The 10 Hot Data Analytics Companies To Watch In 2020

Businesses today are deriving value and gaining competitive advantages by analyzing increasingly huge, sometimes fast-moving data. Here are 10 data analytics software developers the channel should keep an eye on in 2020.

The Ones To Watch In 2020

Data of different varieties, streaming data, data that’s scattered across multiple systems. Finding, preparing and analyzing data today can be a very complex task.

Helping businesses and organizations accomplish those tasks is the foundation of a major segment of the IT industry. The global big data and analytics software market reached $60.7 billion in 2018 and is expected to grow at a CAGR or 12.5 percent over the next five years, according to market researcher IDC.

Here are 10 companies in the big data analytics space that solution providers should be aware of. Some are long-established companies that, either through acquisitions or development initiatives, are offering new or expanded business intelligence and data analysis capabilities. Others are young companies or startups that are bringing new, innovative technologies to the big data analytics market.

Alteryx

CEO: Dean Stoecker

Alteryx is a rising star in the big data arena. The Irvine, Calif.-based company offers an end-to-end data science and advanced analytics system that works on a standalone basis or as a platform for other business intelligence tools such as Tableau and Qlik.

In April, Alteryx acquired ClearStory Data, a developer of an enterprise-scale, continuous intelligence analytics system for complex, unstructured data. In addition to the technology portfolio, the acquisition of Menlo Park, Calif.-based ClearStory Data brought that company’s engineering talent to Alteryx as well as a presence in the Silicon Valley region.

In October, Alteryx acquired Feature Labs, a developer of AI and machine-learning feature engineering tools launched out of the Massachusetts Institute of Technology. Incorporating the startup’s technology into the Alteryx platform will bring data science and machine learning capabilities to a wider audience of information workers.

Alteryx has also been adding talent to its management ranks. In May, Alan Jacobsen, former director of global analytics at Ford Motor Co., joined Alteryx as chief data and analytics officer. In August, former Capital One and PayPal executive Amy Heidersbach came onboard as chief marketing officer. And in December the company named former Hortonworks executive Scott Davidson to the newly created post of chief operating officer.

Databricks

CEO: Ali Ghodsi

Databricks raised $250 million in venture funding in February and then raised another $400 million just eight months later, giving the big data startup an astounding $6.2 billion valuation, according to Bloomberg.

Why all the fuss? Databricks develops the Unified Analytics Platform, a cloud-based system for “massive scale data engineering and collaborative data science tasks,” according to a company description. And the software is being increasingly used for a range of machine learning automation chores.

The San Francisco-based company was founded by the original developers of Apache Spark, the popular open-source big data analytics engine. Databricks and Spark offer an alternative to Hadoop, the big data platform that hasn’t quite lived up to the hype of a few years ago. And Databricks has been embraced by Microsoft, which is an investor and uses the Databricks software within its Azure cloud system.

The privately held company said in October that it had more than doubled its recurring revenue during the previous year, without disclosing actual numbers.

Logi Analytics

CEO: Steven Schneider

Logi Analytics has achieved a measure of success in the market for embedded analytics, marketing its interactive business intelligence and data visualization software to developers, ISVs and others to build dashboards, reports and self-service analytics into their applications.

Logi Analytics bears watching in the new year because in 2019 it made a couple of strategic acquisitions. In June it bought Zoomdata, developer of an analytics platform for big data and live streaming data. That followed the February acquisition of JReport and its software for “pixel-perfect” operational reporting.

The acquisitions expanded the analytical and reporting capabilities of the Logi Analytics offerings, not to mention providing the McLean, Va.-based company with a global partner network.

Promethium

CEO: Kaycee Lai

The Holy Grail of business analytics is making it easier for everyday business users to conduct their own data analysis tasks without heavy reliance on IT programmers, data scientists and other technical experts.

Startup Promethium, Menlo Park, Calif., offers its Data Navigation System, software that uses machine learning algorithms and natural language processing capabilities, as a breakthrough in that direction. DNS makes it possible for non-technical users to generate SQL queries without knowing where the data being analyzed is located, the software turns a natural language question into a SQL statement that automatically locates and assembles all the relevant data for analysis.

Promethium DNS just launched in October.

