10 Most Controversial Companies Of 2012

A Year Of Controversy

Some companies sail along quietly delivering quarter after quarter of solid financial results. Others seem like magnets for controversy and can't seem to stay out of the headlines. And then there are those companies that always seem to be bickering with others -- or suing them for some perceived slight.

Here CRN provides its listing of the 10 companies that just couldn't escape drama this year, in many cases because they live for the adrenaline rush that conflict and intrigue adds to the proceedings.

10. Intel

Like many IT companies, Intel has seen its fair share of changes this year. In January, Intel restructured its executive team, appointing Brian Krzanich, former senior vice president of worldwide manufacturing, as chief operating officer. The bigger change, of course, is that Intel CEO Paul Otellini (pictured) will be stepping down next May, ending a nearly 40-year run with the company. Otellini's decision apparently came as a surprise, judging from what Intel Chairman and former CFO Andy Bryant told Barron's in the wake of the announcement.

"I did everything I can think of to buy myself another year [of Otellini's leadership]," Bryant told Barron's. "We were targeting further out for [his retirement]."

Otellini earlier this month said he expects his successor will come from within Intel, but in the meantime, some analysts are pumping the brakes on recommending Intel shares until the leadership success picture gets clearer.

9. Nokia

Nokia entered the year struggling financially and with a strategy that relied a great deal on the success of Microsoft's Windows Phone. One bright spot for the Finnish handset maker was its September unveiling of the Lumia 920 smartphone, which runs Microsoft's new Windows Phone 8.

The Lumia 920 (pictured) was supposed to catapult Nokia and Microsoft back into some semblance of relevance in the smartphone market. But Nokia's embarrassing admission that it faked a demo video meant to showcase the capabilities of the Lumia 920's video camera didn't help matters.

The Lumia 920 is sold out in many regions, and Nokia shares have rallied recently as a result. However, some analysts question whether this is due to rampant demand or short supply. Nokia is exiting 2012 in much the same position it entered the year, with some glimmers of hope surrounded by pressing questions about its future.

8. Facebook

Facebook raised more than $100 billion in one of the most anticipated initial public offerings in tech history. Shares began the day trading at $38 and reached a high of $45, only to drift back to their opening levels.

And then, to the shock and disappointment of investors, Facebook shares went into an extended free fall, hitting a low of $17.73 in September and triggering class action lawsuits. Questions swirled about the viability of Facebook's premium advertising model, and analysts wondered if the company would ever be able to figure out how to make money from mobile ads.

7. Symantec

Symantec's decision to part ways with CEO Enrique Salem (pictured) in July and its subsequent reorganization of its global sales team were interpreted by Wall Street as signs of the vendor's struggle to transition from the shrink-wrapped software to the software-as-a-service.

Some Wall Street analysts hailed the move as a positive, while others said the move could portend a possible breakup of the company that would separate its security and storage businesses.

This has been a year of big changes at Symantec, and it remains to be seen whether the shakeup in leadership will help get the company back on track.

6. Research In Motion

Much ink has been spilled over Research in Motion's delay in getting its BlackBerry 10 operating system out the door, and it has all been happening against the backdrop of declining sales, acquisition rumors, departing staff and a general pessimism about its ability to remain relevant in the mobile space.

Longtime RIM co-CEOs Mike Lazaridis and Jim Balsillie (pictured) finally stepped down in January, handing the reins to RIM insider Thorsten Heins. "We have a clear shot at being the No. 3 platform in the market," Heins said in September at the BlackBerry Jam conference in San Jose, Calif., according to a report from CNet. "Carriers want other platforms. And we're not just another open platform running on another system. We're BlackBerry."

RIM recently confirmed its plan to launch BlackBerry 10 on Jan. 30.

5. Apple

Apple caused a ruckus in March when it rolled out its third-generation iPad and revealed that it would be called "new iPad." For some reason, people seemed to focus more on this than on the new iPad's high-definition Retina display.

