The Best-Selling Vendors Of 2010

2010 Best Sellers: Top Vendors

Cisco Systems and Hewlett-Packard exercised their dominance last year in multiple product categories in terms of revenue through distribution, but 2010 also marked a period when two long-time runner-ups gained the No. 1 spot in the notebooks and hard drive categories.

Here's a closer look at the best-selling IT vendors in 2010 in terms of dollar share value and how their performance changed from 2009, according to NPD Group's research. (The NPD Group's Distributor Track sales database is comprised primarily of U.S. Global Technology Distribution Council members.)

Also, check out the best-selling products of 2010.

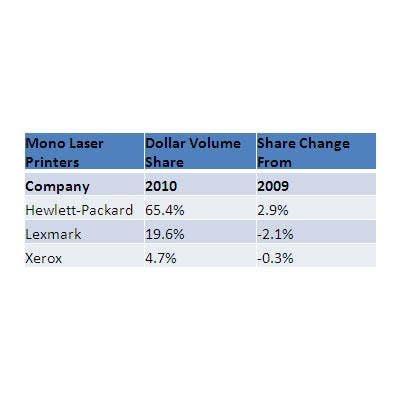

Monochrome Laser Printers

Hewlett-Packard once again dominated this category, and gained market share at the expense of its two closest competitors, Lexmark and Xerox.

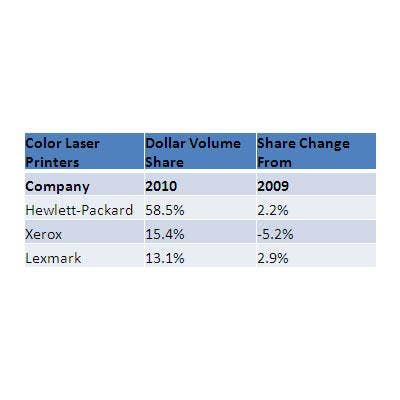

Color Laser Printers

Hewlett-Packard doesn't have as much share in color laser as it does with monochrome, and lost some share in 2010, but still dominates the market.

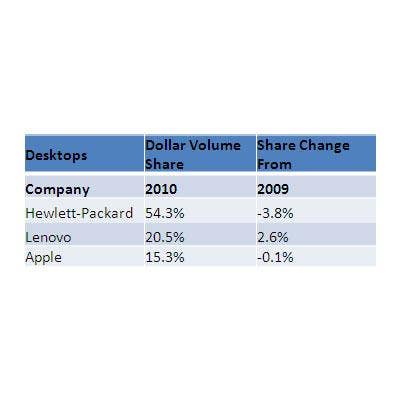

Desktops

Hewlett-Packard's dominance extends far beyond printers as it holds more than 50 percent share in desktop dollar volume through distribution too, according to NPD Group.

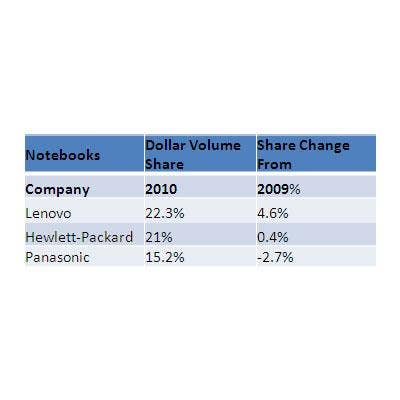

Notebooks

Lenovo surpassed Hewlett-Packard in 2010 in terms of notebook dollar volume through distributors, gaining significant share while HP's share growth remained relatively flat compared to 2009. It marks the first time Lenovo has been the No. 1 notebook vendor through distribution since NPD started reporting sales through distribution.

