Paul Hunter On ‘Huge’ New Storage Incentives And Why HPE is ‘Pouring Fuel’ On The Partner Profitability Fire

HPE North America Managing Director Paul Hunter says the move to nearly triple the incentives for partners selling HPE GreenLake block storage as a service represents a ‘huge’ opportunity for partners in 2023.

A New North America Data Services And Storage Sales Team

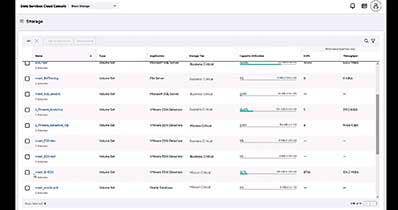

Hewlett Packard Enterprise has nearly tripled partner block storage sales incentives and created a new North America data services and storage sales team to capitalize on the growing demand for cloud storage services, said HPE North America Managing Director Paul Hunter.

“What we have done is we have invested in this opportunity because we see a lot of things coming together that we believe are now in our favor and play to why this is so exciting for our partners,” said Hunter, speaking about the move to increase HPE GreenLake block-storage-as a-service sales incentives from 6 percent to 17 percent. “The first is clearly our customers are looking for the adoption of data services. So our customers are telling us what we are proposing is how they want to buy and they like the proposition.”

The big cloud storage data services sales offensive comes with HPE’s innovative storage portfolio firing on all cylinders, said Hunter.

“Our portfolio is at a really good place,” he said. “With the acquisition of Zerto and the build-out of data services, HCI and block [storage] as a service, backup and data recovery services are really compelling. On top of that, we have had the introduction of the Alletra 5000. We have got a really strong hybrid proposition in storage.”

The increased partner incentives and opportunity to partner with the new North America data services and storage team to add new customers to the HPE GreenLake edge-to-cloud service platform represent a huge opportunity for partners, said Hunter.

“We have added people and set up a dedicated data and storage services sales team end to end that is tasked with working with our partners to land new customer footprints,” Hunter said. “Just to make it even more exciting, we are now paying our partners even more. This [near-tripling] of the partner incentive for landing new block-[storage]-as-a-service and data service opportunities is huge.”

What do you see as the biggest opportunities with regard to how partners align with HPE North America in Fiscal Year 2023?

There are three areas where there is a lot of excitement for partners. They are in different stages of maturity and opportunity. The three areas are data services and storage, cloud and AI.

AI is probably the one that partners are the least mature about and is most nascent from a partner standpoint. But there is significant opportunity, and we are starting to crack the code with how we win with our partners there.

The second one, which continues to get bigger and is scaling in a way that we planned and intended and we are excited about, is cloud. I have talked to a lot of partners in the last month or so as we have been talking to the teams about the changes we have made [for the new fiscal year] and why we think they are exciting for our partners.

The third opportunity, which is a near and present opportunity, is storage and data services.

The two that I think are going to be really meaningful in 2023 are cloud and storage and data services. AI and machine learning will follow behind them. The opportunity there is not as well understood by our partners. It is harder for them to reach. Therefore, it is going to take a little longer [for it to take hold in the channel]. But it is as big—if not bigger—in the medium to long term.

We are very excited about the changes we have made and the effect we think that will have on our ability to collaborate [with our partners] and take advantage of market growth that is there.

You have increased the incentive for block storage as a service from 6 percent to 17 percent as you have moved aggressively to a cloud subscription-like model in the storage business. How big an impact is that going to have on partners?

It’s a big change for our partners. The old model—the traditional model—is refresh the infrastructure every three years and it is technology-led and services-attached. The modern way our customers are looking to buy is they are looking for a services-led approach.

We have been re-equipping our sales force for the best part of three to four years to take a services-led approach. We have also been working with our partners to do the same thing.

There is real evidence that in cloud there are partners that have crossed the chasm. They are not at the early stages of adoption. They have a path to independent repeatability. So they are more than capable of winning in some cases very large cloud transformation projects and digital transformation projects that are underpinned by cloud agility. They are doing it on their own. That to me is one of the most exciting progressions we have seen in the last year. Partners are winning on their own and they don’t need HPE to be with them side by side. That is really encouraging.

We have also gotten breakthroughs with some of our big partners. We just had a really important and influential win with WWT [World Wide Technology].

What is driving the increased investment in data services and storage?

What we have done is we have invested in this opportunity because we see a lot of things coming together that we believe are now in our favor and play to why this is so exciting for our partners. The first is clearly our customers are looking for the adoption of data services. So our customers are telling us what we are proposing is how they want to buy and they like the proposition.

