Venture Capital View: TCV's Ted Coons On IoT Channel Opportunities, IT Automation And The 'Crazy Fast March' Toward Cloud

Looking Ahead

As rapidly as the cloud has disrupted enterprise IT in recent years, expect a lot more disruption to come. That's according to Ted Coons, a New York-based general partner at TCV who focuses on enterprise IT. Coons, whose investments include Datto and Actifio, spoke with CRN about what he calls a "sea change impact" that's coming to nearly every aspect of enterprise IT from the push to cloud environments. He also highlighted what he sees as the opportunities for solution providers in the data center upheaval, as well as in emerging areas such as the Internet of Things. Check out the following slides for our Q&A with Coons.

Where is the cloud headed, in your view?

I contend that everything other than basically networking -- where you actually have to have connectivity back to a device -- is rapidly pushing to consolidated cloud-type environments. Now you're even seeing the domain controller moving, which I think many people didn't think was going to happen. We're seeing a sea change impact on anybody who's both making software or hardware. While I believe very strongly in hybrid cloud, and the persistence of that state for a good long period of time, I do think the value proposition for compute and storage vendors is being rapidly demolished, particularly. Behind the firewall in the enterprise, I think it's accelerated and happened faster than even I thought was likely to happen. We're on this crazy fast march, to where everything other than connectivity is being pushed to a centralized environment, which eases management and increases agility. Whether that reduces cost at this point is less clear, but I think it has the potential, if it gets increased utilization, to reduce cost as well.

How is enterprise connectivity going to change?

I think that one of the crazy things that's happening is that wireless networks are very rapidly outpacing wired networks, in terms of their ability to deliver bandwidth. If you look at the 2016 version of LTE, called Cat 6, theoretically that delivers 300 Mbps of bandwidth, which is a lot. Unless you have optical and at Gigabit speed, modern broadband is 50 to 100 Mbps. I think how connectivity occurs has the potential to very drastically shift over the next couple of years. And I think that's to the benefit of enterprises, and also to the potential benefit of service providers -- MSPs who can get in between and be part of managing that connectivity. Which historically, with MPLS lines and fixed broadband, they weren't able to. There are management opportunities for the channel as we see shifts in how connectivity occurs. Wireless providers are not in a position to serve enterprises well, and that creates a very good opportunity for the channel.

Can you give an example of this?

Historically, if you were using wireless, you were using it for failover, when the core network went down. For instance, in retailing, you can't operate the point-of-sale system if you don't have connectivity, so you can't process transactions. Retail has often used wireless for failover. What you're seeing is wireless has the potential to be used for primary, as opposed to in the server closet, with connectivity through cables down into the basement of the building, down into copper or optical network. Now, you no longer are running all of that wire and connectivity. And the reason why there's a play for the MSP in all of that is, it is a change that I think creates an entry point. But also, SD-WAN is just a fancy way of saying routing is now going to happen in the cloud. You used to have routers that were boxes, persistent somewhere in the network. When routing capabilities are being put in the cloud, the service provider, the channel guy, has the opportunity to manage, monitor, set protocols, charge a monthly fee as part of that whole process of serving the end customer. That's a much more significant use of wireless. And that's very good for the channel.

You mentioned compute and storage -- what are your views on where those are going?

I'm pretty bearish on compute and storage. I think compute is really all about automation and driving utilizations so you're getting the best performance out of your applications. Turbonomic and businesses like that are really where the value proposition is for compute. Servers are a commodity, and what you really want is to drive utilization and efficiency and great performance of your applications. The value prop for compute is at that tools level.

As this relates to storage, it moves from being about actual media, to being able to provide a holistic view of data management. From the on-premise side and running your applications, to the extent you can deal with latency across a cloud environment, you can run those applications remotely. To the extent that you have Tier 0, Tier 1, you'll likely still have storage on-site. Either way, the media itself is not as important as the data management layer. Actifio is fundamentally a data management business, identifying where all your data is, throughout all your environments, and making it accessible.

What continues to happen to more traditional storage?

It's really all about the software that sits on top, I think. The management of data and application awareness. I think bits and the availability of bits are still important, but less so as bandwidth continues to increase. We've seen that all these box manufacturers, even the new guys -- Nimble, Pure -- have really struggled. Yes, they've continued to grow, but I think they will see margin pressure over time. They're just fighting a major tide in terms of white-box manufacturers and the software that sits on top of that.

Why are computing tools so much of a bigger opportunity?

There's a pretty rapid increase in commoditization of most hardware, other than networking. I think where the most significant value has the potential to be created is actually in overall IT operations. Because even though hardware is being commoditized, you still have a massive sprawl as the IT or enterprise buyer. You need to manage application SLAs, more agile frameworks around software development, through DevOps cycles. The value prop for IT is enabling the heterogeneity that naturally exists in your environment, and do that with IT operations tools. I think the tools markets are particularly moving from eyes on glass to having tools starting to automate relatively simple decisions. The software says this alert happened, and this was based on the rules you told me to establish, so that SLAs are achieved. The IT tools start to evolve into IT automation. I think that's one of the most interesting opportunities in the enterprise IT space -- driving the automation of IT decisioning.

What about the opportunity with IoT?

What we've seen traditionally in M2M, you had one of three things. You had connectivity players -- the Sierra Wirelesses of the world. And on the other end, you had carriers. And there were intermediaries, reselling bandwidth as it relates to specific applications, so the carrier doesn't have to go out and develop vertical expertise.

Continuing to develop vertical expertise are companies like Samsara. Samsara's first vertical is focused around fleet. They've got their own very inexpensive connectivity box, and then you pay $10 a month per device connected, to get all of this fleet management, with software capabilities on top. So they can go vertical by vertical to go after IoT. That's one way I see IoT invested against. That's likely the easier place for channel partners to play, to build domain expertise around specific areas -- go after connected car, go after fleet management, industrial automation, HVAC. The good thing about IoT is that the customer already knows they have to have a subscription to have the connectivity. So that might be anywhere between a couple bucks, or if there are major bandwidth requirements, $30 to $40 a month per device. So there's an ability for the channel partner to add on recurring revenue sitting next to connectivity.

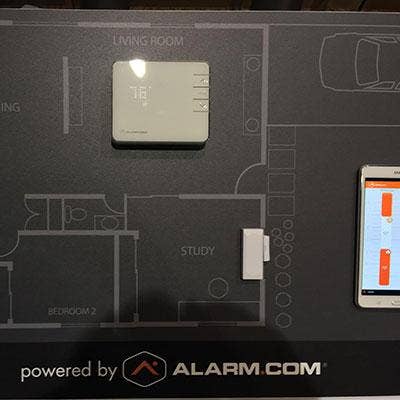

Can you share an example of that?

We made an investment in Alarm.com, which provides all the connectivity for home monitoring. Alarm.com charges for connected alarm panels/sensors and additionally for connecting video cameras, a doorbell, thermostats, lighting or a garage opener. I think it's very easy for a channel partner to get some recurring revenue against the home monitoring connection because there is already a monthly charge being paid for connectivity. They can bundle all of the additional services together, and it's unseen by the end customer. So there's a potential for them to take a reasonable cut.