Palo Alto Networks CEO Nikesh Arora On The ‘Revenge Of The CFO,’ the ChatGPT ‘Boon’ And AI-Based Network Security

Palo Alto Networks CEO Nikesh Arora sounds off on the increased scrutiny by CFOs on security deals, the ChatGPT ‘boon’ and the next evolution of the company’s SASE offering with AI ‘throughout the entire network security stack.’

Palo Alto Networks CEO Nikesh Arora says the time is right for partners to make the cloud security platform powerhouse with a full-fledged “best-of-breed” stack their partner of choice.

“I think the time is now for our partners to make a bet on Palo Alto Networks and make sure that we become their partner of choice,” said Arora in a 45-minute Best of Breed (BoB) virtual interview with CRN Vice President, U.S. Content, Executive Editor Jennifer Follett and Executive Editor News Steven Burke.

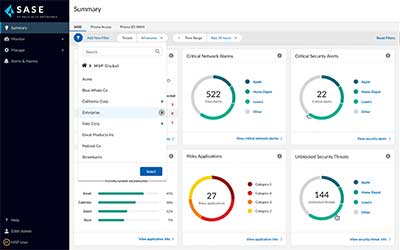

With the breadth and depth of the Palo Alto Networks portfolio running the gamut from cloud security to SASE to the new AI-based Cortex Security Operations Platform, Palo Alto Networks is in a unique position to offer a best-of-breed security stack, said Arora.

“We are now part of 13 leadership positions in [Gartner] Magic Quadrants and alike and if you are going to consolidate, then you want best of breed as well as you want it to work together,” said Arora. “So I think we have the unique opportunity right now to be able to offer our customers best-of-breed security. At the same time, we do that in a comprehensive consolidated fashion where things work together.”

Arora’s comments come as Palo Alto Networks joined the prestigious “Leaders” quadrant for security service edge vendors with the release of the 2023 Gartner Magic Quadrant for security service edge (SSE) vendors.

“At the end of the day, five years ago we were a firewall company,” said Arora. “We sold firewalls and our traditional customer was a network architecture team or the infrastructure team. What has happened is we have transformed our business to be more cloud-first, more cloud-enabled, more participatory in the transformation process, more in the SOC [Security Operations Center].”

Arora said Palo Alto Networks’ channel commitment starts at the top with his own pledge to work with partners to close deals in the sales trenches.

“I’m very happy to go visit customers with our partners,” he said. “We sort of double team and tag team them. You go to the customer and say, ‘Listen, the two of us can give you this amazing capability and give you some comfort in the transformation that you’re undertaking because the both of us together are going to minimize risk for you.’”

At the same time, Arora urged partners to up their services game. “I think the partners need to keep working on their services muscle,” he said. “I think it’s not been a muscle that has been required in the past, but now every customer of meaningful scale and size requires the partners to have services capability, and that requires them to understand our products, understand the technology, understand the customer’s need, and find a way of not just being able to get them the product, but actually implement the product and get them a great security outcome.”

On The Macroeconomic Headwinds Impacting SMB Customers

You’re definitely seeing a demand slowdown in the small- to medium-size space because those customers are getting most hurt with the macro headwinds we are seeing. I don’t think this is going to go away.

I think the nimbler channel partners have anticipated this. They are ready for this scenario. This is not their first rodeo. They’ve seen this before. They have seen how they have to be nimble when the market begins to shift in direction. And I’d say many of them are making adjustments, both in their services, capability, resources, trying to shift toward where the business is.

So I think so far cybersecurity has proven to be more resilient than most other forms of IT. And as a result, our partners are seeing less of an impact than perhaps a traditional IT sort of services partner.

On The Sales Cycle Being Impacted By Macroeconomic Headwinds

I think you’ve seen that everybody in the security space has been talking about more scrutiny, longer lead times, deal cycles taking longer. You know, we joke it’s the revenge of the CFO, and the CFOs have not had to step in and help manage these deal flows or deal cycles because there’s been growth up to the right.

