursue,” Rahim said, adding, “that’s not the ratio of our business right now. However, the wired switching component of the Mist-ified business is growing very rapidly and over time it will start to align more closely to that $1 of Wi-Fi to $2 to $3 of wired,” Rahim said in 2023.

The CEO at the same time noted that revenue from products utilizing Mist AI increased nearly 100 percent during the second quarter of 2023.

Service Provider Market Share

Juniper’s strength traditionally has been squarely within the service provider segment, but that flipped in 2022 when its enterprise networking business outpaced its dominant service provider segment. Despite the shift, however, Juniper still has a massive service provider business that during its most recent fiscal quarter pulled in $418.8 million, representing 30 percent of its business.

During the company's most recent fiscal quarter that ended in September, Rahim (pictured) acknowledged macro headwinds that have recently plagued the company’s service provider and cloud businesses, but said Juniper remains bullish on both.

“We remain encouraged by the momentum we’re seeing in our Cloud Metro portfolio [for service providers] where our new ACX7000 platform had a record revenue quarter and saw solid year-over-year growth from an orders perspective. These products secured six new footprint wins in the Q3 time frame, including a win with an international Tier 1 account.”

Juniper counts some of the biggest telecoms in the U.S. and around the world as customers, including Airtel Africa, AT&T, BT Group and Verizon.

A Stronger Data Center Portfolio

Juniper brings HPE a much stronger position in the data center market to go head-to-head against Cisco. Juniper, in fact, gives HPE a much broader data center networking portfolio to complement the Aruba campus networking platform.

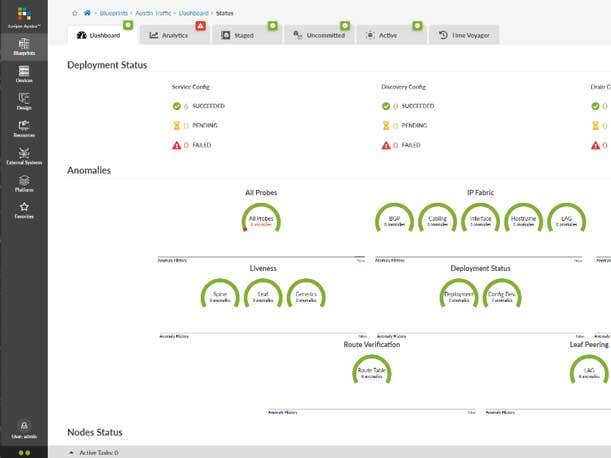

Juniper’s Apstra intent-based data center networking software is aimed at automating network setup, maintenance and changes to ensure network security and efficiency.

Rahim has credited Apstra—which Juniper acquired in 2021—with bringing “public cloud-like automation” to the data center.

“Many customers have already decided that there will be, necessarily for a variety of reasons, large amounts of apps, workloads and data that need to stay in private cloud, but honestly are scared and concerned about the complexity of operating a data center that is truly world-class that can essentially be secured and can provide assured connectivity all the time,” Rahim told CRN in 2021. “And this is precisely why we bought and why we are integrating Apstra.”

In the most recent fiscal quarter, Rahim told analysts that Apstra new logos were up more than 80 percent, with the “pipeline of opportunities” remaining solid. “Hardware pull-through for every dollar of Apstra software has been meaningful and growing, which we view as a positive forward indicator for our data center prospects,” he said.

Key data center wins in the most recent quarter for Apstra and Juniper’s QFX switch offerings included large government agencies, international tier-one service providers and a large global appliance manufacturer, said Rahim.

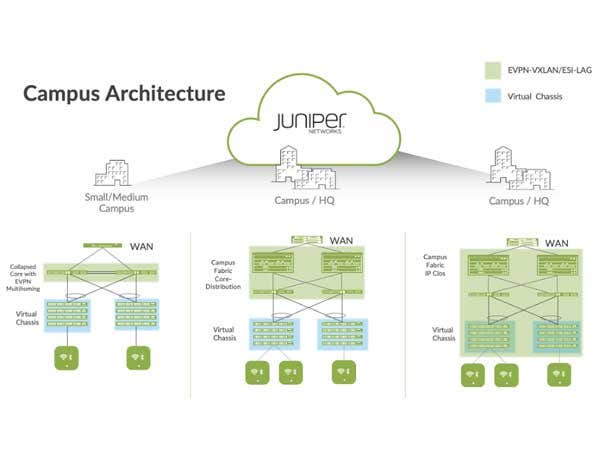

Campus Networking

Thanks to the company's focus on an AI-driven enterprise, Juniper’s campus and branch networking business is breaking records and demand is at an all-time high for these offerings, the company said in the fall. Juniper comes to market with its access switches, wireless access and SD-WAN offerings, all of which are driven by Mist AI.

Notably, Juniper during its most recent quarter broke another record within its enterprise business, which represented more than 50 percent of total company revenue for the first time in its history.

“While we are continuing to experience headwinds from our cloud and service provider customers, many of which are still digesting prior purchases, our enterprise momentum remains strong and provides confidence in our future growth prospects,” Rahim said in October.

Total enterprise revenue grew by nearly 40 percent year over year during the company’s third quarter of 2023 and represented the company’s largest and fastest-growing vertical heading into the last quarter of the year. Registration through the channel also grew by more than 20 percent year over year.

A More Robust Security Portfolio

Juniper brings HPE a robust portfolio of security offerings including a highly regarded firewall product line that includes mainstay SRXSeries firewalls, cSRX container firewalls, vSRX virtual firewalls and next- generation firewall services.

Juniper also brings HPE Juniper Advanced Threat Protection (ATP) products, including a threat intelligence hub that uses AI and machine learning to detect threats.

In addition, Juniper has a product that would make HPE a more formidable competitor to a Cisco-Splunk combination with Juniper Secure Analytics SIEM, a security information and event management system.

Cisco’s proposed $28 billion acquisition of Splunk, which was announced in the fall, gives Cisco a full- stack SIEM that is expected to be combined with the Cisco XDR (extended detection and response) product.

In the most recent quarter, Juniper’s security revenue was $160 million, up 14 percent year over year.