What Do Vendors Really Think Of Distribution?

Vendor Survey

At the Global Technology Distribution Council's annual Vendor Summit last month, vendors took a real-time survey during one of the sessions to get their take on distribution relationships, the challenge of spreading the channel gospel within their own organization and where they see the business going. In all, more than 200 attendees from 65 vendors were on hand. Here's a look at the results.

Business: Feast Or Famine

About one-third of vendor executives said their business was booming -- growing by at least 10 percent. But, a quarter of the respondents also said sales were declining compared to last year.

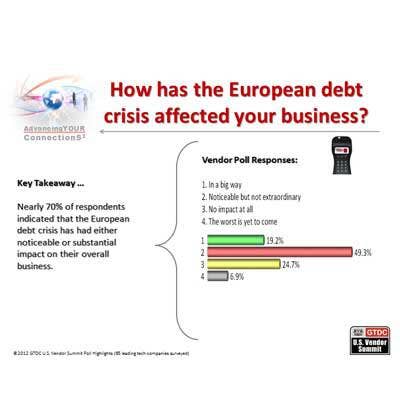

Impact Of European Debt

Nearly 70 percent of respondents said the European debt was having some impact, though most of that group said the impact was "noticeable but not extraordinary." The bad news is almost 7 percent said the worst is yet to come.

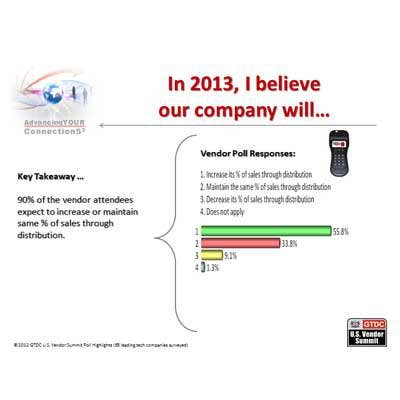

Value Of Distribution

More than half of the vendor executives expect their percentage of sales through distribution to increase, perhaps not surprising because the execs were at a GTDC conference and already have strong relationships with distributors in most cases.

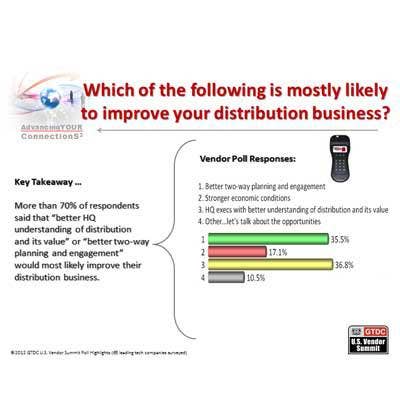

Top Execs Need More Understanding

The vendor executives on hand, mostly channel chiefs and other channel executives within their organizations, said their business through distribution could improve if executives back at headquarters had a better understanding of the value that distribution provides. Additionally, better two-way planning and engagement could also improve those relationships.

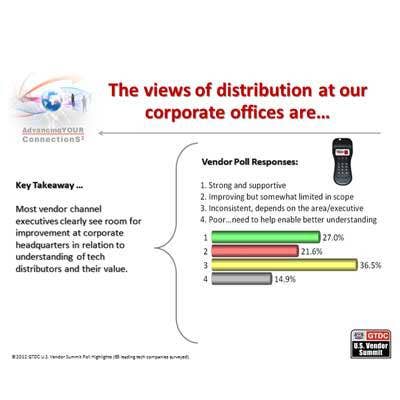

Inconsistent Views

Asked what the views of distributors are within a vendor's corporate offices, more respondents chose "inconsistent, depends on the area/executive" than any other answer. The good news is that 27 percent said distribution is viewed as strong and supportive, and another 21.6 percent said the value of distribution is improving within the vendor's corporate walls. But, another 15 percent said distribution has a poor perception among corporate executives.