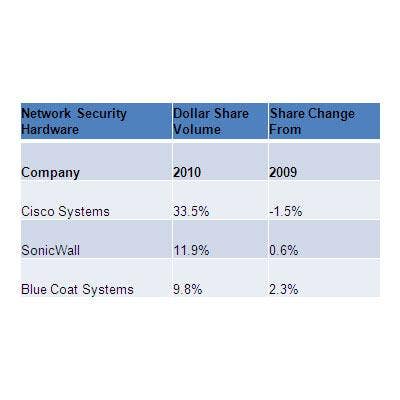

Network Security Hardware

Cisco Systems has long dominated this space and still has nearly 3x the share of its nearest competitor despite losing 1.5 percent share in 2009.

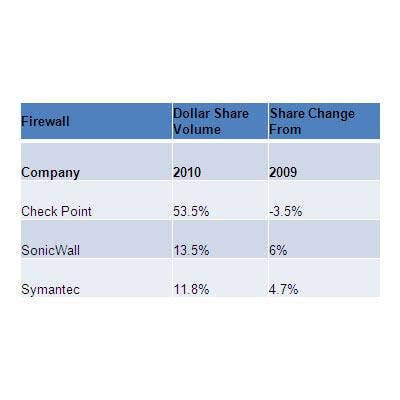

Firewall

SonicWall and Symantec gained significant share in 2010, according to NPD Group, but Check Point still emerged as the Best Selling firewall vendor through distribution in 2010.

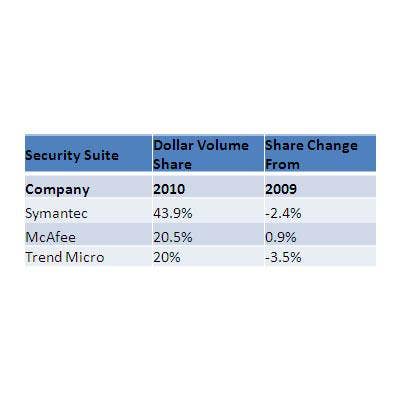

Security Suites

Symantec lost a couple points of margin share in 2010 in security suite revenue through distribution, but the security giant still held more share than McAfee and Trend Micro combined.

Relational Database

Three companies accounted for more than 95 percent of the market in 2010, with Microsoft still leading the charge.

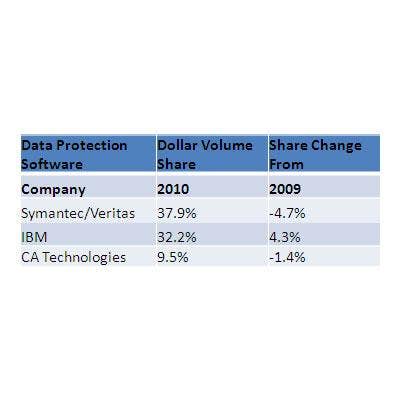

Data Protection Software

Symantec/Veritas owned this market in 2009, but IBM gained enough share last year to make it a two-company race.

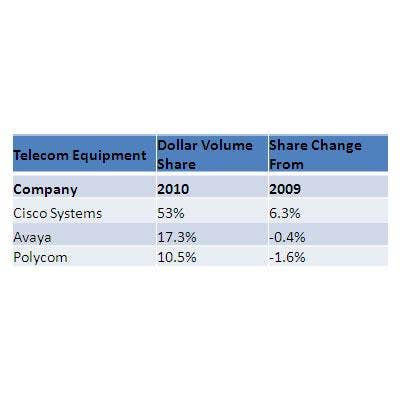

Telecom Equipment

Cisco's channel dominance was quite evident in telecom equipment revenue in 2010 as the networking giant earned more than half of all dollars spent in that category through distribution.

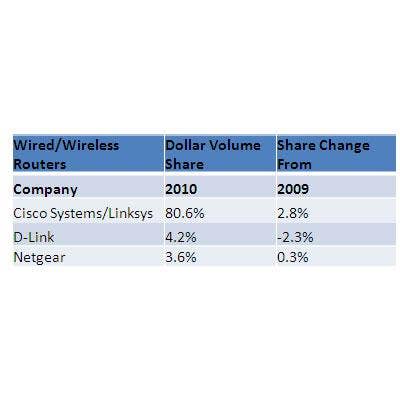

Wired/Wireless Routers

Nobody dominates any product category the way Cisco/Linksys dominates the router category. Cisco even gained shared in 2010 to surpass the 80 percent mark.

