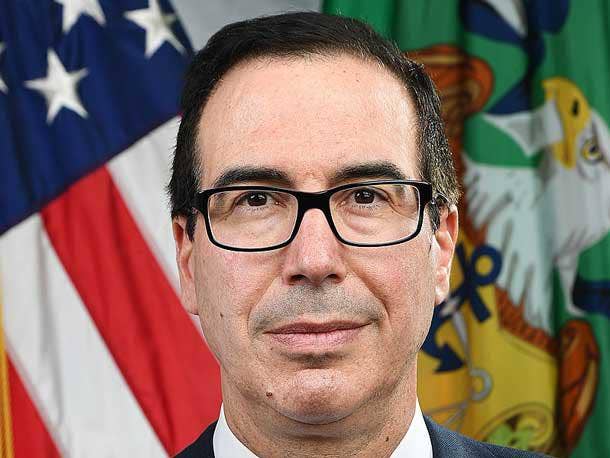

Ex-Secretary Mnuchin’s Fund To Buy Zimperium For $525M

‘He [Mnuchin] has been in the public sector and has great insight and connections into the financial services segment as well, which are the two biggest verticals for us,’ says Zimperium CEO Shridhar Mittal.

Zimperium has agreed to be purchased for $525 million by former U.S. Treasury Secretary Steve Mnuchin’s fund to accelerate the mobile security vendor’s growth plans.

The Dallas-based company said it’ll leverage Liberty Strategic Capital’s proposed acquisition to grow both organically and through strategic acquisitions. Mnuchin will chair Zimperium’s board of directors, while Japanese conglomerate SoftBank - which has been an investor in Zimperium since 2017 – will continue to hold a minority stake in the company.

“We are getting into high-growth mode,” Zimperium CEO Shridhar Mittal told CRN. “The market is really starting to take off for both our endpoint business as well as our mobile DevSecOps business.”

[Related: Contrast Security Raises $150M Led By Former Treasury Secretary Mnuchin’s Equity Fund]

Zimperium plans to use Liberty Strategic’s funding to expand its go-to-market organization, continue to build out its product suite, and pursue inorganic growth opportunities. From a product standpoint, Mittal said he’d like to invest more money into researching mobile vulnerabilities and threats, ensuring its endpoint security capabilities are scalable, and integrating its July 2021 acquisition of whiteCryption.

As far as inorganic growth is concerned, Mittal said Zimperium will explore tuck-in acquisitions that bring the company into adjacent areas in the mobile endpoint and application security spaces. And from a go-to-market standpoint, Zimperium plans to invest more in marketing campaigns and hire more sales and channel personnel to boost the company’s visibility in the market and pursue more opportunities.

“We will be investing in marketing so that people understand the problem, people understand the solution, and people understand the brand,” Mittal said. “That’s what we’ll be focusing on.”

Nearly 100 percent of Zimperium’s business goes through the channel today, and Mittal said the company works closely with both technology partners like Ivanti, SentinelOne and Trellix as well as solution providers like GuidePoint and Optiv. The mobile security market has seen increased demand over the past two years, and Mittal expects the market to accelerate even faster in the years to come.

“As the use of mobile devices and the cyber threats against them proliferate, we believe Zimperium has positioned itself as the leader in securing mobile endpoints and applications,” Mnuchin said in a statement. “We’re excited to work with Zimperium as they lead in this critical and fast-growing market to strengthen mobile security worldwide.”

Zimperium was founded in 2010, employs 221 people, and has raised $72 million in five rounds of outside funding, according to LinkedIn and Crunchbase. The company most recently completed a $12 million venture round led by Sierra Ventures in November 2018, according to Crunchbase. The acquisition by Liberty Strategic Capital is expected to be completed in the second quarter of 2022.

The company said its mobile device and app security portfolio provides real-time, on-device protection against both known and unknown threats. Specifically, Zimperium said its platform protects mobile devices from device, network, phishing, and application attacks.

“Modern operating systems like Android and iOS are playing a more prominent role powering the devices people use in their personal and professional lives,” Mittal said in a statement. “But what many people don’t realize is that protecting these devices is much different from protecting traditional endpoints and requires a new approach.”

As Secretary of the Treasury from 2017 to 2021, Mnuchin was responsible for cybersecurity across the financial services sector, working with CEOs of the largest institutions on cybersecurity preparedness, regulatory coordination, and incident response. Mnuchin also designed economic sanctions targeting Iranian, Russian, and North Korean cyber attackers, using his authority to combat ransomware attacks.

“He has been in the public sector and has great insight and connections into the financial services segment as well, which are the two biggest verticals for us,” Mittal told CRN. “His technical acumen, as well as his financial services and public sector background, made him the ideal partner for us.”

Since leaving office, Mnuchin launched Liberty Strategic Capital and led a $275 million Series F investment in Boston-based endpoint security vendor Cybereason in July 2021 as well as a $150 million Series E investment in Los Altos, Calif-based code security vendor Contrast Security in November 2021. Zimperium is the first cybersecurity acquisition Liberty Strategic Capital has made since its formation.