Aruba’s Phil Mottram On NaaS, Winning Against Cisco And Remedying Supply Chain Struggles

The networking specialist’s president tackles questions on how Aruba is winning against competitors like Cisco and in the NaaS arena, working around supply chain challenges, and areas of focus for 2023, including the data center space.

Aruba On The Record

Aruba, a Hewlett Packard Enterprise company, pulled out all the stops during fiscal year 2022 that included record quarterly revenue of $965 million, an impressive 23 percent jump year over year. And that’s despite a massive product backlog that grew during the year due to to supply chain constraints and component shortages that challenged the company, along with the rest of the tech industry.

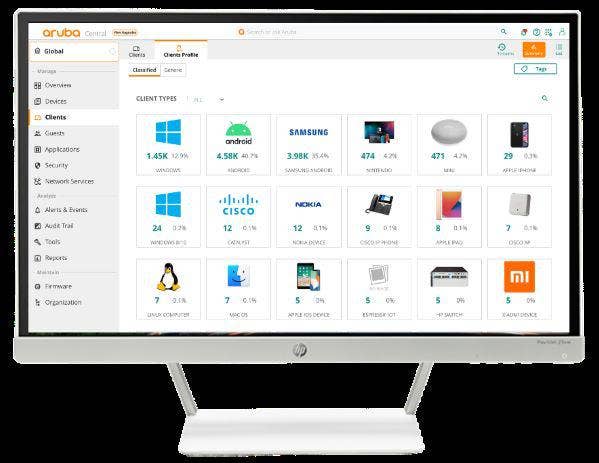

Aruba President Phil Mottram attributes much of the record-breaking growth in orders and demand to its loyal ecosystem of channel partners. The company is taking on—and winning—against other networking behemoths, and it’s due to a mix of its blossoming Network as a Service (NaaS) business and its flagship Aruba Central management platform that works across all of the company’s product lines—something that many competitors just don’t have, Mottram said.

The Santa Clara, Calif.-based company wasn’t completely unscathed during the year, however. Global supply chain issues caused Aruba to rely on alternative sources and, in some cases, even redesign some of its products to exclude components that the company couldn’t get its hands on. Those issues, Mottram said, are finally easing.

Mottram spoke with CRN about the company’s fourth-quarter Fiscal Year 2022 financial results, how Aruba is winning against its competition and in the NaaS arena, and the big areas of focus and investment for 2023.

Here are excerpts from the conversation.

What’s driving Aruba’s record growth right now?

We delivered a record quarterly revenue number for us—the highest we’ve ever had in the company. We’ve been growing and there’s a lot of demand for our products. We’ve now had eight consecutive quarters where the revenue is growing year on year and it was a record for us in terms of the amount of orders that we had during the fiscal quarter, so for the first time ever, we broke over a $5 billion order number. That resulted in the impressive results where our revenue grew 23 percent year on year.

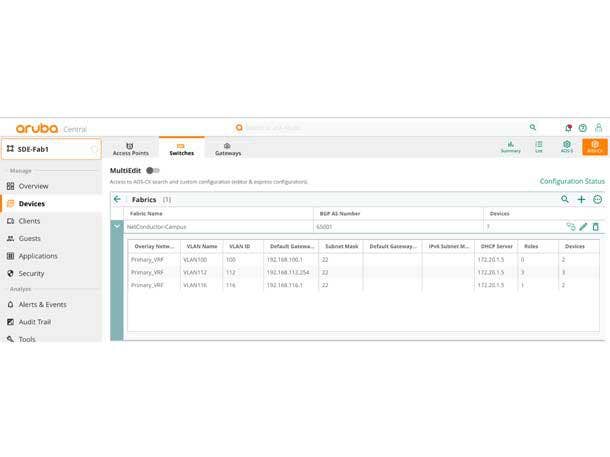

The demand was universal for all the products, by the way, it wasn’t particularly isolated in a particular [segment] or region. I think the reason why we are doing well in the market is some of the platforms that we operate are pretty new. We invested quite heavily, in particular, in our CX platform, which is the product range for the campus and data center switches. And with a new platform, obviously, you’ve got new features, high reliability and performance. We also have a common platform, Aruba Central, which is the one platform you can use to provision and manage all of the Aruba products that they would buy, be that SD-WAN, Wi-Fi, campus switching, etc. Customers like the fact that we have the Central platform, which is part of the HPE GreenLake platform to manage all of the products and services. That’s a couple of positives I hear from customers. The other positives I hear from customers [is that] they like the management capabilities in the platforms. There’s one particular customer that I spoke to about what it’s like working with us versus some of our competitors. They said with one of our competitors, when they used to do an upgrade to the Wi-Fi network it used to take them 500 man hours’ worth of effort to do the upgrade. With us, it takes about four hours. That’s a huge difference. And then the other thing that customers like about Aruba is one of the cultural aspects—this kind of customer-first, customer-last methodology or mantra, where customers have problems and we are normally pretty good around fixing those quite quickly and with some energy. So [those were] things that customers were kind of pointing toward in terms of the performance and the reason why they’d like to buy from us.

How are partners contributing to this growth?

About 95 percent of our business goes through channels. The channel community is a big part of what we’re doing and, specifically, we have experienced significant growth across all sectors, but one in particular is SMB where we’ve got the Aruba Instant On product. We’ve now signed about 24,000 channel partners around the world for Aruba Instant On. That’s just one example of how channel partners are helping us.