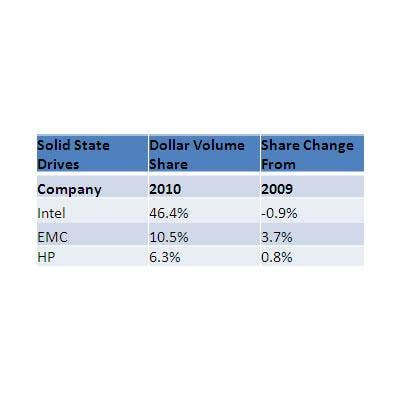

Solid State Drives

Solid state drives is a fairly new category for NPD, and Intel captured nearly half of all dollars spent in 2010 while EMC and HP picked up some market share compared to 2009.

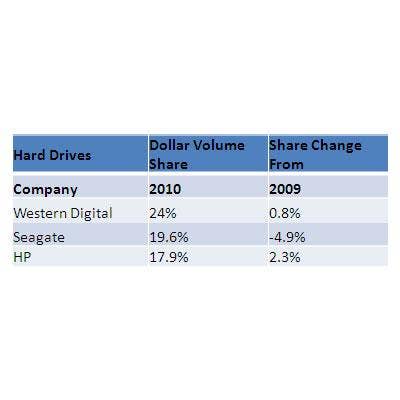

Hard Drives

Western Digital surpassed Seagate last year for the first time in NPD's data in the hard drive category. Western Digital gained minor share, but Seagate lost almost 5 percent share in 2010.

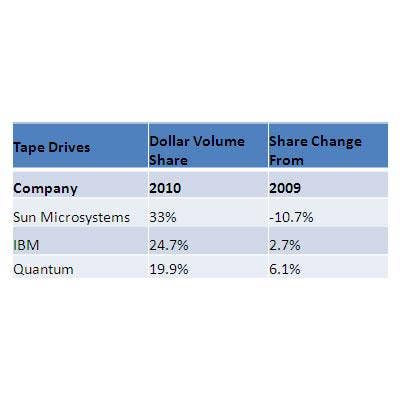

Tape Drives

Sun Microsystems lost its big lead in this category after seeing an unusual spike in 2009 corrected last year, according to NPD. While still holding a comfortable lead over IBM and Quantum, the latter two companies gained share from Sun in 2010.

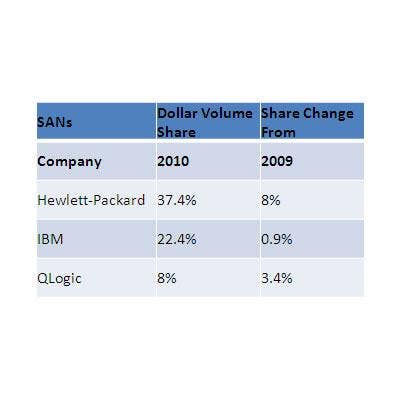

SANs

Hewlett-Packard widened its lead in the SAN category, in terms of dollar volume share through distribution, in 2010, gaining share at the expense of third-place company QLogic.

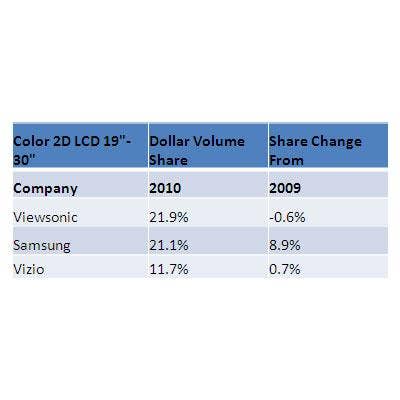

Color LCD, 19-30 Inches

Viewsonic is still the best-selling vendor in this category -- barely. Samsung gained significant share in 2010 to pull neck and neck with Viewsonic. Samsung's share grew after adding a distributor, according to NPD Group.