Apple customers freaked out again in October after the rollout of the iPad mini and the fourth-generation iPad, an incremental update with few new bells and whistles. Many were peeved that they only had the warm feeling of owning the newest iPad for seven months.

None of this compared to the Apple Maps debacle, though. Replacing Google Maps in the iOS 6 update, Apple's home-brewed maps app, was poorly designed and immediately emerged as untrustworthy as a navigational aid. Apple ended up firing iOS chief Scott Forstall for refusing to apologize for the buggy app, and CEO Tim Cook apologized for the whole fiasco.

4. Oracle

Oracle entered 2012 in full squabble mode with HP over apps for HP's Itanium-based server platform, and eventually lost when a court ruled that Oracle is legally obligated to continue developing software for it.

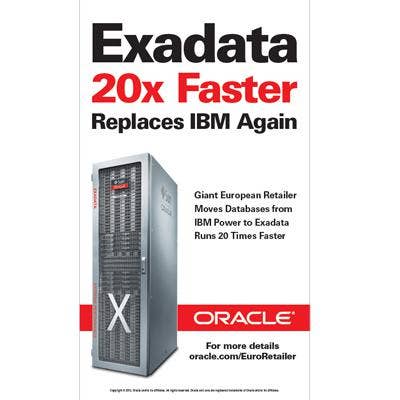

Oracle also got more aggressive with rival IBM in advertisements promoting its Exadata Database Machines. A little too aggressive, as it turned out. IBM challenged the Oracle ads in a complaint filed July 5 with the Advertising Self-Regulatory Council (ASRC) of the National Advertising Division (NAD). The group ruled in IBM's favor, and Oracle discontinued the campaign.

3. Microsoft

Windows 8 churned up all kinds of sub-plots during the run-up to its launch in October, and even after. First, Microsoft rankled iPad-loving organizations with its Windows 8 Companion Device License (CDL), which amounts to an extra cost for customers that access Windows on non-Microsoft devices. "We are in a battle," CEO Steve Ballmer told CRN in July by way of explanation.

Then Microsoft unveiled Surface (pictured), its first ever foray into tablet hardware. Aside from Acer, OEMs didn't have much to say about Surface despite its potential to compete directly with their own Windows 8 tablets.

The intrigue thickened when Steven Sinofsky, head of the Windows unit and a 23-year Microsoft veteran, left the company amid rumors of friction with other business unit.

2. Autonomy

Despite the staggering price tag, many analysts and channel partners believed that Hewlett-Packard's $11.1 billion Autonomy acquisition was a bold and perhaps necessary move that stood a good chance of succeeding. Bringing in someone the caliber of Autonomy co-founder and CEO Mike Lynch (pictured), whose success has prompted comparisons with Bill Gates, could only yield positive things -- or so it was thought.

But three months after Lynch delivered a rousing presentation onstage at HP's Global Partner Conference, HP fired him for missing his numbers. Later, HP took an $8.8 billion charge, $5 billion of which was tied to the Autonomy deal, and accused Lynch and his team of cooking the books prior to the acquisition.

Lynch has denied any wrongdoing and said HP was merely trying to make him the scapegoat for its own mismanagement of Autonomy. He challenged HP to back up its claims, even going so far as to create a public website to respond to HP's accusations.

1. Hewlett-Packard

HP, after a turbulent 2011, reached a Kardashians-level of drama this year, which is exactly what CEO Meg Whitman (pictured) didn't want.

Whitman, in a triumphant and ebullient speech to attendees at HP's Global Partner conference in February, vowed to keep HP on an even keel and out of the headlines.

Things didn't work out that way. Slowing PC and printer sales contributed to quarter after quarter of disappointing financial results, sending shares on a steady decline. HP announced it would lay off 27,000 employees, and several top executives left.

Things really got ugly after Autonomy CEO Mike Lynch was shown the door along with most of his executive team. Later, HP took a $5 billion charge on the Autonomy deal and accused Lynch and his team of cooking the books prior to the acquisition. Much finger-pointing ensued, and even ex-CEO Leo Apotheker joined in.