And what’s happened now is because everybody’s watching the macro environment, the Federal Reserve has got a big hammer. They’re using the hammer every time to tell you that interest rates are going up, which is kind of like freaking a bunch of customers out. And as a result, they look at their CFOs and say, ‘Listen are we getting value for this? Are we getting bang for the buck? Are we negotiating the best price?’

You’ve seen the CFOs come in [and scrutinize these deals]. I think the only way to counter that is to be up front, get in front of the CFOs, have a very solid proposition from a business value perspective, show your commitment and make sure you’re running a tight process.

We just have to get ahead of that problem, get in early with our partners and go to our customers and show them business value.

On The Palo Alto Networks Transformation

At the end of the day, five years ago we were a firewall company. We sold firewalls and our traditional customer was a network architecture team or the infrastructure team. What has happened is as we have transformed our business to be more cloud-first, more cloud-enabled, more participatory in the transformation process, more in the SOC, suddenly the CISO is front and center.

In many cases, even the CIOs themselves are front and center because they’re actually driving many of these transformations. That has required us to get sort of more forthcoming with our channel partners, more forthcoming with the CIOs and CISOs and show them the full breadth of our capability and say, ‘Listen, you know at Palo Alto we are now part of 13 leadership positions in Magic Quadrants and alike and if you are going to consolidate, then you want best of breed as well as you want it to work together.’

So I think we have the unique opportunity right now to be able to offer our customers best-of-breed security. At the same time, do that in a comprehensive consolidated fashion where things work together. So yes, it’s been a phenomenally rewarding transformation. But there is still a lot of work to be done.

On Customers Consolidating Security Solutions In Wake Of Macroeconomic Headwinds

I think it’s fair to say that traditionally cybersecurity has been a best-of-breed market. And when I started trying to figure out what we needed to do from an innovation perspective, consolidation perspective, the argument I got was, ‘Listen, in this industry, people want best of breed. They don’t want to consolidate. And I think, I will humbly sort of submit, that nobody had been given the option.

You never walked up and said, ‘Listen, I have got four amazing things. They’re amazing in their own right. They win their own Magic Quadrant, or Forrester Research ranks them highly. But they also work together. And working together is one part of it, but they actually give you a better security outcome.

So what we are discovering is as the macro environment is getting tougher, customers don’t want to go through the process of integration. They want a lower total cost of ownership. Obviously, with all the hacks and the attacks we hear about, people want a better security posture.

So I think right now we’re going to see a lot more customers think hard about how they want to put their solutions together, how they want to put their architectures together. They want to make sure that they are getting the best security in the market, as well as making sure that they’re getting a better outcome from a security perspective at the right price.

And I think we are in a position where we’re one of the few people offering that capability to the customers. And hopefully that bodes well for us and our partners.

On Being More Visible With Partners

I always say if you don’t have good product to sell and a lot of product to sell, you can keep tinkering with go-to-market, but you’re not going to move the needle a lot.

Now that I feel that we are leaders in 13 categories, we have something for everyone. We have cloud security, we have SD-WAN, we have SASE, we have SOC automation. We have a new product line—[Cortex] XSIAM—which is about re-engineering the entire SOC. We have our traditional firewalls and software products. So we have a large portfolio of products.

Now the question is how can we streamline our ability and get ourselves working together with the partners out there in the field and getting business done? So toward that end it starts at the top. I’m very happy to go visit customers with our partners. We sort of double team and tag team them. You go to the customer and say, ‘Listen, the two of us can give you this amazing capability and give you some comfort in the transformation that you’re undertaking because the both of us together are going to minimize risk for you.’

