8 Solution Providers In The 2015 Fortune 1000

Struggling To Keep Pace

The eight largest North American publicly traded solution providers fell a combined 63 spots in the 2015 Fortune 1000 rankings, as only CDW, Cognizant and PC Connection improved upon their 2014 spots.

Revenue for these eight solution providers increased by a total of just $830 million in the most recent fiscal year, while profit declined by a combined $16.1 million. Despite both falling on the Fortune rankings, Systemax passed Unisys on the list due to a stronger 2014 sales performance. Both companies are now within striking distance of CACI after the federal solution provider saw a significant decline in revenue.

Keep reading to learn how the top solution providers fared on this year's Fortune 1000.

8. PC Connection

2015 Fortune 1000 Rank: 876 (up 36 spots)

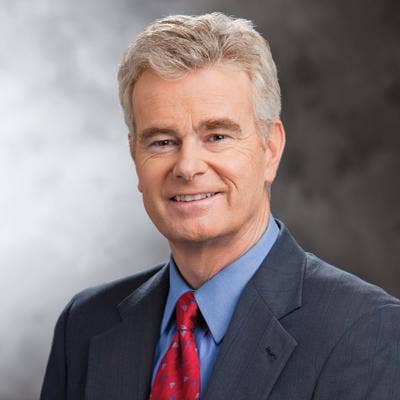

CEO: Timothy McGrath

PC Connection, Merrimack N.H., moved from No. 912 on the Fortune 1000 to No. 876. The company, ranked No. 20 on the 2015 CRN Solution Provider 500, increased profit by 19 percent in 2014 to $43 million and improved its revenue by 10 percent to $2.46 billion.

The company boosted its sales early last year due to the large amount of upgraded PCs and notebooks it sold leading up to the end of Microsoft support for Windows XP.

7. Unisys

2015 Fortune 1000 Rank: 696 (down 32 spots)

CEO: Peter Altabef

Unisys fell in the Fortune 1000 rankings from No. 664 to No. 696 after experiencing a 2 percent drop in revenue to $3.36 billion despite the relative strength of its federal business. Profit for the Blue Bell, Pa.-based company plummeted by 57 percent in 2014 to $47 million.

The solution provider has brought in a lot of new blood to help turn things around, including former Dell Services president Peter Altabef -- who started as Unisys' CEO in January -- and former Accenture executive Neil Gissler, who will serve as senior vice president of services.

The company, ranked No. 19 on the 2015 CRN Solution Provider 500, plans to spend $300 million on the restructuring process, which will result in a layoff of 8 percent of the workforce, or more than 1,800 employees.

6. Systemax

2015 Fortune 1000 Rank: 685 (down eight spots)

CEO: Richard Leeds

Despite recording revenue of $3.44 billion in 2014, up 2 percent from the prior year, Systemax slid from No. 677 to No. 685 in the latest Fortune 1000 rankings. The company also recorded a $38 million loss.

The Port Washington, N.Y.-based company, ranked No. 17 on the 2015 CRN Solution Provider 500, has undertaken a restructuring, with plans to close a distribution center and 31 of its 34 retail stores by the end of June. Systemax also plans to lay off 1,500 of its 4,000 employees in North America. The company said it plans to refocus on its business-to-business and public sector customers.

5. CACI

2015 Fortune 1000 Rank: 674 (down 37 spots)

CEO: Kenneth Asbury

CACI was ranked No. 674 on the Fortune 1000 list, down from No. 637 last year. The federal solution provider reported $3.56 billion in revenue in its fiscal 2014 ended June 30, down 3 percent from the prior year, while profit sunk 10 percent to $135 million. CACI is No. 16 on the CRN 2015 Solution Provider 500.

The company said the sales decline was largely due to lower Afghanistan-related material purchases. Having said that, CACI set itself up nicely for the future by obtaining $1.88 billion in contract awards in the fourth quarter of 2014, up 162 percent from last year.

4. Insight Enterprises

2015 Fortune 1000 Rank: 493 (down 10 spots)

CEO: Kenneth Lamneck

Insight Enterprises came in at No. 493 on the Fortune 1000, down from No. 483 last year. The company reported $5.31 billion in sales, an increase of 3 percent from the prior year, while profit climbed 6 percent to $76 million. The Tempe, Ariz.-based company is No. 13 on the CRN 2015 Solution Provider 500.

The company has been hit hard by changes to Microsoft's partner compensation model related to cuts to cloud sales commissions and Office 365 incentive fees. Specifically, the changes reduced gross profit for Insight's North American software business by $11 million to $14 million in 2014 and are slated to be an additional $5 million to $10 million drag on profit in 2015.

3. Cognizant

2015 Fortune 1000 Rank: 288 (up 20 spots)

CEO: Francisco D'Souza

This marks Cognizant's fifth year on the Fortune 1000 list as the company rose from No. 308 to No. 288 in the rankings. The Teaneck, N.J.-based company, No. 8 on CRN's Solution Provider 500 list, saw its revenue grow by 16 percent to $10.3 billion, while profit soared by 17 percent to $1.44 billion.

Cognizant's $2.8 billion acquisition of health-care IT solution provider TriZetto in the fourth quarter paid off in big sales gains. For the full year, Cognizant's health-care vertical grew 18.7 percent to $2.7 billion, representing 26.2 percent of Cognizant's overall sales, second only to financial services. Cognizant's financial services business, meanwhile, grew 15.3 percent for the full year to $4.3 billion.

2. CDW

2015 Fortune 1000 Rank: 253 (up 12 spots)

CEO: Thomas Richards

CDW is the second-highest-ranking solution provider on the Fortune 1000 this year at No. 253, up 12 spots from No. 265 last year. In 2014 CDW reported revenue of $12.07 billion, up 12 percent from the previous year, while profit soared by 84 percent to $244.9 million. CDW is No. 6 on the 2015 CRN Solution Provider 500.

The Vernon Hills, Ill.-based company also broke into the international market for the first time with a deal in November to acquire a stake in Kelway, an $850 million London-based solution provider.

CDW also continues to make progress growing its professional services and managed services business, which accounted for just 3 percent of sales in 2014.

1. CSC

2015 Fortune 1000 Rank: 229 (down 44 spots)

CEO: Mike Lawrie

CSC is the top solution provider in the Fortune 1000 this year at No. 229. The Falls Church, Va.-based company fell 44 spots from No. 185 on last year's list. Revenue fell by 14 percent to $13.2 billion for CSC's last fiscal year, according to Fortune's data, while profit sunk by 29 percent to $679 million. The Falls Church, Va.-based company is No. 5 on the 2015 CRN Solution Provider 500. For fiscal 2015, ended April 3, CSC reported revenue of $12.17 billion.

CEO Mike Lawrie said in May that CSC is splitting into two publicly traded companies, one focused on its commercial business and the other focused on its U.S. government offerings. Reports have circulated around the company for quite some time that it is seeking a buyout deal.