5 Things To Know About Silver Lake’s $1B Investment In Splunk

Splunk disclosed Tuesday that private equity investment company Silver Lake is making a $1 billion investment in the data management software developer. Here are five things to know about the deal.

A $1 Billion Investment

Silver Lake, the global private equity firm focused on investments in technology companies, will make a $1 billion investment in Splunk, the companies said Tuesday.

Silver Lake is specifically purchasing “$1 billion in aggregate principal amount of [Splunk] convertible senior notes,” both companies said.

Kenneth Hao, chairman and managing partner of Silver Lake, will join Splunk’s board of directors, which will now have 11 members.

Splunk said the company will use the investment “to fund growth initiatives and manage its capital structure, including a newly authorized share repurchase program of up to $1 billion that will be executed over time.”

Fueling Splunk’s Transition To The Cloud

Splunk has been transitioning its core “data-to-everything” platform and related software to the cloud, but that transition has been a lengthy, laborious process. Splunk said the $1 billion Silver Lake investment will “support the continued transformation of [Splunk’s] business.”

In the company’s fiscal 2022 first quarter ended April 1, Splunk reported that cloud revenue was $194 million, up 73 percent year over year. But that was still less than half of the company’s total revenue of $502 million in the quarter.

“We have long admired Splunk’s world-class team and technology, and we believe the company is now at an important inflection point,” Hao said in a statement.

“It has become increasingly clear that a cloud-driven transformation is critical to modernization and Splunk is ideally positioned to help organizations throughout the world manage the complexity associated with this transition. We are confident in the opportunities ahead and eager to work with [Splunk CEO Doug Merritt] and his team to support Splunk’s next phase of growth,” Hao said.

A Hit From The Pandemic

Splunk, which has enjoyed robust growth in recent years, has reported slower sales amid the economic chaos of the COVID-19 pandemic. In the company’s fiscal 2021 ended Jan. 31, 2021, revenue declined 5.5 percent to $2.23 billion from $2.36 billion in fiscal 2020.

“Any executive anywhere that says the pandemic hasn’t affected them is either delusional or not truthful,” CEO Merritt was quoted in a November 2020 Forbes article about the impact of the COVID-19 pandemic.

The impact of the pandemic was most pronounced later in the company’s fiscal 2021. Revenue declined 5 percent in the fiscal second quarter ended July 31, 202), 11 percent in the fiscal third quarter 2020 ended Oct. 31, 2020, and 6 percent in the fourth fiscal quarter ended Jan. 31, 2021.

In the company’s recently reported fiscal 2022 first quarter ended April 30, revenue grew 16 percent year over year to $502 million.

The San Francisco-based company has also been transitioning from a perpetual license sales model to a subscription sales model for its software.

Impact On Splunk’s Stock

As of 2:40 p.m. EDT Splunk’s shares were trading at $136.96 per share, up $11.46, or 9.13, percent from the $125.49 Monday close.

In connection with the Silver Lake investment, Splunk’s board has authorized the repurchase of up to $1 billion shares of its common stock. The repurchase is intended to offset the dilutive effect of Silver Lake’s purchase of the notes.

Splunk Expands Its Cloud Security Offerings

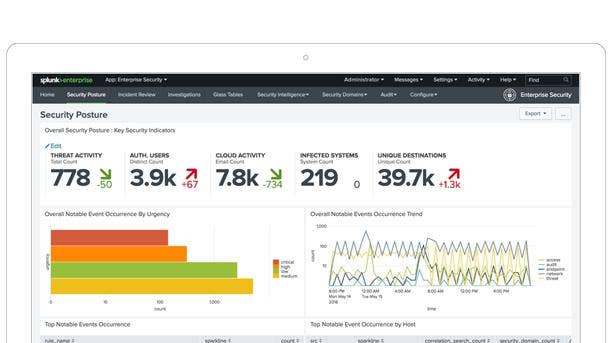

In a major move to expand its cloud software portfolio, Splunk—on the same day of the announcement of the Silver Lake investment—said that its new Splunk Security Cloud service is generally available.

The new cloud offering is a data-centric security operations platform, which the company said “delivers enterprise-grade advanced security analytics, automated security operations and integrated threat intelligence.”