Look, at the end of the day, the compensation has been in place [for partners]. What you want to do is increase your conversion rate and closure rate. You only make money when you sell business. So I think we have great compensation programs in place. Our partner community, our NextWave program, I think is second to none. And I think in that context us going out there with our partners, getting business done, showing them how we can collectively win is going to be a win-win for both of us.

I don’t think we need to change everything in its entirety. I just think we need to get more traction and get more business done together.

On Making Palo Alto Networks The Partner Of Choice

We’d like customers to bet on us. We’d like the channel to bet on us. In the past, there’s been so many options that partners tried to be more sort of unbiased in which partner they worked with from a vendor perspective.

I think the time is now for our partners to make a bet on Palo Alto Networks and make sure that we become their partner of choice because we are able to solve the customers’ problems. We are able to demonstrate leadership in multiple categories.

I think in addition to that, on a more serious note, I think the partners need to keep working on their services muscle. I think it’s not been a muscle that has been required in the past, but now every customer of meaningful scale and size requires the partners to have services capability, and that requires them to understand our products, understand the technology, understand the customer’s need, and find a way of not just being able to get them the product, but actually implement the product and get them a great security outcome.

And I think that’s a new motion. Many of the partners are still sort of revving up. I think you are seeing system integrators and service providers get in this space and be more aggressive because that’s one of the muscles they already have. I think it’s important for the other partners in the ecosystem that they also step up their services game because I think this opportunity is huge.

We’re in a very early stage of cloud transformation, the network transformation and SOC transformation.

On Why Real-Time Security Is A Data Problem And The New SOC Paradigm

Five years ago when I started at Palo Alto Networks, I came to this with a slightly different perspective and I said, ‘Listen, real-time security is a data problem because traditionally security has been set up where we collect a lot of data, a breach would happen and our mean time to respond as an industry was in the 20-day time frame.’ Look at the big hacks that happened in the past—it took us days to figure out what actually happened, days to go remediate that. Now that’s kind of like not security, that’s investigations after a breach has happened.

We need to get ahead of the security problems. And the way you do that is be able to stop things in real time. Now, to stop things in real time you have to have a very high degree of confidence that this is bad and you have to stop it. We have worked hard the last four and a half years to get our own mean time to remediate, mean time to respond at Palo Alto Networks in under a minute.

We used to be in the 20-day time frame, but now we’re down to under a minute. What we’ve done is productize this capability and launched into the market XSIAM. This is our attempt to say, ‘Look, the SOC needs a new paradigm. The new paradigm is we have to collect good data, we have to analyze good data, we have to figure out anomalous behavior and stop it as it is happening.’

To me, that is the Holy Grail of security, real-time security, blocking the event as it’s happening. That’s going to require a huge overhaul of our customers’ Security Operations Centers, our customers’ security architecture. If our partners can work with us, get ahead of this, understand this problem, understand the new paradigm, there’s tons and tons of business for them as well as for us.

This is a new trend. It is just about to start. I don’t think there is enough capability out in the market in terms of thinking like this, transforming it.

We just literally launched the product a few months ago.

We’re seeing amazing early traction. I think that’s an area where we can work really well with our partners because we don’t want to be in the business of transforming our customers. We want to be in the business of creating the best product. We want our partners to work with us to transform the customers, to get them the security outcome they need.

On The ‘Huge Potential Market’ For Cortex XSIAM

It’s early days. When we launched this product [in March], we went out and talked to eight or nine partners about the design of the product and they all wanted to participate because there is a real problem here. They would like us to work with them to get a lower cost of data ingestion, a better security outcome, better integration, and really to accelerate their transformation from where they are to where they’d like to be.

What was surprising to us was in the very first few weeks is the design partners were committed and they wanted to become real customers. So we were able to convert all of them in the first three months from partners who wanted to go through the design and development process to real customers.

And what happened was we said, ‘Wait a minute, there’s something here,’ and then we were very carefully curating which customers we are willing to accept because we wanted to make sure they were in line with our product road map and how we wanted to develop the product.

