10 Cool Tech Companies That Raised Funding In August 2021

Next-generation technology developers in AI, big data monitoring and analytics, edge computing and Kubernetes management were among the startup companies that reported new rounds of funding in August.

Follow The Money

Startups pushing the technology envelope in AI development, data management and observability, data analytics, IoT/OT security and edge computing were among the companies that attracted new venture financing in August.

Dataiku, whose AI and machine learning platform is used to develop advanced AI and analytical applications, topped this month’s roundup with a $400 million funding round. Snorkel AI, which provides its own data-centric AI platform, also made the list.

Data analytics, observability and monitoring were hot with Grafana Labs, Cribl, Monte Carlo and Ahana all reporting impressive funding rounds.

What follows are our picks for 10 cool tech startups that landed new funding in August.

Dataiku

Headquarters: New York

CEO: Florian Douetteau

Funding: The $400 million Series E round brought Dataiku’s total funding to $646.8 million and put its pre-money valuation at $4.6 billion.

Investors: The funding round was led by Tiger Global with participation from existing investors ICONIQ Growth, CapitalG, FirstMark Capital, Battery Ventures, Snowflake Ventures and Dawn Capital. New investors included Insight Partners, Eurazeo, Lightrock and Datadog CEO Oliver Pomel.

What the company does: The Dataiku AI and machine learning platform is used by data scientists and data engineers to design, deploy and manage AI and analytical applications.

CEO Quote: “Organizations that use Dataiku elevate their people—whether technical and working in code or on the business side and low- or no-code—to extraordinary, arming them with the ability to make better day-to-day decisions with data.”

Grafana Labs

Headquarters: New York

CEO: Raj Dutt

Funding: The $220 million Series C round put Grafana’s pre-money valuation at $3 billion.

Investors: The funding round was co-led by new investors Sequoia Capital and Coatue, with participation from existing investors Lightspeed Venture Partners, Lead Edge Capital and GIC.

What the company does: Grafana Labs develops a composable monitoring and observability stack built around the Grafana open-source analytics dashboard and data visualization technology.

CEO Quote: “It’s been an incredible year at Grafana Labs, highlighted by the rapid adoption of Grafana Cloud, the growth of our Loki logs and Prometheus metrics offerings, the introduction of Tempo 1.0 for tracing, and the continued development of the Grafana front end.”

Cribl

Headquarters: San Francisco

CEO: Clint Sharp

Funding: The $200 million Series C round brought the company’s total funding to $254 million.

Investors: Greylock and Redpoint Ventures led the round, joined by new investor IVP and existing investors Sequoia and CRV, and included strategic investments from Citi Ventures and cybersecurity tech developer CrowdStrike.

What the company does: Cribl’s observability data engineering software, including its flagship LogStream system, is used to build pipelines for moving high volumes of machine log, instrumentation, application and metric data between operational, storage, analytical and security systems.

CEO Quote: “You’re going to see us talking a lot about how people need to manage petabytes of data at scale and really figure out how to deal with this tide of data growth. We’re going to have two and a half times more data in five years than we have today and, fundamentally, that’s the problem—and the mission—we’re going after.”

Nozomi Networks

Headquarters: San Francisco

CEO: Edgard Capdevielle

Funding: The company described the $100 million Series D round as a pre-IPO funding round.

Investors: The funding round was led by Triangle Peak Partners with participation from Forward Investments, Honeywell Ventures, In-Q-Tel, Keysight Technologies, Porsche Ventures and Telefonica Ventures.

What the company does: Nozomi Networks develops security and visibility technology for Internet of Things and operational technology systems.

CEO Quote: “As we began the fund-raising process, many of the largest ecosystem partners in the world, along with our customers, recognized Nozomi Networks as the industry leader and requested the opportunity to invest in the company. It’s the ultimate endorsement when not only a prestigious firm such as Triangle Peak Partners leads the investment, but customers and partners embrace Nozomi Networks and further validate our market leadership.”

Snorkel AI

Headquarters: Palo Alto, Calif.

CEO: Alex Ratner

Funding: The $85 million Series C round brings the company’s total funding to $135 million and puts the company’s pre-money value at $1 billion.

Investors: The round was co-led by new investor Addition and funds and accounts managed by previous investor BlackRock. Previous investors Greylock, GV, Lightspeed Venture Partners, Nepenthe Capital and Walden also participated.

What the company does: Snorkel Flow, Snorkel AI’s data-centric AI platform, is powered by programmatic data labeling and used to rapidly develop and deploy data-intensive AI applications.

CEO Quote: “We’re incredibly excited by the value Snorkel Flow has driven for our enterprise customers by enabling them to adopt a programmatic, data-centric approach to AI, taking projects previously blocked on the data to production value in days. This new Series C funding will enable us to accelerate the pace of our product development even further and to bring Snorkel Flow to even more domains and use cases.”