The world is changing slightly in the way that network services can be bought. It used to be this kind of one-off, kind of Capex-type model. And now obviously, the world is moving more toward essentially buying on an as-a-service, X-per-month basis, which is something that we call NaaS, or Network as a Service. We led the market with some very big deals in the early stages of the market. So the last couple of years, we’ve done now about 30 big contracts in the NaaS space. And what we’re trying to do is shift focus toward having more standardized and repeatable offers that the channel can take out to market. We announced eight of those in March-April this year and they are going live, as we speak, for channel partners to take out to the market. We’ll be adding to those standardized SKUs, which we will announce at our next Aruba Atmosphere next year.

What has Aruba done to prepare and become operationally ready for XaaS and NaaS, which is a process that Cisco recently revealed it has struggled with?

What we’ve done is we’ve learned quite a lot in terms of deploying the contracts that we first won. And by the way, those experiences went pretty well from our side and from the customer’s perspective as well. But I think because they were bigger deals, they were way more bespoke in the approach. What we realized is if you’re going sell less to tens of thousands of customers, which we think we will, you need to have a way more standardized offer. So, we’ve learned a lot around how do you package the offer? How do you make it very standardized, very repeatable, and where are the areas that the partner can add value to make sure that the resellers are included and benefiting from this move? We spent quite a lot of time on that.

Then, obviously, with all companies, the thing that follows on from that is the systems to support it. That’s where a lot of the heavy lifting is in terms of how to code these products into your systems, what happens in the event that a customer stops paying, who’s liable for what, etc. So, all of that stuff is the heavy lifting to get to move from something that’s relatively simple on paper to something that’s up and running in the market. These things take a lot longer than people would think, to be honest, maybe some other people are being naive, but there is a lot to think about. In a Capex environment, you sell to someone, they pay you, life is good, largely. There might be some incidents, or whatever it might be, but you get the bulk of the money, and the risk is taken care of up front. Whereas on an as-a-service basis, you’re potentially spreading it over three years or five years, so if the customer stops paying after a year, what are you going to do? And who’s liable for that? Certainly, when you’re staring down potentially a recession, you have to think these sorts of things through, so that’s where the heavy lifting is.

Are you seeing head-to-head wins against competitors like Cisco?

Yes, we think we’re gaining share in all sectors that we operate in, so SD-WAN, Wi-Fi and then the switching portfolio. Why we win would depend on the competitor that we are competing against, to be honest. In the SD-WAN space, where we win is where people start with SD-WAN and come from a network starting point— we tend to win easily, but consistently, in the network space. However, some people’s journeys to SD-WAN start in other areas. They may say, ‘You know what, we think this is more of a security thing first,’ and then they work their way toward SD-WAN being the solution. So it kind of depends on what the starting point is as to why we win.

But the main reasons would be that I think customers like the vision of having a common platform to manage all of the network technologies. That is definitely one thing. When we talk about Aruba Central as the common platform across all the products, that’s a good thing. Not all of our competitors have that. And then the other side of it is in some instances, customers do like the flexibility of this NasS solution. This offer is not attractive to all customers, but for some who are less Capex-intensive in their businesses, they quite like that offer.

In addressing supply chain shortages, have you redesigned or relied on alternative sources to remedy this huge issue?

We did all of the above, basically. We have redesigned some platforms, so where we had component parts that are in short supply, we’ve either found another supplier or what we’ve done is we’ve recently redesigned the products to take that component out and introduce new components, either from the same supplier or a new supplier. But I think that work is largely done, albeit that it isn’t necessarily immediately felt. What I mean by that is, we redesigned other elements of the portfolio. We made a decision on it in July, and in January, we will start to see the new products start to come online. But when you launch the new product with the new design, it’s not like you’re walking into a supplier’s warehouse and saying, ‘Oh, by the way, I see you’ve got 10 million of these components just sitting idly on the shelf. Please push them toward this new product.’ You still have to get into a bit of a queue, so it takes awhile to build that momentum up. The supply chain situation is improving, and we can redesign where appropriate to take out [certain] parts.

Are you chipping away at the massive backlog, and is the slowdown in the consumer PC space helping to free up components?

So we’ve got three or four key product areas where most of our backlog is now starting to come down. In Q4, [the backlog] was lower than Q3 at the end of it. There’s just one particular product that we’re still short on and that’s the one where we did the redesigns and that should start getting better. I think we’ll start eating into that backlog, if it’s not this quarter, it’ll be next quarter. So, the situation is definitely getting better.

Yes, [gaining components from the slower PC market] is what we hear about from our suppliers as well. Where consumers are buying less laptops, less phones, some of our products actually compete with some of the phone providers, so if you see that demand drop, that shifts some supply to us.

What are the key investment areas for Aruba in 2023?

For investment areas, I think of our strategy like a triangle. On the bottom, you’ve got the products and services we offer, and some relatively new platforms. We are making some substantial investments in the data center space as well. We do have a base product that works for some data center customers. We’ve also got the CX 10000, which is this collaboration that we have with Pensando, but there’s more we can do [in this] space to take on some of our key competitors. We’re investing quite significantly in data center build [in 2023] and somewhat into 2024 as well. So, you’ll see more products and services being added. The other things that you will see is continued investment into the Aruba Central platform and continued investment into the NaaS offers.