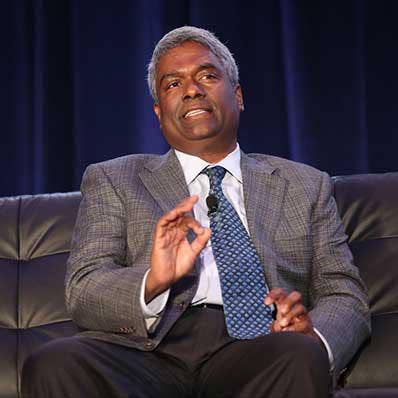

NetApp CEO Kurian: Cloud Optimization Spending Takes Toll On Financials

‘We continued to see increased budget scrutiny, requiring higher-level approvals, which resulted in smaller deal sizes, longer selling cycles and some deals pushing out. Customers are looking to stretch their budget dollars, sweating assets, shifting spend to hybrid flash and capacity flash arrays from higher-cost performance flash arrays and, as our cloud partners have described, optimizing cloud spending,’ says NetApp CEO George Kurian.

A weakening IT spending environment and continued cloud cost optimization took their toll on storage and hybrid cloud technology developer NetApp, which is in the process of taking cost control measures to arrest a decline in revenue and income.

NetApp CEO George Kurian, speaking late Wednesday to financial analysts during the San Jose, Calif.-based company’s third fiscal quarter 2023 financial conference call, said changes in customer purchasing habits in the quarter created headwinds that impacted NetApp’s financials.

“We continued to see increased budget scrutiny, requiring higher-level approvals, which resulted in smaller deal sizes, longer selling cycles and some deals pushing out,” he said. “We are feeling this most acutely in large enterprise and the Americas tech and service provider sectors. Customers are looking to stretch their budget dollars, sweating assets, shifting spend to hybrid flash and capacity flash arrays from higher-cost performance flash arrays and, as our cloud partners have described, optimizing cloud spending.”

[Related: NetApp CEO: Journey To Cloud Complete, Focus On Evolved Cloud]

That, plus a softening economic environment, forced NetApp to take actions to control costs, including increasing scrutiny of program spending, slowing down second fiscal quarter hiring, implementing a hiring freeze in the third fiscal quarter, and laying off about 8 percent of NetApp’s employees earlier this month.

NetApp reported public cloud annual recurring revenue in the quarter of $605 million, which Kurian said did not meet the company’s expectations because of a shortfall in cloud storage. “Spending optimization and the winding down of project-based workloads like chip design, EDA and HPC were headwinds again in Q3,” he said. “We have a sizable base of public cloud customers, with a number of large customers who have grown rapidly over the past year and are now optimizing. Their cost optimizations mask the growth of other customers.”

However, Kurian said, NetApp’s CloudOps portfolio for helping customers build businesses in the cloud and its NetApp Spot cloud cost optimization technology both continue to grow nicely because of customers’ focus on cost optimization.

NetApp remains well-positioned to take advantage of thegrowth trends of data-driven digital and cloud transformations, Kurian said.

“We are aligned to customers’ top priorities and have demonstrated success in controlling the elements within our control,” he said. “Building on that solid foundation, we are sharpening our execution to accelerate near-term results while strengthening our position for when the spending environment rebounds.”

NetApp currently has three areas of focus, Kurian said.

The first is to manage elements within the company’s control, particularly focusing on cost controls so that expenses do not grow ahead of revenue, keeping an eye on program spending and hiring, and focusing investments on the products that represent the biggest opportunity, he said.

“We’ve made difficult decisions to reduce investment in products with smaller revenue potential like Astra Data Store and SolidFire,” he said. “The results of this focus are visible in our ability to maintain our free cash flow, operating margin and EPS guidance despite lower revenue.”

The second focus is on reinvigorating NetApp’s storage business, where a rapid move to embrace the cloud caused NetApp to lose some momentum in its hybrid cloud business, Kurian said.

“We were slow to fully embrace the customer desire for lower-cost, capacity-oriented all-flash systems,” he said. “At the start of Q4, we rectified that situation with the introduction of the AFF C-series—the most comprehensive, industry-leading portfolio of QLC-based all-flash arrays that addresses a wide range of workloads and price points. These products will help customers manage through a cost-sensitive environment while at the same time supporting their pursuit of sustainability targets.”

The quarter also saw NetApp release BlueXP, a unified control plane that helps decrease resource waste, complexity and the risk of managing diverse environments, Kurian said.

The third area is building a more focused approach to the cloud, Kurian said.

The public cloud for NetApp is a huge growth opportunity with an accretive gross margin profile, Kurian said. NetApp has not been using its go-to-market resources to their best effect and is looking at realigning its sales resources to the buying centers and consumption models for all the company’s offerings, he said.

“Our cloud storage business is predominately consumption-based and largely driven by our hyperscaler partners,” he said. “These factors, coupled with the current cloud cost-optimization environment, have impacted our ability to forecast ARR. … We believe strongly that public cloud services can be a multibillion-dollar ARR business for us. However, achieving that target will take longer than we initially planned due to the industrywide slowdown in cloud spending and our recent performance.”

For its third fiscal quarter 2023, which ended Jan. 27, NetApp reported total revenue of $1.53 billion, down 5.0 percent from the $1.61 billion the company reported for its third fiscal quarter 2022.

Revenue for the quarter missed analyst expectations by $80 million, according to Seeking Alpha.

Product revenue of $682 million for the quarter was down significantly over last year’s $846 million, while services revenue of $844 million was up from last year’s $768 million. Product revenue included software revenue of $390 million, down from last year’s $507 million, and hardware revenue of $292 million, down from last year’s $339 million.

NetApp also reported hybrid cloud segment revenue of $1.38 billion, down from last year’s $1.50 billion, while public cloud segment revenue of $150 million was up from last year’s $110 million.

NetApp’s Americas commercial business accounted for 44 percent of total revenue, while its U.S. public sector business accounted for 10 percent. About 78 percent of NetApp’s revenue came from indirect channels, down slightly from 79 percent last year.

For the quarter, NetApp reported GAAP net income of $65 million, or 30 cents per share, down significantly from the $252 million, or $1.10 per share, the company reported last year. On a non-GAAP basis, NetApp reported $301 million, or $1.37 per share, down slightly from last year’s $330 million, or $1.44 per share.

Analysts had been expecting non-GAAP earnings of $1.37 per share, according to Seeking Alpha.

Looking ahead, NetApp continues to expect gross margin to range between 66 percent and 67 percent. With new disciplined cost controls, the company is raising its fiscal year 2023 operating margin guidance to between 23 percent and 24 percent, which includes approximately 2 points of foreign exchange headwind.

For its fiscal fourth quarter 2023, NetApp is expecting net revenue to range between $1.475 billion and $1.625 billion which, at the midpoint, implies an 8 percent decrease year over year. The company also expects cloud revenue and ARR to be about flat sequentially in the fourth fiscal quarter. Component prices are likely to fall during the quarter, which NetApp said means improving product margins.