It’s one of the few security products where we’re seeing every deal is seven figures. I’ve been in security for four and a half years, so excuse me, but you guys might know this better or your viewers might, but it is very rare that you find a product market fit where a product you launch starts off with a seven-figure deal.

So I think this is a huge potential market. This is the market that has traditionally been occupied by SIEM vendors, data ingestion players, by UBEA (User and Entity Behavior Analytics) players, by all these things and tools that we have built to help the SOC. I think all of that stuff is going to be sort of overhauled and redone with AI as the basis and good data is the baseline. I think that’s the XSIAM opportunity.

It’s early days, but I think as we get our feet wet, we can understand exactly what the customers need. As we build the product to its full potential, there will be tremendous opportunities from partners to work with us to make sure that they can go address individual customers and go down this journey with us, perhaps in a transformation way, or perhaps as managed services partners.

On How Cortex XSIAM’s AI Capabilities ‘Flip’ The Old Model On Its Head

The traditional model was let’s collect all the data in the enterprise in a large data lake, and people did that in many different ways: They had these SIEM vendors, they had these data ingestion plays and they were collecting the data. And then they’re saying, ‘Let’s collect all the alerts and see what’s going in our security infrastructure.’

At Palo Alto Networks, we were getting 67,000 alerts a week. That’s a lot of alerts. It is very hard to figure out which ones to focus on and which one is more important. So these tools called UBEA came about, saying, ‘Let’s look at the behavioral analysis and figure out which ones we need to prioritize.’

Now, the problem is in security you don’t get to choose. In security you’ve got to solve every alert, every problem, because if you don’t, then the risk is the one you ignore is most likely the one that’s going to cause the breach.

So we took a view that we have to solve every alert that comes into the SOC. Now, if you apply that mindset, you realize you can’t do it using humans. You can’t do it using only SOC analysts. You’ve got to figure out a lot more technology, a lot more AI, a lot more automation.

So we flipped the model on its head and said, ‘AI starts with good data. So let’s first and foremost make sure we collect good data.’ Toward that end, we overhauled our XDR product. We collect the most amount of data in the industry on a per-endpoint basis because we believe that’s what allows us to create that foundational layer of data that allows us to make sure that we can reconcile all the 67,000 alerts we get.

And interestingly, we were able to reduce our number of alerts by 50X by doing that. So once we collect the single source of truth, the data, we brought it down by 50X. Then we use our automation product and we’re down another eight times. So we’re down to 500 events a week instead of 67,000 alerts. That sounds and seems a lot more manageable.

That’s the transformation I’m talking about. It’s the transformation of how we think about collecting data for security purposes, how you automate it, how you use AI and that’s really what I think the overall impact is going to be.

There’s a series of vendors out there who have traditionally offered the capabilities. In some cases, they’re 15 years old. I think that’s where we’re going to see a bunch of upheaval.

On The AI Difference Between Palo Alto Networks And CrowdStrike

At the end of the day, both CrowdStrike and Palo Alto Networks and others throughout the industry are trying to get our customers to better security outcomes. We have the privilege of serving north of 61,000 firewall customers. We have with them the access to lots of data around firewalls. We have north of 4,500 endpoint XDR customers. They are in the fray. We have 2,000-plus cloud customers, a similar number of SASE customers.

When you collect all of that, I think we have the largest amount of proprietary security data in partnership with our customers. That allows us to reconcile that to real-time security, to find the alerts, the threats, to find the malware and really provide the service our customers need. As I said, AI is a data problem. The one who has the most data wins.

On The Need For Partners To Get Customers To Go On The ‘Transformation Journey’

Those [partner] models are out there. We have MDR (Managed Detection and Response) partners out there. We have MSSPs out there. So I don’t think there is a dearth of managed service partners out there. I think the question is, ‘Can you lead the customers on this transformation journey?’ I think there is a transformation journey that precedes the need to run this managed services capability.

