Q1 Storage: Leaders Dell, NetApp And HPE Give Big Ground To Pure Storage, Huawei

Pure Storage, with its all-flash storage focus, was a big winner with 8.7-percent growth in first quarter sales. But even that paled in comparison with Huawei's 17.7-percent growth despite the Chinese company's lack of a solid position in the U.S. market.

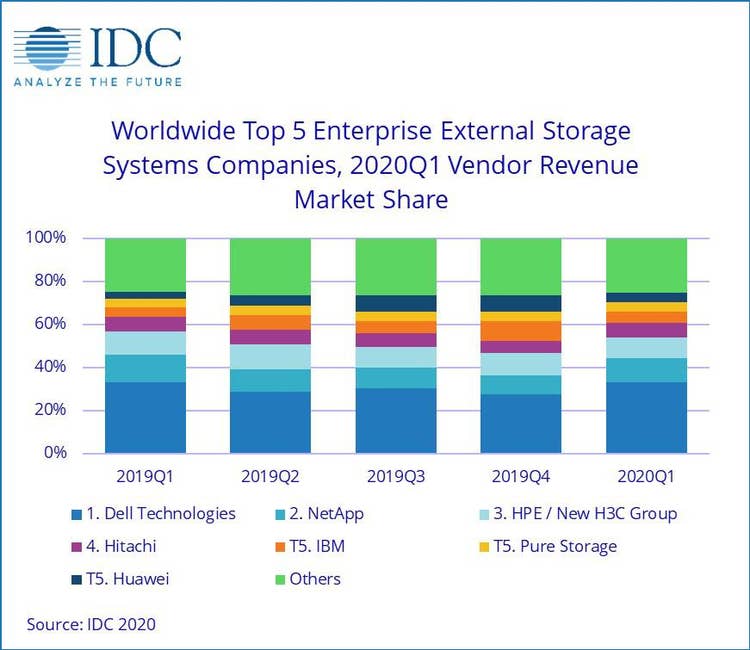

Storage industry revenue for the first quarter of 2020 took a huge hit as the top-three branded vendors' sales dropped a collective 17 percent year-over-year in the face of the global COVID-19 coronavirus pandemic, according to the latest analysis by IDC.

Those three - Dell Technologies, NetApp, and Hewlett Packard Enterprise - along with Hitachi Vantara and much of the rest of the storage industry collectively recorded a total 8.2-percent drop in first quarter storage revenue to $6.5 billion, Framingham, Mass.-based IDC reported in its latest Worldwide Quarterly Enterprise Storage Systems Tracker.

However, strong growth by Pure Storage and China-based Huawei, along with a small bump by IBM, managed to take part of the sting out of the quarter's falling storage revenue, IDC reported.

[Related: The Heartbeat Of Business: The 2020 CRN Storage 100]

Overall revenue for the branded OEM storage vendors dropped 8.2 percent compared to the first quarter of 2019 to $6.2 billion, while sales of ODM (original design manufacturer) storage directly to large hyperscaler data centers grew 6.9 percent to $4.9 billion.

The storage industry as a whole experienced a rare drop in total capacity shipped during the first quarter, IDC reported. Total capacity for the quarter dropped 18.1 percent to 92.7 exabytes, as a huge 20.0 percent drop to 54.8 exabytes in storage capacity shipped to hyperscaler data centers far exceeded the 3.0 percent growth to 17.3 exabytes shipped by the branded vendors.

Overall, it was a difficult quarter for the storage industry due largely to the COVID-19 coronavirus pandemic, said Sebastian Lagana, research manager for infrastructure platforms and technologies at IDC, in a prepared statement.

"ODMs once again generated growth, taking advantage of increasing spend from hyperscalers – demand that we anticipate will remain solid through the first half of 2020 as many enterprises continue to default to remote work, individuals and employees leverage cloud-based collaboration tools, and content delivery networks ensure support for elevated levels of streaming entertainment consumption requirements," Lagana said.

From a technology perspective, revenue for the all-flash storage array business, which over the last few years were a pillar of strength for the overall storage business, grew an anemic 0.4 percent over the first quarter of 2019 to $2.8 billion, while sales of hybrid flash and spinning disk arrays fell 11.5 percent to $2.5 billion, IDC said.

Storage sales to the U.S. market fell 10.0 percent in the first quarter of 2020 versus the first quarter of 2019, IDC said.

Dell Technologies in the first quarter remained the leading storage vendor with revenue of $2.16 billion, IDC reported. That was enough to give it a 33.2 percent market share despite an 8.2 percent drop in sales over last year. Dell Technologies is banking on the introduction earlier of this year of its new PowerStore line of arrays it will use to replace several older lines of mutually incompatible storage arrays.

NetApp kept its number-two spot with revenue for the quarter of $715.7 million. NetApp, which for the last year has seen a drop in storage sales every quarter, has been gradually shifting its focus from on-premises storage hardware to sales of its software for managing data across both on-premises and cloud environments.

HPE came in at third place during the quarter despite a 17.0 percent drop in storage sales over last year to $646.2 million. HPE is in the process of consolidating its Nimble and 3Par storage lines to its new HPE Primera family of arrays.

Coming in fourth was Hitachi Vantara, with sales of $430.3 million, down 8.5 percent from one year earlier. The storage business of Hitachi Vantara, based on the organization previously known as Hitachi Data Systems, is gradually shifting from a focus on selling hardware outright to offering its technology, starting with the new VSP E990, to be consumed as a sale, a lease or a service.

IBM, which IDC said held the number five spot with storage sales of $332.1 million, up 3.8 percent, is also in the process of consolidating its non-mainframe-focused storage lines. The company in February introduced its new FlashSystem line to replace its older Storwize and A9000 families.

Pure Storage was number six in first quarter storage sales with revenue of $311.7 million, up a strong 7.7 percent over last year. Pure Storage sells only all-flash storage, and only through channel partners.

Coming in at number seven was China-based Huawei, which, according to IDC, enjoyed worldwide storage sales growth of 17.7 percent to $270.7 million. That growth was doubly impressive given that Huawei has little-to-no storage sales in the world's largest market, the United States, because of U.S. government concerns about working with Chinese vendors in the IT business.