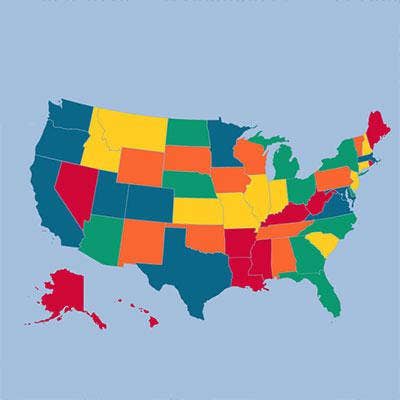

Best And Worst States 2014: Taxes And Regulations

The Top Five And The Bottom Five

Entrepreneurs have a lot to think about when starting and growing a business. What they don't want to have to think about are taxes and red tape.

CRN's analysis of the best and worst states in which to start a solution provider business included an examination of the states with the highest and lowest tax and regulatory burdens for businesses. The examination looked at states' corporate tax rates (as of Jan. 1, 2014), property taxes, regulatory environment, and tax incentives for job creation, research and development, and other business investments. Information sources included reports from the Tax Foundation, the Federation of Tax Administrators, and Forbes Best States For Business.

The first five states have the highest scores (No. 5 to No. 1), followed by the five with the worst rankings (No. 46 to No. 50) on overall taxes and regulation.

Taxes And Regulations No. 5: Idaho

Idaho has a 7.4-percent corporate income tax, ranking it No. 18 in the CRN analysis. But the Gem State is ranked No. 3 for its low property taxes and No. 1 (along with many other states, including some of the top five) for tax incentives and credits. Idaho ranked a middle-of-the-road No. 21 for its regulatory environment.

Taxes And Regulations No. 4: Oklahoma

Oklahoma ranked No. 12 for its 6-percent corporate income tax and No. 11 for property taxes. On the regulatory environment side the Sooner State was ranked No. 13 in the CRN analysis.

Taxes And Regulations No. 3: Nevada

Nevada ranked No. 1 for corporate income tax – because it's one of a handful of states that doesn't have one. And it was ranked No. 9 for low property taxes. But the Silver State's ranking for regulatory environment was a mediocre No. 31 and it was No. 48 for available tax incentives and credits.

Taxes And Regulations No. 2: Missouri

Missouri ranked No. 7 for its 6.25-percent corporate income tax and No. 7 for its property taxes. For its regulatory environment the Show Me State was ranked a business-friendly No. 6.

Taxes And Regulations No. 1: Utah

Utah, which ranked No. 3 overall in this year's Best States analysis, was No. 5 for its corporate income tax (5 percent) and No. 4 for property taxes. For its regulatory environment the Beehive State was ranked No. 8.

Taxes And Regulations No. 46: Illinois

Now we come to the states that are not the most business friendly when it comes to taxes and regulations.

Illinois has a corporate income tax rate of 9.5 percent, resulting in a No. 47 rank among all the states. The Prairie State also scored poorly (ranked No. 44) for its high property taxes and for its regulatory environment (No. 34).

Taxes And Regulations No. 47: New Jersey

New Jersey takes a hit from its high property taxes, ranked No. 50 among all states. The Garden State is ranked No. 41 for its 9-percent corporate income tax (for companies with income greater than $100,000, with lower rates of 6.5 percent and 7.5 percent for companies with less income).

New Jersey also doesn't do well in the regulatory environment department where it ranks No. 38.

Taxes And Regulations No. 48: Rhode Island

Rhode Island ranked dead last in this year's overall Best States analysis and the Ocean State's poor scores in the taxes and regulations criteria was a major reason why.

Rhode Island has a 9-percent corporate income tax rate, ranking the Ocean State No. 43 in the CRN analysis. The state was ranked even worse for its property taxes (No. 46) and was worst among all the states (No. 50) for its regulatory environment.

Taxes And Regulations No. 49: Vermont

Vermont was ranked No. 48 for its high property taxes and No. 47 for its regulatory environment.

The Green Mountain State's top corporate tax rate is 8.5 percent for corporate income above $25,000 (with rates of 6 percent and 7 percent for lesser amounts), rates that ranked the state No. 42 in that criterion.

Taxes And Regulations No. 50: New Hampshire

New Hampshire likes to promote itself as a low-tax state, given that it has no personal income tax or state sales tax. But our analysis shows that the Granite State isn't so friendly for businesses.

New Hampshire has a corporate income tax of 8.5 percent, higher than (gasp!) neighboring Massachusetts (8 percent) and not far behind California's 8.84 percent. That ranked New Hampshire at No. 48 in corporate taxes. Its rank for property taxes was No. 42 and for regulatory environment was a poor No. 46.