The second thing is our portfolio continues to be laden with innovation. Our portfolio is at a really good place. With the acquisition of Zerto and the build-out of data services, HCI and block [storage] as a service, backup and data recovery services are really compelling. On top of that we have had the introduction of the Alletra 5000. We have got a really strong hybrid proposition in storage.

What we have done is really invested behind that opportunity. We have added people and set up a dedicated data and storage services sales team end to end that is tasked with working with our partners to land new customer footprints. Just to make it even more exciting, we are now paying our partners even more. This [near-tripling] of the partner incentive for landing new block [storage] as a service and data service opportunities is huge.

What kind of reaction are you seeing from partners to the new storage incentives?

In the past four weeks I have spent a lot of time with partners. I had a partner roundtable in New York and partner roundtables in Canada and Toronto. They were saying we never thought you would progress this far a year on.

This is what they were telling us. They were telling us that this [GreenLake edge-to-cloud service] proposition we have been working on for several years really resonates with our customers. We are winning with it, and we see huge opportunity for the year ahead. There are lots of things they want us to work on. Life is not perfect, but they are enthusiastic and excited about the year ahead.

What is the call to action on storage for partners?

The key here is working with customers and partnering with them to deliver more agile services into a line of business. It is not about feature and function benefit. It is about how do we work with customers to deliver business agility. That is fundamentally what cloud is. When our partners approach it from a business and service-level perspective, they are winning.

We have a similar situation with the opportunity in artificial intelligence. We have a few partners, Mark III is one of them, who are really building out advisory capabilities to help customers with how to put AI/machine learning into production. That is the problem our customers have.

The machine learning/AI opportunity is becoming democratized. It is becoming more and more accessible to smaller and smaller businesses. So you have got huge productivity and services gains that can be delivered through AI and machine learning. Where partners have gotten that expertise, they are really thriving. You have got to come at it with an expert-led, advisory-based, consultative discussion with the client. That challenges our partners in some instances to do new things.

Those partners that have managed services businesses are thriving because they are already leading with a services-led conversation. So they find it easier to adopt and adjust to these new emerging areas of business.

What do partners have to do to align with the AI/machine learning push?

We are looking to make this as simple as possible for our partners to engage with so we have set up three specialist sales teams: one for HPC/AI [high-performance computing and artificial intelligence], one for cloud and workloads, and one for data and storage services.

If partners have got opportunities and they want to work with us, they just have to reach out to one of those three specialist teams. Those specialist teams are available to work with partners just as they are there to work with end-user sales teams. It is pretty straightforward. What we are doing is we are building out expertise throughout those specialty sales teams.

Take the cloud services team, for example. We are adding expertise on workloads, machine learning/AI and we are coupling that within industry expertise.

So our customer sales teams are augmenting their teams with industry expertise. We have set up eight vertical sales teams Historically, we had four. So we have doubled the number of verticals. Part of doing that is the expectation that we add industry expertise so our own sales teams become more specialists in the language of our customers. And we’re seeing that be successful from a repeatability standpoint.

How big is the opportunity for partners to sell high-performance computing and AI, and what does that mean for partner evolution?

We are looking at how we are managing the evolution of our partners and transforming their business. Our partners over time are transforming their businesses to a services-led model.

We first announced GreenLake in 2018. Four years on, we are now getting to the point where we are crossing the chasm on adoption. It is starting to become mainstream for some partners. And we’re still adding additional partners. We are growing the partner base every month. This is reaching a stage where partners have a degree of independence. They know what they are doing and understand the magic sauce. They are really thriving and succeeding.

AI and machine learning I suspect is probably where cloud was [with GreenLake] two or three years ago. So we have got a few partners that really recognize the opportunity and have invested in data scientists and line-of-business expertise. Mark III would be one. CBT is another. They are being successful not because they have technology expertise, but because they have data expertise.

We’re also refining the model. The market is so widespread that it is very easy to miss the opportunity because you are spread so thinly. Where we are seeing success is where partners are helping customers move their machine learning/AI models into production. That is where customers are struggling. It is not with the algorithms and the design of the algorithms. They have plenty of expertise there. It is how do they deploy those algorithms at scale with consistency and not have machine learning algorithm drift.

We are refining to reach the white heat of the market and where the opportunity is so that it is something within touching distance of our partners and where they can build their expertise.

What kind of opportunities do you see going forward for partners?

Clearly at a corporate level we have momentum with GreenLake and the cloud services portfolio. If anything, we see even faster adoption in North America.

We have delivered cloud services growth, which is above the average for the company. So it is growing even faster in North America—the U.S. and Canada.

