Dell Banks On Partners As It Enters Choppy Waters, Says Channel Chief

Dell's Greg Davis: View From Above

With corporate raider Carl Icahn yammering about sacking CEO Michael Dell and demand for its PCs quickly drying up, Dell is turning to its partners for help. And, according to Greg Davis, vice president and general manager of Dell's global channel, they’re delivering.

Dell's channel chief oversees the company's 140,000 resellers that make up the computer maker's PartnerDirect program. "We can't compete alone," Davis said in a one-on-one interview with CRN. Partners are Dell’s lifeblood, he said, helping it slug it out in a dog-eat-dog battle to stay one step ahead of its archrivals Hewlett-Packard, IBM and Lenovo.

CRN recently caught up with Davis, and had a chance to ask him about his channel challenges, Dell's buyout distractions and its recent mixed fiscal second-quarter performance. Here's what he had to say.

Dell's Challenges

Dell's fiscal second-quarter results were mixed. Net income dropped 72 percent and revenue was flat compared with the prior year. Since then it's been on an acquisition spree, buying 25 companies to build out networking, software and services businesses. Notable buys include Quest Software, Perot Systems, Force 10 Networks and Wyse Technologies. One of its biggest hurdles is to retool itself into an all-around provider of hardware, software and services, similar to rivals IBM and HP, except to keep a focus primarily on the midmarket.

Davis told CRN it has had some success, but combining those acquisitions into cohesive "integrated systems" will be a long road. Davis said it could be a two- to three-year journey. "We have acquired multiple companies in the last 18 months. Each one of them has had different deals, tools and portals. If partners want to sell a complete Dell solution today you have to use three different tools. It's not ideal," he said. "Our commitment is making Dell the easiest partner to work with. And we are getting there."

Buyout Blues

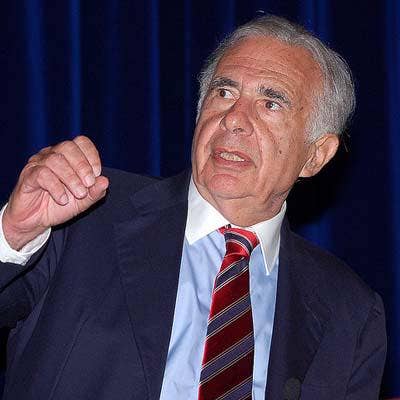

Dell has lots of balls in the air -- from Michael Dell's $24.8 billion privatization bid, to activist investor Carl Icahn (pictured) attacking Dell's leadership, and a slumping PC market. A number of partners have told CRN they are concerned. They say they are worried that Dell will change as it transitions either leadership or goes private, and not for the better. Davis maintains, however, that Dell is committed to its channel strategy. "I'm committed," he said. "I've said it publicly, put it in written letters, and I've said it at town halls. While I can't foresee all activities that could impact Dell and I can't comment directly on what will happen under different scenarios, we have been open and honest about our strategy. It doesn't change."

A number of partners also have told CRN that they've noticed Dell's numerous staff changes and departures, leading them to believe Dell is undergoing some belt-tightening. Davis attempts to put partners' minds at ease. "I can't talk about belt-tightening. I can say Dell's channel team has grown and continues to grow," he said. "We continue to make an investment in channel resources."

Market Share Horse Race

On a bright note, Dell's aggressive sales tactics have paid off when it comes to winning market share. Dell's worldwide server unit shipments rose in the second quarter as rivals HP and IBM lost ground, according to sources that have seen the preliminary data from market researcher IDC. The IDC data shows Dell's server unit shipments in the second quarter were up 4.8 percent to 552,486 units, just 28,684 units behind No. 1 global shipment winner HP.

"We are very proud we are beating the market when it comes to growth. We won't rest on our laurels. We have to earn it every day," Davis said, in reference to Dell's recent market share wins.

"From a channel perspective, we have to be able to compete on price. We are committed to being price-competitive. But we can't compete on price alone. We have to sell the value of an entire solution. It's much more than just about selling a system. It's about more complex solutions."

Unified Channel Program

Dell's acquisition of Quest Software has meant increased sales opportunities for both the Dell and Quest partner community, but the integration of the product and channel programs has been bumpy. Davis said its "Better Together" channel story will soon morph into a Dell "Easy to Work With" channel story.

Next month, Davis said, Dell will be folding its software group into the PartnerDirect program, giving partners 150 software products to sell. Part of its September push also will include new PartnerDirect tools, training and deal registration tools.

Dell partners previously had multiple channel programs and tools for selling Quest, SonicWall and Wyse products. Starting in September, instead of having to register deals through multiple tools, there will be one -- Dell PartnerDirect. "Our partners can work with Dell with storage, server, networking, security and now software from one destination," he said. "There's still a lot of integration work for us to do, but we're moving along."

Channel Recruitment

Some VARs also have confided to CRN that they are worried about Dell's battles with Carl Icahn and fear what might happen to the long-term prospect of Dell’s business should he take control of the company. Davis declined to comment on Dell's pending buyout and battles with Icahn. But he said uncertainty hasn't impacted partner relations.

"These distractions are not affecting our channel or our partners' ability to build relationships with customers. We believe in our strategy. We believe in a strong partnership," Davis said.

Partner Growth

It's no surprise Davis believes the key to Dell's success is rooted in its partners. Last month's impressive server share gains against HP and IBM, Dell partially attributed to its partners.

Davis said the number of Dell partners in the company's PartnerDirect program is up 38 percent in the last year to 140,000. What is more important, Davis said, is its number of Preferred- and Premium-level partners, which now stands at 4,200, up 17 percent from the previous year.

Dell partners are responsible for bringing in 33 percent of Dell's global commercial revenue this past quarter, Davis said. In 2007, the channel brought in roughly 14 to 16 percent of revenue, he said.

Sell, Sell, Sell

Recent market share wins, however, haven't been without some consequences. Selling systems with razor-thin margins came at a cost, driving down operating income 71 percent for Dell's PC division, according to second-quarter earnings.

Part of Dell's plan has been to cut prices to the bone. Davis said he is pinning his hopes on that the PCs Dell sells to companies will lead to more lucrative software and services sales down the road.

"The channel is absolutely part of our growth strategy. That's why we have been building our partner business and training opportunities," Davis said. "We have new deal-registration tools for selling servers, security and storage. We've seen a 14 percent increase in partner deal registrations and are approving 72 percent of the deals. We are focused on integration of software competencies, and ramping up [the] channel so they know what the solutions are and can sell them."

Training Is Key

While a growing number of training courses might be considered a necessary inconvenience for VARs, Davis said training via the PartnerDirect program is the key to selling integrated solutions -- not just hardware. That translates into better sales numbers for partners and Dell.

"Training partners and growing our partner business is absolutely a key part of Dell's channel strategy. We need a base of partners who are trained in helping companies with completely embedded solutions for database, storage and security. Bottom line, we have more people focused on the channel this year than we did last year, and next year we'll have more people than this year."

More Training Courses, Expanded Offerings

Dell delivered 110,000 training courses to solution providers in the first six months of Dell's fiscal year, Davis said, with a major push to bring even more training programs from recent acquisitions into one solution. The strategy involves going deeper, and merging existing training opportunities that existed with Quest, EqualLogic, Compellent and Force 10 Networks, he said.

Davis said Dell is adding four new software competencies to its training portfolio, including security, systems management, data protection and information management.

Davis said combining those acquisitions into cohesive "integrated systems" is a Herculean effort on Dell's part, but should be a painless transition from a partner perspective.