I think first you’ve got to work with the customers to get them there. And then the question is, ‘Does the customer want to manage it themselves or do they rely on a third-party partner to do it?’ I think both models need to be there to allow the end customer the flexibility to choose which one they go with.

But I think there’s a precursor to that, which is getting them from where they are today to a better state.

On Cloud Credits And Public Cloud Marketplaces

The public cloud marketplaces, I think, are really a creation of end customers having committed a lot of dollars toward the public cloud and not fully consuming them. So I think they have just become a mechanism for swapping credits for both technology as well as cybersecurity products and services. I think that market is probably going to be temporary, temporary as in a few years’ time frame.

But I think as companies start to get up to the spend that they’ve committed to the public cloud partners, their marketplace currency will shrink. I think it’s more of a transitory payment mechanism. I wouldn’t build a long-term business model around it. I think the key opportunity as it relates to public cloud is actually going to those customers as a third-party partner and saying, ‘Can I accelerate your cloud journey? Can I help you transform yourself into a better, bigger sort of cloud customer so you end up consuming those credits you’ve committed to because they’re kind of like, use it or lose it?’ That’s why we see a bunch of transactions that go to those public cloud marketplaces as security vendors because that’s just currency that customers use. I don’t know that’s a long-term sort of disintermediation of the market. I think it’s just a short-term event because it’s being used as currency or credits that have not been consumed for what they were bought for.

On The Majority Of Customers Being ‘Overoptimistic’ About Public Cloud Transformation

I think a majority of the customers have been overoptimistic in their ability to transform to the public cloud. So what you’re seeing is if you look at the balance sheets of all the public cloud providers, they’re sitting with a lot of liability, which has not been fully consumed and they need to get their customers to consume it.

There has been a bit of a slowdown in commitment for public cloud. I don’t think that means that the consumption is going to slow down, but I think the commitment has slowed down because people are saying, ‘Do I need to commit to these big numbers which the cloud providers were encouraging them to do? I can make do with a lot less for now because I’m not moving that fast.’

I think as the customers go down that journey of moving faster and moving their applications to the cloud, you will see that they will meet. The overoptimistic behavior is going to normalize.

We’ll start to find a steady stream. But I think there has been a bit of a dislocation caused by enthusiasm and optimism, which will normalize.

I don’t think there is a lack of buy-in or commitment on people that want to do the public cloud. I just think they were too optimistic in how quickly they could get there. So I don’t think there’s going to be a repatriation as much as it’ll take time to catch up to what their expectations were.

I think a lot of the customers are down that path. They realize that they have to rewrite their applications into the cloud. Lift and shift is not the answer. So it is taking longer.

On Why ChatGPT Is A ‘Boon’ For Palo Alto Networks

I think it’s amazing. Many years ago, in 2000, I used to work in mobile data and we used to keep telling people, ‘Listen, on your phone, you can read the news if you want, you can get stock tickers if you want.’ And people would look at us and say, ‘What? How do you do that? I thought you made phone calls with it.’ We had these old banana phones from Nokia you used to program for that. People didn’t quite get it. Then suddenly this new invention happened called iPhone, which didn’t have a keyboard. And people said, ‘Oh I get it now. I can just click on the screen and it’s all data and I can get it. That’s cool. Why didn’t you tell me that before?’ So I think that’s kind of the opportunity ChatGPT has positioned us for.

We’ve been using supervised machine learning for 12 years at Palo Alto Networks. We’ve been using unsupervised machine learning for seven years. We kept going blue in the face, telling people we are using AI. And nobody believed it. Now with ChatGPT people are telling us, ‘You should have told me that is what you were doing before.’

So I think it’s a boon. I think people have finally realized the value of AI and how powerful AI can be and imagine. I think [Nvidia CEO] Jensen Huang just said on an earnings call that this thing’s going to be a million times more powerful in 10 years.