We attribute that to being really focused on what is important. When you have a big portfolio, it is easy to split your time across all parts of it equally. But for the opportunity that is cloud and data we have really leaned into that as a priority from the very first moment two years ago.

So we have had a laserlike focus on one key metric: the number of new customers we add to our platform. That metric is what has driven all our behavior in the last two years. We doubled it from 2020 to 2021 and we increased it another 60 [percent to] 70 percent from 2021 to 2022. And of course the base gets bigger. So we are adding new customers at an accelerated pace year after year. The attention within our teams to that one metric has brought real clarity on what is important.

Then you have the innovation portfolio the company is bringing to market. We are announcing more and more services with greater agility.

Because we have built up a critical mass of customers here, we need to now consider how do we run and lead the customer engagement and manage that opportunity for the lifetime of the customer. That is the adoption of the principle of customer lifetime value. This isn’t a new idea. It is something many companies have been doing for some time.

We think of ourselves as a cloud services company. As soon as you do that, it changes the lens on how you manage the business: one being customer lifetime value. That is all about how do you take the installed base of attached services support and evolve that to be as-a-service-proficient. So we are looking at our customers’ end-to-end business and partnering with them to adjust what they buy and how they buy in a way that is far more agile and responsive to their needs. That is the principle.

So Brian Falvey, who leads our cloud services team, is adding workload specialists and he also has the responsibility for our services installed base as well. So we have a single owner end to end for our services, support and consumption business.

How big an opportunity is there for partners to do the cost-of-workload analysis comparing HPE GreenLake and public cloud?

There is a great position for our partners to be the independent advisers for our customers. The market for cloud continues to grow. The market for hybrid cloud continues to grow. And I have no doubt that the market for public cloud will continue to grow. So there is opportunity for all of us to have vibrant, healthy growing businesses.

There is an emerging independence for partners who are providing advice to customers on where’s the best place to put their workloads. In many instances, customers trust those partners because they are independent. It is a lovely way for partners to grow their services business and grow their relevance.

Customers need help untangling what is the best thing to do to gain agility in a way that is cost-effective and that also frees them up to focus on innovation. Customers tell us that their No. 1 priority for their people is innovation. So when we and our partners can help them run their IT at a lower, better or in a more effective way than they are able to then they are happy to relinquish that responsibility. That frees up their people to work on innovation.

What kind of feedback are you getting from customers on the direction of the company?

We hosted our global customer advisory board in October. We do that every six months. That event is really valuable because our customers speak to us in a really authentic manner.

That’s a really good way for us to assess what progress we are making in six-month increments. At the most recent customer advisory board, our customers told us that they love the direction we are taking and they want us to go faster and further and deliver on the innovation road map we have outlined.

Blue chip companies make up the customer advisory council and when blue chip companies tell you that you are on the right track, that they are excited with what you are bringing to market and they are happy with the consumption experience, it just encourages you to want to go faster. It was an inspiring event for us.

I also had a partner roundtable with10 partners in New York and they were brimming with confidence and enthusiasm. They are excited about the year ahead. Customers make more fundamental decisions when capital is hard to come by, when investment is hard to come by. That is a good thing for us because it means we are likely to have more meaningful change on behalf of our customers and partners.

How important is the new U.S. industries vertical market focus for the future of partners?

It is critical because we have to be able to talk to our customers with authenticity and credibility in the language of their industry.

We have had some breakthroughs with some life sciences companies on the cloud services platform particularly as it relates to machine learning. When you are talking to a life sciences company or an instrumentation company about machine learning implementation, you have got to do it in the language of the data of their industry, and that requires expertise. Therefore, that requires us to be set up by vertical. That is what we are doing. We will add industry expertise. Our partners will need to do the same and we will need to be collaborating much, much more tightly by industry. We’ll see that develop over time. I think that will be another tailwind for us going into 2023.

Are there any other major changes in partner compensation besides the near-tripling of the storage incentives?

I don’t think so. Profitability for our partners is one of our strengths. I consistently get told that we are one of—if not the most—profitable vendor for our partners. So we already have the incentive for [partner] owners to want to do more business with us, for them to want to sell a bigger part of the portfolio.

So we are pouring fuel on the fire with the contributions we are making. This is an area that is a strength for us and continues to get stronger.

How do you feel about the new year with all the changes you have made?

It’s all about execution. We have got the right strategy. We have got the right plan. We made the right investments. It is all about the execution now and keeping a laserlike focus on delivering on a few key metrics. If we continue to have customer additions to our platform as a North Star we’ll be in a great position.