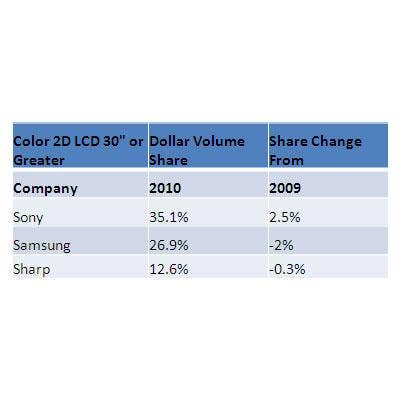

Color LCD, 30 Inches And Above

Sony widened its lead in the LCD 30 inches and above category, according to NPD. More than one-third of all dollars spent in 2010 in the category went to Sony, with Samsung getting almost 27 percent share.

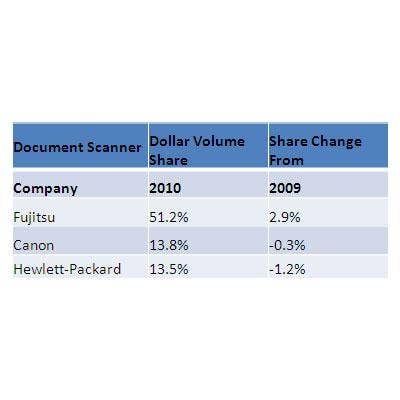

Document Scanners

It's Fujitsu and then everyone else in the document scanner category, again. Fujitsu gained some share from its next closest competitors, Canon and Hewlett-Packard.

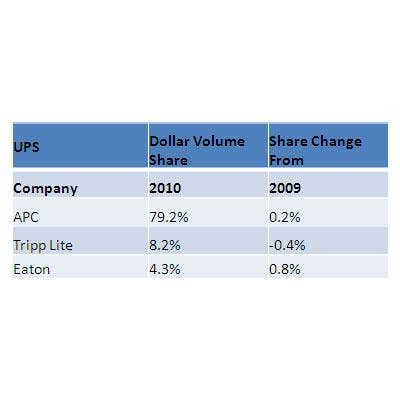

UPSes

It's certainly no surprise that American Power Conversion dominates the UPS space, but it's perhaps somewhat shocking that the company can still pick up some share, albeit ever so slight, from its closest competitor, Tripp Lite.

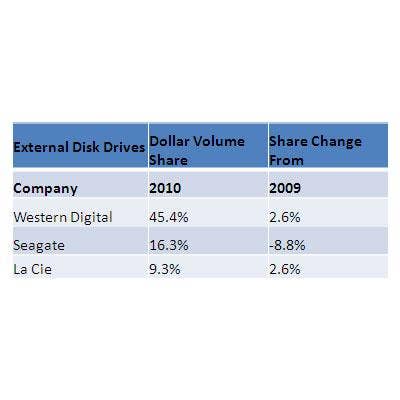

External Disk Drives

Seagate's challenges in hard drives extended to this category too where the company lost about one-third of its 2009 share last year. Meanwhile, Western Digital continues to grow. Seagate's share spiked in 2009, according to NPD Group, and its showing in 2010 seemed to be a correction in the market.

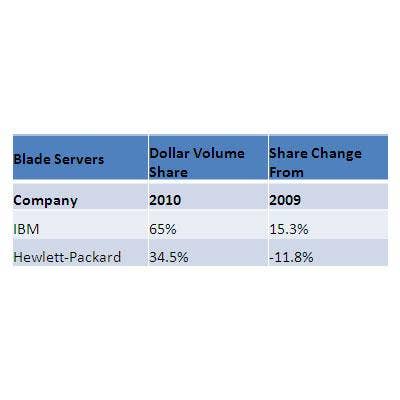

Blade Servers

IBM and Hewlett-Packard were nearly even in this category in 2009, but IBM took a big lead in 2010, according to NPD Group.