Security Firm ZeroFox To Go Public At $1.4B Valuation, Unveils Plans To Buy IDX

‘VARs are always looking for something new and something hot. Both sets of channel partners will be able to sell more than they can today to the customers that they have,’ says ZeroFox CEO James Foster of the planned acquisition of data breach response services provider IDX,

ZeroFox plans to acquire data breach response services provider IDX and go public at a $1.4 billion valuation by merging with a special purpose acquisition company.

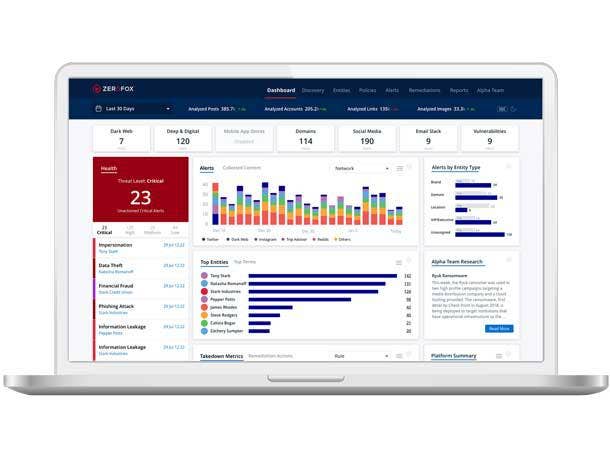

The Baltimore-based external threat intelligence and protection vendor said becoming publicly traded on the New York Stock Exchange will allow ZeroFox to invest in its artificial intelligence capabilities, scale its go-to-market efforts and expand its team. The combination of ZeroFox and IDX will create a company capable of addressing the full life cycle of external cyberthreats and risks for its customers.

ZeroFox expects to be listed in the first half of 2022 once its merger is complete with publicly traded special purpose acquisition company L&F Acquisition Corp., which has Avant founder Al Goldstein and former U.S. Sen. Joe Lieberman on its board of directors. L&F CEO Adam Gerchen will join ZeroFox’s board, while current ZeroFox and IDX shareholders will hold 76 percent of the company’s stock.

[Related: LookingGlass Buys Attack Surface Management Startup AlphaWave]

“We view this as a milestone, not a finish line,” ZeroFox Chairman and CEO James Foster told CRN. “This has been our call and focus for the better part of a decade now, and we don’t think there’s anybody at our scale doing this.”

The purchase price for IDX was not disclosed.

Adding IDX’s post-breach expertise to ZeroFox’s pre-breach, prevention and detection capabilities will make it possible for customers to get all of their external cybersecurity needs met by a single vendor. Although other vendors also offer threat intelligence and digital risk protection, he said ZeroFox’s dedicated focus and orientation around external threats make it unique.

“Customers are constantly asking for more response capability,” Foster said. “We’re at an all-time high breach rate and ransomware rate. Agents and firewalls are no longer enough.”

ZeroFox and IDX sell predominantly through the channel, leveraging VARs as well as some larger MSSPs and system integrators that serve the U.S. government space, Foster said. ZeroFox has between 50 and 100 channel partners spread across the globe, while IDX’s go-to-market efforts are concentrated in North America. ZeroFox serves Africa, the Middle East and Latin America through distribution, he said.

Solution providers will have the opportunity to wrap consulting, strategic advisory and professional services around the combined ZeroFox and IDX technology portfolio, Foster said. Less than 5 percent of ZeroFox’s revenue comes from professional services, with the company preferring to get the channel engaged in services opportunities, according to Foster.

“VARs are always looking for something new and something hot,” Foster said. “Both sets of channel partners will be able to sell more than they can today to the customers that they have.”

As part of the transaction, Monarch Alternative Capital is leading a $170 million investment in ZeroFox to fund acquisitions, the repayment of debt and growth capital. Public equity investors will hold a more than 11 percent stake in ZeroFox, while participants in the $170 million funding round will hold a nearly 10 percent stake. The company expects to be listed under the ticker symbol ZFOX.

The combined ZeroFox and IDX will have more than 650 employees and serve over 1,700 clients, including BNY Mellon, Caesars Entertainment, Costco, Kaiser Permanente, Major League Baseball, the Mayo Clinic, Moody’s, NASA, Nike, Uber and United. Seven of the Fortune 10 and 128 of the Global 2000 work with ZeroFox, and the company has 130 customers doing more than $100,000 of business each year.

ZeroFox expects revenue in the fiscal year ending Jan. 31, 2022, to accelerate to $150 million, up 14.5 percent from $131 million a year earlier. The company expects to record a $26 million loss in its current fiscal year. ZeroFox was founded in 2013, and prior to Monday had raised $154.2 million in five rounds of outside funding.

“This is an opportunity to further our investment,” Foster said. “I’m pretty excited about what we’ve got here in front of us.”