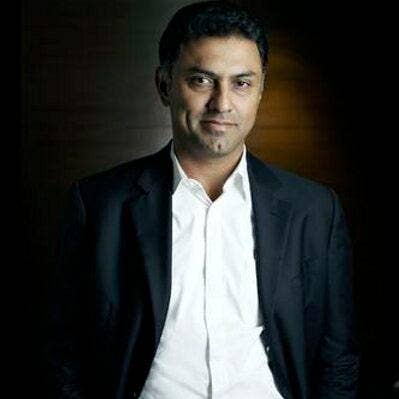

Palo Alto Networks CEO Nikesh Arora: Twistlock, PureSec Are Best In Market

Arora says Palo Alto Networks is driving consolidation in the cloud security space by making it so that customers no longer have to buy piece products for containers, private cloud, public cloud, on-premise, SaaS or serverless security.

Palo Alto Networks CEO Nikesh Arora said Wednesday's acquisitions of Twistlock and PureSec will give customers access to best-in-breed cloud security technologies without having to buy piece products.

The Santa Clara, Calif.-based platform security vendor said that customers have moved from discussing public cloud security two years to container security today. Arora said Twistlock is "by far the leader" in the container security market, and since customers still want to use best-in-breed technology, the company decided it was important to buy Twistlock and integrate it into their cloud security platform.

The next conversation customers are looking to have is around serverless security, Arora said, so Palo Alto Networks decided to bite the bullet and purchase PureSec since it too was the leader in its market. The company wants to integrate both Twistlock and PureSec as quickly as possible so that it can offer customers a fully integrated public cloud security suite, Arora said.

[Related: Palo Alto Networks To Buy Cloud Security Startups Twistlock, PureSec]

"Our customers want the entire thing," Arora told Wall Street analysts Wednesday. "They want the full capability for data security, and they want best of breed."

Palo Alto Networks is driving consolidation in the cloud security space, Arora said, by making it so that customers no longer have to buy piece products for containers, private cloud, public cloud, on-premise, SaaS or serverless security. The Twistlock and PureSec deals come a year after Palo Alto Networks bought AWS deployment specialist Evident.io and cloud security remediation platform RedLock.

"We are driving hard and fast to keep creating integrations so that customers don't have to buy piece products and spend time integrating," Arora said.

Cloud applications are increasingly being architected with multiple different cloud services underpinning them such as Platform-as-a-Service, Infrastructure-as-a-Service, or virtual machines, said Chief Product Officer Lee Klarich. Containers and serverless are increasingly emerging as a foundational component of these architectures, according to Klarich.

Combining Twistlock and PureSec into a single cloud security suite will make it possible for customers to see how an application is designed, architected and secured from the build phase to the runtime environment, Klarich said.

Arora said it's really about a "land grab" in cloud security where vendors that are able to demonstrate and deploy products in the enterprise and understand the problems customers are facing will reap the financial benefits in a major way. All told, Arora said the $2 billion cloud security market is being unserved today.

"There are not enough products, and there are not enough salespeople going out and demonstrating the products to those customers," Arora said.

Palo Alto Networks sales for the quarter ended April 30 skyrocketed to $726.6 million, up 28 percent from $567.7 million a year earlier. That crushed Seeking Alpha's projection of $705 million.

The company recorded a net loss of $20.2 million, or $0.21 per diluted share, 50 percent better than a net loss of $40.4 million, or $0.44 per diluted share, the year before. On a non-GAAP basis, net income soared to $130.1 million, or $1.31 per diluted share, up 30.1 percent from $100 million, or $1.04 per diluted share, last year. That beat Seeking Alpha's net income projection of $1.25 per share.

Palo Alto Networks' stock sunk $10.72 (4.98 percent) to $204.60 per share in after-hours trading Wednesday, which is the lowest the company's stock has traded since January of this year.

Subscription and support revenue for Palo Alto Networks increased to $448.2 million, up 28.2 percent from $349.6 million the year before. And product revenue climbed to $278.4 million, up 27.6 percent from $218.1 million last year.

Sales in the Americas increased by 28 percent in the quarter, according to Chief Financial Officer Kathy Bonanno.

For the coming quarter, Palo Alto Networks expects non-GAAP net income of $1.41 per diluted share to $1.42 per diluted share on total sales of $795 million to $805 million. That's in line with expectations, according to Seeking Alpha.