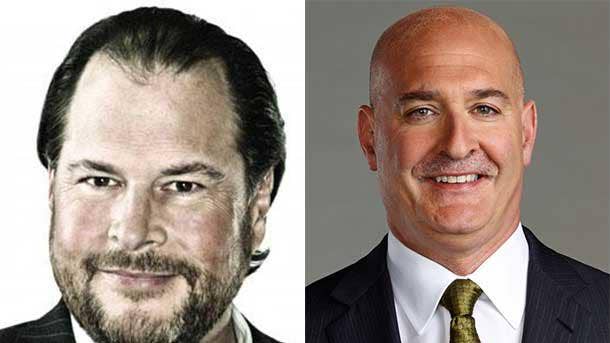

Salesforce.com

CEOs: Marc Benioff and Keith Block

On Aug. 1, cloud application giant Salesforce wrapped up its blockbuster $15.7 billion acquisition of business analytics and data visualization software vendor Tableau Software. The acquisition was seen as evidence of the increasingly data-centric nature of today’s business environment. Salesforce and Tableau executives said the combination of Salesforce CRM applications and Tableau business analytics software would create a digital transformation powerhouse.

Observers will be watching in 2020 to see just how Salesforce makes that happen. Salesforce has promised to continue operating Tableau as an independent subsidiary but has yet to provide details about integrating the two companies’ product lines and how – or if – Tableau’s software will work with Salesforce’s existing Einstein Analytics business intelligence software.

SAS

CEO: James Goodnight

SAS has long been one of the leaders in the business analytics industry. But SAS will be especially interesting to watch in 2020 as the company makes good on its plan to invest $1 billion in AI over the next three years.

In March 2019, SAS announced that it would spend the $1 billion on AI research and development, educational initiatives to address customer needs and help them better understand and benefit from AI, and expert services to optimize customer return on AI projects.

SAS is already working with AI in such areas as advanced analytics, machine learning, deep learning, natural language processing and computer vision. The company is building AI capabilities into the core SAS platform and other applications for data management, customer intelligence, fraud and security intelligence, and risk management, as well as within applications for such industries as financial services, government, health care, manufacturing and retail.

Sight Machine

CEO: Jon Sobel

One of the major promises of Internet of Things technology is the ability to collect operational data from industrial systems and analyze it in order to achieve peak performance. But how to collect and analyze all that data?

Sight Machine, based in San Francisco, has developed a data analytics platform that acquires, refines and contextualizes data from every part, machine, production line and plant throughout a manufacturing company, creating a “digital twin” or virtual representation of physical assets, products, processes or systems that is constantly updated to represent current operational conditions.

The company also offers a number of applications that run on the platform focused on manufacturing productivity, predictive maintenance and product quality.

Sisense

CEO: Amir Orad

SiSense has always been in the top tier of business intelligence software vendors with its comprehensive, single-stack data analytics platform that includes database, ETL (extract, transform and load), analytics and visualization tools.

In May, Sisense acquired Periscope Data, a fast-rising developer of a Software-as-a-Service data analytics system that combines the capabilities of SQL, Python and R, and was generally seen as particularly focused on the data science side of business analytics.

In December Sisense unveiled an update to its platform that incorporated some of Periscope’s technology. For example, a new In-Warehouse Data Prep module for self-service analytics in multi-cloud environments is based on Periscope’s Data Engine technology

As Sisense moves into 2020, observers will be watching to see how successful the company is at further leveraging the Periscope acquisition for competitive advantage.

Tibco

CEO: Dan Streetman

Tibco has been a significant player in the business analytics space in recent years with its Spotfire data visualization and analytics software and its Jaspersoft reporting software. Tibco was one of the top leaders in the most recent Forrester Wave: Enterprise BI Platforms report from Forrester Research.

In the last year Tibco has been expanding its big data technology portfolio to include more software in the data management realm. In March Tibco acquired SnappyData, developer of a high-performance, in-memory data system to complement the Tibco Connected Intelligence platform. Just a few months earlier Tibco bought Orchestra Networks, a developer of master data management and data asset management software. That follows the company’s 2017 purchase of Cisco’s data virtualization business.

So Tibco is entering 2020 with a more complete data management and business analytics product lineup. With Tableau and Looker Data Sciences being acquired by Salesforce.com and Google Cloud, respectively, the company could become one of the bigger independent business analytics vendors in 2020. But this year reports surfaced that Broadcom, the chip manufacturer that acquired CA Technologies and Symantec’s enterprise security business, was also eyeing Tibco for a possible acquisition deal.

VoiceBase

CEO: Walter Bachtiger

VoiceBase is a developer of AI-powered speech analytics software that analyzes recorded calls from call centers and other departments to provide sales, marketing and service operations with insights about customer experience, product feedback, marketing campaign effectiveness, compliance and agent performance.

VoiceBase’s products use deep-learning speech technology, natural language processing capabilities, a query language and predictive analytics models to provide speech analytics, automatic speech-to-text transcription, knowledge extraction from transcripts, and AI-based predictive analytics to determine the intent behind what’s spoken. The company recently added the ability to analyze text data, such as from chats, emails and social data postings.

San Francisco-based VoiceBase was founded in 2010. This year the company partnered with data visualization giant Tableau software, linking the two companies’ technologies for developing visual representations of VoiceBase’s analytical results.