Computing took 30 years to be 10,000 times more powerful. Jensen is saying a million times in 10 years. My brain can’t compute that. But I’ll tell you it is going to be faster, better and doing a lot more things than we can ever imagine today.

At the end of the day, every tool in the world can be used for good things or bad things. As long as there are more good people than bad people. I think the good guys win. But yes, it doesn’t stop the [security] arms race from continuing, unfortunately.

On Why Palo Alto Networks Is Winning The SASE Battle

It has just been called the SASE market for the last two years. Before that it used to be called the VPN business, and there was this use case called internet proxy on-boarding, which was some of the breakthrough [for SASE]. People said, ‘Wait a minute, I don’t have to go through a VPN to get to internet apps. I can just use a proxy-based architecture to go access apps.’ And then the pandemic hit and all the attacks and all the hacks happened.

Users said, ‘Wait a minute, we need good security.’ That has really been the genesis of people saying, ‘I need to overhaul the entire security capability across my network stack. I need everybody to have that same sort of first-class citizenship or I want zero trust security.’

The words ‘zero trust’ suddenly, like AI, have become sort of commonplace in the security industry with President Biden signing an executive order saying we need zero trust.

Well, zero trust has been around for a while. What we did was we took that concept and made sure that our hardware form factors, our software form factors, our remote access capabilities, our campus capabilities, are in a single technology stack.

I think what is happening in the world is suddenly people are saying, ‘Wait a minute. I want a common security platform in any use case across my enterprise from a network security perspective.’ That’s really what has driven SASE.

We have been blessed that we have the firewall stack. We were able to transform that into our software security stack. We were also able to make that available as a remote security stack. So we’re the only vendor in the industry who can, irrespective of form factor, give you consistent security, consistent policy across an entire network security stack.

To be honest, that’s what’s driven our business the last two years. We didn’t have the product two years ago.

Today, we think we’re second in the market. We probably have half of the business that the leader in the market has. We had zero. We’re growing a lot faster. So hopefully we’ll catch up sometime soon. But it’s really the need for having first-level security or best-of-breed security that has been driving the SASE business.

Our sweet spot is large customers, large enterprises, and many of them have the ability to understand our security stack because we serve north of 60,000 firewall customers who have been using that stack for a long time.

On The Next Evolution Of The SASE Revolution

When I joined four and a half years ago, we had our firewall team and we had about 26 people working on this VPN/SASE product. Today our entire 1,200-person engineering team treat this as a first-class citizen. There are hundreds of dedicated engineers who work on this. We have all our eggs in the basket working on network security and delivering zero trust.

We have been very aggressively working on deploying AI toward the product. Our next generation, our next evolution of the product, is the application of AI throughout the entire network security stack.

I think what a lot of the market misses in this SASE transformation is moving from a security-

only service to a network and security service. Now we’re actually carrying traffic for our customers, which we never did. So we’re actually operating the network for them, which is a big responsibility. At the same time, it comes with a lot of opportunity and its own challenges.

On How Palo Alto Networks Partners Should Approach The SASE Opportunity

Partners who work with us on hardware firewalls and virtual firewalls should know that customer is a prime candidate for Palo Alto Networks’ SASE.

If you already have deployed Palo Alto firewalls as a partner or as a customer, if you have already deployed our software firewalls, the SASE stack is the same stack. It is the same policies. It is the same sort of management interface. You don’t need to learn new security. You just need to go out and go turn it on for the rest of your remote users.

So I think the partners need to make sure that every Palo Alto Networks customer they have helped on-board, provision or sell to in the last many years is a prime candidate for SASE. It’s an easy transformation. It’s an easy transition. There are amazing commercial economics built around it. So that is lesson No. 1.

Lesson No. 2 is since we weren’t in the market our stack is new. Our stack is two years old. Our competitor’s stack is probably 10 years old. So we are providing that capability in a brand-new stack.

