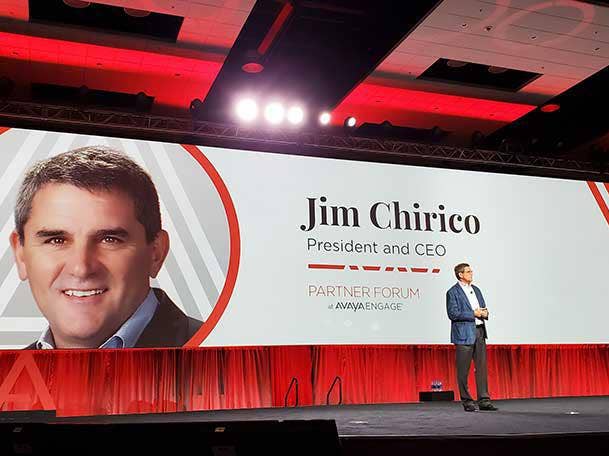

Avaya’s Jim Chirico: Cloud, Subscriptions ‘Far Outpacing’ Competition

“We actually are seeing ourselves winning more deals than not and winning against our competition, who might be more of a point-in-time solution,” The UC giant’s CEO Jim Chirico told CRN following Q4 2020 earnings.

Once considered a premise-based unified communications player, Avaya’s cloud and software-as-a-service business has doubled in just one year and the company has the channel to thank for most of its cloud and subscription growth.

“The channel generated about 75-80 percent of our subscription revenues and we doubled the number of cloud customers this quarter,” Jim Chirico, president and CEO of Avaya, told CRN following the company’s fourth-quarter 2020 earnings call. “So, a significant uptick that was predominantly driven by the channel, who is transforming with us.”

The UC powerhouse’s Cloud, Alliance Partner and Subscription revenue has been ticking up all year, now accounting for 33 percent of Avaya’s total revenue compared to 18 percent in the first quarter of 2020. What’s more, Avaya expects Cloud, Alliance Partner and Subscription to represent between 35-40 percent of Avaya’s total revenue in 2021.

[Related: Avaya CEO Jim Chirico: Partners Leading Charge On 'Record-High' Subscriptions Sales]

At the same time, software and services continued to hold steady at 88 percent of revenue, up five points year over year, and recurring revenue as a percentage of revenue sat at 63 percent for Q4 2020, also up 5 points year over year. Where Avaya is starting to see a real difference, however, is within its cloud annual recurring revenue metric, OneCloud ARR, which was up 400 percent year over year -- a figure that Chirico expects to double in 2021.

OneCloud ARR includes Avaya’s OneCloud subscription, Avaya Cloud Office, it’s Communications-Platform-as-a-Service (CPaaS), Device as a Service, and the company’s private cloud offering.

“Anywhere you look across those metrics, that’s far outpacing any of the cloud companies in the industry today,” Chirico said.

The reason why Avaya is winning in the cloud arena is because of its recent investments around systems, tools, and processes to “cloudify” the company, as well as driving a new mindset internally -- and also with its partners -- away from perpetual licenses and a capex model to one in favor of opex investments and bundled offerings that customers can consume on-demand, Chirico said. “We’ve really tried to tackle [this transformation] on multiple dimensions,” he said.

Durham, N.C.-based Avaya during the fourth-quarter added over 1,500 new business customers and saw growth in the large enterprise space as some companies -- especially overseas -- began safely returning to their offices. In fact, 135 of Avaya’s deals were more than $1 million in value, 17 were more than $5 million, and 4 were over $10 million.

Avaya, unlike its competitors, is seeing growth in enterprise sales, Chirico said. The growth is being driven by enterprises realizing that UC and collaboration is not a one-time expense, but more a transformational investment that will boost productivity regardless of their employees’ physical locations, as well as customer experiences for industries like healthcare and education.

“We’re seeing our RFP business pick up significantly and companies continuing to invest. What they are looking for now is a company like Avaya … I think customers are looking to drive as many solutions as they can through one global provider who has the expertise and the services capabilities needed to support a [disbursed workforce],” Chirico said. “We actually are seeing ourselves winning more deals than not and winning against our competition, who might be more of a point-in-time solution.”

Avaya also saw a minor resurgence in hardware revenues compared to previous quarters as COVID-19 restrictions begin to lift in some countries and employees returned to their offices or adopted hybrid, work from home/from the office approaches. The growth in hardware, said Chirico, was entirely driven by channel partners.

The channel pulls in about 70-75 percent of Avaya’s total revenue today.

Hardware sales in Avaya’s Q3 2020 quarter, which ended in June, sank by about 30 percent -- a substantial drop-off. While still down in the current quarter, hardware revenues fell by 17 percent during the most recent fiscal quarter.

For Q4 2020, which ended on September 30, Avaya Holdings Corp.’s overall revenue on a non-GAAP basis climbed 4.1 percent year over year to $757 million from $726 million a year ago.