Monte Carlo

Headquarters: San Francisco

CEO: Barr Moses

Funding: The $60 million Series C round—the third in less than a year—brings the company’s total financing to $101 million.

Investors: The funding round was led by ICONIQ Growth with participation from Salesforce Ventures and existing investors Accel, GGV Capital and Redpoint Ventures.

What the company does: Monte Carlo’s data observability software is used to monitor data in databases, data warehouses and data lakes to maintain quality, reliability and lineage.

CEO Quote: “The problems of bad data [and] data downtime have been around for a while. But the impact of that has been exacerbated in the last few years as companies actually become data-driven.”

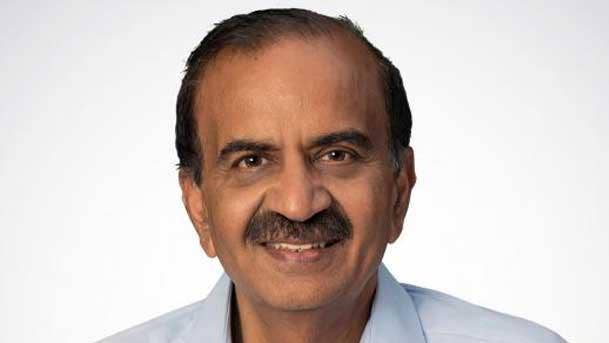

Pensando Systems

Headquarters: Milpitas, Calif.

CEO: Prem Jain

Funding: The $35 million in funding is a continuation of the company’s Series C round that began in October 2019. It brings the company’s total financing to nearly $313 million.

Investors: Ericsson Ventures, Qualcomm Ventures and Liberty Global Ventures (the global investment arm of Dutch telecom giant Liberty Global).

What the company does: Pensando develops a distributed services platform, incorporating a custom programmable processor optimized for edge computing tasks.

CEO Quote: “We’re going to continuously adapt. We will not be able to do everything ourselves,” Jain said of Pensando’s plans to work with major vendors like HPE, Dell and VMware as systems partners and ServiceNow and Splunk as integration partners. “We are very focused on what we can do the best and then partner with other companies to see how we can take advantage of some of the new technologies within the market and bring it to our customers.”

Ahana

Headquarters: San Mateo, Calif.

CEO: Steven Mih

Funding: The $20 million Series A round brings the startup’s total funding to $24.8 million, including last year’s seed funding round.

Investors: The round was led by Third Point Ventures, the emerging technology investment arm of the Third Point LLC investment advisement firm. The oversubscribed round included participation by existing investors GV (formerly Google Ventures), Leslie Ventures and Lux Capital.

What the company does: The Ahana Cloud managed service is a SQL query engine that speeds up queries against huge volumes—even petabytes—of structured and unstructured data in AWS S3 data lakes.

CEO Quote: “We’re at a phenomenal intersection of data, cloud, open source and analytics that’s going to drive many unicorns—it already has. And we see ourselves as one that will do very well over time.”

Armored Things

Headquarters: Boston

CEO: Julie Johnson Roberts

Funding: The Series A round raised $12 million in financing.

Investors: The round was led by Nimble Ventures with additional new investment from Gutbrain Ventures, PBJ Capital and Micromanagement Ventures, and participation from existing investors Glasswing Ventures, Will Ventures and iNovia Capital.

What the company does: Armored Things develops crowd analysis and intelligence software used by facilities and security teams to gain an understanding of how many, and how often, people are utilizing spaces in arenas, buildings and on campuses.

CEO Quote: “The market for crowd intelligence and analytics in sporting [and] entertainment venues and college and corporate campuses is poised for exceptional growth over the next few years. The investment support from Nimble and our new and existing investors puts us in a powerful position to capitalize on that opportunity. The deep experience and expertise they add continues to be invaluable as we take the next steps in our growth.”

Nirmata

Headquarters: San Jose, Calif.

CEO: Jim Bugwadia

Funding: The company raised $4 million in “pre-series” A funding.

Investors: The round was led by Z5 Capital with participation from Uncorrelated Ventures, Samsung Next, Benhamou Global Ventures (BGV) and angel investors Saqib Syed and BV Jagadeesh.

What the company does: Nirmata’s Kyverno is a unified management system for deploying and managing Kubernetes clusters for cloud-based application containerization, providing governance, compliance, security and automation for production Kubernetes workloads and clusters.

CEO Quote: “Kubernetes gives a lot of flexibility in the way that workloads are deployed. Yet developers may not know 80 percent of what needs to be configured, nor should they. Kyverno gives users the ability to focus on what matters—their workloads and applications—by aiding the adoption of Kubernetes policies rather than requiring users to learn and adopt new ones.”