The other point is a more philosophical point of view which we have taken. Every other stack in SASE in the industry is a stack built on one of our competitors’ own networks. We don’t do that.

I worked at Google for 10 years and my personal belief is that we’ll be on Google Cloud, Amazon, Azure, Oracle or Alibaba around the world for any company that has not got a very large network infrastructure of its own. At $6 billion or $7 billion this year, we’re still a small company. I think we made the bet early in the public cloud. We run everyone’s traffic on the public cloud. We partner with Google and Amazon. They run the traffic for us and I think that’s going to win in the long term. So those are the really three big reasons why partners should be working with us in a constructive, collaborative way to take every one of our collective customers and move them down the network transformation journey with Palo Alto Networks Prisma Access or Prisma SASE.

On Cider Security, Bridgecrew And Code-To-Cloud Security

As you know, everybody in the world is moving toward the cloud. And we’ve talked about how that’s going to be a critical part of the customer’s transformation journey. In that context, we wanted to make sure that we don’t repeat the mistakes that were made early on in disparate security capabilities around the enterprise.

We went and bought a few companies you’re well aware of. We integrated them early. We got them to work together. And as we go implement that, our customers keep telling us what’s the next problem they’re trying to solve. And instead of relying on customers to integrate that solution with our stack, we just go out and find the best in the market and put it together.

We discovered as we were building runtime capabilities and watching applications in process to make sure that there were no security breaches, our customers said, ‘Really, these security breaches creep in while you’re in the development process. So when people code there’s a risk that you create a security flaw.’

The way to protect against that is what we fondly call ‘supply chain security’—as in you make sure the supply chain of software development is not corrupted. So we bought Cider [Security], which actually helps you with your software development process and fits with our last acquisition, called Bridgecrew, which is infrastructure as code. That capability now makes sure not only are you protected in runtime or when you are deploying but also when you are coding. We call it ‘code-to-cloud security.’

We are now closing in on nine modules for Prisma Cloud. We hope to be able to get to double digits in the near future. Really our aspiration is to make sure that our customers don’t have to go integrate multiple cloud security providers. They can have one.

Especially, as we talked about earlier, the need for real-time security is most exacerbated in the cloud. You want it real time. You want things to be stopped because the cloud has ephemeral assets and you want to make sure you’re stopping security breaches right as they happen and that’s kind of where Cider plays into Prisma Cloud.

On The Big Change In The Palo Alto Networks Culture

When I came on board, we were a firewall company. We were closing in on about 5,000 employees then who had primarily been very successful at building a network security business based on firewalls.

Today, we’re north of 14,000 people. So as you can imagine, just on that basis, 9,000 people are new at Palo Alto. Not just that there’s a series of people in the 5,000 who are gone and we’ve replaced them with other great people. So I think 70 [percent] to 80 percent of the company is new. The company is very focused on these new security capabilities that we’re selling to our customers, making sure our customers have a great security outcome.

I think the management here has to be applauded for what we were able to do during the pandemic. We actually took a very employee-first point of view. We were the first company to go out there and say we’re not going to do any RIFs [reductions in force], and we’re not going to change the state of our company. People were nervous. We felt that it was our responsibility as leadership to step up and give them the comfort and the surety that we were going to be there for them.

And it has been an upward-and-to-the-right journey from there, both in terms of our products and in terms of what we’ve been able to do with our partners. Everyone likes to win and Palo Alto Networks is winning. We are now the largest cybersecurity company and I think we have an amazing team. We wouldn’t be here without our employees and all the contributions they make.

On The Big Problems Facing CEOs

I don’t think a CEO’s job gets easier on any day. As I joke, all the easy problems get solved before they come to me. So I only get the hard problems, and I’ll just tell you that the stream of hard problems doesn’t change. It’s just the nature of them that might change.

Our job is to make sure we solve the problems with an employee-first, customer-first mindset and that’s what we do every day.