NetApp’s All-Flash Storage Focus Helps Push Q2 Sales To $1.52B

NetApp in its second fiscal quarter 2019 showed it still has what it takes to be one of the winningest vendors in the IT market.

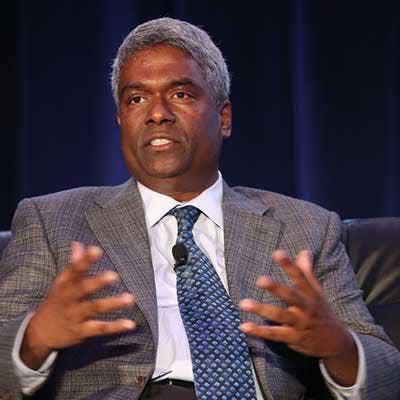

A big push in all-flash storage sales combined with a focus on helping customers build hybrid on-premises and cloud architectures led the Sunnyvale, Calif.-based storage vendor to its 10th consecutive quarter of meeting or beating guidelines, said CEO George Kurian.

Kurian, talking to CRN on Wednesday shortly after NetApp reported its second fiscal quarter 2019 financials, said his company saw a 29-percent year-over-year growth in sales of its all-flash storage arrays, which helped lead an 11-percent growth in overall product revenue.

[Related: NetApp Insight: NetApp Significantly Expands Ability To Treat On-Premises, Cloud As One]

With that growth in all-flash storage sales, NetApp is enjoying an annualized net revenue run rate of $2.2 billion for its all-flash array business.

Product revenue continues to be strong, and NetApp continues to gain share in existing markets while extending its market with hybrid clouds, Kurian said.

"No one else is growing faster in all-flash array sales at the size and scale we have," he said. "We're gaining share, and we're setting the agenda around hybrid cloud deployment."

NetApp on Wednesday for what is likely the last time separated sales of its strategic product and mature products.

Sales of its strategic product sets, including all-flash storage, converged infrastructure, hyper-converged infrastructure, and hybrid cloud, accounted for 70 percent of product revenue, and were up 15 percent year-over-year. Sales of mature products accounted for about 30 percent of product revenue, and were up 4 percent.

"We feel that these levels will be stable," Kurian said. "There's no need to break them out going forward."

NetApp on Wednesday reported revenue of $1.52 billion, which was up 7 percent year-over-year from the $1.42 billion the company reported for its second fiscal quarter 2018.

The company also reported GAAP net income of $241 million, or 91 cents per share, up from last year's $174 million, or 63 cents per share. On a non-GAAP basis, NetApp reported net income of $280 million, or $1.06 per share, up from last year's $221 million or 80 cents per share.

Looking forward, NetApp expects revenue in its third fiscal quarter 2019 to be in the range of $1.550 billion to $1.650 billion, up from the $1.52 billion the company reported for its third fiscal quarter of 2018.

The company is also expecting to report earnings of 96 cents to $1.02 per share on a GAAP basis, and $1.12 to $1.18 per share on a non-GAAP basis.

NetApp share prices fell Wednesday by about 5.9 percent to $74.25 by the end of the trading day and before the company reported its quarterly financials. In after-market trading, NetApp shares were hovering at around $74 per share in the first couple hours.