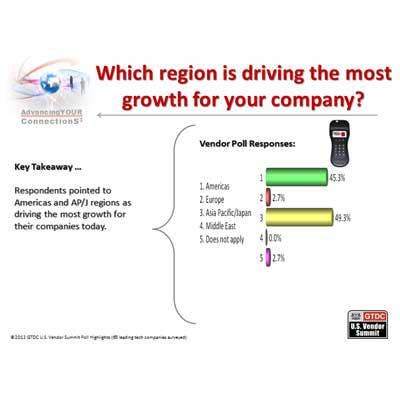

Americas, Asia Driving Growth

With much of Europe in financial crisis, it's perhaps no surprise that most vendor executives picked Asia Pacific/Japan (49.3 percent) and the Americas (45.3 percent) as the region responsible for driving the most growth for their respective companies.

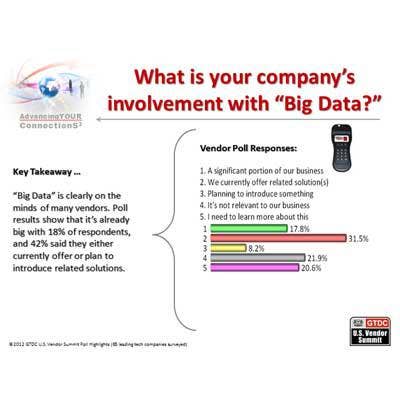

To Big Data Or Not To Big Data

While nearly half of respondents said that big data accounts for a significant portion of their business or they currently offer solutions in that area, more than 40 percent said it's not relevant to their business or they need to learn more about it.

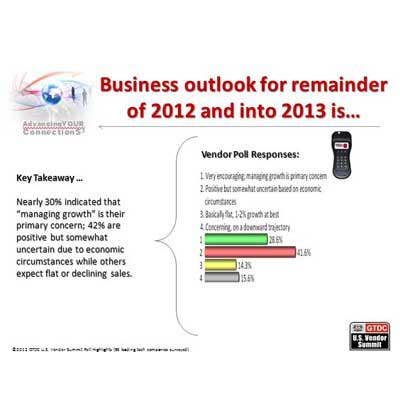

Cautious Outlook

Similar to pretty much every other economic indicator, vendor executives at the GTDC Summit are encouraged about managing growth into 2013 but uncertain about what will happen based on economic circumstances.

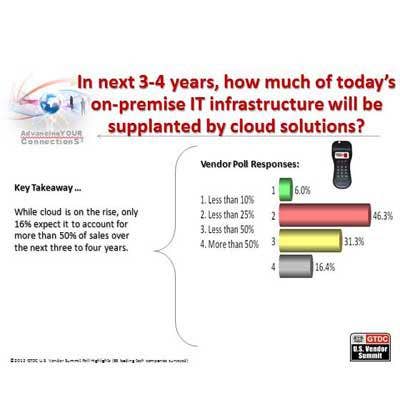

Cloudy Future

Cloud computing will be an area of growth for the next three or four years, but it is unlikely to supplant on-premise solutions as the top IT infrastructure during that period. Almost half of respondents think cloud will account for between 10 and 25 percent of IT solutions.

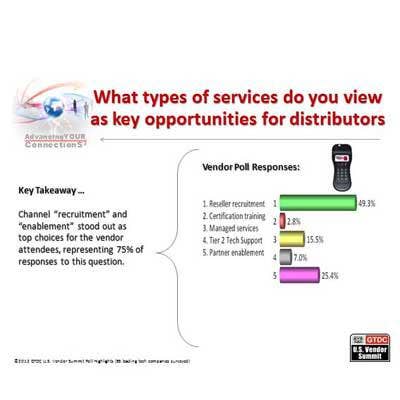

Distributors As Recruiters

Nearly half of the executives said reseller recruitment is the top opportunity for vendors to leverage through distribution, according to the survey. And for current solution providers, distributors can help enable those partners too, executives said.